For motor carriers operating within the boundaries of South Carolina, understanding the nuances of the Application for Motor Carrier Property Tax form PT-442 is a vital part of managing their business obligations to the state. This comprehensive form, designed by the South Carolina Department of Revenue, serves as the primary document for the declaration and payment of property taxes related to motor vehicles. It meticulously outlines the need for detailed information, including the name and type of ownership (ranging from sole proprietorships to corporations), the physical and mailing addresses of the business, and a roster of vehicles for which the tax applies. The form mandates the inclusion of a Federal Identification Number or Social Security Number for processing and verification purposes, ensuring the accuracy and legitimacy of the provided information. Furthermore, the PT-442 form addresses the contingency of sold or repossessed vehicles within its specified tax year, underscoring the state's effort to accurately levy taxes while providing pathways for rightful deductions or exemptions. It's a document that, while primarily focused on taxation, offers insight into the broader regulatory landscape faced by motor carriers, necessitating a careful and informed approach to compliance.

| Question | Answer |

|---|---|

| Form Name | Form Pt 442 |

| Form Length | 3 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 45 sec |

| Other names | PT-442, 442 form, SSN, PT-453 |

|

|

|

|

|

|

STATE OF SOUTH CAROLINA |

|

|

|

|

|

|

|||

|

|

|

|

|

|

DEPARTMENT OF REVENUE |

|

|

|

|

|

|

|||

|

|

|

|

|

APPLICATION FOR MOTOR |

|

|

|

(Rev. 4/4/02) |

||||||

|

|

|

|

|

|

CARRIER PROPERTY TAX |

|

|

|

7070 |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Telephone: |

(803) |

|

|

|

|

|

|

|

For Office Use |

||||||

|

|

|

|

|

|

|

|

|

|

|

|||||

Mail to: South Carolina Department of Revenue |

|

|

|

SID No. |

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|||||||

|

License and Registration |

|

|

|

File No. |

|

|

|

|

|

|||||

|

Columbia, South Carolina |

|

|

|

|

|

|

|

|

|

|||||

|

|

FEI |

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

SSN |

|

|

|

|

|

||

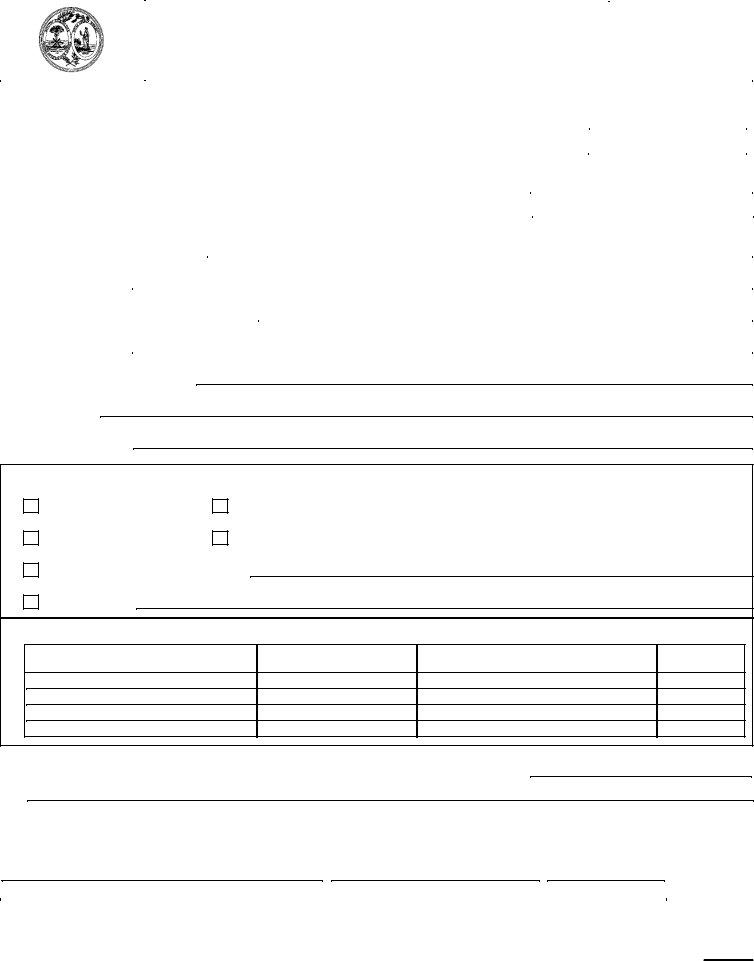

1. |

Name of Owner/Corporation |

|

|

|

|

|

|

|

|

|

|

||||

2. |

Business Name |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

Please Print or Type |

|

|

|

|

|

|

|

|

3. Physical Location (no post office box) |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

Street No. - RFD |

City |

County |

|

State |

Zip Code |

||||

4. |

Mailing Address |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

Street No. - RFD, Post Office Box |

City |

County |

State |

Zip Code |

|||||||

5.Open Date at this Location

6.Telephone

7.No. of Locations

8.Type Of Ownership

Sole Proprietor

LLC/LLP

Partnership

Unincorporated Association; Enter Legal Name

Corporation; Enter Charter Name

Other; Explain

9. Names of Business Owner, Partners or Officers:

Name/Title |

Social Security No. |

Address |

If Partner, |

|

Percent Owned |

||||

|

|

|

1.

2.

3.

4.

10. We have physical locations (real property owned or leased) in the following counties:

I declare that the application, including the accompanying schedules, if any, has been examined by me and to the best of my knowledge and belief the information contained therein is true and correct.

SIGNATURE OWNER, PARTNERS OR CORPORATE OFFICER |

TITLE |

DATE |

|

|

|

The statutes covering the Motor Carrier Property Tax are Code Sections

Social Security Privacy Act

It is mandatory that you provide your social security number on this tax form. 42 U.S.C 405(c)(2)(C)(i) permits a state to use an individual's social security number as means of identification in administration of any tax. SC Regulation

State of South Carolina

Department of Revenue

301 Gervais Street, P.O. Box 125, Columbia, South Carolina, 29214

SOUTH CAROLINA MOTOR CARRIER PROPERTY TAX

INFORMATION SHEET

Calendar Year, Due Date, Vehicles to Be Included

The motor carrier property tax return for the calendar year 2003 is due by June 30, 2004. The return should include all vehicles registered with a gross vehicle weight greater than 26,000 pounds and buses for hire registered with a BC tag designed to carry 16 or more passengers including the driver.

Please use Blue or Black Ink only when completing the for

Special Mobile Tags

If the vehicles have SM tags, the property taxes should be paid to the County not the Department of Revenue.

Farm Tags

Starting with calendar year 2000, there is no weight class for farm tags with the Department of Revenue. If the vehicle(s) have FM tags, the property taxes should be paid to the County.

Federal Identification Number (FEI)/Social Security Number (SS)

A return cannot be processed without a FEI or SS number. The number provided should be for the owner of the vehicle. All type corporations and partnerships should provide the FEI number. Individuals/sole proprietors should provide their

SSnumber and FEI if one has been assigned to them. This number is also required because it will allow the Department of Revenue to continue to pursue a method to consolidate the vehicle file.

Filing One Return For All Vehicles

The Department of Revenue is still working to consolidate the file received from the Department of Public Safety so that vehicle owners may file one return for all vehicles required to be reported. Because of the different names used to register vehicles and the lack of valid FEI/SS numbers, more than one return may have been received. DO NOT throw any tax returns away.

If more than one return is received, please use the one with the file number you filed under for tax year 2002. All vehicles MUST be reported on one return. If this is the first time you filed and you received more than one return, please use the return with the most correct information and indicate on the others the file number you filed under. (Example: All information reported on DOR

Vehicle Sold

If the vehicle(s) have been sold prior to December 31, 2003 please attach a copy of the Bill of Sale to the

Vehicle Repossessed

If the vehicle was repossessed prior to December 31, 2003, you will need to attach written confirmation from the financial institution as to the day the vehicle was picked up and they regained possession of the vehicle. If the vehicle was repossessed after December 31, 2003 the return and payment for 2003 are still due.

(Rev. 2/18/04)

Social Security Privacy Act Disclosure

It is mandatory that you provide your social security number on this tax form. 42 U.S.C. 405(c)(2)(C)(i) permits a state to use an individual's social security number as means of identification in administration of any tax. SC Regulation

Credit Balance (Line 8)

If there is a credit balance from the return for calendar year 2002, use Line 8 to take credit against the current tax liability. Keep a record of any credit balance remaining to be used on next year's return. All credit deductions are subject to the future verification and audit of the original credit deducted for calendar year 1997. If you did not file a return for 1997 you would have no credit balance.

This office will be unable to verify credit information by telephone due to the number of calls expected concerning filing the current return and the time required to do the verification.

Property Taxes Charged By County

If the county charged property taxes for vehicles required to be reported on this return, you should contact the county auditor's office to request a refund from the county. No credit is allowed on the Motor Carrier Property Tax return for taxes paid to the county.

Payment of Property Tax

If a return is filed by June 30, 2004 the law allows for a split payment of the tax. No less than

Application for Motor Carrier Property Tax form

New accounts are asked to complete the enclosed

Record Keeping

Keep a copy of all returns filed with the Department of Revenue and keep records to substantiate information included on the return. Records should be kept for at least three years.

Schedule

Complete Purchase date and Purchase price for all listed vehicles. Any vehicles you may own with a GVW greater than 26,000 pounds that are not listed,should be added to the schedule and all columns completed.

Telephone Numbers

For assistance call (803)

Mailing Address

SC Department of Revenue

MC Property Tax

Columbia SC