Form O-1 is a document used to apply for an artist or entertainer visa. This visa is available to individuals who are not from the United States and have extraordinary ability in the arts or entertainment field. There are several requirements that must be met in order to qualify for this visa, and it can be a complex process. This blog post will provide an overview of the Form O-1 visa application process, as well as some tips on how to increase your chances of being approved. If you are an artist or entertainer looking to work in the United States, read on for more information about the Form O-1 visa.

| Question | Answer |

|---|---|

| Form Name | Form O 1 |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | land valuation form, valuation form, o 1 form, form o 1 |

FORM

[See rule 8D]

Report of valuation of immovable property (other than agricultural lands, plantations,

forests,) mines and quarries Part

ALL QUESTIONS TO BE ANSWERED BY THE REGISTERED VALUER. IF ANY PARTICULAR QUESTION DOES NOT APPLY TO THE PROPERTY UNDER VALUATION, HE MAY INDICATE SO. IF THE SPACE PROVIDED IS NOT SUFFICIENT, DETAILS MAY BE ATTACHED ON SEPARATE SHEETS

Name of registered valuer Registration No.

General :

1. Purpose for which valuation is made

2. Date as on which valuation is made

3. Name of the owner/owners

4.If the property is under joint

5. |

Brief description of the property |

|

|

||

6. |

Location, Street, Ward No. |

|

|

||

7. |

Survey/Plot No. of land |

|

|

||

8. |

Is |

the |

property |

situated |

in |

residential/commercial/mixed area/industrial area ?

9.Classification of locality high class/middle class/poor class

10.Proximity to civic amenities, like schools, hospitals, offices, markets, cinemas, etc.

11.Means and proximity to surface communication by which the locality is served

Land:

12.Area of land supported by documentary proof, shape, dimensions and physical features

13. Roads, streets or lanes on which the land is abutting

14. Is it freehold or leasehold land ?

15.If leasehold, the name of lessor/lessee, nature of lease, dates of commencement and termination of lease and terms of renewal of lease :

(i) Initial premium

(ii) Ground rent payable per annum

(iii)Unearned increase payable to the lessor in the event of sale or transfer

16.Is there any restrictive covenant in regard to use of land ? If so, attach a copy of the covenant

17.Are there any agreements of easements ? If so, attach copies

18.Does the land fall in an area included in any Town Planning Scheme or any Development Plan of Government or any statutory body? If so, give particulars

19.Has any contribution been made towards development or is any demand for such contribution still outstanding?

20.Has the whole or part of the land been notified for

[WTR57;O1,1]-

Printed From Taxmann’s Income Tax Rules on CD |

Page 1 of 4 |

acquisition by Government or any statutory body ? Give date of the notification

21. Attach a dimensioned site plan

Improvements :

22.Attach plans and elevations of all structures standing on the land and a

23.Furnish technical details of the building on a separate sheet [The Annexure to this Form may be used]

24. (i) Is the building

(ii)If partly

25.What is the Floor Space Index permissible and percentage actually utilised?

Rents :

26. (i) Names of tenants/lessees/licensees, etc.

(ii) Portions in their occupation

(iii)Monthly or annual rent/compensation/licence fee, etc., paid by each

(iv) Gross amount received for the whole property

27.Are any of the occupants related to, or close business associates of, the owner ?

28.Is separate amount being recovered for the use of fixtures like fans, geysers, refrigerators, cooking ranges, built in wardrobes, etc., or for service charges ? If so, give details

29.Give details of water and electricity charges, if any, to be borne by the owner

30.Has the tenant to bear the whole or part of the cost of repairs and maintenance ? Give particulars

31.If a lift is installed, who is to bear the cost of maintenance and operation__owner or tenant?

32.If a pump is installed, who has to bear the cost of maintenance and operation__owner or tenant ?

33.Who has to bear the cost of electricity charges for lighting of common space like entrance hall, stairs, passages, compound, etc__owner or tenant ?

34.What is the amount of property tax ? Who is to bear it? Give details with documentary proof

35.Is the building insured ? If so, give the policy No. amount for which it is insured and the annual premium

36.Is any dispute between landlord and tenant regarding rent pending in a court of law ?

37.Has any standard rent been fixed for the premises under any law relating to the control of rent?

Sales :

38.Give instances of sales of immovable property in the locality on a separate sheet, indicating the name and address of the property, registration No., sale price and area of land sold

[WTR57;O1,1]-

Printed From Taxmann’s Income Tax Rules on CD |

Page 2 of 4 |

39. Land rate adopted in this valuation

40.If sale instances are not available or not relied upon, the basis of arriving at the land rate

Cost of Construction :

41.Year of commencement of construction and year of completion

42.What was the method of construction

43.For items of work done on contract, produce copies of agreements

44.For items of work done by engaging labour directly, give basic rates of materials and labour supported by documentary proof

Part II - Valuation

Here the registered valuer should discuss in detail his approach to valuation of the property and indicatehow the value has been arrived at, supported by necessary calculations.

Part III - Declaration

I hereby declare that -

(a)the information furnished in Part I is true and correct to the best of my knowledge and belief :

(b)I have no direct or indirect interest in the property valued;

(c)I have personally inspected the property on

Date |

|

. |

|

|

|

|

|

|

|

|

||

Place |

|

. |

|

|

|

|

Signature of registered valuer |

|||||

|

|

|

|

|

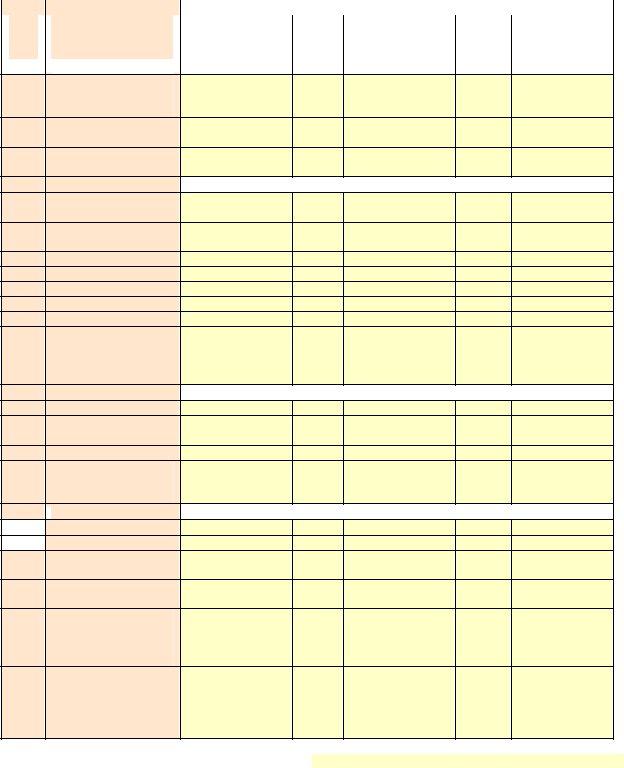

ANNEXURE TO FORM |

|

|

|

|

|||

|

Technical details |

|

|

Main building |

Annexe |

Servants' quarters |

|

Garages |

Pump house |

|

||

1. |

No. of floors and height |

|

|

|

|

|

|

|

|

|

|

|

|

of each floor |

|

|

|

|

|

|

|

|

|

|

|

2. |

Plinth area |

|

|

|

|

|

|

|

|

|

|

|

|

(As per IS : |

|

|

|

|

|

|

|

|

|

|

|

3. |

Year of construction |

|

|

|

|

|

|

|

|

|

|

|

4. |

Estimated future life |

|

|

|

|

|

|

|

|

|

|

|

5. |

Type of construction- |

|

|

|

|

|

|

|

|

|

|

|

|

load bearing walls/RCC |

|

|

|

|

|

|

|

|

|

|

|

|

frame/steel frame |

|

|

|

|

|

|

|

|

|

|

|

6. |

Type of foundations |

|

|

|

|

|

|

|

|

|

|

|

7. |

Walls |

|

|

|

|

|

|

|

|

|

|

|

|

(a) Basement and plinth |

|

|

|

|

|

|

|

|

|

|

|

|

(b) Ground floor |

|

|

|

|

|

|

|

|

|

|

|

|

(c) Superstructure |

|

|

|

|

|

|

|

|

|

|

|

|

above ground floor |

|

|

|

|

|

|

|

|

|

|

|

8. |

Partitions |

|

|

|

|

|

|

|

|

|

|

|

9. |

Doors and windows |

|

|

|

|

|

|

|

|

|

|

|

|

(Floor |

|

|

|

|

|

|

|

|

|

|

|

|

(a) Ground floor |

|

|

|

|

|

|

|

|

|

|

|

|

(b) 1st floor |

|

|

|

|

|

|

|

|

|

|

|

|

(c) 2nd floor, etc. |

|

|

|

|

|

|

|

|

|

|

|

10. |

Flooring |

|

|

|

|

|

|

|

|

|

|

|

|

(a) Ground floor |

|

|

|

|

|

|

|

|

|

|

|

|

(b) 1st floor |

|

|

|

|

|

|

|

|

|

|

|

|

(c) 2nd floor, etc. |

|

|

|

|

|

|

|

|

|

|

|

[WTR57;O1,1]- |

|

|

|

|

|

|

|

|

|

|

|

|

Printed From Taxmann’s Income Tax Rules on CD |

|

|

|

|

Page 3 of 4 |

|||||||

11.Finishing

|

|

|

|

(a) Ground floor |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(b) 1st floor |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(c) 2nd floor, etc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

12. |

|

Roofing and terracing |

|

|

|

|

|

|

|

|

|

|

|

||

13.Special architectural or decorative features, if any

14.(i) Internal wiring- surface or conduit

(ii)Class of fittings : Superior/ordinary/poor

15.Sanitary installations.

(a)(i) No. of water closets

(ii)No. of lavatory basins

(iii) No. of urinals

(iv) No. of sinks

(v) No. of bath tubs

(vi) No. of bidets

(vii) No. of geysers

(b) Class of fittings : Superior coloured/superior white/ordinary

16.Compound wall.

(i) Height and length

(ii) Type of construction

17.No. of lifts and capacity

18.Underground Pump- Capacity and type of construction

19. Overhead tank :

(i) Where located

(ii) Capacity

(iii) Type of construction

20.

21.Roads and payings within the compound, approximate area and type of paving

22.Sewage disposal- whether connected to public sewers. If septic tanks provided, No. and capacity

Signature of registered valuer

Note: Necessary modifications in this Annexure may be made to suit the property under valuation.

[WTR57;O1,1]-

Printed From Taxmann’s Income Tax Rules on CD |

Page 4 of 4 |