hawaii conveyance tax forms can be filled out in no time. Simply use FormsPal PDF editor to get the job done without delay. We at FormsPal are focused on providing you the absolute best experience with our editor by consistently introducing new features and upgrades. With all of these improvements, using our editor becomes better than ever! To start your journey, go through these basic steps:

Step 1: Click on the orange "Get Form" button above. It'll open up our pdf tool so that you can start completing your form.

Step 2: With this online PDF editing tool, you could accomplish more than simply fill in blanks. Try each of the features and make your forms appear faultless with custom text added, or adjust the file's original input to excellence - all that backed up by the capability to add any pictures and sign the file off.

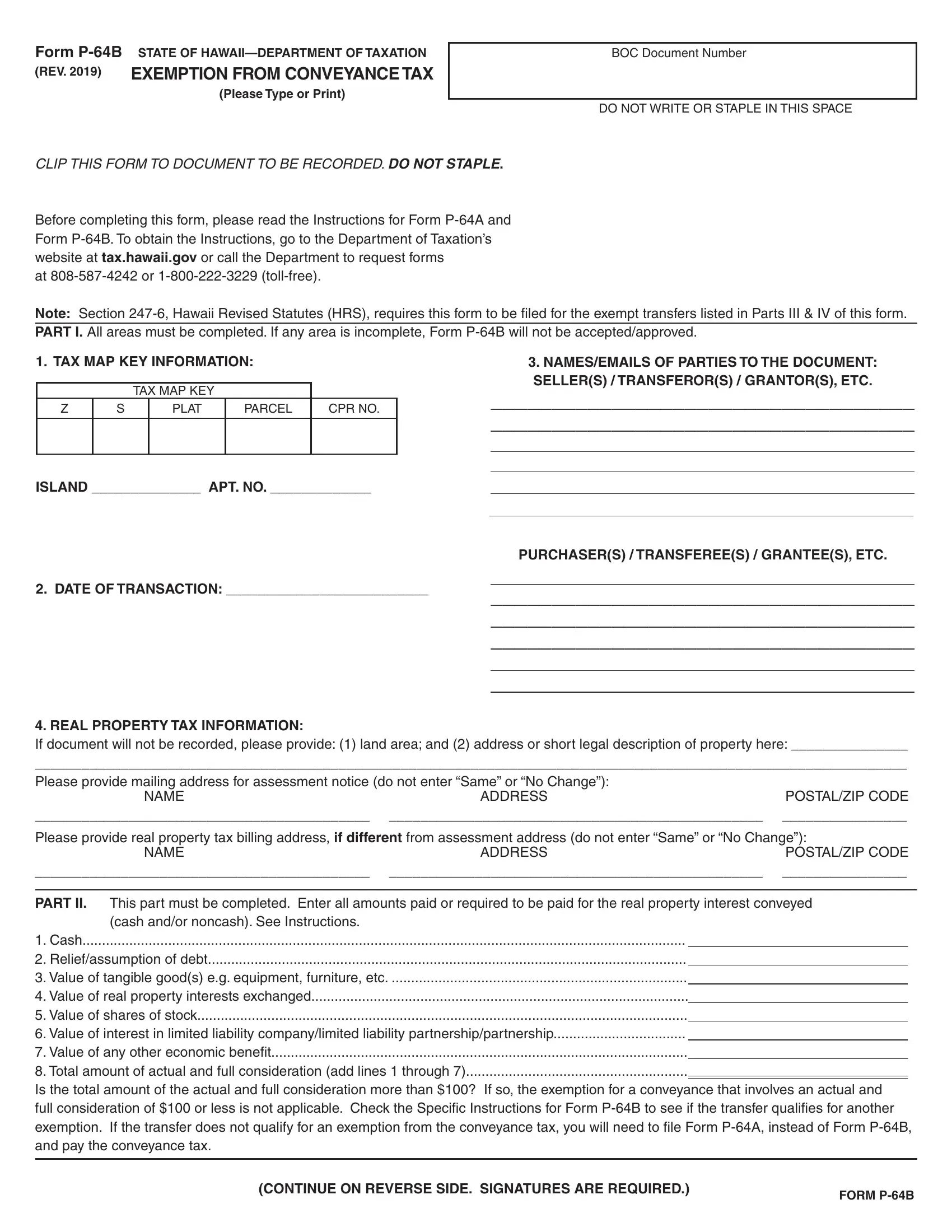

With regards to the blanks of this particular PDF, this is what you should do:

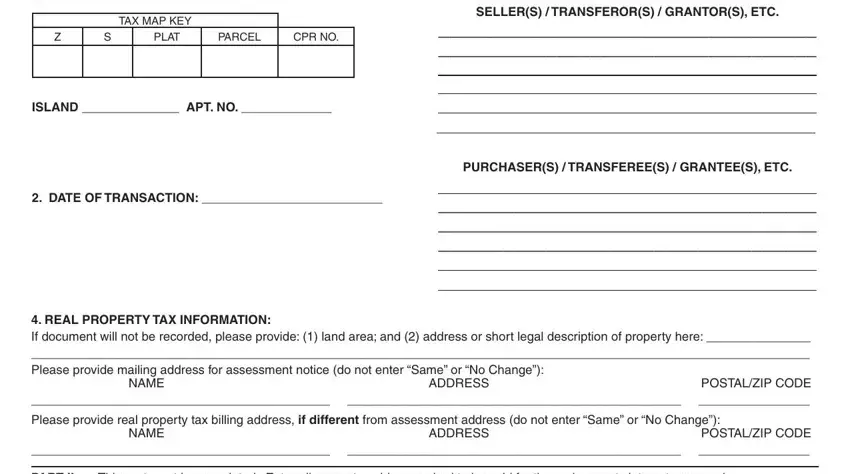

1. Whenever submitting the hawaii conveyance tax forms, be sure to incorporate all of the essential blanks within its associated form section. This will help to speed up the work, enabling your information to be handled without delay and accurately.

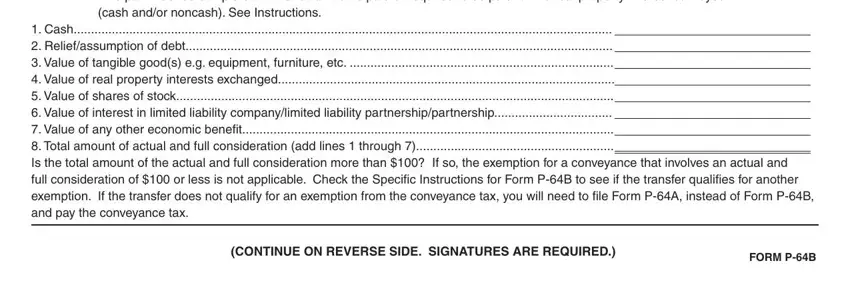

2. Soon after this array of fields is done, go to type in the applicable information in all these: PART II, This part must be completed Enter, Cash Reliefassumption of debt, CONTINUE ON REVERSE SIDE, and FORM PB.

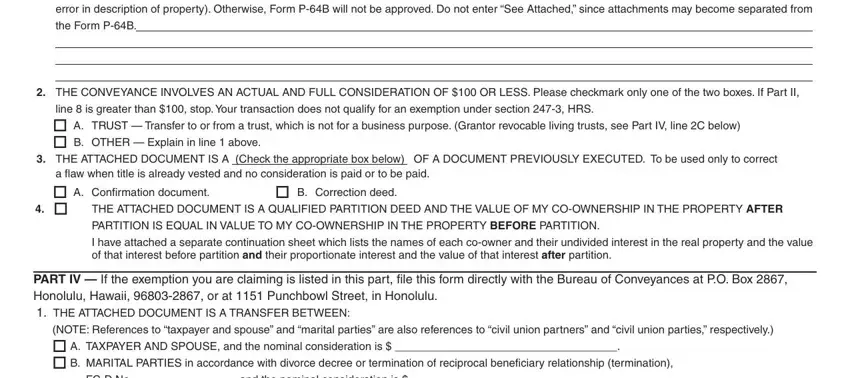

3. Completing error in description of property, the Form PB, THE CONVEYANCE INVOLVES AN ACTUAL, line is greater than stop Your, THE ATTACHED DOCUMENT IS A Check, a flaw when title is already vested, B Correction deed, THE ATTACHED DOCUMENT IS A, PARTITION IS EQUAL IN VALUE TO MY, and PART IV If the exemption you are is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

It's easy to make errors while completing the THE CONVEYANCE INVOLVES AN ACTUAL, thus make sure that you look again before you decide to send it in.

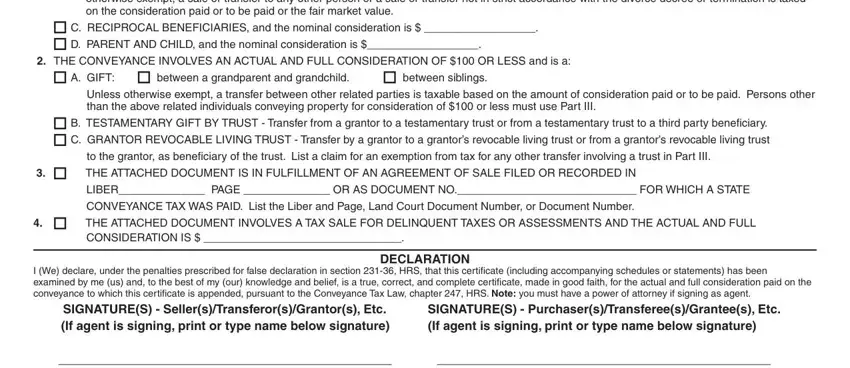

4. This particular section comes with all of the following fields to complete: If the conveyance is pursuant to a, C RECIPROCAL BENEFICIARIES and, THE CONVEYANCE INVOLVES AN ACTUAL, between a grandparent and, A GIFT Unless otherwise exempt a, between siblings, THE ATTACHED DOCUMENT IS IN, LIBER PAGE OR AS DOCUMENT NO FOR, CONVEYANCE TAX WAS PAID List the, THE ATTACHED DOCUMENT INVOLVES A, CONSIDERATION IS, I We declare under the penalties, and DECLARATION.

5. This last notch to conclude this form is critical. Ensure to fill in the appropriate form fields, consisting of DAYTIME PHONE NO DAYTIME PHONE, and FORM PB, prior to finalizing. Failing to do so can end up in a flawed and potentially nonvalid document!

Step 3: Be certain that your details are correct and simply click "Done" to progress further. Find your hawaii conveyance tax forms the instant you register here for a free trial. Conveniently get access to the form inside your FormsPal account page, along with any edits and changes all synced! FormsPal guarantees safe form tools with no data recording or distributing. Feel at ease knowing that your data is in good hands here!