rev 72 and rev 956 can be filled in without any problem. Simply make use of FormsPal PDF editor to get the job done right away. The tool is constantly maintained by our staff, getting useful functions and becoming much more convenient. Getting underway is simple! What you need to do is follow the following easy steps down below:

Step 1: Click on the orange "Get Form" button above. It is going to open up our editor so that you can start filling out your form.

Step 2: With our advanced PDF editing tool, you are able to do more than simply fill out blanks. Express yourself and make your forms look faultless with custom textual content added, or optimize the file's original input to perfection - all comes with an ability to insert your personal photos and sign the document off.

It really is easy to finish the form using out detailed guide! Here's what you must do:

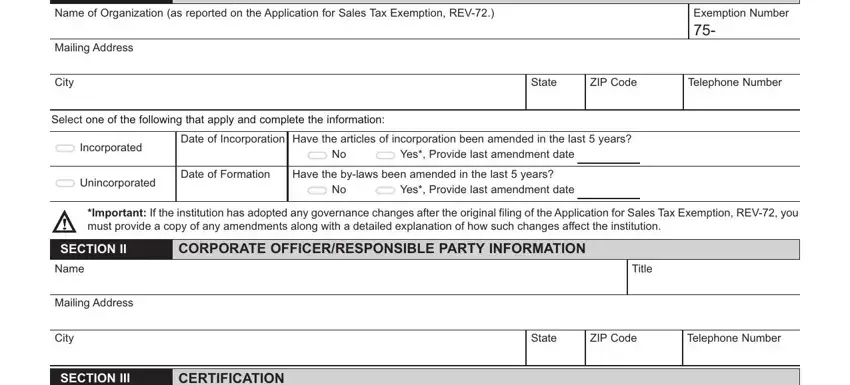

1. First, once completing the rev 72 and rev 956, start in the part that features the subsequent blank fields:

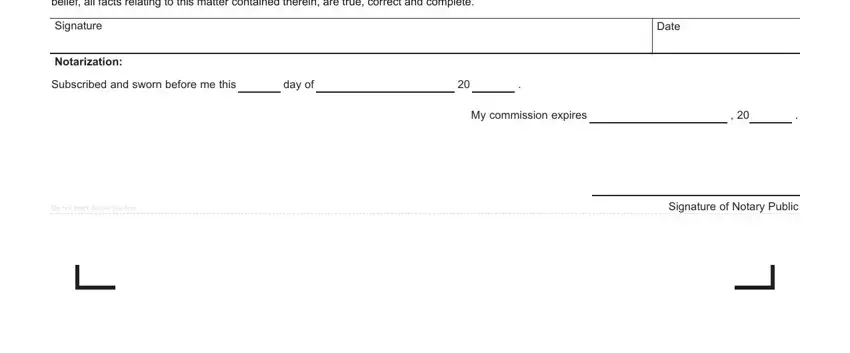

2. Soon after completing the last step, head on to the subsequent step and complete the necessary particulars in these fields - Under penalties of perjury I, Signature, Notarization, Date, Subscribed and sworn before me this, day of, My commission expires, Do not mark below this line, and Signature of Notary Public.

It's easy to make errors when completing the day of, hence be sure you look again before you send it in.

Step 3: Just after taking another look at the fields and details, press "Done" and you are all set! Sign up with FormsPal now and instantly access rev 72 and rev 956, available for downloading. Each and every edit you make is conveniently saved , which enables you to edit the file at a later time if required. FormsPal ensures your data privacy via a protected system that in no way records or shares any kind of sensitive information provided. Be confident knowing your docs are kept safe any time you use our services!