realty transfer tax statement of value pa can be completed without difficulty. Just use FormsPal PDF tool to do the job right away. To have our tool on the forefront of efficiency, we work to put into action user-driven features and improvements on a regular basis. We're at all times looking for feedback - play a pivotal part in revolutionizing PDF editing. For anyone who is seeking to begin, here's what it's going to take:

Step 1: Click on the "Get Form" button in the top area of this webpage to get into our PDF tool.

Step 2: With this online PDF tool, you can actually accomplish more than merely fill in blank form fields. Express yourself and make your forms appear perfect with custom textual content incorporated, or tweak the file's original content to excellence - all that comes with the capability to insert just about any pictures and sign it off.

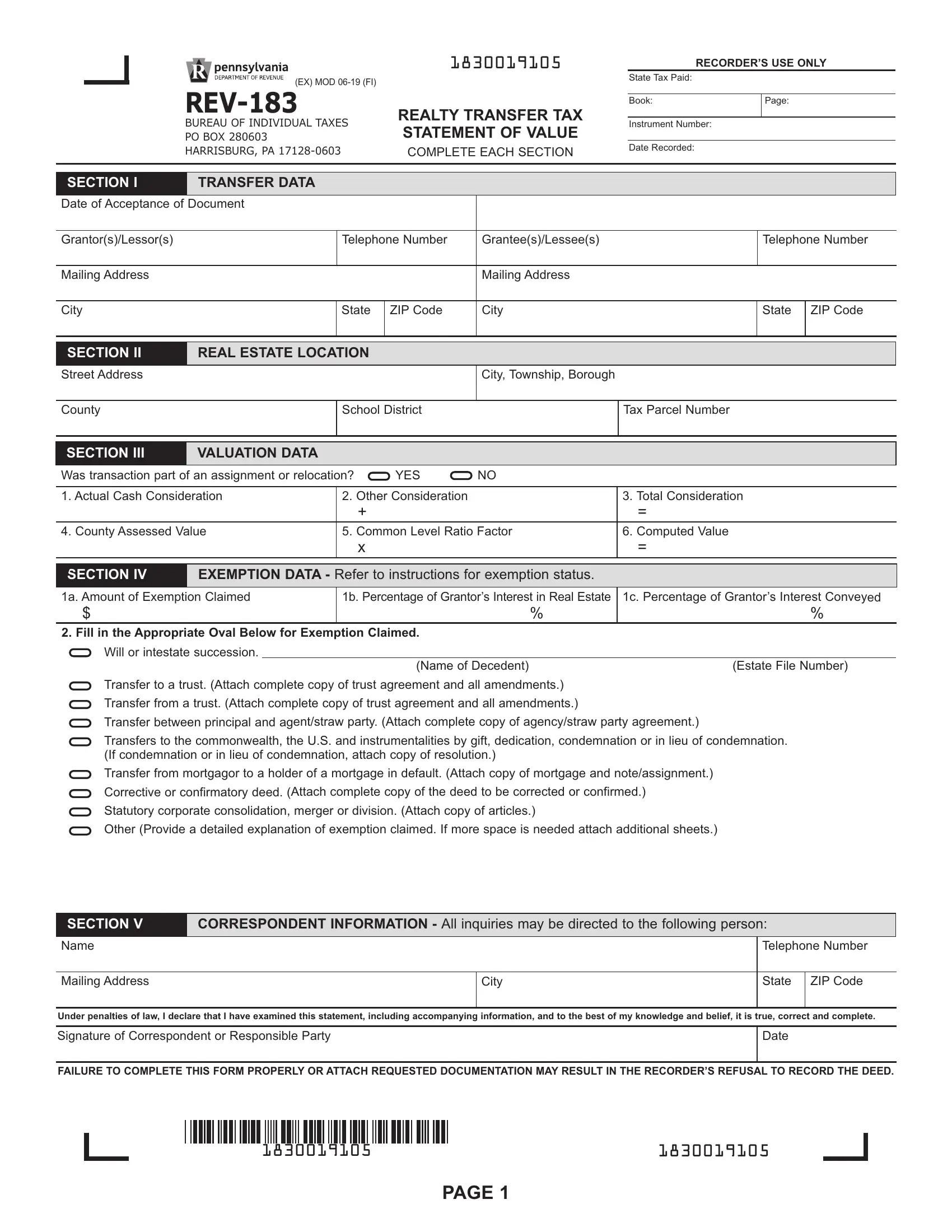

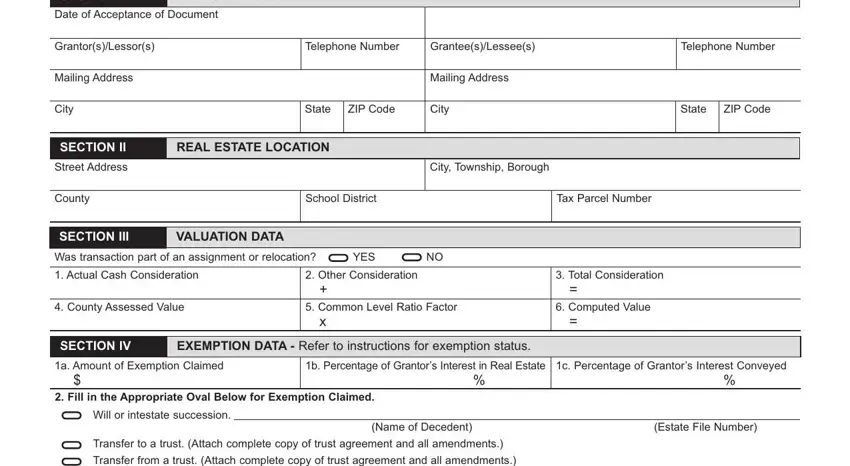

When it comes to blank fields of this particular PDF, here is what you should consider:

1. When submitting the realty transfer tax statement of value pa, be certain to include all essential fields in the corresponding form section. It will help to hasten the process, making it possible for your information to be processed swiftly and correctly.

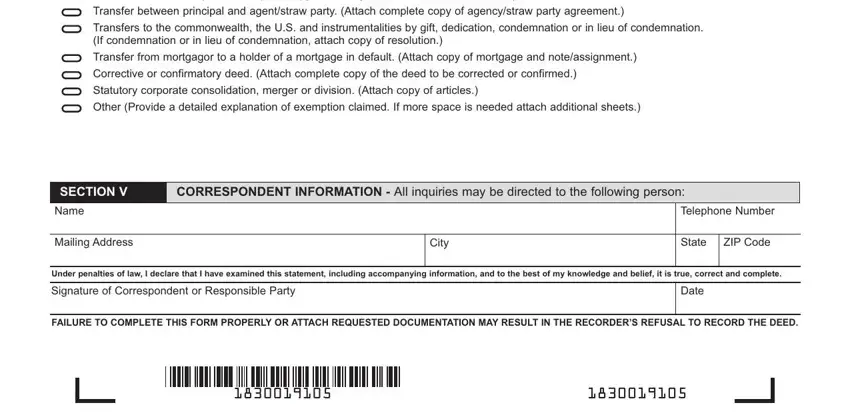

2. Once your current task is complete, take the next step – fill out all of these fields - Transfer to a trust Attach, SECTION V, CORRESPONDENT INFORMATION All, Name, Mailing Address, City, Telephone Number, State, ZIP Code, Under penalties of law I declare, Signature of Correspondent or, Date, and FAILURE TO COMPLETE THIS FORM with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

Be really careful when filling out Date and Telephone Number, as this is where a lot of people make errors.

Step 3: After you've reviewed the details entered, press "Done" to complete your form. After registering a7-day free trial account at FormsPal, you'll be able to download realty transfer tax statement of value pa or send it through email without delay. The PDF file will also be available through your personal account menu with your every single change. When using FormsPal, you're able to fill out documents without worrying about data incidents or entries getting distributed. Our protected system makes sure that your private information is kept safely.