form pr74 can be filled out online effortlessly. Just use FormsPal PDF editing tool to get it done quickly. Our editor is continually evolving to provide the very best user experience possible, and that is thanks to our dedication to constant improvement and listening closely to user opinions. To start your journey, go through these basic steps:

Step 1: Access the form inside our editor by clicking the "Get Form Button" at the top of this page.

Step 2: As soon as you start the online editor, there'll be the form prepared to be completed. Besides filling out various fields, you can also perform various other things with the Document, such as adding custom text, changing the initial text, adding graphics, signing the document, and much more.

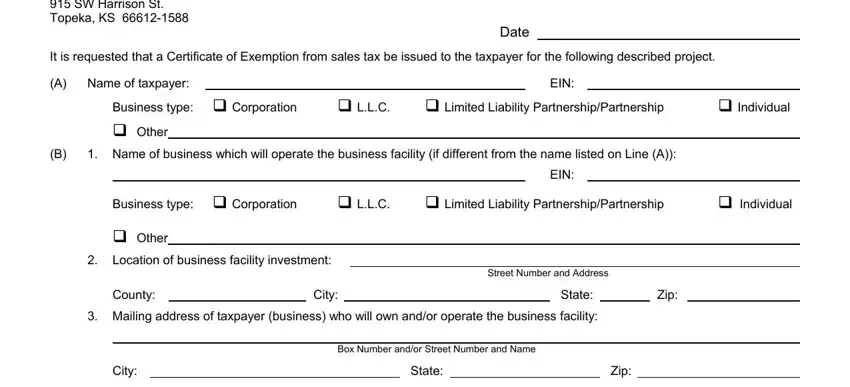

This PDF form will need specific info to be filled in, hence you must take your time to fill in precisely what is required:

1. Begin completing the form pr74 with a selection of essential fields. Note all the important information and ensure there is nothing neglected!

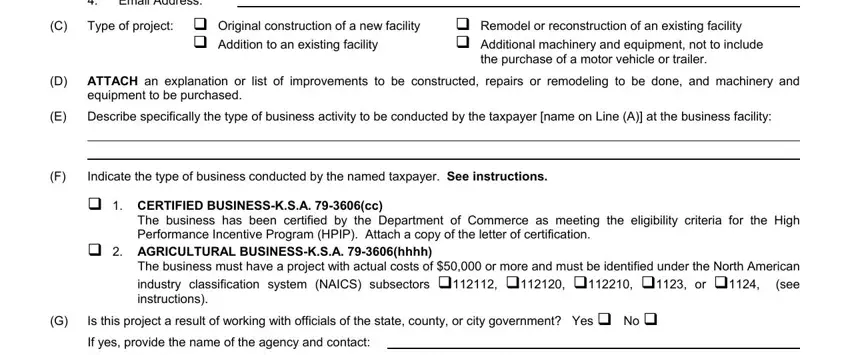

2. Given that the last part is done, it's time to include the required particulars in Email Address, C Type of project D ATTACH an, Remodel or reconstruction of an, Original construction of a new, equipment to be purchased, E Describe specifically the type, Indicate the type of business, CERTIFIED BUSINESSKSA cc, The business has been certified by, AGRICULTURAL BUSINESSKSA hhhh, The business must have a project, Is this project a result of, If yes provide the name of the, and G H List the names and addresses so you can go further.

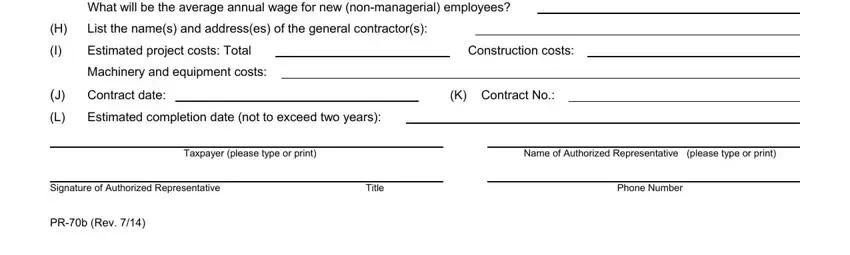

3. In this part, have a look at G H List the names and addresses, What will be the average annual, Construction costs, Estimated project costs Total, J Contract date L Estimated, Taxpayer please type or print, Signature of Authorized, Title, PRb Rev, K Contract No, Name of Authorized Representative, and Phone Number. These should be taken care of with greatest precision.

It's simple to get it wrong when filling out the Phone Number, so make sure you look again prior to when you submit it.

Step 3: As soon as you've looked over the information provided, simply click "Done" to complete your form. Create a free trial plan with us and obtain instant access to form pr74 - which you can then begin to use as you would like from your personal account page. FormsPal ensures your information privacy by using a secure system that in no way records or distributes any kind of personal information provided. Be confident knowing your docs are kept confidential when you use our editor!