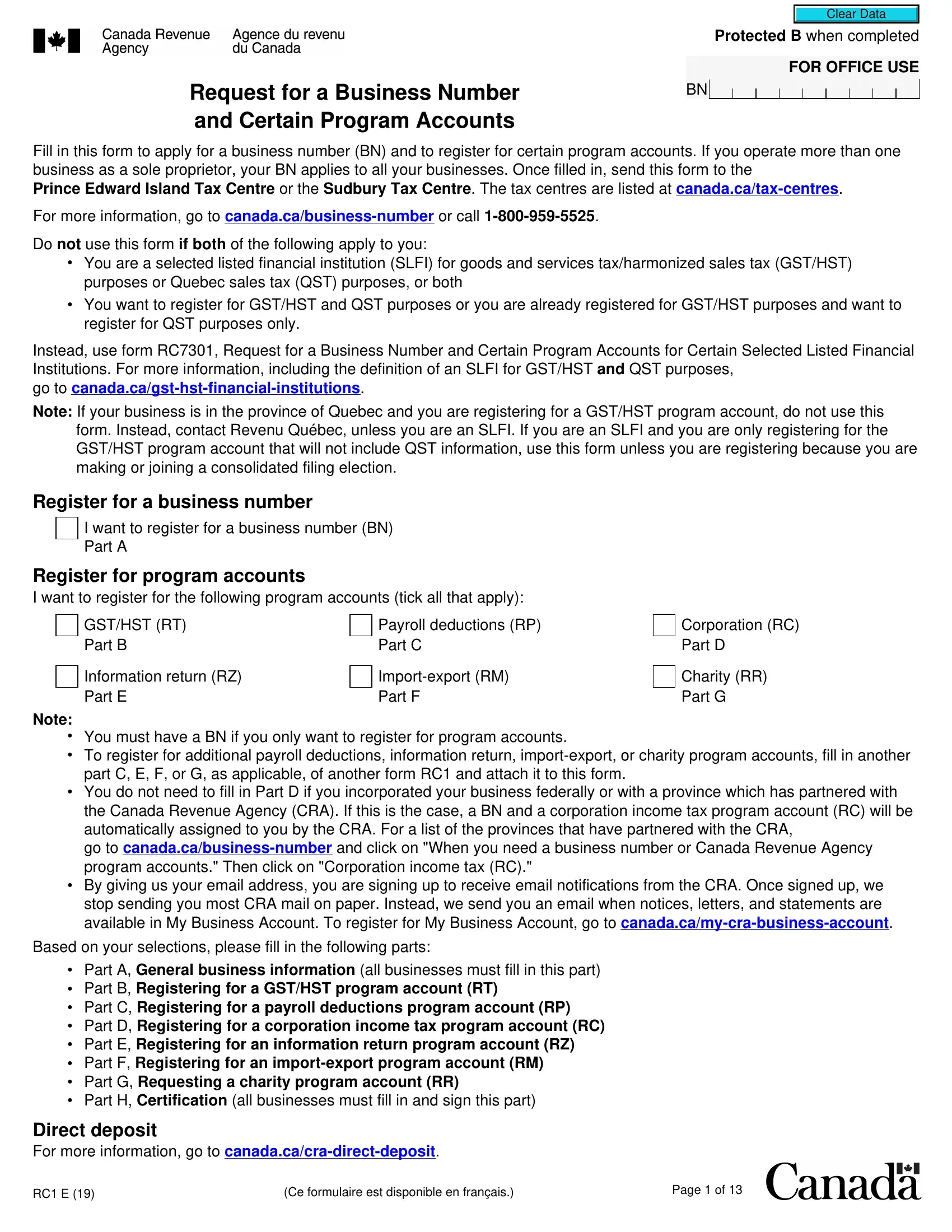

Making use of the online PDF editor by FormsPal, you'll be able to fill out or change rc1 form here. To keep our editor on the forefront of practicality, we aim to implement user-driven capabilities and enhancements regularly. We're routinely grateful for any suggestions - join us in remolding PDF editing. Getting underway is simple! All you need to do is take these easy steps directly below:

Step 1: Click the orange "Get Form" button above. It will open up our tool so that you could begin filling in your form.

Step 2: This editor offers the ability to customize your PDF document in various ways. Transform it by adding your own text, correct what's already in the PDF, and place in a signature - all when it's needed!

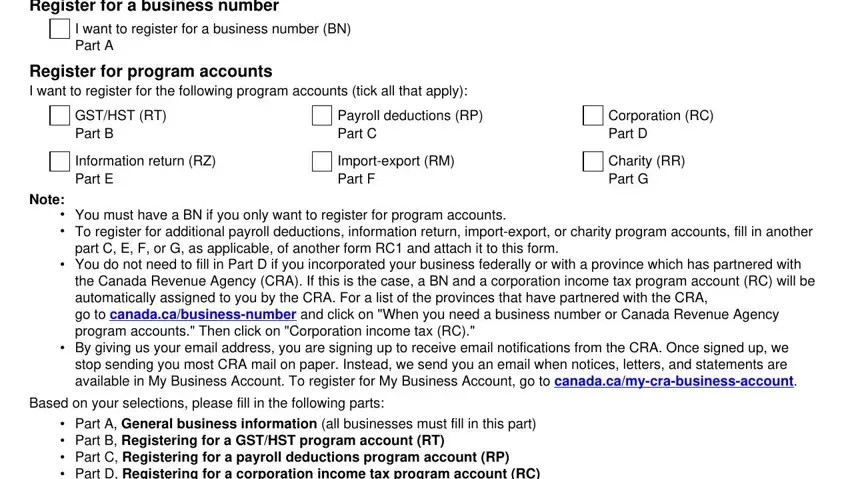

It will be an easy task to complete the form with this practical guide! Here's what you must do:

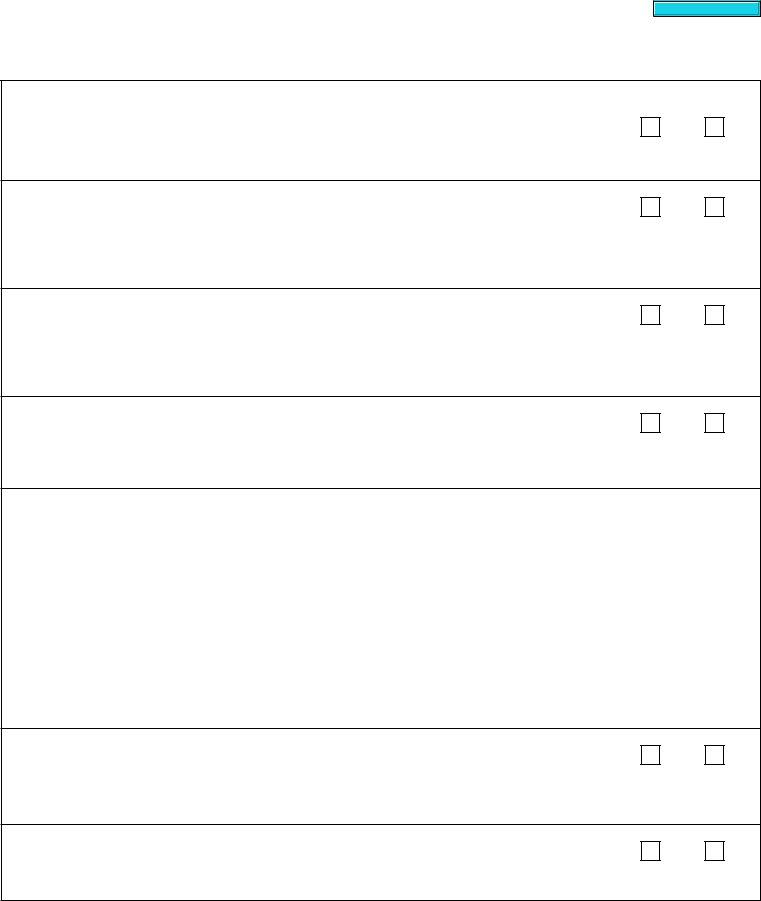

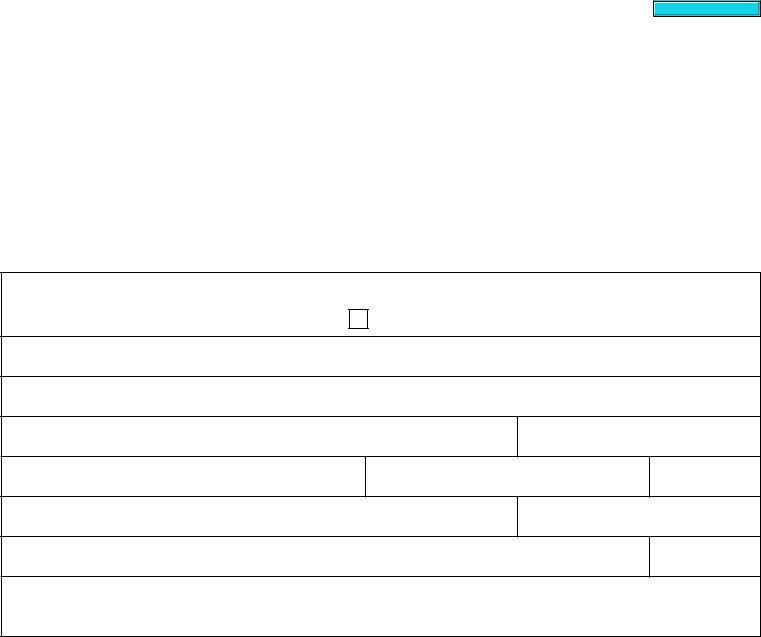

1. Fill out the rc1 form with a group of major fields. Collect all the important information and make sure absolutely nothing is missed!

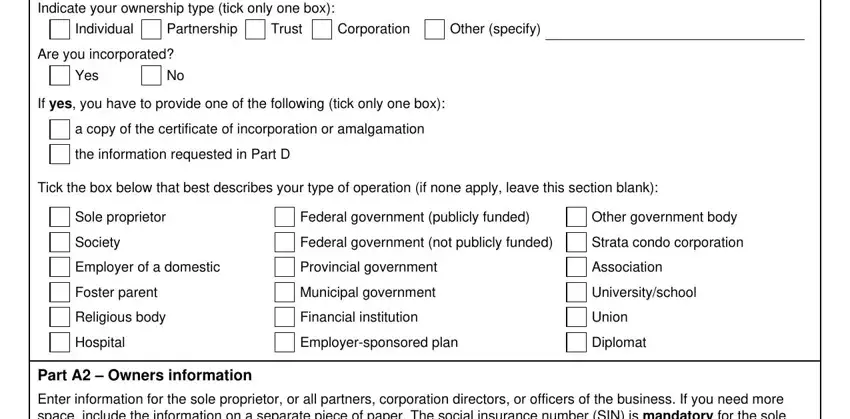

2. After the last array of fields is finished, it's time to put in the essential specifics in Indicate your ownership type tick, Individual, Partnership, Trust, Corporation, Other specify, Are you incorporated, Yes, If yes you have to provide one of, a copy of the certificate of, the information requested in Part D, Tick the box below that best, Sole proprietor, Society, and Federal government publicly funded allowing you to go to the 3rd stage.

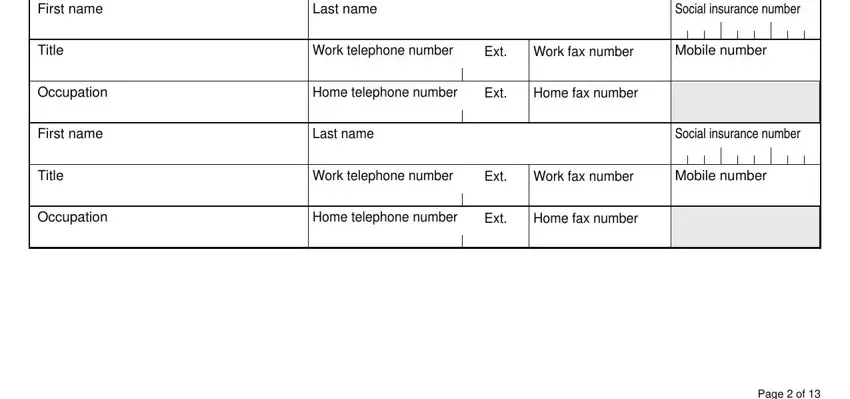

3. Completing First name, Title, Occupation, First name, Title, Occupation, Last name, Social insurance number, Work telephone number, Ext, Work fax number, Mobile number, Home telephone number, Ext, and Home fax number is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

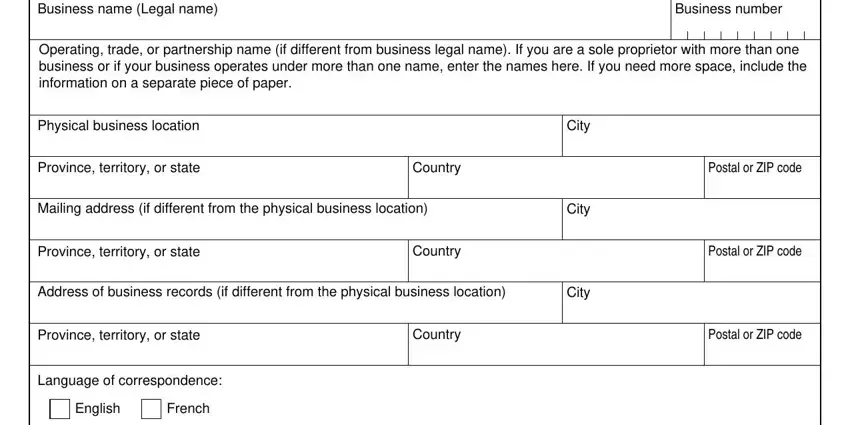

4. This specific paragraph comes with these form blanks to focus on: Business name Legal name, Business number, Operating trade or partnership, Physical business location, Province territory or state, Country, Mailing address if different from, City, City, Postal or ZIP code, Province territory or state, Country, Postal or ZIP code, Address of business records if, and City.

A lot of people often make some errors while completing Country in this part. You need to review what you type in here.

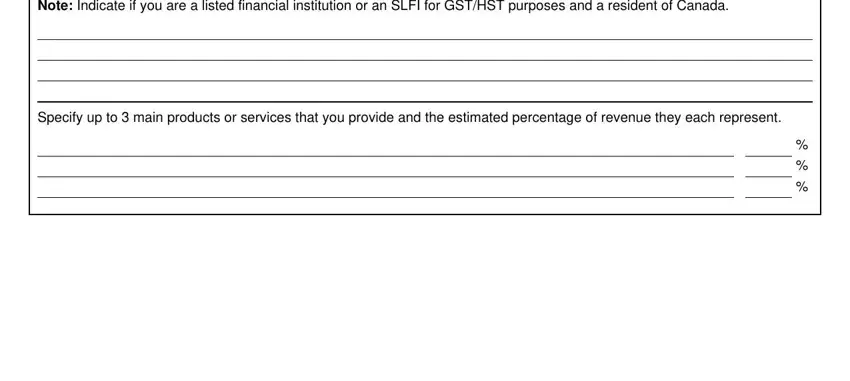

5. The form should be finalized by going through this area. Here one can find a comprehensive set of blanks that need correct information to allow your form usage to be faultless: Describe your major business, and Specify up to main products or.

Step 3: Prior to submitting the file, double-check that blanks were filled in right. When you’re satisfied with it, press “Done." Try a free trial option with us and get direct access to rc1 form - readily available in your personal cabinet. Whenever you work with FormsPal, you can fill out documents without having to worry about personal data breaches or records getting distributed. Our protected platform ensures that your private data is maintained safe.