California Public Employees’ Retirement System |

|

Customer Account Services Division |

|

|

Retirement Account Services Section |

DATE OF |

BIRTH:_______/_______/_______ |

|

P.O. Box 942709 |

|

|

Sacramento, CA 94229-2709 |

|

MM / DD / YYYY |

TTY: (877) 249-7442 |

|

|

888 CalPERS (or 888-225-7377) phone • (916) 795-3005 fax |

|

www.calpers.ca.gov |

|

|

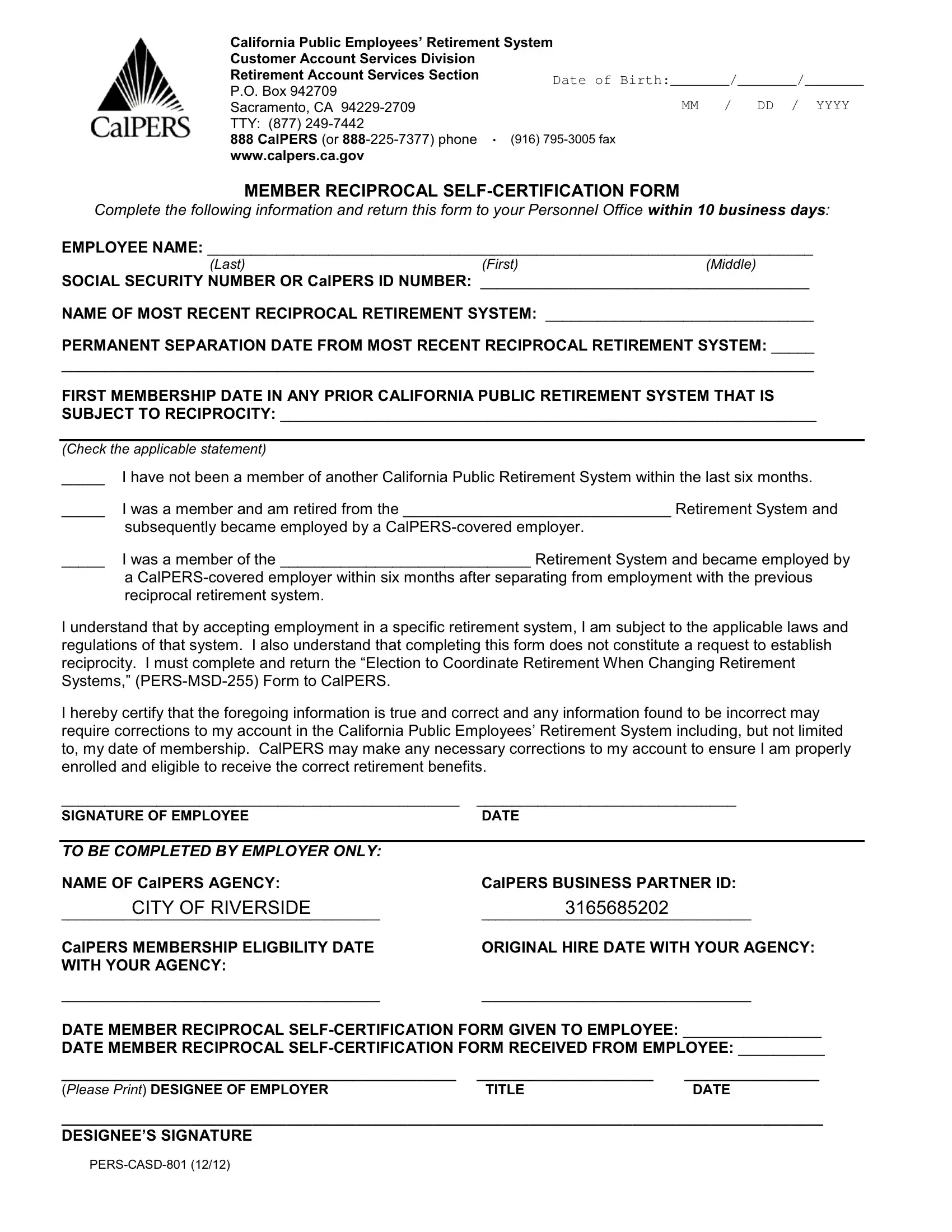

MEMBER RECIPROCAL SELF-CERTIFICATION FORM

Complete the following information and return this form to your Personnel Office within 10 business days:

EMPLOYEE NAME: ______________________________________________________________________

(Last)(First)(Middle)

SOCIAL SECURITY NUMBER OR CalPERS ID NUMBER: ______________________________________

NAME OF MOST RECENT RECIPROCAL RETIREMENT SYSTEM: _______________________________

PERMANENT SEPARATION DATE FROM MOST RECENT RECIPROCAL RETIREMENT SYSTEM: _____

_______________________________________________________________________________________

FIRST MEMBERSHIP DATE IN ANY PRIOR CALIFORNIA PUBLIC RETIREMENT SYSTEM THAT IS SUBJECT TO RECIPROCITY: ______________________________________________________________

(Check the applicable statement)

_____ |

I have not been a member of another California Public Retirement System within the last six months. |

_____ |

I was a member and am retired from the _______________________________ Retirement System and |

|

subsequently became employed by a CalPERS-covered employer. |

_____ |

I was a member of the _____________________________ Retirement System and became employed by |

|

a CalPERS-covered employer within six months after separating from employment with the previous |

|

reciprocal retirement system. |

I understand that by accepting employment in a specific retirement system, I am subject to the applicable laws and regulations of that system. I also understand that completing this form does not constitute a request to establish reciprocity. I must complete and return the “Election to Coordinate Retirement When Changing Retirement Systems,” (PERS-MSD-255) Form to CalPERS.

I hereby certify that the foregoing information is true and correct and any information found to be incorrect may require corrections to my account in the California Public Employees’ Retirement System including, but not limited to, my date of membership. CalPERS may make any necessary corrections to my account to ensure I am properly enrolled and eligible to receive the correct retirement benefits.

______________________________________________ |

______________________________ |

SIGNATURE OF EMPLOYEE |

DATE |

|

|

TO BE COMPLETED BY EMPLOYER ONLY: |

|

NAME OF CalPERS AGENCY: |

CalPERS BUSINESS PARTNER ID: |

CITY OF RIVERSIDE |

3165685202 |

______________________________________________ |

_______________________________________ |

CalPERS MEMBERSHIP ELIGBILITY DATE |

ORIGINAL HIRE DATE WITH YOUR AGENCY: |

WITH YOUR AGENCY: |

|

______________________________________________ |

_______________________________________ |

DATE MEMBER RECIPROCAL SELF-CERTIFICATION FORM GIVEN TO EMPLOYEE: ________________

DATE MEMBER RECIPROCAL SELF-CERTIFICATION FORM RECEIVED FROM EMPLOYEE: __________

______________________________________ |

_________________ |

_____________ |

(Please Print) DESIGNEE OF EMPLOYER |

TITLE |

DATE |

________________________________________________________________________________________

DESIGNEE’S SIGNATURE

MEMBER RECIPROCAL SELF-CERTIFICATION FORM

Instructions

Reciprocity is an agreement among public retirement systems to allow members to separate from one public employer and enter into employment with another public employer within a specific time limit without losing some valuable retirement and related benefit rights.

The Public Employees’ Pension Reform Act of 2013 (PEPRA), effective January 1, 2013, requires a CalPERS covered employer to determine the applicable PEPRA retirement benefit formula for new employees. CalPERS refers to all members that do not fit within the PEPRA definition of a “new member1” as “classic members” who are subject to the Public Employees’ Retirement Law (PERL). PEPRA allows a member after January 1, 2013, to retain his/her classic member retirement benefit status if the member continues his/her membership in all previous California Public Retirement System(s) by leaving his/her service credit and contributions (if any) on deposit, and the member enters into employment that results in CalPERS membership within six months of separating from the most recent California Public Retirement System. Classic member status also requires the membership date to be on or before December 31, 2012, in a California Public Retirement System in which reciprocity is established.

EMPLOYER INSTRUCTIONS

1.Employers must provide the Member Reciprocal Self-Certification Form to all new employees upon hire.

2.Employers must sign and date the Member Reciprocal Self-Certification Form on the date the form is given to the employee.

3.Upon receipt of the completed Member Reciprocal Self-Certification Form, the employer will enter the date the employee returns the form.

4.The employer will enroll the new employee into CalPERS membership through my|CalPERS based on the information provided on the Member Reciprocal Self-Certification Form. my|CalPERS will determine the proper retirement benefit formula. If an employer believes the retirement benefit formula is incorrect, employers may contact CalPERS at 1-888-225-7377.

5.It is the responsibility of the employer to retain the completed Member Reciprocal Self-Certification Form in the employee’s employment records for auditing purposes.

1A new member is defined in PEPRA as any of the following:

•A new hire who is brought into CalPERS membership for the first time on or after January 1, 2013, who has no prior membership in any California Public Retirement System.

•A new hire who is brought into CalPERS membership for the first time on or after January 1, 2013, who has a break in service of greater than six months with another California Public Retirement System that is subject to Reciprocity.

•A member who first established CalPERS membership prior to January 1, 2013, who is rehired by a different CalPERS employer after a break in service of greater than six months.

PERS-CASD-801 (12/12)

EMPLOYEE INSTRUCTIONS

1.The Member Reciprocal Self-Certification Form will assist your employer in determining whether you are considered a new member or a classic member under PEPRA.

2.As the new employee, you must complete, sign and date the Member Reciprocal Self-Certification Form to self-certify your most recent service in a reciprocal California Public Retirement System, your first membership date in any previous California Public Retirement System and your permanent separation date from the most recent California Public Retirement System; or indicate that you are not a member of any California Public Retirement System that is subject to Reciprocity.

3.As the new employee, you must return the Member Reciprocal Self-Certification Form to your Personnel Office within 10 business days of employment.

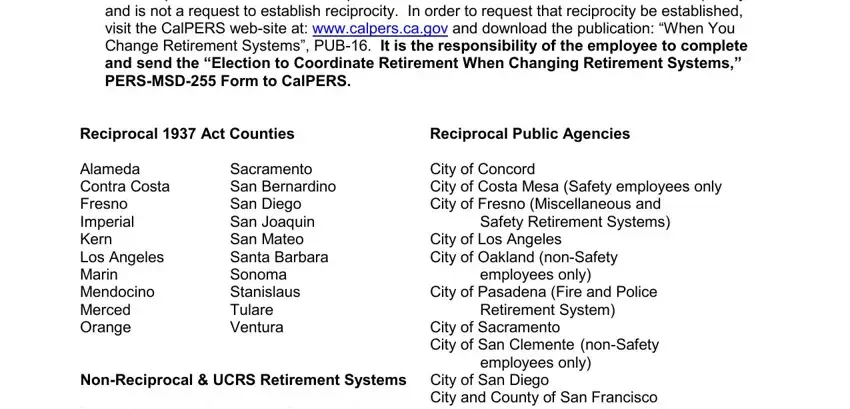

4.The completion of the Member Reciprocal Self-Certification Form does not establish reciprocity and is not a request to establish reciprocity. In order to request that reciprocity be established, visit the CalPERS web-site at: www.calpers.ca.gov and download the publication: “When You Change Retirement Systems”, PUB-16. It is the responsibility of the employee to complete and send the “Election to Coordinate Retirement When Changing Retirement Systems,” PERS-MSD-255 Form to CalPERS.

Reciprocal 1937 Act Counties |

Reciprocal Public Agencies |

Alameda |

Sacramento |

City of Concord |

Contra Costa |

San Bernardino |

City of Costa Mesa (Safety employees only |

Fresno |

San Diego |

City of Fresno (Miscellaneous and |

Imperial |

San Joaquin |

Safety Retirement Systems) |

Kern |

San Mateo |

City of Los Angeles |

Los Angeles |

Santa Barbara |

City of Oakland (non-Safety |

Marin |

Sonoma |

employees only) |

Mendocino |

Stanislaus |

City of Pasadena (Fire and Police |

Merced |

Tulare |

Retirement System) |

Orange |

Ventura |

City of Sacramento |

|

|

City of San Clemente (non-Safety |

|

|

employees only) |

Non-Reciprocal & UCRS Retirement Systems |

City of San Diego |

|

|

City and County of San Francisco |

Non-reciprocal systems are not covered by |

City of San Jose |

reciprocity retirement laws, but participate |

Contra Costa Water District |

in retirement agreements with other systems. |

East Bay Regional Park District |

|

|

(Safety employees only) |

State Teachers’ Retirement System |

Los Angeles County Metropolitan |

Legislators’ Retirement System |

Transportation Authority |

Judges’ Retirement System |

(Non-Contract Employees’ Retirement |

Judges’ Retirement System II |

Income Plan, formerly Southern |

University of California Retirement System |

California Rapid Transit District) |

PERS-CASD-801 (12/12)