The RCT 101D form, an essential document under the guidance of the Pennsylvania Department of Revenue, serves a specific purpose for corporations operating within the state. It is designed for companies whose activities in Pennsylvania fall under the "de minimis" threshold, as defined by Corporation Tax Bulletin 2004-01, issued on April 13, 2004. This declaration is relevant for the tax period specified by the corporation at the beginning and end dates listed on the form. Corporations must detail their name, address, Revenue ID, and Federal EIN, among other identifiers. It specifically addresses the minimal level of activity that does not mandate the filing of a PA corporate net income tax report for the period in question. For transportation companies, this includes revenue miles in PA versus everywhere and trips into PA, while non-transportation companies must report days spent in the state and total PA sales. The form carries an affirmation section where a corporate officer is required to attest to the accuracy of the information provided, under penalty of law. By completing the RCT 101D, corporations not only affirm their de minimis activity but also acknowledge that to claim any tax benefits from this period, they must file a complete RCT-101, PA Corporate Net Income Tax Report, and settle any tax due. This protocol underscores the balance between regulatory compliance and the practicalities of business operations within Pennsylvania.

| Question | Answer |

|---|---|

| Form Name | Form Rct 101D |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | pa declaration printable, rct 101d, pa declaration, pa minimis |

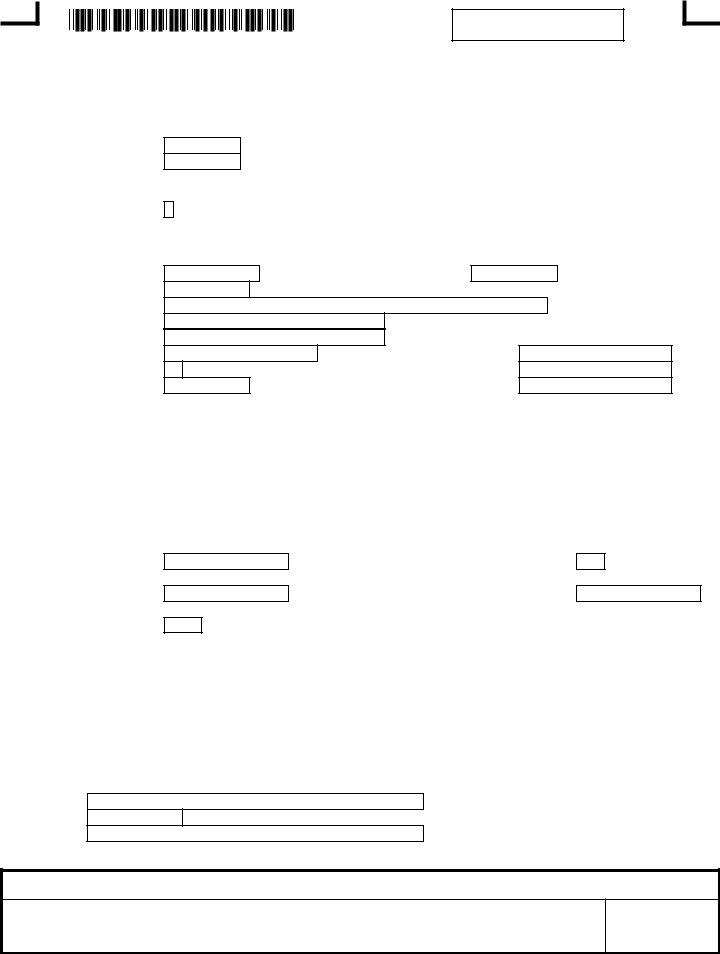

1014016101 |

1014016101 |

DEPARTMENT USE ONLY

Declaration of de minimis Pennsylvania Activity

Step a

Tax Year Beginning Tax Year Ending

Step B

Address Change

Step c

Revenue ID

Federal EIN

Corporation Name

Address Line 1

Address Line 2

City

State

ZIP

Parent Corporation EIN

Province

Country Code

Foreign Postal Code

During the tax period beginning |

|

and ending |

|

, the |

Pennsylvania did not exceed the de minimis activities outlined in Part II of Corporation Tax Bulletin

Transportation Companies (Truck and Bus Companies)

Revenue Miles in PA

Revenue Miles Everywhere

Trips into PA

Number of Days in PA

Total PA Sales

The undersigned acknowledges that de minimis levels of activity are sufficient to subject a corporation to tax, but the department has elected not to require the filing of a tax return based solely upon de minimis activities. Further, for the taxpayer to utilize any tax benefits generated in this period, the taxpayer will be required to file a complete

Step D: corporate officer (must sign affirmation below)

name phone emaIl

I affirm under penalties prescribed by law, this declaration, including any accompanying schedules and statements, has been examined by me and to the best of my knowledge and belief is a true, correct and complete declaration.

corporate officer Signature

Date