Once you open the online tool for PDF editing by FormsPal, it is easy to complete or modify Form Ow 8 Es Oklahoma right here and now. In order to make our editor better and less complicated to use, we consistently work on new features, taking into consideration suggestions coming from our users. To get the ball rolling, go through these easy steps:

Step 1: Firstly, access the pdf editor by clicking the "Get Form Button" above on this page.

Step 2: The tool grants the opportunity to modify almost all PDF files in a variety of ways. Transform it by writing customized text, adjust original content, and add a signature - all at your disposal!

Filling out this PDF typically requires focus on details. Make certain every single blank field is done properly.

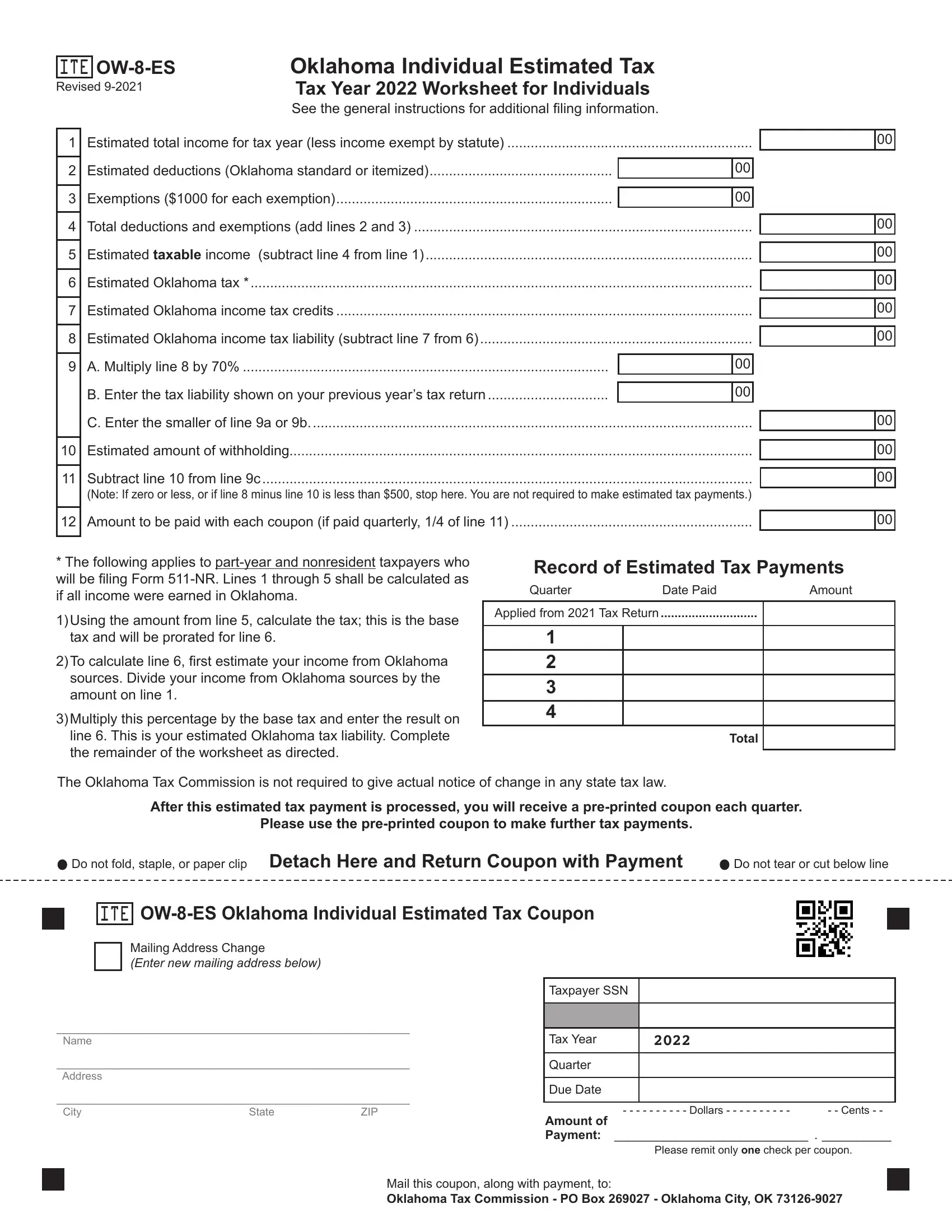

1. You will need to complete the Form Ow 8 Es Oklahoma properly, so pay close attention when filling in the parts comprising these blanks:

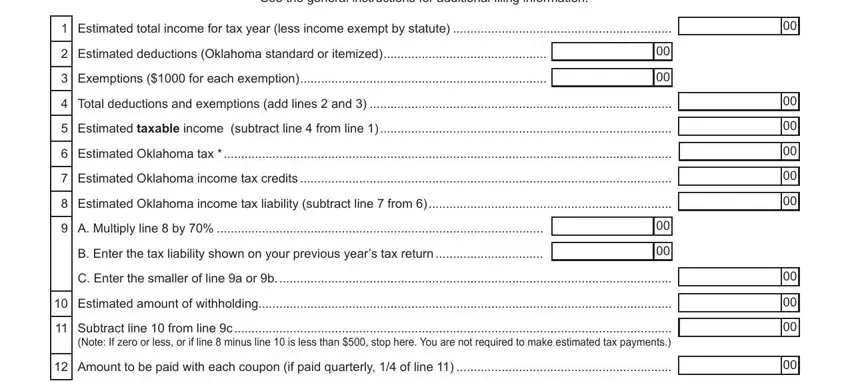

2. Once the previous segment is done, you have to include the needed details in The following applies to partyear, Using the amount from line, tax and will be prorated for line, To calculate line first estimate, Multiply this percentage by the, line This is your estimated, Record of Estimated Tax Payments, Date Paid, Applied from Tax Return, Total, The Oklahoma Tax Commission is not, After this estimated tax payment, Please use the preprinted coupon, Do not fold staple or paper clip, and Detach Here and Return Coupon with in order to go further.

A lot of people frequently get some points incorrect when filling in Detach Here and Return Coupon with in this area. You should read twice everything you type in here.

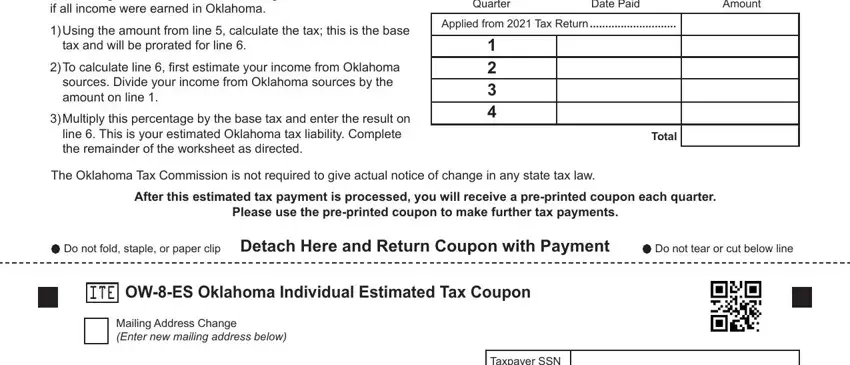

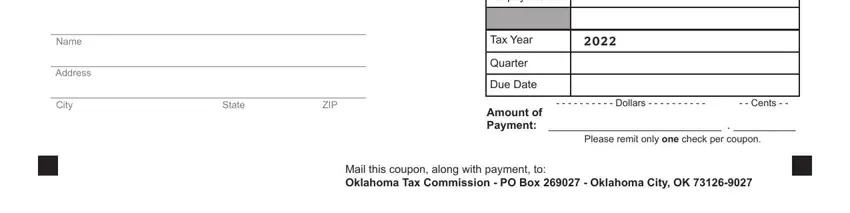

3. This next section is all about Taxpayer SSN, Tax Year, Quarter, Due Date, Amount of Payment, Dollars, Cents, Please remit only one check per, and Mail this coupon along with - fill out all these empty form fields.

Step 3: Before finishing this form, double-check that form fields are filled in the correct way. As soon as you confirm that it is correct, click on “Done." Join us now and immediately obtain Form Ow 8 Es Oklahoma, set for downloading. Every single change made is handily preserved , which means you can modify the pdf at a later point if needed. When you use FormsPal, you can certainly complete documents without worrying about personal data leaks or data entries being distributed. Our protected system makes sure that your personal information is kept safely.