You could work with pc 220a effectively using our online PDF editor. We at FormsPal are aimed at providing you the perfect experience with our tool by regularly introducing new functions and enhancements. Our tool has become even more user-friendly as the result of the newest updates! Now, filling out PDF documents is easier and faster than ever before. Here is what you'd have to do to get going:

Step 1: Click on the orange "Get Form" button above. It is going to open up our pdf editor so you can start filling out your form.

Step 2: Using our handy PDF tool, it is easy to do more than simply fill in blanks. Express yourself and make your documents appear perfect with custom textual content added in, or adjust the original content to excellence - all that comes along with an ability to incorporate any photos and sign the document off.

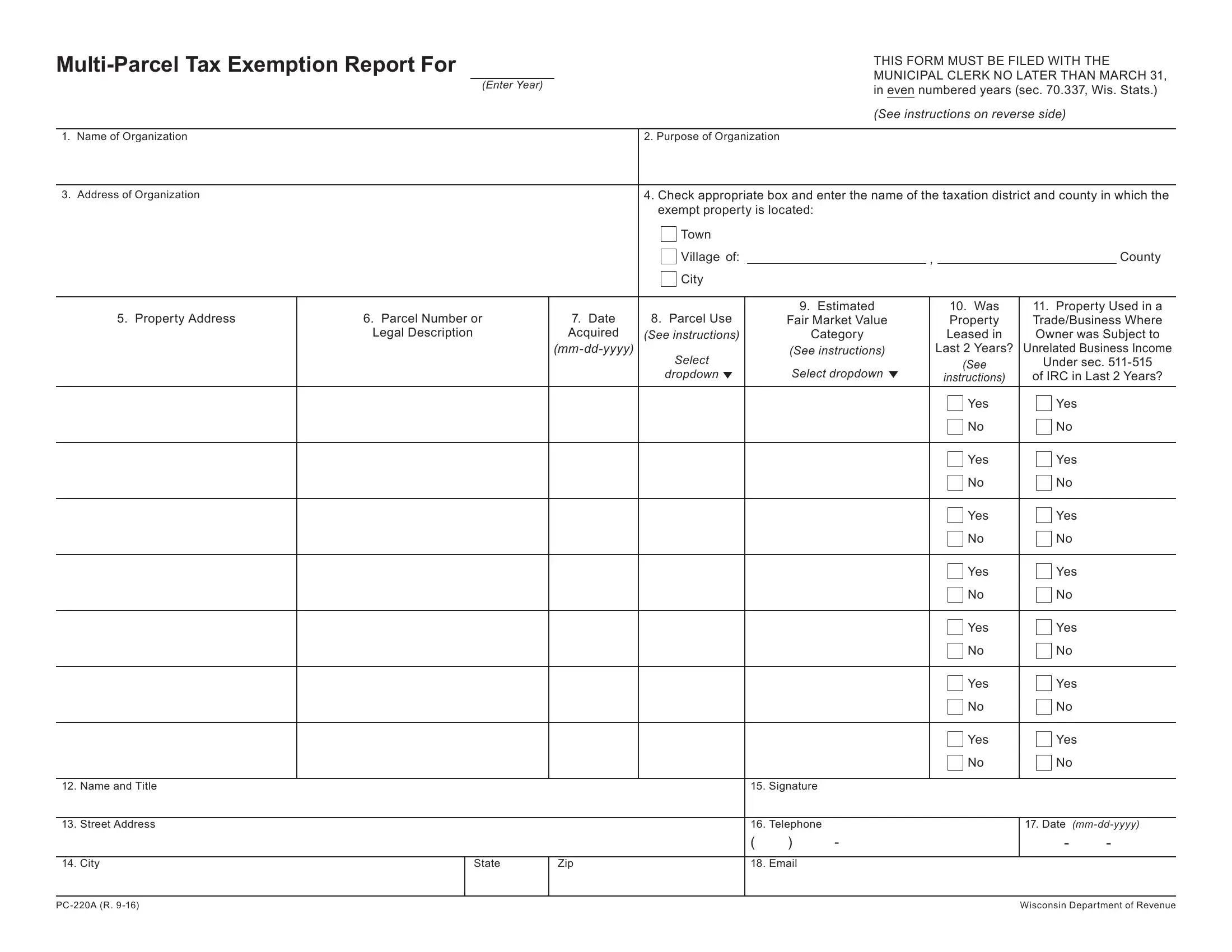

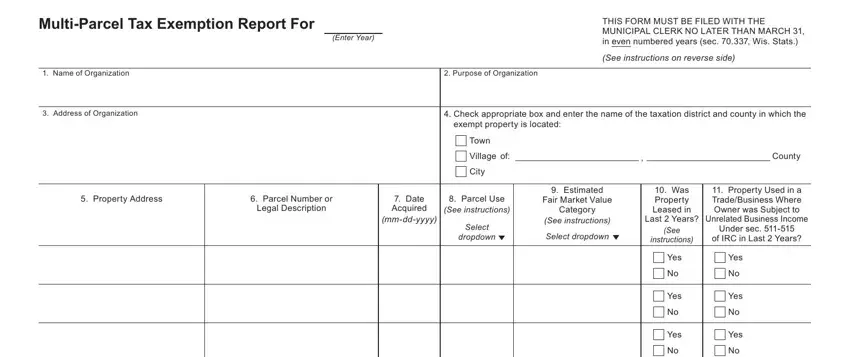

This PDF requires specific info to be typed in, therefore you should definitely take whatever time to fill in what is required:

1. The pc 220a involves particular information to be inserted. Make certain the next blank fields are filled out:

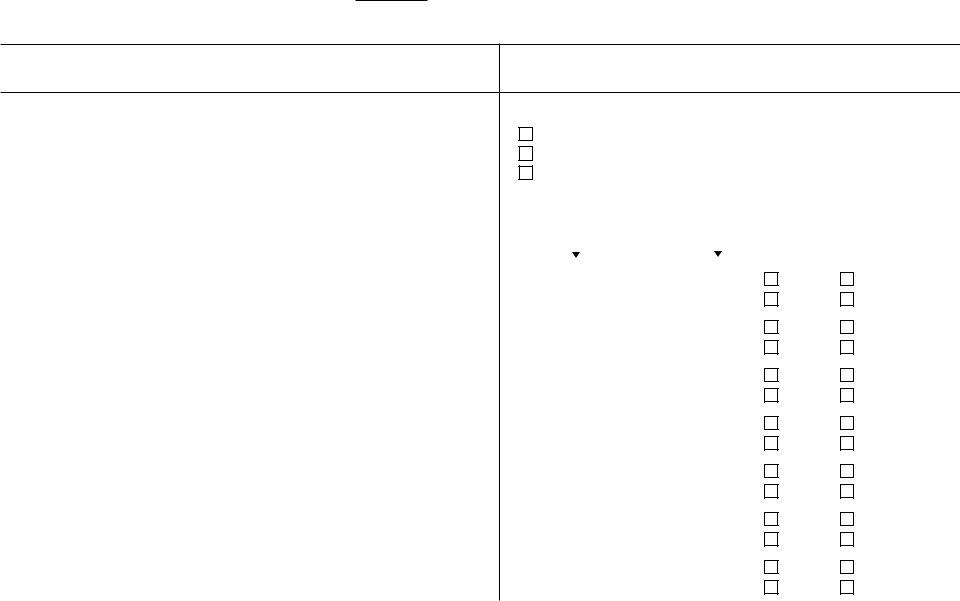

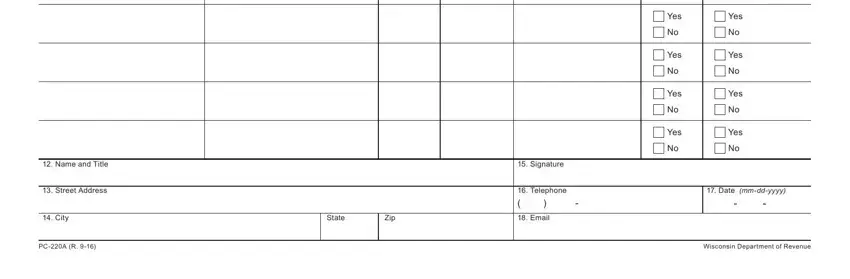

2. Once your current task is complete, take the next step – fill out all of these fields - Yes, Yes, Yes, Yes, Yes, Yes, Yes, Yes, Name and Title, Street Address, City, PCA R, State, Zip, and Signature with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

It's easy to make an error when completing the Zip, therefore be sure to look again before you finalize the form.

Step 3: Soon after proofreading your fields, click "Done" and you're good to go! After setting up a7-day free trial account here, it will be possible to download pc 220a or send it via email without delay. The PDF document will also be at your disposal via your personal cabinet with your every edit. FormsPal is dedicated to the privacy of our users; we make sure all information going through our tool remains confidential.