When working in the online PDF editor by FormsPal, you can easily complete or change conveyance tax here. Our editor is continually developing to provide the very best user experience achievable, and that is because of our dedication to continual improvement and listening closely to customer opinions. All it requires is a few easy steps:

Step 1: Access the PDF in our tool by pressing the "Get Form Button" at the top of this webpage.

Step 2: With the help of this advanced PDF editor, you'll be able to do more than merely complete blank fields. Edit away and make your docs appear high-quality with custom text added, or fine-tune the file's original content to excellence - all that comes along with an ability to add almost any images and sign the document off.

Be mindful when filling out this pdf. Make certain every blank field is completed accurately.

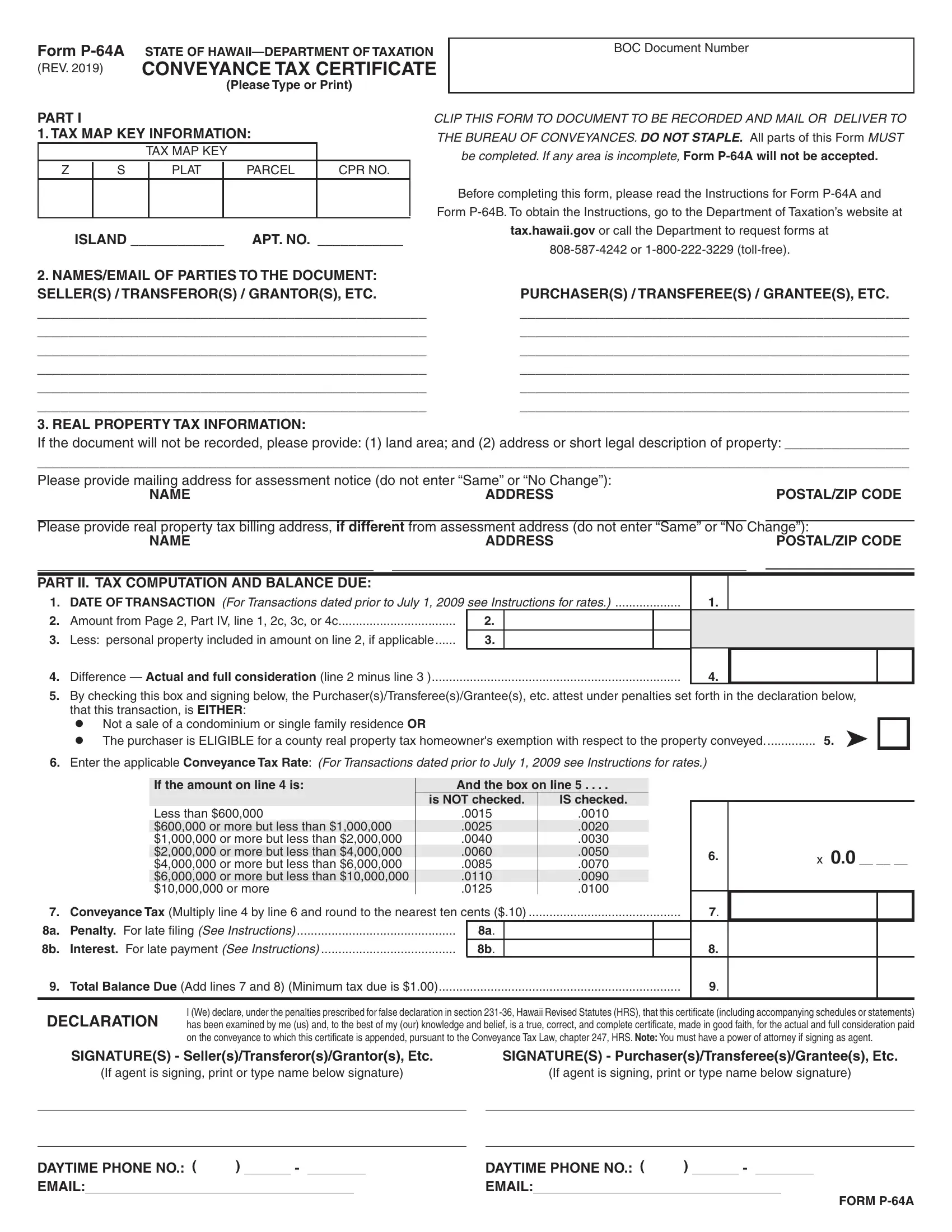

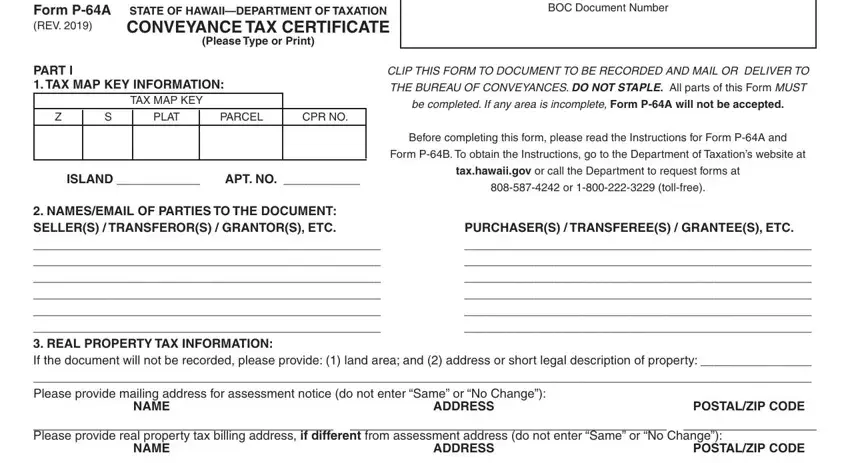

1. It's very important to complete the conveyance tax accurately, therefore be careful while filling in the parts comprising these particular blank fields:

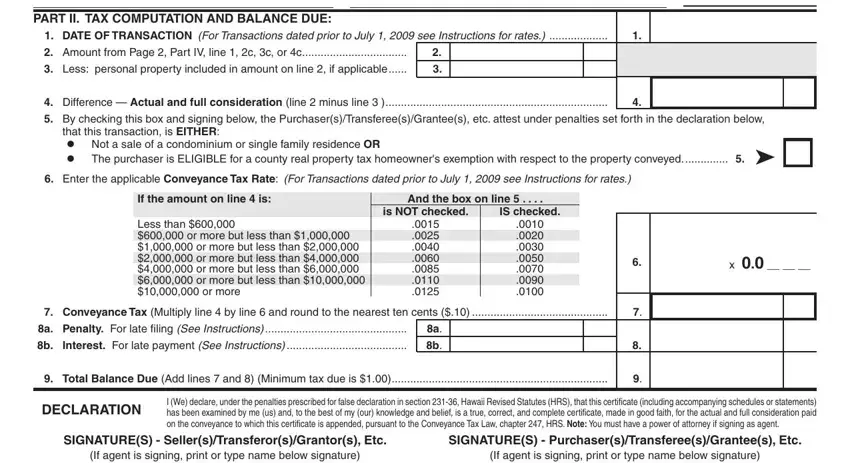

2. The third step would be to fill in all of the following blanks: PART II TAX COMPUTATION AND, Amount from Page Part IV line c, Less personal property included, Difference Actual and full, that this transaction is EITHER, The purchaser is ELIGIBLE for a, Enter the applicable Conveyance, If the amount on line is, And the box on line, is NOT checked, IS checked, Less than or more but less than, Conveyance Tax Multiply line by, a Penalty For late filing See, and b Interest For late payment See.

3. The next part will be easy - fill out all of the fields in If agent is signing print or type, If agent is signing print or type, DAYTIME PHONE NO EMAIL, DAYTIME PHONE NO EMAIL, and FORM PA to conclude this process.

It's easy to make a mistake while filling in your If agent is signing print or type, and so make sure to go through it again before you decide to finalize the form.

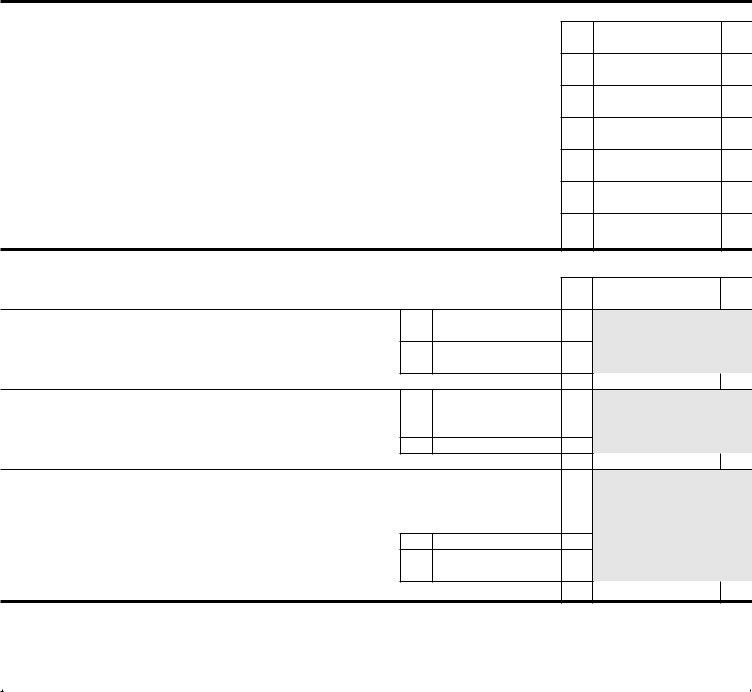

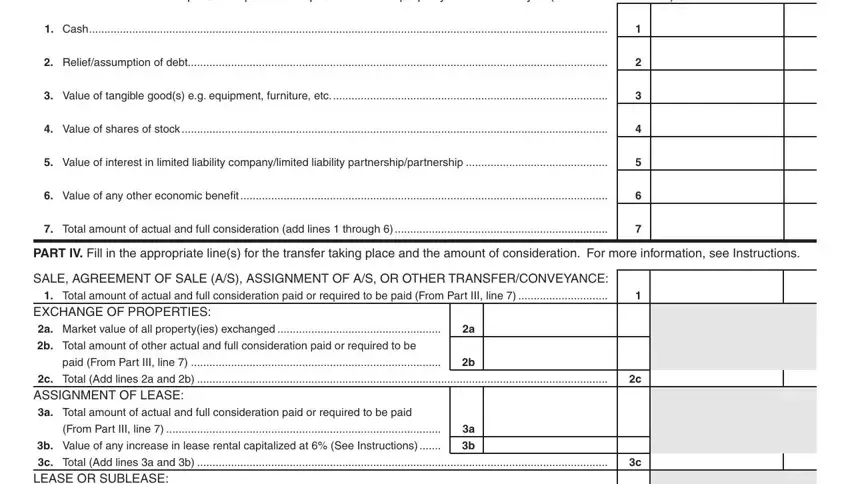

4. To move onward, your next stage requires completing several form blanks. These comprise of PART III Enter all amounts paid or, Cash, Reliefassumption of debt, Value of tangible goods eg, Value of shares of stock, Value of interest in limited, Value of any other economic, Total amount of actual and full, PART IV Fill in the appropriate, SALE AGREEMENT OF SALE AS, b Total amount of other actual and, paid From Part III line, c Total Add lines a and b, From Part III line, and b Value of any increase in lease, which you'll find key to carrying on with this particular PDF.

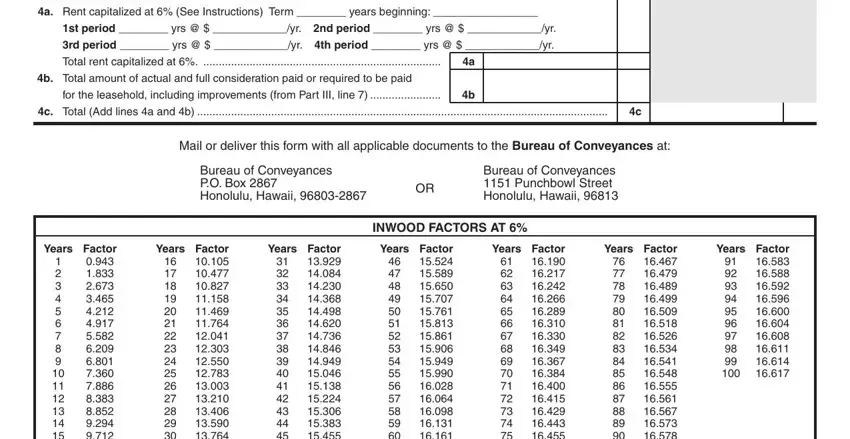

5. The document needs to be concluded by going through this area. Below you will find a full set of fields that must be filled in with correct information to allow your form usage to be complete: c Total Add lines a and b LEASE, st period yrs yr nd period yrs, rd period yrs yr th period yrs, Total rent capitalized at, b Total amount of actual and full, for the leasehold including, c Total Add lines a and b, Mail or deliver this form with all, Bureau of Conveyances PO Box, Bureau of Conveyances Punchbowl, Years Factor, Years Factor, Years Factor, INWOOD FACTORS AT, and Years Factor.

Step 3: Prior to submitting the form, you should make sure that form fields are filled in the correct way. When you think it is all fine, press “Done." After registering a7-day free trial account with us, you'll be able to download conveyance tax or send it through email immediately. The PDF file will also be easily accessible in your personal account page with all of your edits. FormsPal guarantees safe form completion without personal data recording or sharing. Rest assured that your information is secure here!