The Quarterly Services Survey, known more formally as the QSS-4E form, functions as a critical tool for capturing data pivotal to assessing the economic health of the United States' service sector. Issued by the U.S. Census Bureau, part of the Department of Commerce, this instrument gathers comprehensive information on service revenue and other indicators from businesses across the nation. The form's specificity in covering establishments primarily in services—excluding sectors like retail, wholesale, manufacturing, mining, and construction—targets a nuanced understanding of this expansive area of the economy. With a structure that allows for reporting on organizational changes such as acquisitions, mergers, or divestitures, the QSS-4E ensures that data reflect the dynamic nature of service businesses. Moreover, it emphasizes the reporting of data on an accrual basis, simplifying the process of recording financial transactions when they occur regardless of physical payment. Beyond capturing financial data, the survey underlines confidentiality, protecting respondents' information under federal law from unauthorized use in taxation, regulation, or investigation, and barring its release under the Freedom of Information Act. The collection of this information, driven by a need for accurate, timely data, plays a pivotal role in economic planning and policy-making, emphasizing its significance beyond mere number collection.

| Question | Answer |

|---|---|

| Form Name | Form Qss 4E |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | qss 4e qss 4e form |

OMB No.

U.S. DEPARTMENT OF COMMERCE

Economics and Statistics Administration

U.S. CENSUS BUREAU

FORM

Due Date

Need help or have questions?

Call

(8:30 a.m. - 5:00 p.m. ET,

YOUR CENSUS REPORT IS CONFIDENTIAL. It may be seen only by persons sworn to uphold the confidentiality of Census Bureau information and may be used only for statistical purposes. Under the same law, information that you report cannot be used for taxation, regulation, or investigation and are exempt from release under the Freedom of Information Act. Further, copies of your response retained in your files are immune from legal process.

QUARTERLY SERVICES SURVEY

(Please correct any errors in name, address, and ZIP Code.)

21962014

Return via Internet: |

Return via Fax: |

To view Survey Results: |

|||||

econhelp.census.gov/qss |

|

census.gov/services |

|||||

|

|

|

|

|

|

|

|

Username: |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Password: |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

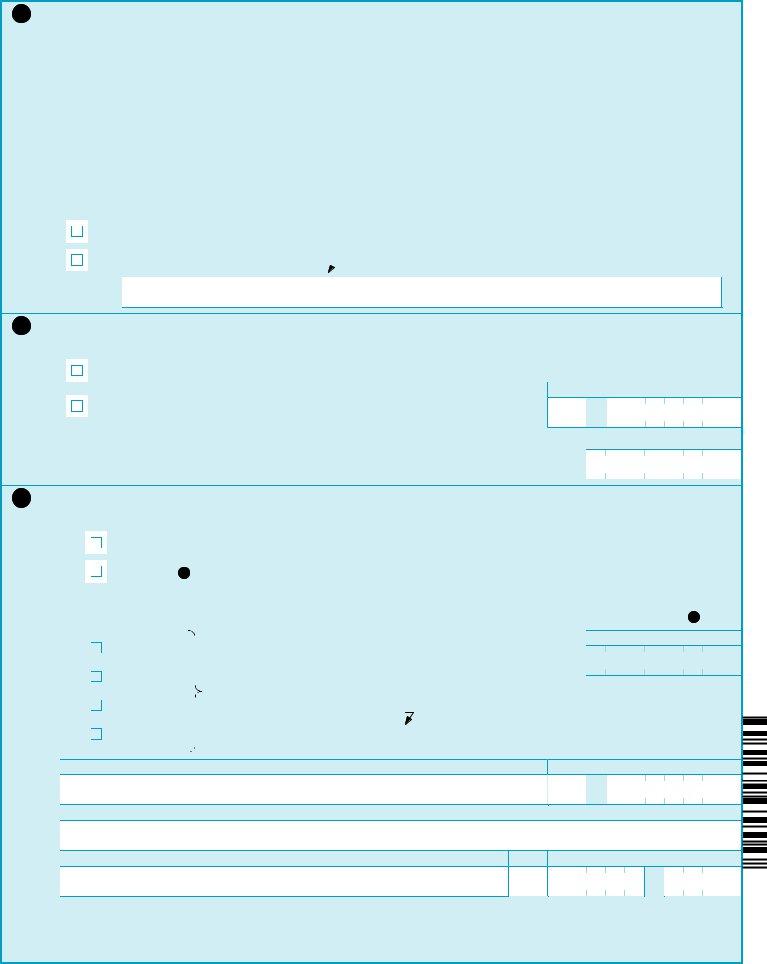

GENERAL INSTRUCTIONS |

|

|

|

|

Throughout this survey, any reference to "this firm" is referring to the EIN that is printed in the mailing address area or the new EIN that was provided as a response in 2 . Any responses related to "this firm" should only include data for the EIN referenced.

•Any significant change in this firm's operations should be noted in 8

•For establishments sold or acquired during the quarter(s), report data only for the period the establishments were operated by this firm

•Estimates are acceptable if book figures are not available

•Enter "0" where applicable

• Report data on an accrual basis |

Bil. |

Mil. |

Thou. |

Dol. |

|

|

• Dollars should be rounded to the nearest dollar |

1 |

0 3 0 |

2 8 0 |

4 5 6 |

|

|

• If a figure is $1,030,280,456 it should be reported as |

|

|

||||

|

|

|

|

|

|

|

INCLUDE:

•Data for all Services establishments (excluding data for Retail, Wholesale, Manufacturing, Mining, and Construction operations) operated by this firm

•Data for auxiliary facilities primarily engaged in supporting services to this firm's establishment(s) such as warehouses, garages, central administrative offices, and repair services

CONTINUE ON PAGE 2

21962022

Form |

Page 2 |

1SURVEY COVERAGE

Did this firm provide the business activities described below?

Yes

No - Specify this firm's business activity

2FEDERAL EMPLOYER IDENTIFICATION NUMBER (EIN) Does this firm report payroll under EIN

Yes |

|

|

|

|

EIN (9 digits) |

|

|

No - Enter current |

- |

|

|

reported for this EIN |

|

|

|

|

|

|

|

|

Month |

Day |

Year |

3ORGANIZATIONAL CHANGE

A. Did this firm experience any acquisitions, sales, mergers, and/or divestitures in the

Yes

No - Go to 4

B. Which of the following organizational changes occurred in the

Check all that apply. If more than one organizational change occurred during the reporting period, explain in 8 .

|

|

|

Acquisition |

Date of organizational change |

Month |

Day |

Year |

|

|

|

|||||

|

|

|

|

|

|

||

|

|

|

Merger |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

AND |

|

|

|

|

|

|

|

Sale |

|

|

|

|

|

|

|

Enter detailed information below |

|

|

|

|

|

|

|

Divestiture |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of company |

|

EIN (9 digits) |

|

|

- |

Address (Number and street, P.O. Box, etc.) |

|

|

City, town, village, etc. |

State |

ZIP Code |

|

|

- |

CONTINUE ON PAGE 3

Form |

Page 3 |

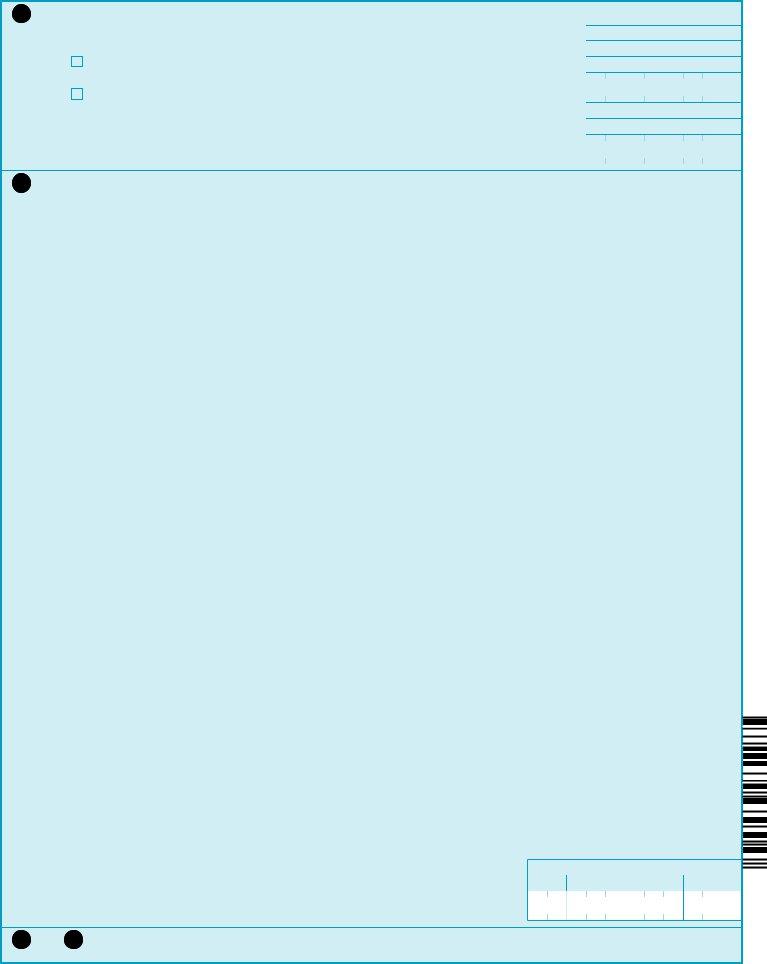

4REPORTING PERIOD

What time period is covered by the data provided in this report?

|

|

|

|

|

Beginning Date |

||

|

|

|

Calendar quarter |

|

|||

|

|

|

|

|

|

|

|

|

|

|

Month |

Day |

|

Year |

|

|

|

|

Other - Report beginning and ending dates |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

End Date |

|

|

|

|

|

|

Month |

Day |

|

Year |

|

|

|

|

|

|

|

|

5SALES, RECEIPTS, OR REVENUE

Firms operating on a commission basis should report commissions, fees, and other operating revenue income, not gross billings or sales.

21962030

Taxable Firms

INCLUDE:

•Total value of service contracts

•Amounts received for work subcontracted to others

•Revenue from services performed by domestic locations for foreign parent firms, subsidiaries, branches, etc.

•Market value of compensation in lieu of cash

•Franchise sales, fees, and royalties

•Sale or licensing of rights to intellectual property protected by copyright or as industrial property (e.g., patents, trademarks)

EXCLUDE:

•Taxes (sales, amusement, occupancy, use, or other) collected directly from customers or clients and paid directly to a local, state, or Federal tax agency

•Revenue from a domestic parent organization, or from franchise locations owned by others

•Rents from and revenue of separately operated departments, concessions, etc., which are leased to others

•Revenue from customers for carrying or other credit charges

•Commissions from vending machine operators

•Revenue of foreign subsidiaries (those located outside the U.S. , i.e., outside the 50 states, District of Columbia, U.S. Commonwealth Territories, or U.S. Possessions)

•Nonoperating revenue such as income from investments, sales of

•Revenue from the sale of used equipment

•Installment payments from leasing under capital, finance, or

•Intracompany transfers

•Interest income

•Gross contributions, gifts, and grants (whether or not restricted for use in operations)

INCLUDE:

•Program service revenue

•Gross sales of merchandise, minus returns and allowances

•Income from interest, dividends, gross rents (including display space rentals and share of receipts from departments operated by other companies), royalties, and other investments

•Net gains (losses) from the sale of real estate (land and buildings), investments, or other assets (except inventory held for resale)

•Gross contributions, gifts, and grants (whether or not restricted for use in operations)

•Dues and assessments from members and affiliates

•Commissions earned from the sale of merchandise owned by others (including commissions from vending machine operators)

•Gross receipts from fundraising activities

EXCLUDE:

•Taxes (sales, amusement, occupancy, use, or other) collected directly from customers or clients and paid directly to a local, State, or Federal tax agency

•Gross receipts of departments or concessions operated by other companies

•Amounts transferred to operating funds from capital or reserve funds

$ Bil. |

Mil. |

Thou. |

Dol. |

|

|

|

|

|

What was this firm's revenue in the |

. . . . . . . . |

6 and 7 Not Applicable.

CONTINUE ON PAGE 4

21962048

Form |

Page 4 |

8REMARKS - Please use this space to explain any significant

9CONTACT INFORMATION

|

Name of person to contact regarding this report (Please print) |

Title |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Area code |

Number |

Extension |

|

|

Area code |

Number |

||||

|

Telephone |

|

|

- |

|

|

|

Fax |

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

Website

THANK YOU

for completing your QUARTERLY SERVICES SURVEY.

We suggest you keep a copy for your records.

Public reporting burden for this collection of voluntary information is estimated to average 10 minutes per response, including the time for reviewing instructions, searching existing data sources, gathering and maintaining the data needed, and completing and reviewing the collection of information. Send comments regarding this burden estimate or any other aspect of this collection of information, including suggestions for reducing this burden, to: Paperwork Project 0607- 0907, U.S. Census Bureau, 4600 Silver Hill Road,

Respondents are not required to respond to any information collection unless it displays a valid approval number from the Office of Management and Budget. This