When you wish to fill out rc151 form, it's not necessary to install any programs - just try our online tool. Our tool is consistently evolving to grant the very best user experience possible, and that is due to our commitment to continual improvement and listening closely to user comments. All it requires is several basic steps:

Step 1: Just hit the "Get Form Button" at the top of this page to see our pdf file editing tool. This way, you will find all that is necessary to work with your document.

Step 2: Once you access the online editor, you will notice the form prepared to be completed. Apart from filling out different blank fields, you may as well do some other things with the Document, specifically putting on your own textual content, editing the initial text, adding images, affixing your signature to the PDF, and a lot more.

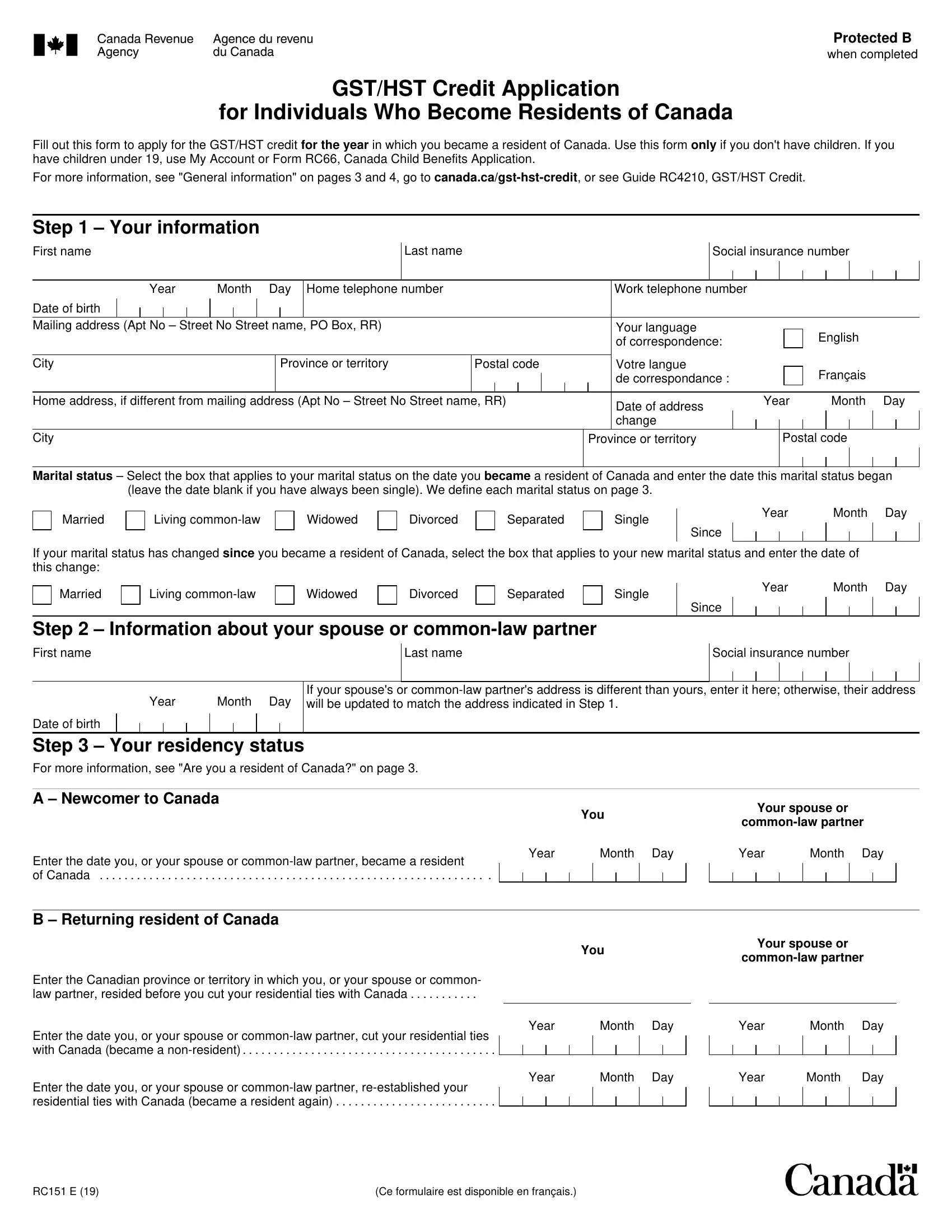

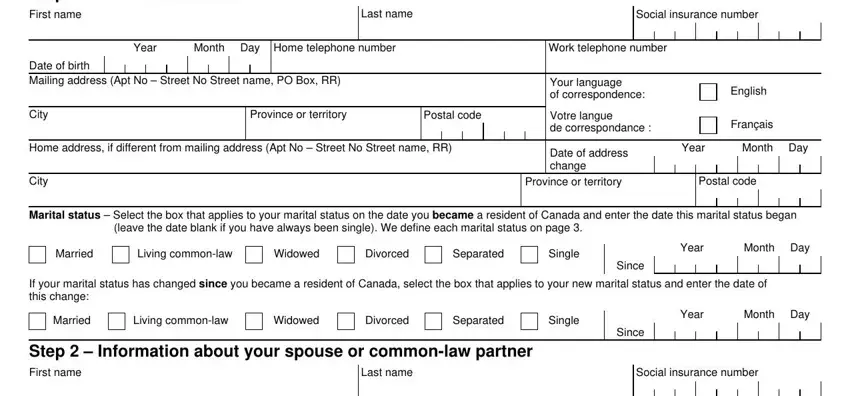

In order to finalize this form, ensure that you type in the information you need in each blank:

1. The rc151 form needs particular information to be inserted. Make certain the following blank fields are filled out:

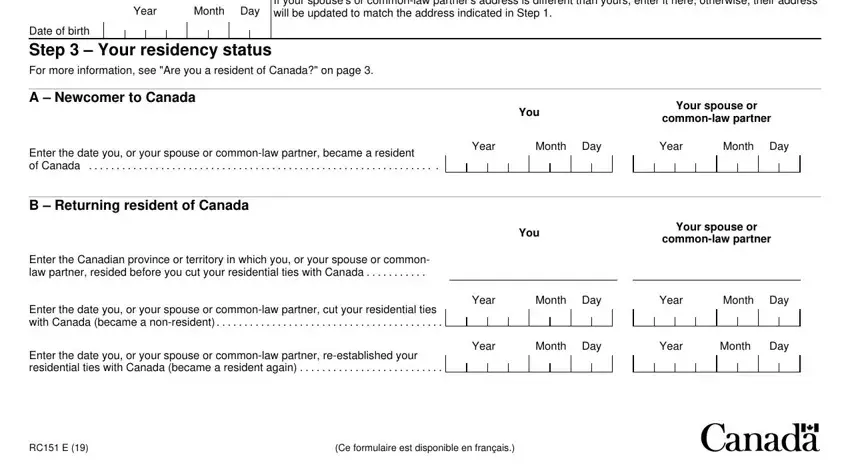

2. Just after filling out this step, go on to the subsequent step and fill in all required details in these blank fields - Year Month Day, If your spouses or commonlaw, Date of birth Step Your, A Newcomer to Canada, Enter the date you or your spouse, B Returning resident of Canada, Enter the Canadian province or, Enter the date you or your spouse, Enter the date you or your spouse, You, Your spouse or, commonlaw partner, Year Month Day, Year Month Day, and You.

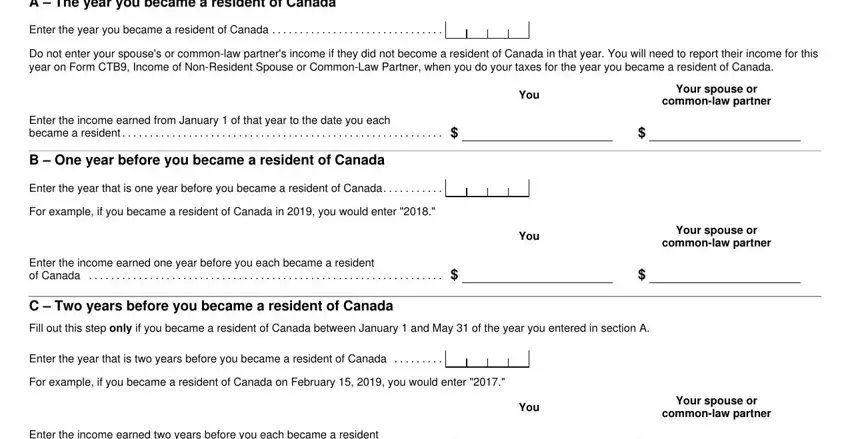

3. This next part is focused on A The year you became a resident, Enter the year you became a, Do not enter your spouses or, Enter the income earned from, B One year before you became a, Enter the year that is one year, For example if you became a, Enter the income earned one year, C Two years before you became a, You, You, Your spouse or, commonlaw partner, Your spouse or, and commonlaw partner - fill out all of these empty form fields.

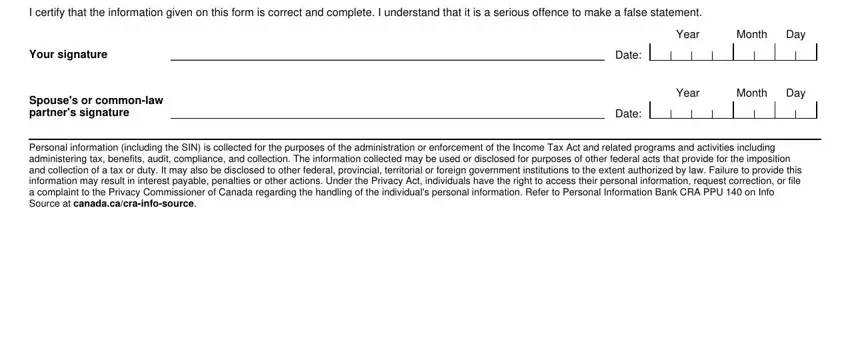

4. The following subsection will require your details in the following areas: I certify that the information, Your signature, Spouses or commonlaw partners, Year Month Day, Year Month Day, Date, Date, and Personal information including the. Be sure to enter all of the needed information to go onward.

It's very easy to make errors when filling in your Personal information including the, therefore be sure to reread it before you send it in.

Step 3: Make certain the information is accurate and click "Done" to finish the project. Sign up with FormsPal right now and instantly get access to rc151 form, prepared for downloading. Every single edit made is conveniently kept , which enables you to change the pdf at a later time as required. We do not share or sell any details you type in when dealing with documents at FormsPal.