pennsylvania account can be filled out online very easily. Just open FormsPal PDF editing tool to complete the task quickly. FormsPal team is always endeavoring to improve the tool and help it become much better for people with its cutting-edge features. Uncover an constantly progressive experience today - take a look at and discover new opportunities along the way! Starting is effortless! Everything you need to do is stick to these basic steps down below:

Step 1: Open the PDF form inside our tool by clicking the "Get Form Button" at the top of this webpage.

Step 2: After you launch the online editor, there'll be the document prepared to be completed. Other than filling out various blank fields, you can also perform many other things with the file, particularly putting on custom text, modifying the initial text, adding graphics, putting your signature on the document, and more.

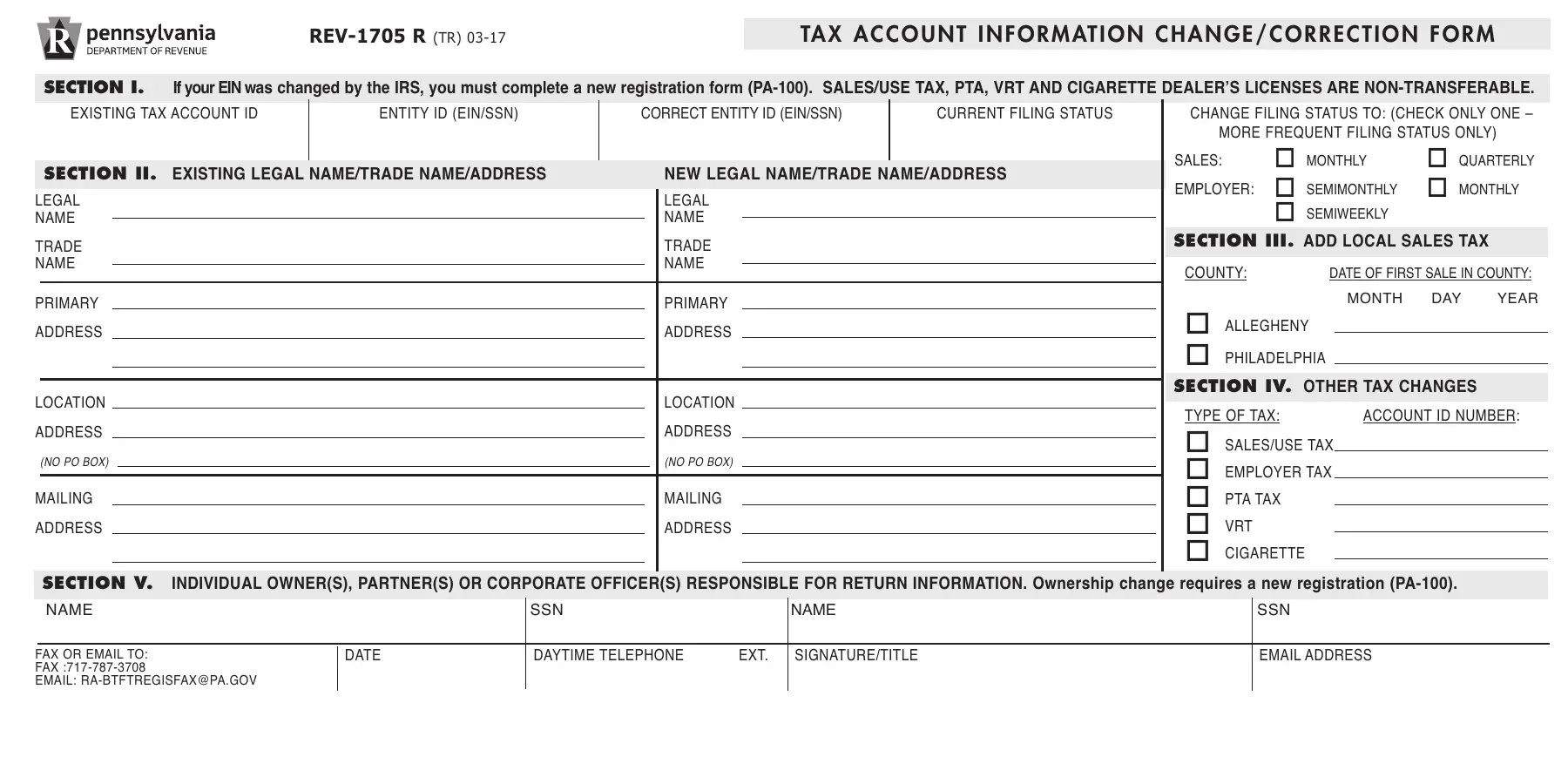

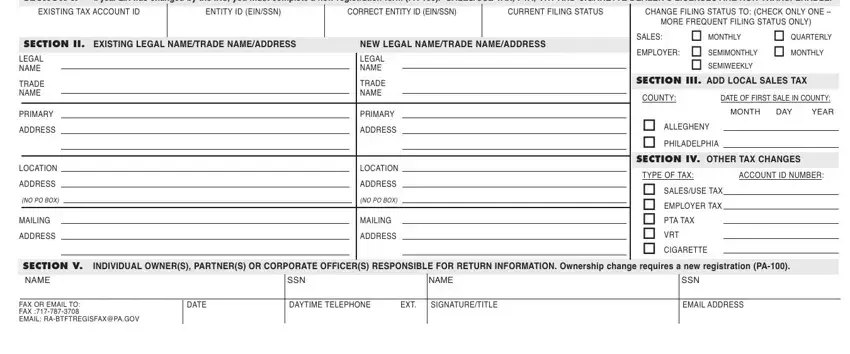

In an effort to complete this PDF form, make certain you provide the required details in every single blank:

1. First of all, once filling out the pennsylvania account, begin with the form section that has the subsequent blanks:

Step 3: Proofread the details you have inserted in the blank fields and then click on the "Done" button. Obtain your pennsylvania account when you subscribe to a free trial. Immediately gain access to the pdf file within your FormsPal account page, together with any modifications and changes conveniently preserved! FormsPal ensures your data confidentiality via a secure system that in no way saves or shares any sort of sensitive information typed in. Be assured knowing your docs are kept protected any time you work with our tools!