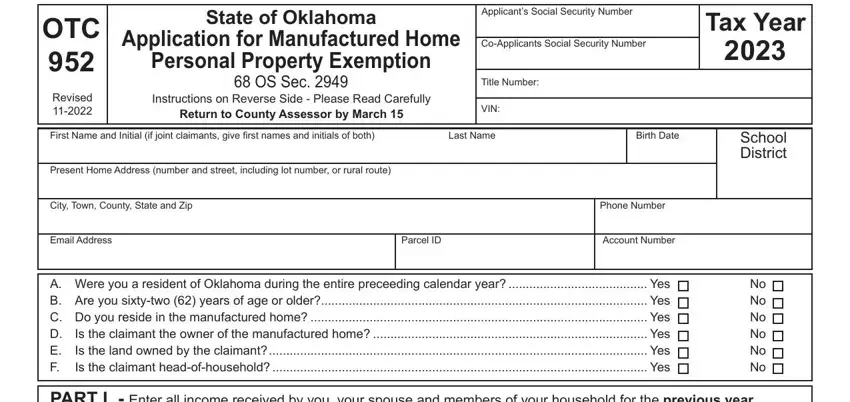

OTC |

State of Oklahoma |

|

Applicant’s Social Security Number |

|

Tax Year |

|

|

|

|

APPLICATION FOR MANUFACTURED HOME |

|

|

|

Co-Applicants Social Security Number |

|

|

952 |

PERSONAL PROPERTY EXEMPTION |

|

|

|

|

|

|

|

|

|

|

|

|

|

68 O.S. Sec. 2949 |

|

Title Number: |

|

|

|

|

|

|

|

|

|

Revised |

Instructions on Reverse Side - Please Read Carefully |

|

|

|

|

|

|

|

VIN: |

|

|

|

7-2012 |

Return to County Assessor by March 15 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First Name and Initial (if joint claimants, give irst names and initials of both) |

Last Name |

|

Birth Date |

|

School |

|

|

|

|

|

|

|

District |

Present Home Address (number and street, including lot number, or rural route) |

|

|

|

|

|

|

|

|

|

|

|

|

|

City, Town, County, State and Zip |

|

|

|

|

|

|

A. |

Were you a resident of Oklahoma during the entire preceeding calendar year? |

Yes |

|

|

No |

|

|

|

|

|

|

|

B. |

Are you sixty-two (62) years of age or older? |

Yes |

|

|

No |

|

|

|

|

|

|

|

|

|

C. |

Do you reside in the manufactured home? |

Yes |

|

|

No |

|

|

|

|

|

|

|

D. |

Is the claimant the owner of the manufactured home? |

Yes |

|

|

No |

|

|

|

|

|

|

|

E. |

Is the land owned by the claimant? |

Yes |

|

|

No |

|

|

|

|

|

|

|

F. |

Is the claimant head-of-household? |

Yes |

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

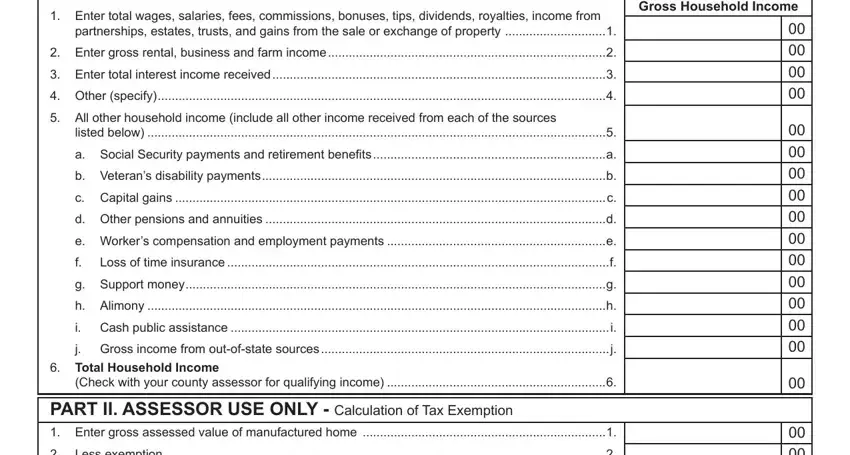

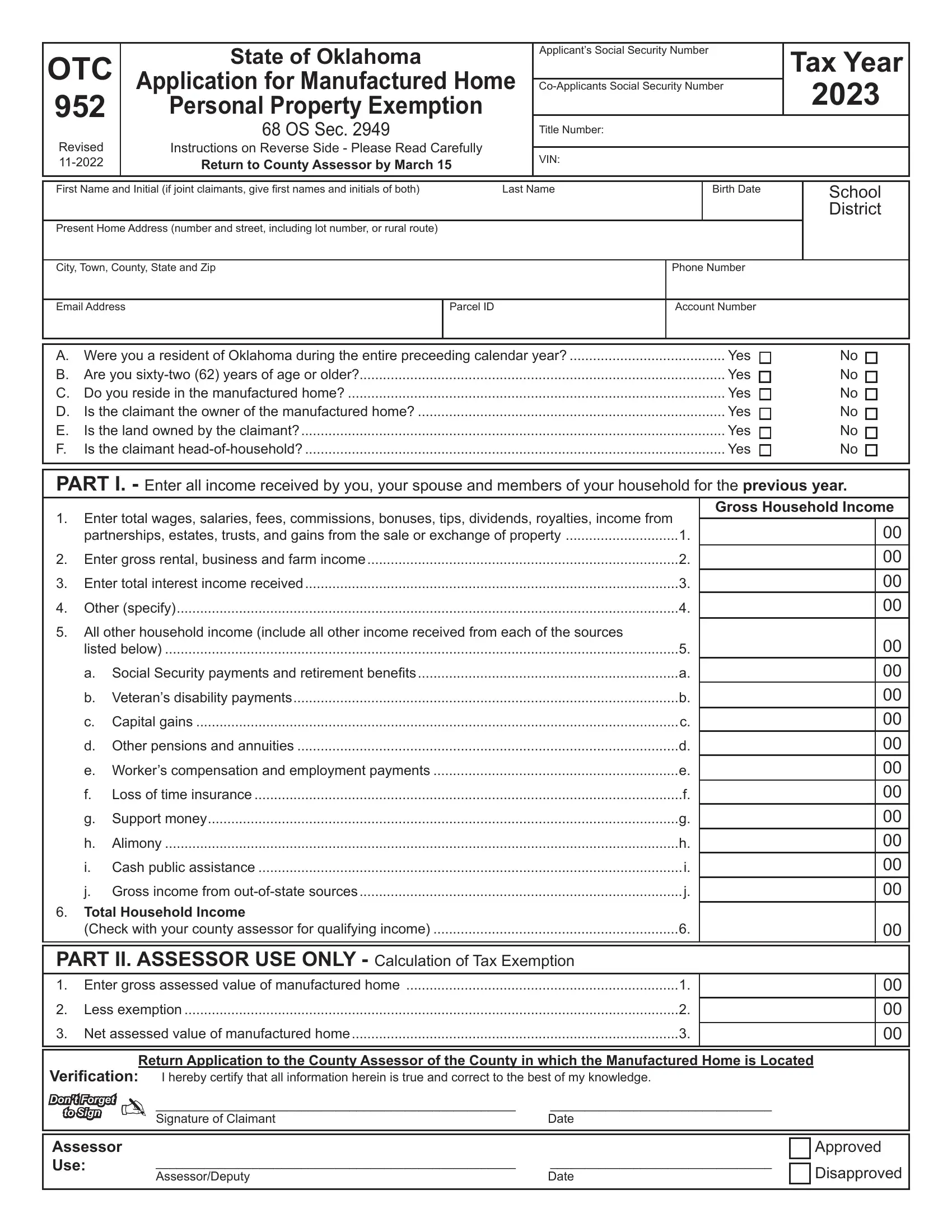

PART I. - Enter all income received by you, your spouse and members of your household for the Previous Year

Gross Household Income

1.Enter total wages, salaries, fees, commissions, bonuses, tips, dividends, royalties,income from

|

partnerships, estates, trusts, and gains from the sale or exchange of property |

1. |

00 |

2. |

Enter gross rental, business and farm income |

2. |

00 |

3. |

Enter total interest income received |

3. |

00 |

4. |

Other (specify) |

4. |

00 |

5.All other household income (include all other income received from each of the sources

listed below) |

5. |

00 |

a. |

Social Security payments and retirement beneits |

a. |

00 |

b. |

Veteran’s disability payments |

b. |

00 |

c. |

Capital gains |

c. |

00 |

d. |

Other pensions and annuities |

d. |

00 |

e. |

...............................................................Worker’s compensation and employment payments |

e. |

00 |

f. |

Loss of time insurance |

00 |

g. |

Support money |

g. |

00 |

h. |

Alimony |

h. |

00 |

i. |

Cash public assistance |

i. |

00 |

j. |

Gross income from out-of-state sources |

j. |

00 |

6.Total Household Income

|

(Check with your county assessor for qualifying income) |

6. |

00 |

|

|

|

|

PART II. ASSESSOR USE ONLY - Calculation of Tax Exemption |

|

|

|

1. |

Enter gross assessed value of manufactured home |

1. |

|

00 |

2. |

Less exemption |

2. |

|

00 |

3. |

Net assessed value of manufactured home |

3. |

|

00 |

RETURN APPLICATION TO THE COUNTY ASSESSOR OF THE COUNTY IN WHICH THE MANUFACTURED HOME IS LOCATED

VERIFICATION:

ASSESSOR

USE:

I hereby certify that all information herein is true and correct to the best of my knowledge.

____________________________________________________ |

________________________________ |

Signature of Claimant |

Date |

|

|

|

Approved |

____________________________________________________ |

________________________________ |

|

Disapproved |

|

Assessor/Deputy |

Date |

|

APPLICATION FOR MANUFACTURED HOME PERSONAL PROPERTY EXEMPTION - PAGE 2

INSTRUCTIONS

68 O.S. 2012 Section 2949. Personal Property tax exemption for heads of households 62 years of age or older residing in certain manufactured homes.

A.Beginning with the year 2013 and for each year thereafter, any person sixty-two (62) years of age or older, who is the head of a household, is a resident of and is domiciled in this state during the entire preceding calendar year, whose gross household income for the preceding year did not exceed the greater of $22,000.00 or 50% of the H.U.D. median family income for the county where the manufactured home is located and owns and resides in a manufactured home which is located on land not owned by the owner of the manufactured home may receive an exemption on the manufac- tured home in an amount equal to Two Thousand Dollars ($2,000.00).

B.The application for the exemption provided by this section shall be made each year before March 15 or within thirty (30) days from and after the receipt by the taxpayer of notice of valuation increase, whichever is later, and upon the from prescribed by the Oklahoma Tax Commission, which shall require the taxpayer to certify the correct- ness of the amount of said gross income. The form prescribed by the Oklahoma Tax Commission pursuant to this section

shall state in bold letters that the form is to be returned to the county assessor of the county in which the manu-

factured home is located.

C.For persons sixty-ive (65) years of age or older as of March 15 and who have previously qualiied for the exemption provided by this section, no annual application shall be required in order to receive the exemption

provided by this section; however any person whose gross household income in any calendar year exceeds the amount

speciied in this section in order to qualify for the exemption provided by this section shall notify the county assessor and

the exemption shall not be allowed for the applicable year. Any executor or administrator of an estate within which is included a homestead property exempt pursuant to the provisions of this section shall notify the county assessor of the change in status of the homestead property if such property is not the homestead of a person who would be eligible for the exemption provided by this section.

D.As used in this section:

1.“Gross household income” means the gross amount of income of every type, regardless of the source, received by all persons occupying the same household, whether such income was taxable or nontaxable for

federal or state income tax purposes, including pensions, annuities, federal Social Security, unemployment payments, veterans’ disability compensation, public assistance payments, alimony, support money, workers’

compensation, loss-of-time insurance payments, capital gains and any other type income received, and exclud- ing gifts, and

2.“Head of household” means a person who as owner or joint owner maintains a home and furnishes the support for said home, furnishings, and other material necessities.