Navigating the complexities of tax forms is essential for effective financial planning, and the Personal Income Tax Return Form (PIT-2), issued by the Department of Revenue & Customs under the Ministry of Finance, Royal Government of Bhutan, is no exception. Designed to capture the comprehensive income details of the taxpayer for a specific income year, this form delves into personal particulars, marital status, details regarding dependents, and an exhaustive breakdown of various income sources including salary, consultancy services, rental property, dividends, interest from financial institutions, cash crops, and other income types. Each section is meticulously structured to ensure that taxpayers provide precise information, from basic salaries and bonuses to rental income and dividends, laying out specific deductions and exemptions, ultimately computing the gross and adjusted gross income. With sections dedicated to the taxpayer's particulars such as name, taxpayer number (TPN), citizen ID number, and so forth, the form also pays close attention to personal circumstances that affect tax liability, including marital status and details of children that might influence the tax computation. Furthermore, it emphasizes the importance of accurately declaring all sources of income, supported by detailed computations for salary, rental properties, dividends, interest, and income from other sources like cash crops, requiring thorough documentation like bank statements and loan documents for verifications. Understanding the intricacies of the PIT-2 form is crucial for taxpayers to comply with tax regulations effectively and is a step towards responsible citizenship and financial transparency.

| Question | Answer |

|---|---|

| Form Name | Form Pit 2 |

| Form Length | 8 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 2 min |

| Other names | pit form puducherry, how to file pit online bhutan, pitform, pit form |

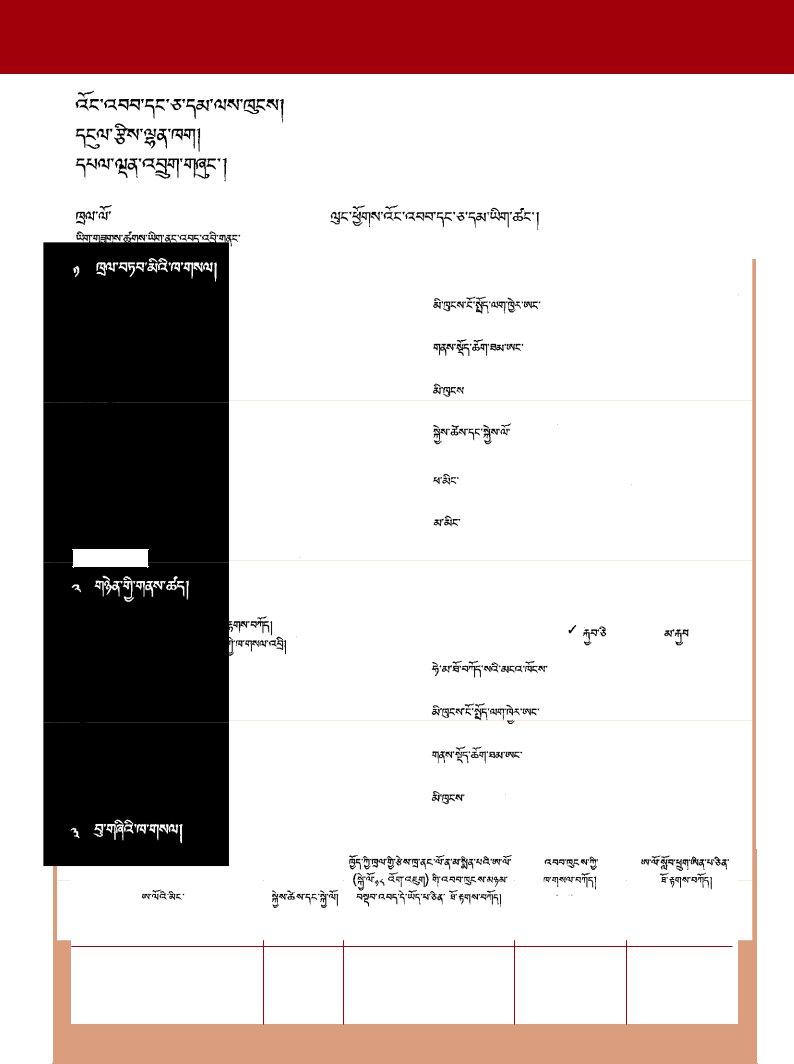

PERSONAL INCOME TAX RETURN FORM [ FORM PIT - 2 ]

DEPARTMENT OF REVENUE & CUSTOMS

MINISTRY OF FINANCE

ROYAL GOVERNMENT OF BHUTAN

|

|

INCOME YEAR |

|

|

|

|

|

RRCO |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

(Please ill the following in BLOCK LETTERS) |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

/1. TAXPAYER’S PARTICULARS |

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/Name |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

/Taxpayer No. (TPN) |

|

|

/Citizen ID No. |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

/Permanent Address |

|

|

|

|

|

|

|

|

|

|

|||

|

|

/House No.* |

|

|

|

|

/Residence Permit No. |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/Thram No.* |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

/Village |

|

|

|

|

/Nationality |

|

|

|

|

|

|

|

||

|

|

/Gewog |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

/Dzongkhag |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

/Date/Year of Birth |

|

|

|

|

|

|

|

|

|

|

/Present Address |

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

/Address |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

/Post Box No. |

|

|

|

|

/Father’s Name* |

|

|

|

|

|

|

|

||

|

|

/Dzongkhag |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

/Telephone number |

|

|

/Mother’s Name* |

|

|

|

|

|

|

|

||||

|

2. |

MARITAL STATUS |

|

|

|

|

|

|

|

|

|

|||||

|

|

(O) |

(R) |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/2. |

MARITAL STATUS |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/Are you married? Please tick |

Yes |

|

No |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

If married, please ill in spouse’s particulars: |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

/Spouse’s name |

|

|

|

|

/Previous Place of Registration |

|

|

|

|

|

|

|

|

|

|

/Date/year of birth |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

/Citizen ID number |

|

|

|

|

|

|

|

|

|

|

/Present Address |

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

/Residence Permit number |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/Telephone number |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

/Nationality |

|

|

|

|

|

|

|

|

/3. |

DETAILS OF CHILDREN |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Specify the source |

Tick if the child is |

|

|

|

|

of income clubbed |

||

Child’s Name |

Date of Birth |

Tick if the income of |

student. |

||

in the return. |

|||||

|

|

a child below 18 years |

|

||

|

|

|

|

||

|

|

of age is clubbed in the return |

|

|

1

2

3

4

Footnote: JIS,JY,[YJ,XS)I;,DS,;,NIS,],EYS, NIJ,GUL,HI,HI’Y,DS,’L/If required, please use

Page 1 of 8

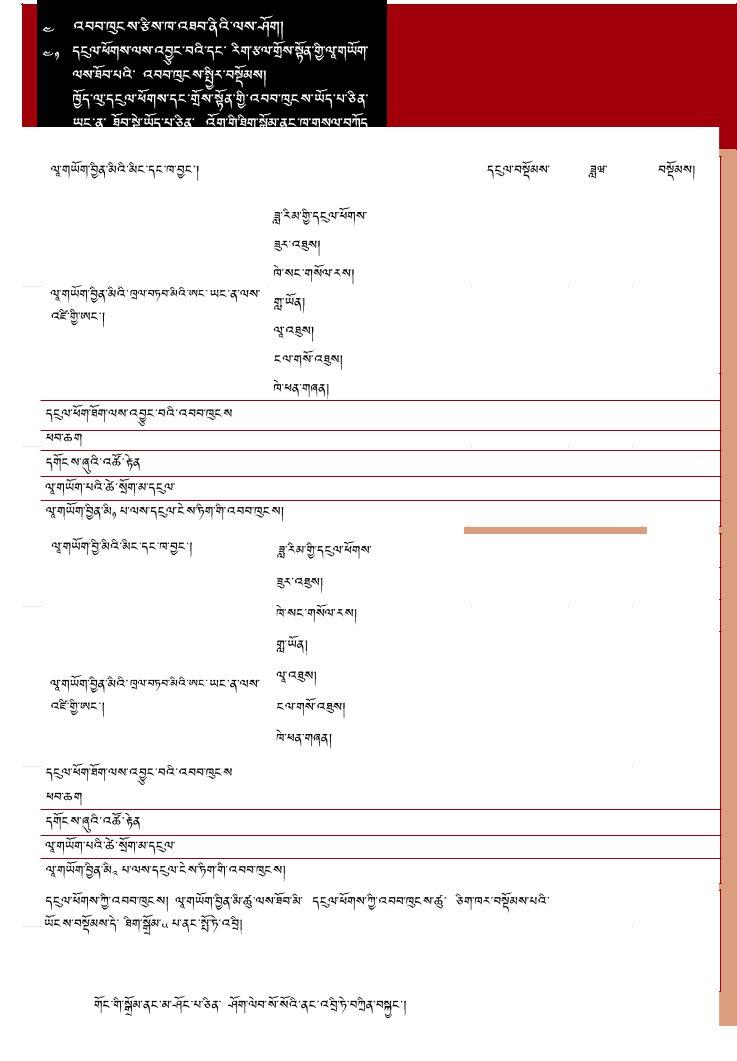

4 INCOME COMPUTATION WORKSHEET

4.1 GROSS INCOME FROM SALARY AND CONSULTANCY SERVICES

(If you have/had income from salary or consultant fees, please ill in the following)

Employer’s name and address: |

Amount |

Month |

Total |

|

|

|

|

|

|

|

|

/Basic salary |

|

|

|

|

|

|

|

|

|

/Allowance(s) |

|

|

|

|

|

|

|

|

|

/Bonus |

|

|

|

|

|

|

|

|

|

/Fees |

|

|

Employer’s TPN or ACS code: |

|

|

|

|

/Commission(s) |

|

|

||

|

|

|

|

|

|

|

/Leave encashment |

|

|

/Any other beneits

/Gross salary income

/Less:

/Provident fund (PF)

/Group insurance scheme (GIS)

/Net salary incom from employer 1

/Basic salary

Employer’s name and address:

/Allowance(s)

/Bonus

Employer’s TPN or ACS code: |

|

/Fees |

|

|

|

|

|

/Commission(s) |

|

|

|

|

|

/Leave encashment |

|

|

|

|

|

/Any other beneits |

|

|

|

|

/Gross salary income |

|

|

|

|

/Less: |

|

|

/Provident fund (PF)

/Group insurance scheme (GIS)

/Net salary incom from employer 2

Adjusted gross salary income

AGI (i): Add the totals of net salary income from employers to give adjusted gross salary

income and transfer the amount to Table No5 5

Footnote: |

If required, please use additional sheet. |

|

Page 2 of 8

. |

4.2 GROSS INCOME FROM RENTAL PROPERTY |

|

[If you own rental property/properties and have a |

|

rental income, please ill in the following (Rental |

|

property includes land, building and houses |

|

used for rental purpose] |

|

|

Type of property

Plot / Thram

number

Location

Rental per/ No. of Plots No. of Units plot/month

Rental income

Remarks

A:Gross rental income for all properties (add the above)

B1: Interest paid on loans (enclose bank statements)

B2: Repair and maintenance (20%) of A

B3: Insurance premiums

B4: Local taxes

B:Total speciic deductions/exemption(add the four above:B = B1+B2+B3+B4)

AGI (ii)

AGI (ii) Adjusted gross rental income (A – B) and if positive, transfer the amount to Table No 5.

Footnote: |

/If required, please use additional sheet. |

Page 3 of 8

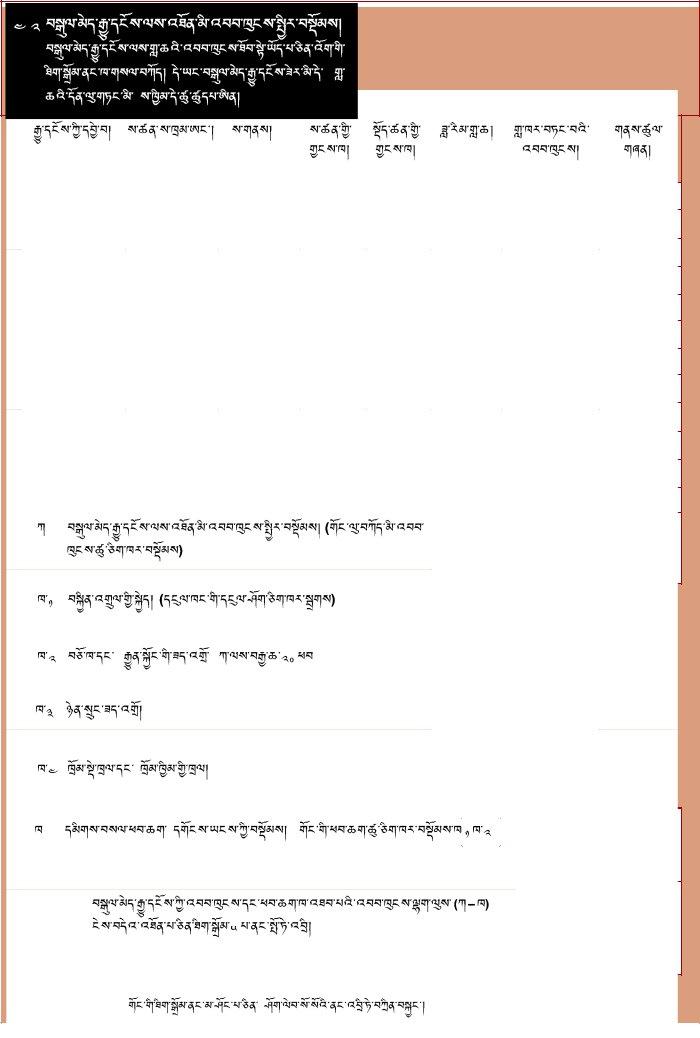

4.3GROSS INCOME FROM DIVIDEND

If you have received dividend, please ill in the following.

Name of company

Share Certiicate No. of shares Face value of shares Number

%of dividend declared

Dividend

A: Gross dividend income from all companies (add the above)

B1: Interest paid on loans (enclose loan documents)

B2: Exemption |

|

10,000 |

|

|

|

|

|

|

|

|

|

B: Total speciic deductions/exemption (add the two above B = B1+B2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AGI (iii) Adjusted gross dividend income (A – B) and If positive, transfer the amount to Table No 5

Footnote:/If required, please use additional sheet.

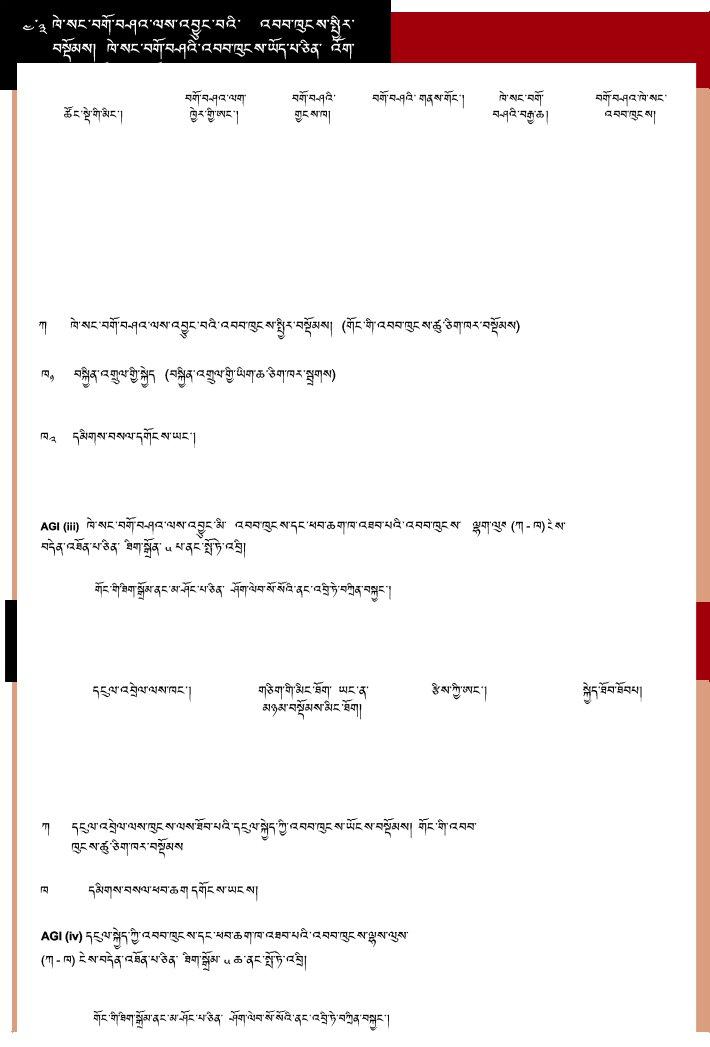

4.4 GROSS INCOME FROM INTEREST (If you have ixed deposit accounts with a inancial institution, please ill in the following

|

Financial institutions |

|

Single or joint account |

Account number |

|

Interest received |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A: Gross interest from all inancial institutions. (add the above) |

|

|

||||

|

B: Speciic deductions/exemption |

|

|

|

10,000 |

|

|

|

|

|

|

|

|

||

|

AGI (iv) Adjusted gross interest income (A – B) and If positive, transfer the amount to Table No 5 |

|

|

||||

|

|

|

|

|

|

|

|

|

Footnote: |

|

/If required, please use additional sheet. |

|

|||

Page 4 of 8

4.5GROSS INCOME FROM CASH CROP

(If you own any orchards (apple, orange and cardamom), please ill in the following.

Type of orchard

Plot number Thram number

Location

Gross income from sales

A:Gross income from all orchards (add the above)

B:Speciic deduction/exemption (30% of A)

AGI (v) Adjusted gross income from cash crops (A – B) and

If positive, transfer the amount to Table 5

Footnote: |

/If required, please use additional sheet. |

|

|

|

If required, please use additional sheet. |

|

4.6 GROSS INCOME FROM OTHER SOURCES |

(If positive, transfer the amount to Table No 5) |

(If you have received any income from other |

|

|

|

sources, please ill in the following) |

|

|

|

|

Type of income

Name and address of person from whom received

TPN or ACS code

Income

A:Gross income from all other sources (add the above)

B:Speciic deduction/exemption (30% of A)

AGI (vi) Adjusted gross income from other sources (A – B)

and If positive, transfer the amount to Table 5

Footnote: |

/If required, please use additional sheet. |

Page 5 of 8