When you wish to fill out pa application for tax clearance certificate, you won't have to install any sort of applications - just try our online tool. We are devoted to making sure you have the absolute best experience with our tool by continuously presenting new capabilities and enhancements. Our editor has become even more user-friendly thanks to the newest updates! So now, editing PDF forms is easier and faster than ever before. All it requires is just a few basic steps:

Step 1: Press the "Get Form" button above. It will open up our pdf editor so you can start filling out your form.

Step 2: As soon as you launch the tool, you will get the document made ready to be filled out. Besides filling in various fields, you might also perform other sorts of actions with the Document, including adding your own text, changing the original textual content, adding images, placing your signature to the form, and more.

It's easy to complete the form with this helpful tutorial! This is what you must do:

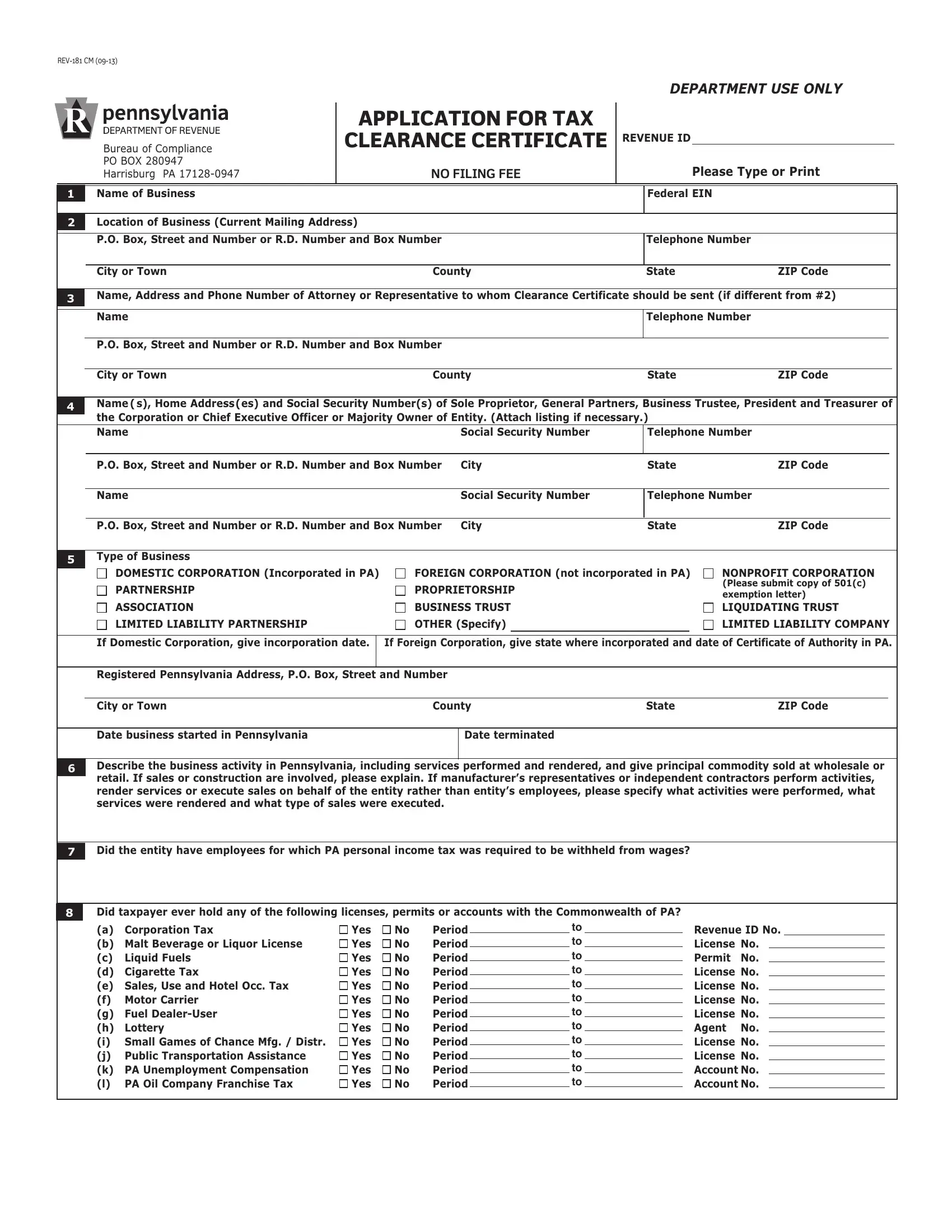

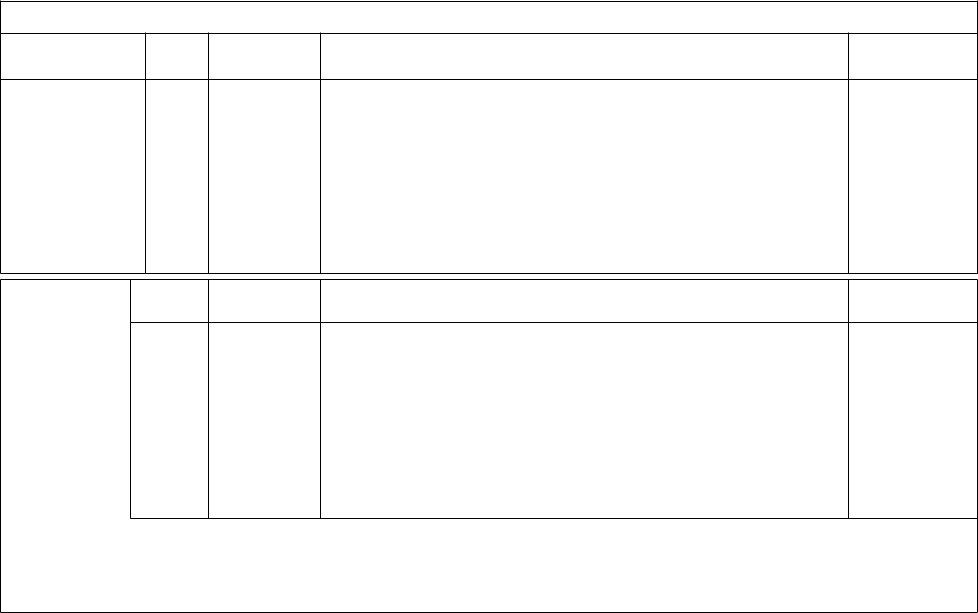

1. Begin filling out your pa application for tax clearance certificate with a selection of necessary blanks. Consider all the information you need and make certain nothing is missed!

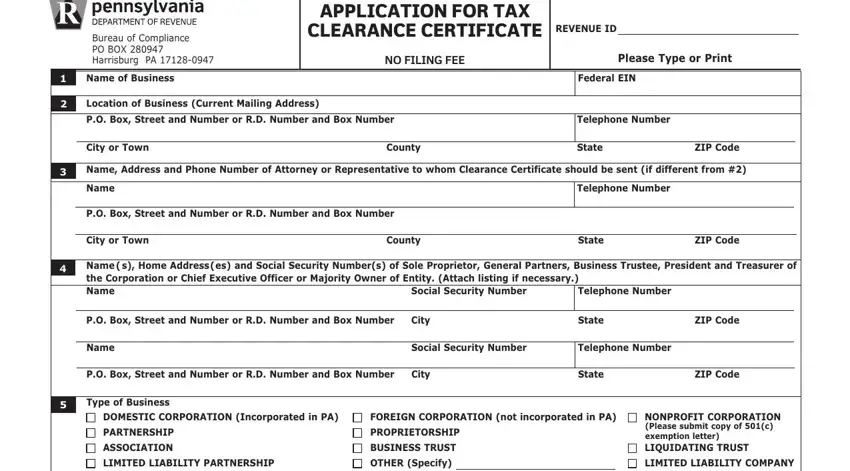

2. When the prior array of fields is done, go on to enter the relevant details in all these: If Domestic Corporation give, Registered Pennsylvania Address PO, City or Town, County, State, ZIP Code, Date business started in, Date terminated, Describe the business activity in, Did the entity have employees for, Did taxpayer ever hold any of the, a Corporation Tax b Malt Beverage, Yes No Yes No Yes No Yes No Yes No, Period Period Period Period Period, and Revenue ID No License No Permit No.

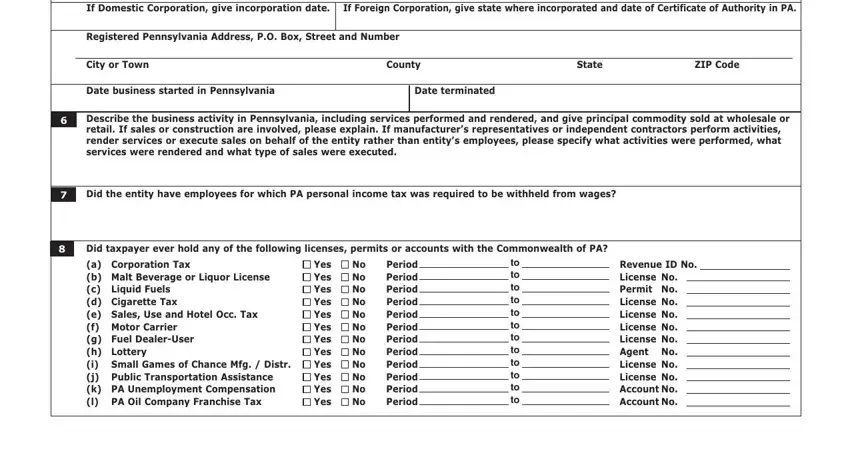

3. This next step is generally straightforward - complete all the empty fields in Were the assets or activities of, Yes, No If Yes give predecessors name, Name, PO Box Street and Number, Acquisition Date, City or Town, County, State, ZIP Code, Has the business held title to any, G If Yes complete Schedule A last, G If you currently hold title to, Will the assets or activities of, and If Yes complete to complete this segment.

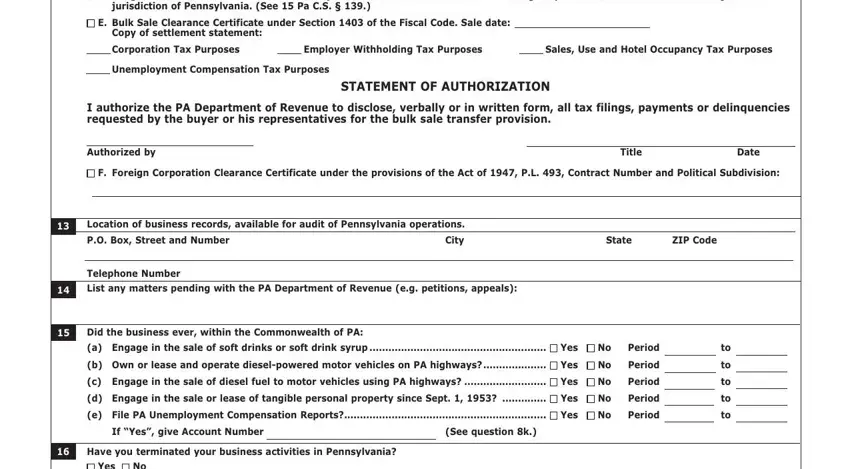

4. This next section requires some additional information. Ensure you complete all the necessary fields - D Merger or consolidation of two, jurisdiction of Pennsylvania See, E Bulk Sale Clearance Certificate, Copy of settlement statement, Corporation Tax Purposes, Employer Withholding Tax Purposes, Sales Use and Hotel Occupancy Tax, Unemployment Compensation Tax, STATEMENT OF AUTHORIZATION, I authorize the PA Department of, Authorized by, Title, Date, F Foreign Corporation Clearance, and Location of business records - to proceed further in your process!

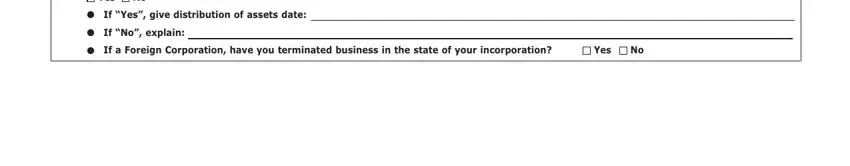

5. This very last stage to conclude this form is crucial. Make sure you fill in the displayed blank fields, and this includes Yes No, G If Yes give distribution of, G If No explain, G If a Foreign Corporation have, and Yes, prior to using the file. Neglecting to do it might give you an unfinished and possibly unacceptable form!

People generally make some errors when completing G If a Foreign Corporation have in this part. You should revise everything you enter here.

Step 3: Right after taking one more look at your completed blanks, click "Done" and you're done and dusted! Right after creating afree trial account at FormsPal, you will be able to download pa application for tax clearance certificate or send it through email promptly. The PDF document will also be at your disposal via your personal account with your each and every change. With FormsPal, you'll be able to fill out documents without stressing about data breaches or data entries getting distributed. Our protected platform ensures that your private information is maintained safely.