In order to make a claim for an exemption from self-employment tax, you will need to fill out Form Onrr 4054A. This form is used by the state of Oklahoma to determine whether or not you are exempt from paying self-employment tax. There are a number of factors that will be considered when making this determination, so it is important to complete the form accurately and provide all the necessary information. If you have any questions about the form or how to complete it, be sure to contact the Oklahoma Tax Commission.

| Question | Answer |

|---|---|

| Form Name | Form Onrr 4054 A |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | operator form onrr sample, number onrr 4 make, report form oil, 3 onrr search |

REPORTER USE

U.S. DEPARTMENT OF THE INTERIOR

Office of Natural Resources Revenue

OIL AND GAS OPERATIONS REPORT

PART A - WELL PRODUCTION

OMB Control Number

OMB Approval Expires 5/31/2022

ONRR USE

|

REPORT TYPE: |

|

ORIGINAL |

|

ONRR LEASE/AGREEMENT NUMBER: (11) |

OR |

AGENCY LEASE/AGREEMENT NUMBER: (25) |

||

|

|

|

|||||||

|

|

|

|

|

|

||||

|

|

|

MODIFY (DELETE/ADD BY LINE) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

REPLACE (OVERLAY PREVIOUS REPORT) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

PRODUCTION MONTH: (6) MMCCYY |

ONRR OPERATOR NUMBER: (5) |

OPERATOR NAME: (30) |

|

|

|

|||

|

|

|

|

|

|

|

|

||

|

OPERATOR LEASE/AGREEMENT NAME: (30) |

|

|

|

OPERATOR LEASE/AGREEMENT NUMBER: (20) |

||||

|

|

|

|

|

|

|

|

|

|

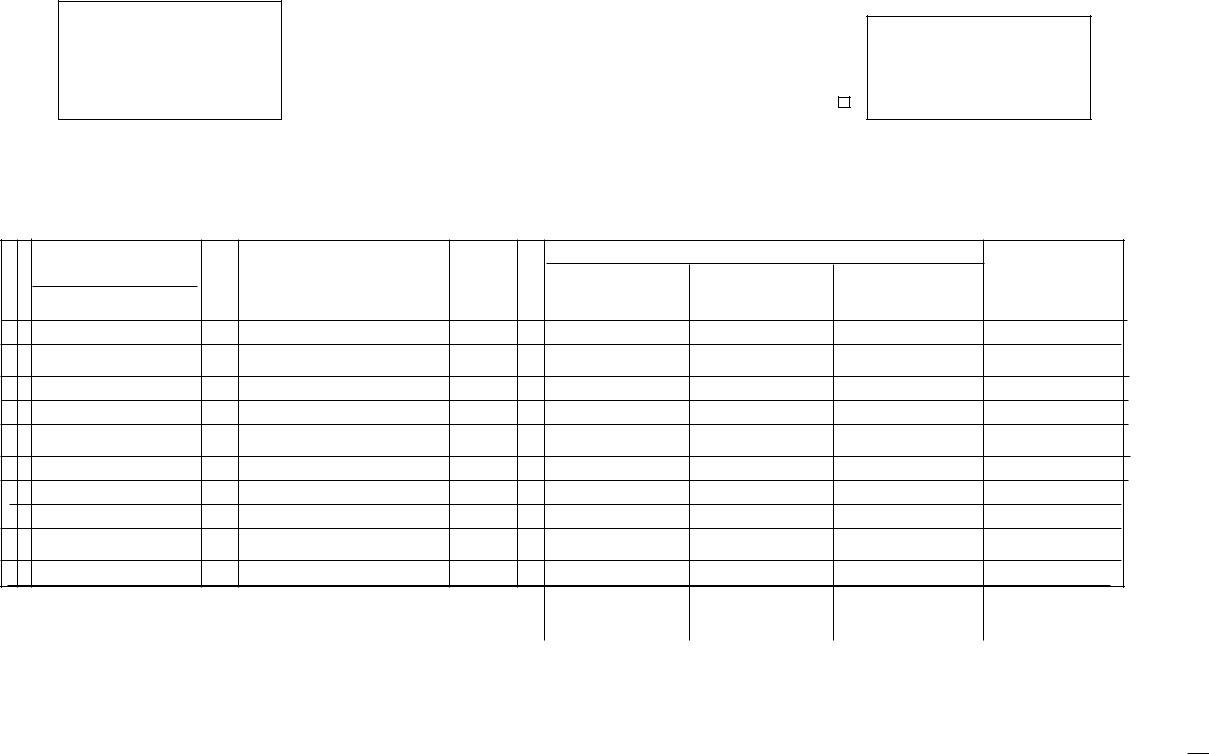

LINE NUMBER

1

2

3

4

5

6

7

8

9

10

ACTION CODE (1)

API WELL NUMBER

(12)

STATE |

COUNTY |

SEQUENCE |

SIDE- |

TRACK |

|||

(2) |

(3) |

(5) |

(2) |

|

|

|

|

PRODUCING INTERVAL (3)

OPERATOR

WELL NUMBER

(15)

WELL

STATUS

CODE

(5)

DAYS PRODUCED (2)

PRODUCTION VOLUMES

OIL/CONDENSATE |

GAS |

WATER |

(BBL) |

(MCF) |

(BBL) |

(9) |

(9) |

(9) |

INJECTION

VOLUME

(BBL/MCF)

(9)

|

|

TOTAL PRODUCTION (9) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL INJECTION (9) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CONTACT NAME: (FIRST, M.I., LAST) (30) |

|

|

TELEPHONE NUMBER: (10) |

|

|

EXTENSION NUMBER: (5) |

||

|

|

|

( |

) ( |

- |

) |

( |

) |

AUTHORIZING SIGNATURE: |

DATE: (8) MMDDCCYY |

COMMENTS: (60) |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Form |

PAGE |

|

OF |

[Rev. 5/2019] |

|

|

|

INSTRUCTIONS

OIL AND GAS OPERATIONS REPORT

PART A - WELL PRODUCTION

WHO MUST FILE

○A separate report must be filed monthly (unless

WHEN TO FILE

○Reports must be received by the 15th of the second month following the production month (e.g., the report for June is due on August 15).

○You are required to report electronically under 30 CFR 1210

unless ONRR approved you to report on paper.

WHERE TO FILE

Reports must be filed with:

Office of Natural Resources Revenue

P. O. Box 25627

Denver, Colorado

REFER TO THE PRODUCTION REPORTER HANDBOOK PRIOR TO COMPLETING THIS FORM.

The Paperwork Reduction Act of 1995 (PRA) Statement: The PRA (44 U.S.C. 3501 et seq.) requires us to inform you that

we collect this information to corroborate oil and gas production and disposition data with sales and royalty data. Responses are mandatory (43 U.S.C. 1334) and submitted monthly for all production reporting for Outer Continental Shelf, onshore Federal, and Indian lands. Proprietary information is protected in accordance with the standards

established by the Federal Oil and Gas Royalty Management Act of 1982 (30 U.S.C. 1733), the Freedom of Information Act [5 U.S.C.552(b)(4)], and the Department regulations (43 CFR 2). An agency may not conduct or sponsor, and a

person is not required to respond to, a collection of information unless it displays a currently valid OMB Control Number. Public reporting burden for this form is estimated at an average of 1 minute per line for electronic reporting and 3 minutes per line for manual reporting, including the time for reviewing instructions; gathering and maintaining data; and completing and reviewing the form. The burden hours reflect the total burden hours for parts A, B, and C of this form. Direct your comments regarding the burden estimate or any other aspect of this form to the Office of the Natural

Resources Revenue, Attention: Rules & Regs Team, P.O. Box 25165, Denver, CO