The process of transferring vehicle ownership is a critical step that ensures legal and administrative alignment with state records. In particular, the Rf 200 form plays a fundamental role for vehicles registered before 1st January 1993. It represents a formal notification of the change in ownership, with specific sections designed for completion by both the current owner disposing of the vehicle and the new owner taking possession. This comprehensive document necessitates careful attention to detail from both parties involved. The form mandates disclosures such as vehicle registration details, chassis number, and the personal information of both parties. Additionally, declarations from both the seller and buyer affirm the transfer of ownership on a declared date. Vital instructions included with the form guide involved parties through the process of notifying the local Motor Tax Office, ensuring the correct handling of the registration book, and underlining the importance of timely submission to avoid potential legal and financial repercussions. Notably, the form encapsulates a robust framework that safeguards the interests of both sellers and buyers by ensuring a documented transition of ownership, thus preventing future disputes or liabilities linked to the vehicle's usage post-transfer.

| Question | Answer |

|---|---|

| Form Name | Form Rf 200 |

| Form Length | 3 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 45 sec |

| Other names | rf200 form no No Download Needed needed, rf 200, rf200 form, ireland ownership form |

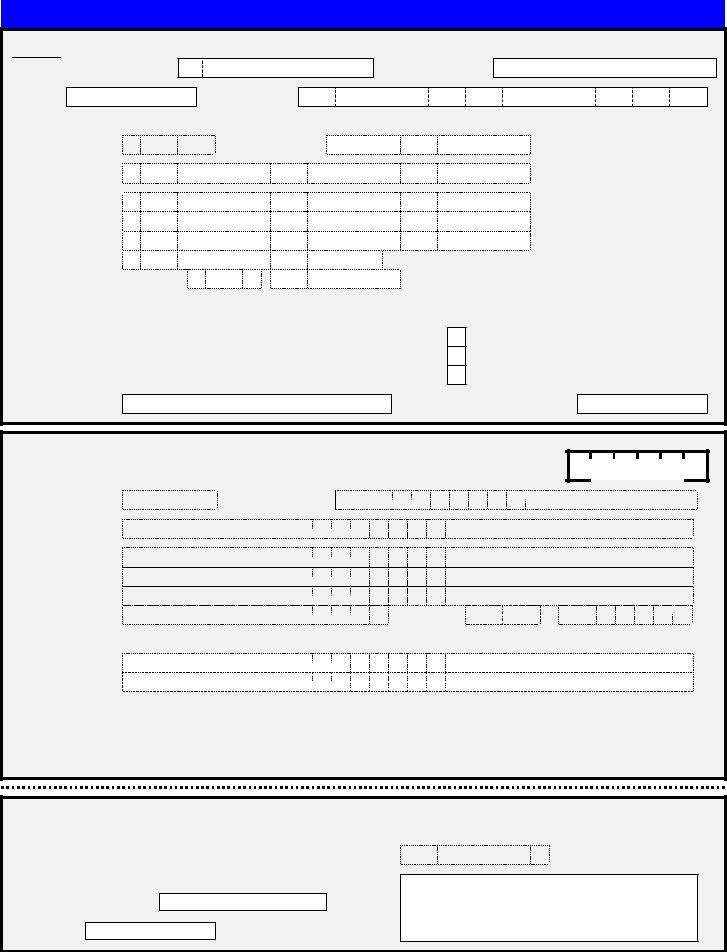

NOTIFICATION OF TRANSFER OF VEHICLE OWNERSHIP

For Vehicles Registered Before 1/1/93 Only

RF 200

PLEASE READ NOTES OVERLEAF BEFORE COMPLETING THIS FORM

This Form must be completed by both Parties at the same time

PART A TO BE COMPLETED BY THE OWNER (including Motor Dealer) DISPOSING OF THE VEHICLE

REGISTRATION NUMBER |

|

Colour(s) |

Chassis Number |

NAME AND ADDRESS |

|

|

|||

|

First Name(s) |

||||

Mr, Ms, etc. |

|

|

|

||

|

|

|

|

||

Surname OR |

|

|

|

|

|

Company Name |

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

Town/City

County

PhoneNo.

DECLARATION

Make/Model

I/We declare that ownership of the above vehicle was transferred to the new owner mentioned in Part B below on

the |

|

|

day of |

|

|

|

|

|

(Day) |

(Month, Year) |

|||||||

|

|

|||||||

Seller’s Signature

and the Registration Book

(tick as appropriate)

is enclosed

has been delivered to Motor Dealer is not available see Note E

Date

PART B TO BE COMPLETED BY THE NEW OWNER (including Motor Dealer)

NEW OWNER’S NAME AND ADDRESS |

|

|

|

|

Garage Code |

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mr, Ms, etc. |

|

|

|

First Name(s) |

|

|

|

|

|

|

|

|

|

|

|

|

||

Surname OR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Company Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Town/City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

County |

|

|

|

|

|

|

Phone No. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address where vehicle is ordinarily kept (Enter ‘As Above’ if vehicle is kept at above address)

DECLARATION |

|

|

|

|

|

I/We declare that |

(i) ownership of the above vehicle was transferred to me/us, |

||||

(ii) I/We have entered my/our name(s) and address in the Registration Book (unless buyer is Motor Dealer) |

|||||

|

|

|

|

|

|

Buyer’s Signature |

|

|

Date |

|

|

PART C TO BE COMPLETED BY OWNER (including Motor Dealer) DISPOSING OF THE VEHICLE THIS PART SHOULD BE DETACHED AND RETAINED BY THE NEW OWNER

I/We have on this date |

|

|

to |

|

|

|

|

Seller’s Signature

Buyer’s name and address

Date

NOTES

IMPORTANT

It is in the interest of the owner selling, trading in or otherwise disposing of the vehicle to ensure that:

(i)If the New Owner is a Company registered under the Companies Act (1963) the name and address of the Company as stated in its Certificate of Incorporation should be used and the signature must be that of the Managing Director or Secretary.

(ii)If the New Owner is a Private Firm the name by which it is ordinarily known together with the full name(s) of the Owner/Partner(s) should be used and the signature must be that of the Owner/Partner.

(iii)Form completed and sent to your local motor tax office as soon as possible.

OTHERWISE YOUR NAME WILL CONTINUE TO APPEAR AS THE REGISTERED OWNER OF THE VEHICLE AND YOU COULD BE HELD ACCOUNTABLE FOR PARKING OR OTHER OFFENCES INVOLVING THE VEHICLE.

‘OWNER’ IS THE ‘KEEPER’ AS DEFINED IN SECTION 130 OF THE FINANCE ACT, 1992 AND THE NEW OWNER AS STATED AT PART B OVERLEAF WILL BE RECORDED IN THE RECORDS ESTABLISHED UNDER SECTION 60 OF THE FINANCE ACT, 1993.

A. When to use this form

This form should be used when any person or body has sold,

B. When NOT to use this form

Do NOT use this form if the vehicle was registered since 1st January 1993, in such case you must use the Vehicle Licensing Certificate (or form RF105 if the new owner is a motor dealer), which must be sent to the Department of the Environment and Local Government, Vehicle Registration Unit, Shannon Town Centre, Co. Clare

C. How to complete this form

Parts A and C of this form must be completed by the OWNER DISPOSING OF the vehicle. Part B of this form must be completed by the NEW OWNER ACQUIRING the vehicle.

D. What to do next

When the OWNER DISPOSING OF the vehicle and the NEW OWNER have completed the form:

•The OWNER DISPOSING OF the vehicle should detach Part C of the form and hand it to the NEW OWNER.

•The NEW OWNER (if not a motor dealer) should enter his/her name and address in the “Next Owner” section of the vehicle’s Registration Book.

•The OWNER DISPOSING OF the vehicle should IMMEDIATELY forward Parts A and B of this form WITH the Registration Book to the local Motor Tax Office unless the NEW OWNER is Motor Dealer.

•In cases where the NEW OWNER is a Motor Dealer, the OWNER DISPOSING OF the vehicle should IMMEDIATELY forward Parts A and B of this form to the local Motor Tax Office, HOWEVER, the Registration Book should NOT be sent to the Motor Tax Office, but should be handed to the Motor Dealer, to be held by the Motor Dealer until the vehicle is sold on.

E.Registration Book Unavailable

Where the OWNER DISPOSING OF the vehicle is unable to provide the Registration Book, an Application Form (RF134) for Replacement Documents should be completed and forwarded to the local Motor Tax Office with the appropriate fee.

WARNING - PENALTIES

ANY PERSON INVOLVED IN THE TRANSFER OF OWNERSHIP OF A VEHICLE AND WHO FAILS TO CARRY OUT THE ABOVE INSTRUCTIONS IS LIABLE TO PROSECUTION AND POSSIBLE HEAVY PENALTIES.