Handling PDF files online can be easy with this PDF editor. You can fill in Form Rev 72 As here effortlessly. We are aimed at making sure you have the ideal experience with our editor by regularly adding new features and upgrades. With these improvements, using our editor gets better than ever before! Should you be seeking to begin, this is what it will require:

Step 1: Click on the "Get Form" button in the top section of this webpage to access our editor.

Step 2: With our online PDF editing tool, you're able to accomplish more than merely fill out blank form fields. Edit away and make your forms seem great with custom text put in, or optimize the file's original content to excellence - all backed up by the capability to insert stunning images and sign it off.

This form will need some specific details; to ensure accuracy and reliability, please be sure to take into account the tips further down:

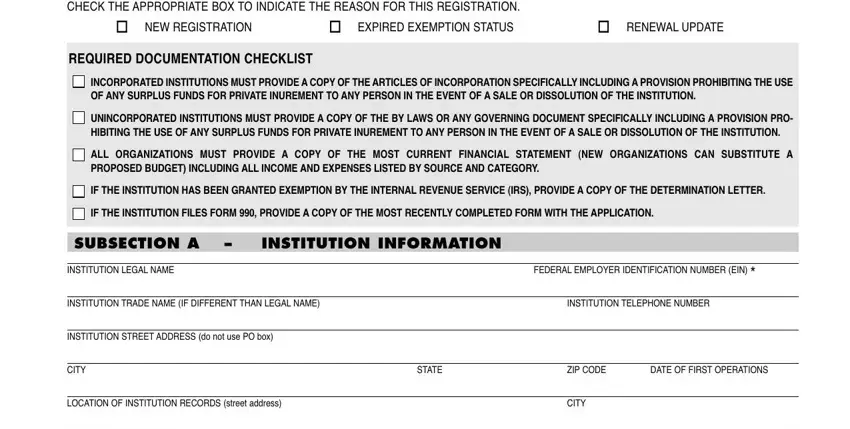

1. It is advisable to fill out the Form Rev 72 As properly, therefore be mindful while working with the parts including these blank fields:

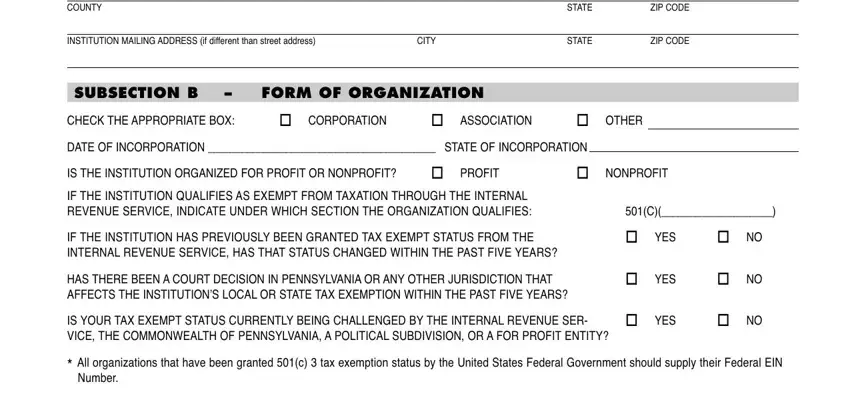

2. Once your current task is complete, take the next step – fill out all of these fields - COUNTY, STATE, ZIP CODE, INSTITUTION MAILING ADDRESS if, CITY, STATE, ZIP CODE, SUBSECTION B, FORM OF ORGANIZATION, CHECK THE APPROPRIATE BOX, CORPORATION, ASSOCIATION, OTHER, DATE OF INCORPORATION STATE OF, and IS THE INSTITUTION ORGANIZED FOR with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

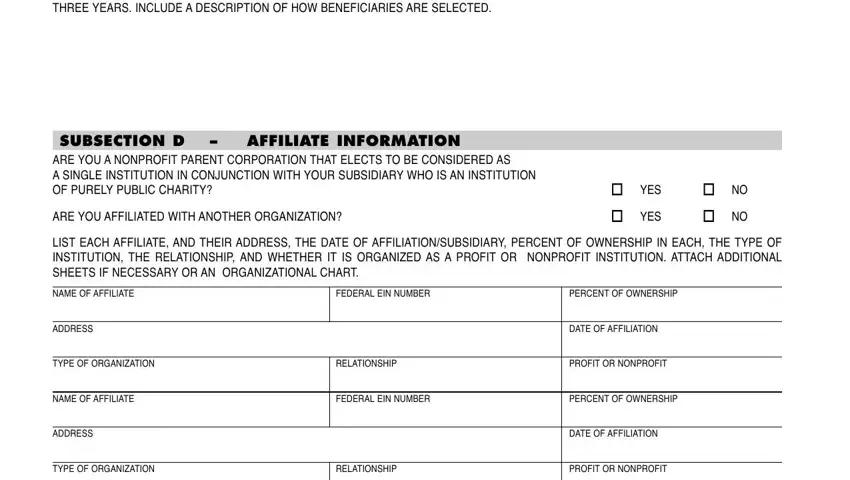

3. In this specific part, examine PROVIDE A DETAILED DESCRIPTION OF, SUBSECTION D ARE YOU A NONPROFIT, AFFILIATE INFORMATION, ARE YOU AFFILIATED WITH ANOTHER, YES, YES, LIST EACH AFFILIATE AND THEIR, NAME OF AFFILIATE, FEDERAL EIN NUMBER, PERCENT OF OWNERSHIP, ADDRESS, DATE OF AFFILIATION, TYPE OF ORGANIZATION, RELATIONSHIP, and PROFIT OR NONPROFIT. These must be filled in with highest accuracy.

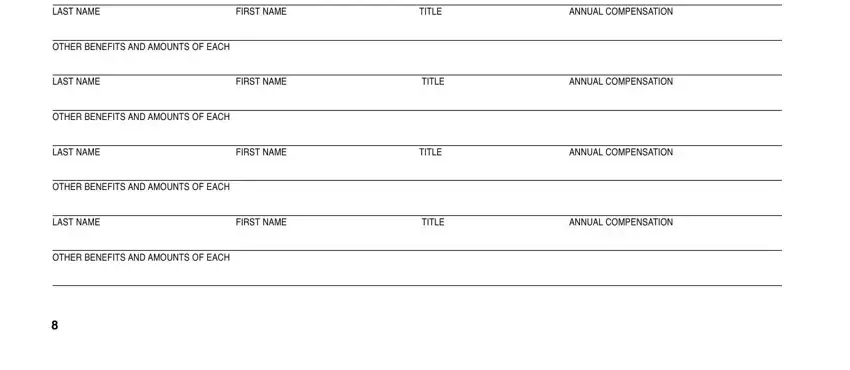

4. Filling in LAST NAME, FIRST NAME, TITLE, ANNUAL COMPENSATION, OTHER BENEFITS AND AMOUNTS OF EACH, LAST NAME, FIRST NAME, TITLE, ANNUAL COMPENSATION, OTHER BENEFITS AND AMOUNTS OF EACH, LAST NAME, FIRST NAME, TITLE, ANNUAL COMPENSATION, and OTHER BENEFITS AND AMOUNTS OF EACH is key in this next section - ensure that you take your time and take a close look at each and every field!

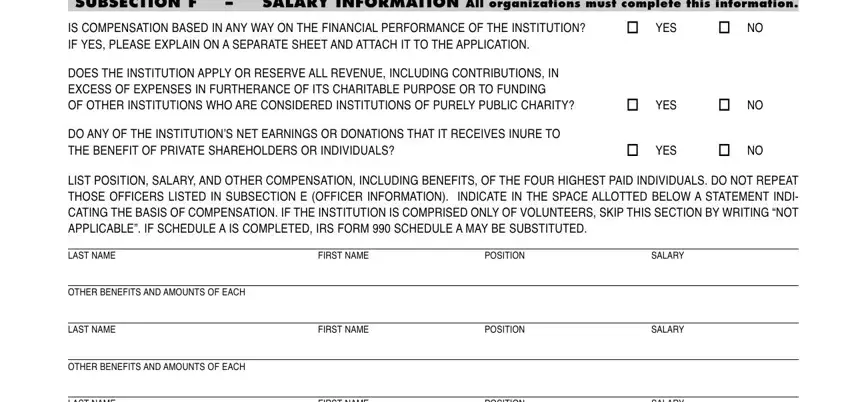

5. As you approach the finalization of your document, you will find just a few more points to do. In particular, SUBSECTION F, SALARY INFORMATION All, IS COMPENSATION BASED IN ANY WAY, YES, DOES THE INSTITUTION APPLY OR, YES, DO ANY OF THE INSTITUTIONS NET, YES, LIST POSITION SALARY AND OTHER, LAST NAME, FIRST NAME, POSITION, SALARY, OTHER BENEFITS AND AMOUNTS OF EACH, and LAST NAME should all be filled in.

As to YES and YES, ensure that you do everything correctly here. These two are considered the key fields in the file.

Step 3: Check the details you've inserted in the blanks and then click on the "Done" button. Right after setting up a7-day free trial account at FormsPal, you will be able to download Form Rev 72 As or email it without delay. The form will also be at your disposal from your personal account menu with your every single edit. FormsPal ensures your information privacy via a protected system that never saves or distributes any kind of personal information involved in the process. Be confident knowing your files are kept confidential whenever you use our tools!