In the intricate landscape of international patent filings, the PCT RO 144 form emerges as a crucial document for innovators seeking global protection for their inventions. This form, integral to the Patent Cooperation Treaty (PCT) procedures, serves as a notice of confirmation of precautionary designations. Essentially, it is used by applicants to affirm the countries or regions where they intend to seek patent protection, as initially indicated in their PCT application. Importantly, the form outlines specific designations, including whether applicants desire a regional patent or another form of protection. Additionally, it addresses the financial aspect of these filings, detailing the prescribed fees associated with confirming these designations. Applicants from certain states might be eligible for a significant fee reduction, which can impact the overall cost efficiency of the international patenting process. Through modes of payment that include bank drafts, deposit accounts, and various others, the form also ensures flexibility in handling the associated fees. The signature of the applicant or agent, accompanied by a deposit account authorization if applicable, finalizes the submission, marking a critical step in safeguarding intellectual property across borders. Form PCT/RO/144, thus, encapsulates a fundamental procedural element, facilitating the strategic expansion of patent protection on a global scale.

| Question | Answer |

|---|---|

| Form Name | Form Pct Ro 144 |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | Calculation, PRECAUTIONARY, pct fee calculator, overpayment |

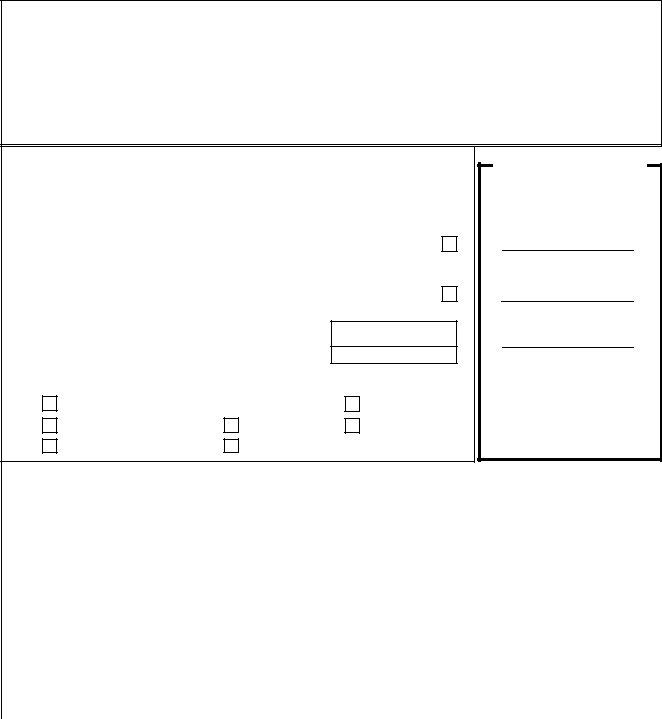

PATENTCOOPERATIONTREATY

PCT

NOTICEOFCONFIRMATIONOFPRECAUTIONARYDESIGNATIONS

|

(to be filed with the receiving Office) |

|

|

(PCT Rules 4.9(c) and 15.5) |

|

|

|

|

Applicant’s or agent’s file reference |

|

International filing date |

|

|

(day/month/year) |

|

|

|

International application No. |

|

(Earliest) Priority date |

|

|

(day/month/year) |

|

|

|

Applicant |

|

|

|

|

|

1.The applicant hereby confirms the following designations made under Rule 4.9(b):

Name of State (specify if a |

regional patent and/or |

Name of Applicant(s) for that State |

another kind of protection or |

treatment is/are desired) |

|

2.PRESCRIBED FEES (Applicants from certain States are entitled to a reduction of 75% of the designation fee and the confirmation fee. Where the applicant is (or all applicants are) so entitled, the total to be entered in the TOTAL box is 25% of the sum of the amounts entered at D and C. See Notes to the Fee Calculation Sheet as annexed to the Request Form, PCT/RO/101,for details.)

for receiving Office use only

____________________ x _____________________ |

= |

|

Number of designations |

Amount of designation fee |

|

confirmed |

|

|

Confirmation fee = 50% of the above total |

+ |

|

|

Total fees payable |

= |

Mode of payment (payment must accompany this notice):

authorization to charge |

|

bank draft |

|

||

deposit account (see below) |

|

|

|

|

cheque |

cash |

postal money order |

revenue stamps |

D

Total designation fee

C

TOTAL

coupons

other (specify):

3. |

Signature of applicant or agent |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deposit account authorization |

|

|

|

|||||

|

|

|

|

|

|

|

|

|

||

|

|

The RO/ _______ |

|

|

is hereby authorized to charge the total fees indicated above to my deposit account. |

|||||

|

|

|

|

|

|

is hereby authorized to charge any deficiency or credit any overpayment in the total fees |

||||

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|||||

|

|

|

|

|

|

indicated above to my deposit account. |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

||

|

|

Deposit Account Number |

Date (day/month/year) |

Signature |

||||||

|

|

|

|

|

|

|

|

|

|

|

Form PCT/RO/144 (January 1996)