pa form rev 1630 can be filled in effortlessly. Simply try FormsPal PDF editing tool to get it done without delay. In order to make our editor better and easier to utilize, we consistently develop new features, with our users' suggestions in mind. All it takes is a couple of easy steps:

Step 1: Access the form inside our editor by hitting the "Get Form Button" at the top of this page.

Step 2: Once you access the online editor, you will get the document made ready to be filled out. Besides filling out different fields, you might also perform other actions with the Document, including writing custom textual content, changing the original text, inserting graphics, putting your signature on the document, and much more.

This PDF form will require specific info to be typed in, hence you must take some time to enter precisely what is required:

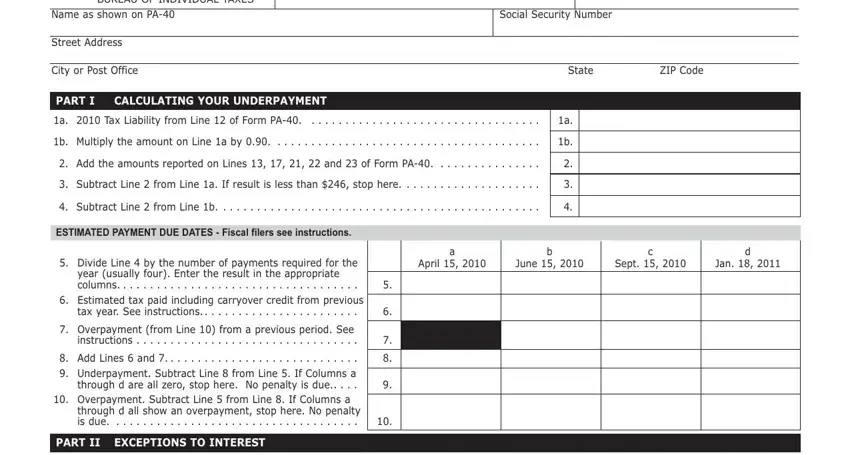

1. Fill out your pa form rev 1630 with a selection of essential fields. Note all of the required information and be sure absolutely nothing is missed!

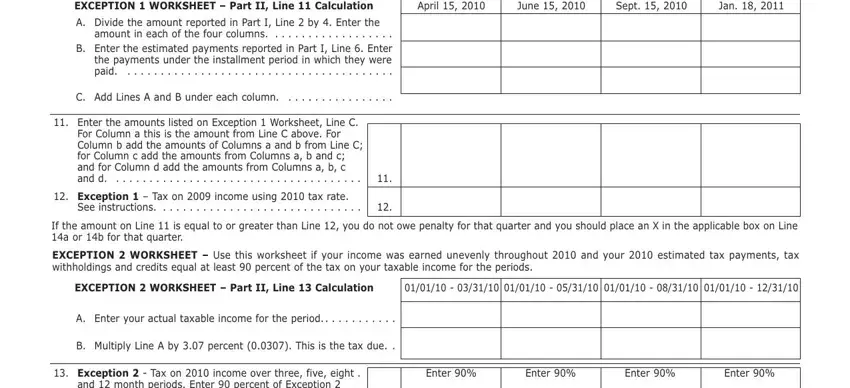

2. After this section is filled out, go on to enter the applicable details in these: EXCEPTION WORKSHEET Part II Line, April, June, Sept, Jan, A Divide the amount reported in, amount in each of the four columns, B Enter the estimated payments, C Add Lines A and B under each, Enter the amounts listed on, For Column a this is the amount, Exception Tax on income using, See instructions, If the amount on Line is equal to, and EXCEPTION WORKSHEET Use this.

3. Completing If the amount on Line is equal to is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

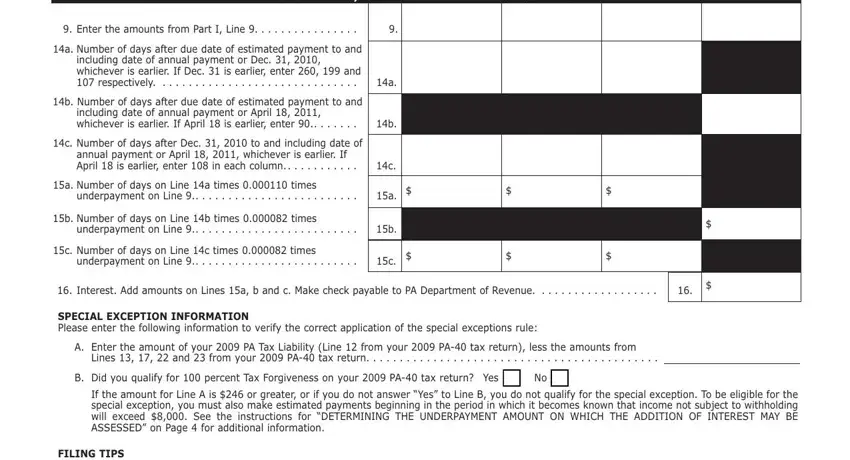

4. The following paragraph will require your information in the subsequent places: AND EXAMPLE AT BOTTOM OF THIS PAGE, Enter the amounts from Part I, a Number of days after due date of, including date of annual payment, b Number of days after due date of, including date of annual payment, c Number of days after Dec to, annual payment or April, a Number of days on Line a times, underpayment on Line, b Number of days on Line b times, underpayment on Line, c Number of days on Line c times, underpayment on Line, and Interest Add amounts on Lines a b. Ensure you enter all needed information to go onward.

5. Now, this final subsection is precisely what you'll have to complete before closing the PDF. The blank fields you're looking at are the following: .

It is easy to make a mistake when completing your this field, therefore be sure you go through it again prior to deciding to submit it.

Step 3: Be certain that your details are correct and simply click "Done" to complete the task. Join FormsPal now and immediately obtain pa form rev 1630, ready for downloading. All alterations made by you are saved , which means you can customize the form later if needed. When using FormsPal, it is simple to fill out documents without needing to get worried about data leaks or entries getting shared. Our protected platform helps to ensure that your personal details are kept safely.