The RCT-121-C form plays a pivotal role for foreign casualty or foreign fire insurance companies, associations, or exchanges operating within the jurisdiction requiring this comprehensive documentation. Initiated by the Bureau of Corporation Taxes and aimed for the 2011 report, it primarily focuses on capturing details related to gross premium taxes. This form meticulously outlines the annual payments necessary from these entities, delineating categories such as tax liability, estimated payments, credits, and the final remittance amount, among others. It is carefully structured to facilitate both first-time filers and those needing to amend previous submissions, also touching upon scenarios like changes in address, out-of-existence status, and considerations for electronic payment verifications. Furthermore, it makes provisions for overpayments, offering options for their handling which can significantly affect a company's fiscal planning. Adding another layer of complexity, the form includes a retaliatory worksheet and schedules detailing various taxes, assessments, licenses, and fees compared across states, embodying the principle of fair treatment in taxation. The detailed reporting instructions ensure accuracy and compliance, while the inclusion of preparer information underscores the responsibility and authorization involved in the process. This form, thus, stands as a critical document, encapsulating the financial obligations and operational transparency of foreign insurance entities within the regulatory framework they operate.

| Question | Answer |

|---|---|

| Form Name | Form Rct 121 C |

| Form Length | 3 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 45 sec |

| Other names | prepayments, 2011, E-mail, NAIC |

1213011101 |

|

|

|

|

GROSS PREMIUM TAX |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

FOR FOREIGN CASUALTY OR FOREIGN FIRE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Bureau of Corporation Taxes |

INSURANCE COMPANIES, ASSOCIATIONS OR EXCHANGES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

PO BOX 280407 |

|

2011 REPORT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Harrisburg PA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

CORP TAX ACCOUNT ID |

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

_ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

(DepartmentUseOnly) |

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

DateReceived |

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FEDERAL ID (EIN) |

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

_ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

CITY |

STATE |

ZIP CODE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

o Check to send all correspondence to preparer. |

|

|

|

|

|

o Check to indicate a change of address |

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

State of Domicile |

|

|

|

|

|

|

|

NAIC No. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o First Report o Amended Report (See instructions.) |

o EIP Credit o LastReport |

|||||||||||||||||||||||||||||||||||||||

ANNUAL PAYMENTS

TAX YEAR ENDING

12/31/11

DUE DATE

04/15/12

|

REVENUEUSEONLY |

A.TaxLiability |

B.Estimated |

C.Restricted |

Remittance |

||

TAXTYPE |

Payments&Credits |

||||||

TYPE |

BUDGET |

fromTaxReport |

Credit |

AminusBminusC |

|||

|

onDeposit |

||||||

|

CODE |

CODE |

|

|

|

||

|

|

|

|

|

|||

60 |

710101 |

|

|

|

|

||

|

|

|

|

|

|

|

|

60 |

125163 |

|

|

|

|

||

|

|

|

|

|

|

|

|

60 |

115101 |

|

|

|

|

||

|

|

|

|

|

|

|

|

60 |

125165 |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GRAND TOTALS

oPLEASE CHECK THIS BOX ONLY IF THE TOTAL PAYMENT SHOWN ABOVE HAS BEEN OR WILL BE PAID ELECTRONICALLY.

OVERPAYMENT INSTRUCTIONS (Choose only Option A or Option B and write the appropriate letter in the box provided.)

oA=Automaticallytransferoverpaymentstootherunderpaidtaxesforthecurrenttaxperiod,thentothenexttaxperiod. B=Refundoverpayment(s)ofthecurrenttaxperiodafterpayinganyotherunderpaidtaxesforthecurrenttaxperiod.

Bycheckingthe“AmendedReport”boxonthisform,thetaxpayerconsentstotheextensionoftheassessmentperiodforthistaxyeartooneyearfromthedateoffilingofthisamendedreport orthreeyearsfromthefilingoftheoriginalreport,whicheverperiodlastexpires.Forpurposesofthisextension,anoriginalreportfiledbeforetheduedateisdeemedfiledontheduedate.

Iaffirmunderpenaltiesprescribedbylawthatthisreport(includinganyaccompanyingschedulesandstatements)wasexaminedbyme,tothebestofmyknowledgeandbeliefisatrue,cor- rectandcompletereportandIamauthorizedtoexecutethisconsenttotheextensionoftheassessmentperiod.ThisdeclarationisbasedonallinformationofwhichIhaveanyknowledge.

SignatureofOfficer |

|

|

Title |

Date |

TelephoneNumber |

|

|

|

|

|

|

( |

) |

|

|

|

|

|||

Iaffirmunderpenaltiesprescribedbylaw,thisreport(includinganyaccompanyingschedulesandstatements)hasbeenpreparedbymeandtothebestofmyknowledgeandbeliefisa |

||||||

true,correctandcompletereport. |

|

|

|

|

|

|

|

|

|

|

|

|

|

PRINTIndividualPreparerorFirm’sName |

|

|

SignatureofPreparer |

|

FaxNumber |

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

PRINTIndividualorFirm’sStreetAddress |

|

|

Title |

|

TelephoneNumber |

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

City |

State |

ZIPCode |

|

|

|

|

|

|

|

|

|

|

|

1213011101 |

1213011101 |

1213011201

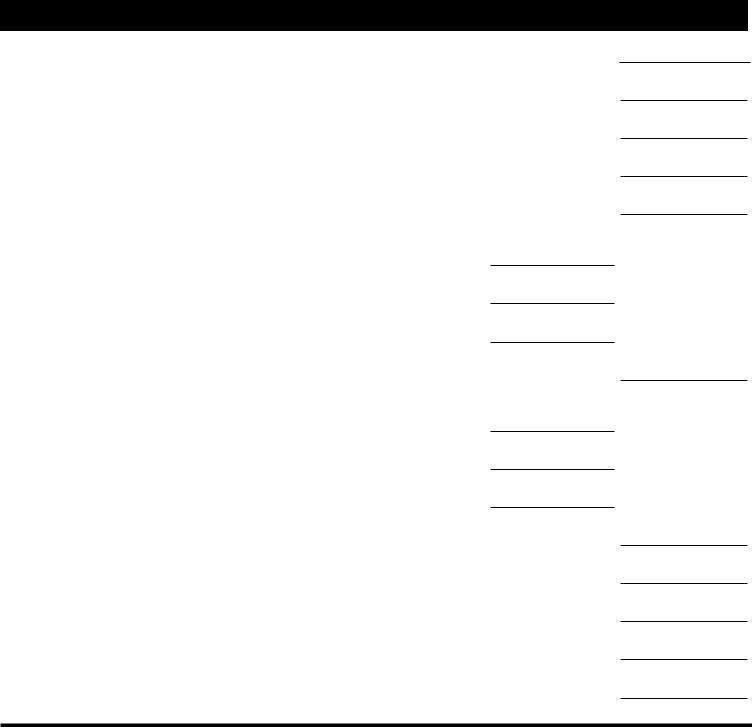

RETALIATORY WORKSHEET

SCHEDULEOFTAXES,ASSESSMENTS,LICENSESANDFEES |

|

||

|

PENNSYLVANIA |

STATEOFDOMICILE |

|

PremiumTaxes: |

|

|

|

$ |

$ |

||

Fire,CasualtyandTitlePremiums |

|||

|

|

||

OceanMarineGrossProfitTax |

|

|

|

LifePremiums |

|

|

|

Annuities |

|

|

|

AccidentandHealthPremiums |

|

|

|

ReinsuranceAssumedfromUnauthorizedCompanies |

|

|

|

|

|

|

|

OtherTaxes(FireMarshal,Franchise,Income,etc.) |

|

|

|

Worker’sCompensationAssessments(NotaretaliatoryitemforPA)

OtherAssessments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LicensesandFees(AnnualBasis) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Totals |

$ |

$ |

|

|

|

RetaliatoryPayabletothePADepartmentofRevenue |

|

$ |

............................. |

|

ANSWER THE FOLLOWING QUESTIONS

(a)How many agents are licensed to represent your company in Pennsylvania during the tax year?

(b)What are your state fees for licensing agents of similar Pennsylvania insurers?

(c) Are the fees in Question (b) imposed on the company |

|

or the agent? |

1213011201

1213011301 |

|

|

Page 3 |

ATTACHCOPYOFPENNSYLVANIABUSINESSPAGEANDSCHEDULETOFTHEANNUALREPORTFILEDWITHTHEPENNSYLVANIAINSURANCEDEPARTMENT.

Fire, Casualty and Title Insurers (Do not include Ocean Marine Premiums.)

1. GrossDirectPremiumsReceivedLessCancellationsandPremiumsReturned ........................................ $

2. Less:ExtraordinaryMedicalBenefitPremiums ..............................................................

3. Less:DividendstoPolicyholders ........................................................................

4. Less:OtherDeductions(Attachschedule.) ................................................................

5. PremiumsTaxable(Line1minusLines2,3and4) ..........................................................

LifeInsurers

6. GrossLifePremiums(DirectWritingBasis) ........................................... $

7. Less:DividendstoPolicyholders ...................................................

8. Less:OtherDeductions(Attachschedule.) ...........................................

9. LifePremiumsTaxable(Line6minusLines7and8) .........................................................

AccidentandHealthInsurers

10. GrossDirectAccidentandHealthPremiums .......................................... $

11. Less:DividendstoPolicyholders ...................................................

12. Less:OtherDeductions(Attachschedule.) ...........................................

13. AccidentandHealthPremiumsTaxable(Line10minusLines11and12) ...........................................

14. TotalTaxablePremiums(AddLines5,9and13) ............................................................

15.

(wholedollarsonly)

16.

(wholedollarsonly)

17. Total(Line15plusLine16)ForeignCasualtyorFire;EnterthisamountonPage1,ColumnA ............................

(wholedollarsonly)

Á

Á

Á

1213011301