Once you open the online tool for PDF editing by FormsPal, you can easily complete or change LLC here. To keep our editor on the cutting edge of practicality, we work to put into action user-oriented features and enhancements regularly. We're at all times thankful for any feedback - play a vital part in revampimg the way you work with PDF files. It just takes several basic steps:

Step 1: Press the "Get Form" button above on this webpage to get into our tool.

Step 2: As soon as you open the tool, you'll notice the form all set to be filled in. Aside from filling in different fields, you may also do some other things with the form, specifically adding custom words, editing the original textual content, inserting illustrations or photos, signing the PDF, and more.

It's straightforward to complete the pdf with this practical tutorial! This is what you must do:

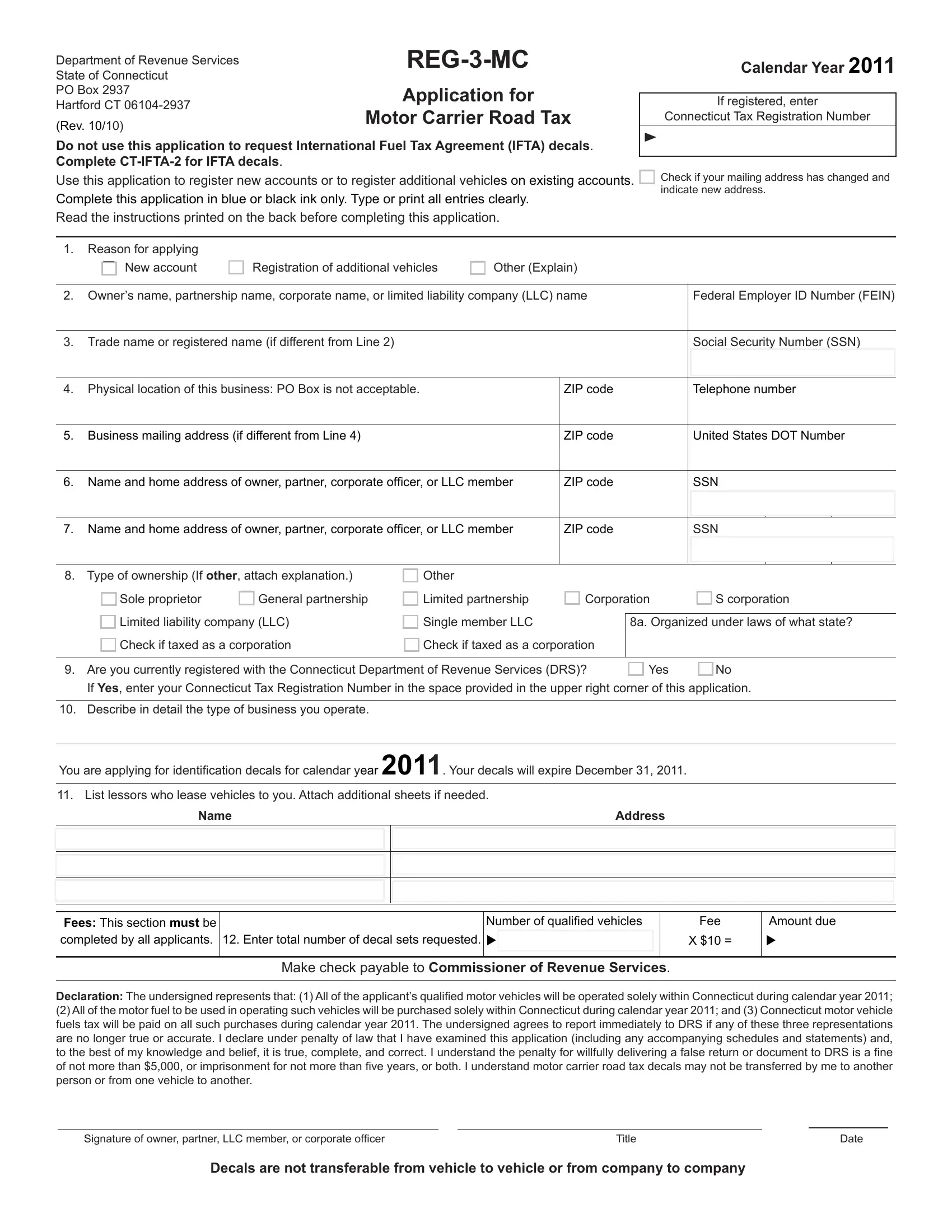

1. The LLC needs particular information to be entered. Be sure that the subsequent blank fields are completed:

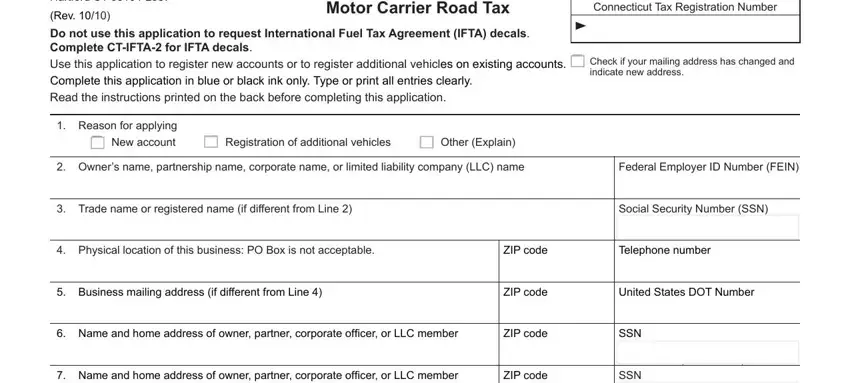

2. Once your current task is complete, take the next step – fill out all of these fields - S corporation, Type of ownership If other attach, Other Limited partnership, Sole proprietor Limited, General partnership, Corporation, a Organized under laws of what, Yes No, If Yes enter your Connecticut Tax, Describe in detail the type of, You are applying for identifi, List lessors who lease vehicles, Name Address, Fees This section must be, and Number of qualifi ed vehicles with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

A lot of people often make mistakes while filling in Describe in detail the type of in this area. Ensure that you review what you enter right here.

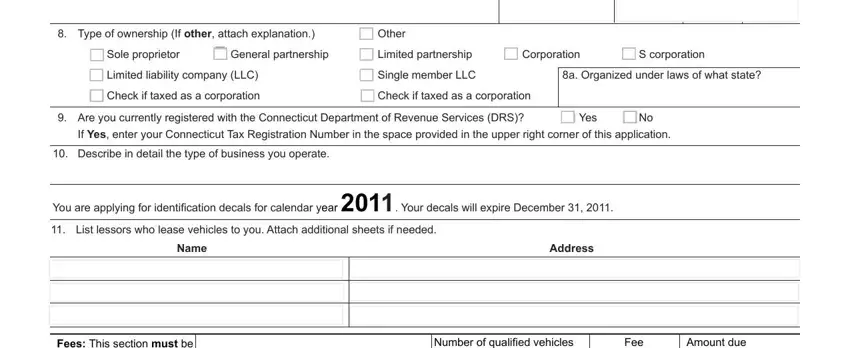

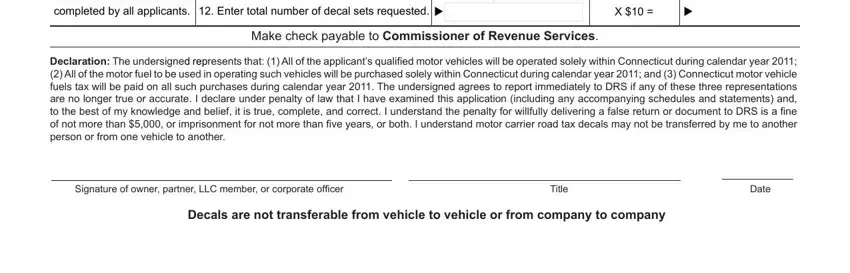

3. Within this stage, look at Fees This section must be, Enter total number of decal sets, Number of qualifi ed vehicles, Fee, Amount due, Make check payable to Commissioner, Declaration The undersigned, Signature of owner partner LLC, Title, Date, and Decals are not transferable from. Each one of these need to be taken care of with greatest precision.

Step 3: Before finalizing the document, make sure that form fields have been filled in as intended. Once you think it's all fine, click “Done." Obtain your LLC once you sign up at FormsPal for a 7-day free trial. Easily use the pdf inside your FormsPal account, together with any edits and changes automatically saved! When you work with FormsPal, you can easily complete documents without having to be concerned about database breaches or entries getting shared. Our secure software makes sure that your personal data is stored safely.