Form Rf-200 is a document used to identify and track workers who have access to state or federally restricted areas. It is also used to record the date of each worker's last security clearance update. The form must be completed by the employer and kept on file for three years. Completed forms can be submitted to the Department of Homeland Security, local law enforcement, or other regulatory agencies as needed. There are several reasons why an employer might need to complete a Form RF-200. Perhaps a new employee needs clearance to work in a secure area, or an existing employee's clearance has expired and needs to be updated. Whatever the reason, it's important to understand how this form works and what information needs to be included. This blog post will provide an overview of Form RF-200 and explain how employers can ensure compliance with all relevant regulations. Stay tuned for future posts that will go into more detail about specific aspects of this document!

| Question | Answer |

|---|---|

| Form Name | Form Rf 200 |

| Form Length | 3 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 45 sec |

| Other names | rf200 form no No Download Needed needed, rf 200, rf200 form, ireland ownership form |

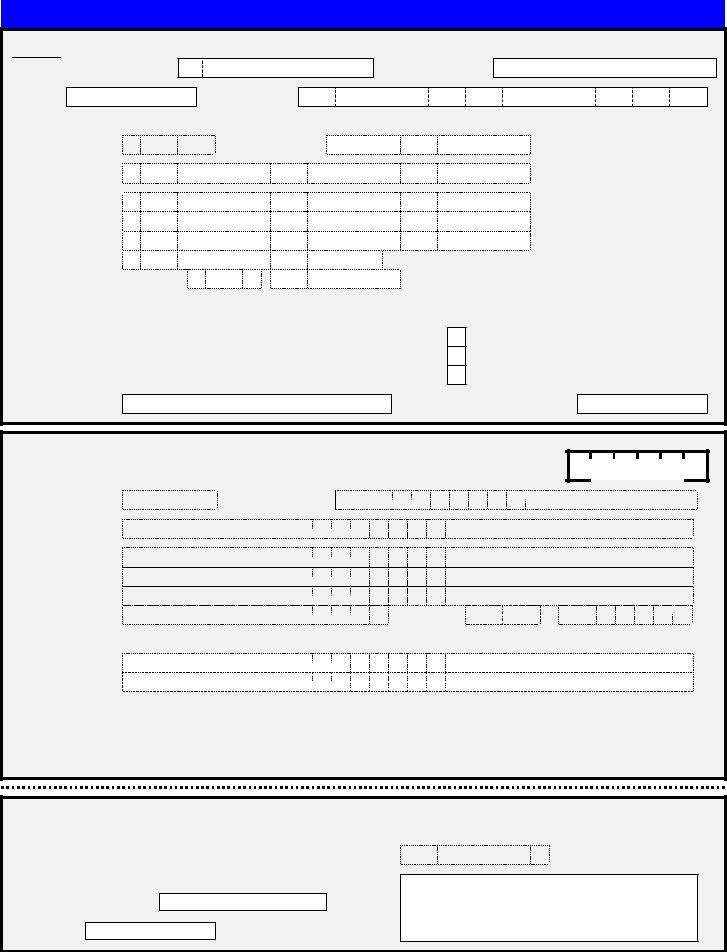

NOTIFICATION OF TRANSFER OF VEHICLE OWNERSHIP

For Vehicles Registered Before 1/1/93 Only

RF 200

PLEASE READ NOTES OVERLEAF BEFORE COMPLETING THIS FORM

This Form must be completed by both Parties at the same time

PART A TO BE COMPLETED BY THE OWNER (including Motor Dealer) DISPOSING OF THE VEHICLE

REGISTRATION NUMBER |

|

Colour(s) |

Chassis Number |

NAME AND ADDRESS |

|

|

|||

|

First Name(s) |

||||

Mr, Ms, etc. |

|

|

|

||

|

|

|

|

||

Surname OR |

|

|

|

|

|

Company Name |

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

Town/City

County

PhoneNo.

DECLARATION

Make/Model

I/We declare that ownership of the above vehicle was transferred to the new owner mentioned in Part B below on

the |

|

|

day of |

|

|

|

|

|

(Day) |

(Month, Year) |

|||||||

|

|

|||||||

Seller’s Signature

and the Registration Book

(tick as appropriate)

is enclosed

has been delivered to Motor Dealer is not available see Note E

Date

PART B TO BE COMPLETED BY THE NEW OWNER (including Motor Dealer)

NEW OWNER’S NAME AND ADDRESS |

|

|

|

|

Garage Code |

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mr, Ms, etc. |

|

|

|

First Name(s) |

|

|

|

|

|

|

|

|

|

|

|

|

||

Surname OR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Company Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Town/City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

County |

|

|

|

|

|

|

Phone No. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address where vehicle is ordinarily kept (Enter ‘As Above’ if vehicle is kept at above address)

DECLARATION |

|

|

|

|

|

I/We declare that |

(i) ownership of the above vehicle was transferred to me/us, |

||||

(ii) I/We have entered my/our name(s) and address in the Registration Book (unless buyer is Motor Dealer) |

|||||

|

|

|

|

|

|

Buyer’s Signature |

|

|

Date |

|

|

PART C TO BE COMPLETED BY OWNER (including Motor Dealer) DISPOSING OF THE VEHICLE THIS PART SHOULD BE DETACHED AND RETAINED BY THE NEW OWNER

I/We have on this date |

|

|

to |

|

|

|

|

Seller’s Signature

Buyer’s name and address

Date

NOTES

IMPORTANT

It is in the interest of the owner selling, trading in or otherwise disposing of the vehicle to ensure that:

(i)If the New Owner is a Company registered under the Companies Act (1963) the name and address of the Company as stated in its Certificate of Incorporation should be used and the signature must be that of the Managing Director or Secretary.

(ii)If the New Owner is a Private Firm the name by which it is ordinarily known together with the full name(s) of the Owner/Partner(s) should be used and the signature must be that of the Owner/Partner.

(iii)Form completed and sent to your local motor tax office as soon as possible.

OTHERWISE YOUR NAME WILL CONTINUE TO APPEAR AS THE REGISTERED OWNER OF THE VEHICLE AND YOU COULD BE HELD ACCOUNTABLE FOR PARKING OR OTHER OFFENCES INVOLVING THE VEHICLE.

‘OWNER’ IS THE ‘KEEPER’ AS DEFINED IN SECTION 130 OF THE FINANCE ACT, 1992 AND THE NEW OWNER AS STATED AT PART B OVERLEAF WILL BE RECORDED IN THE RECORDS ESTABLISHED UNDER SECTION 60 OF THE FINANCE ACT, 1993.

A. When to use this form

This form should be used when any person or body has sold,

B. When NOT to use this form

Do NOT use this form if the vehicle was registered since 1st January 1993, in such case you must use the Vehicle Licensing Certificate (or form RF105 if the new owner is a motor dealer), which must be sent to the Department of the Environment and Local Government, Vehicle Registration Unit, Shannon Town Centre, Co. Clare

C. How to complete this form

Parts A and C of this form must be completed by the OWNER DISPOSING OF the vehicle. Part B of this form must be completed by the NEW OWNER ACQUIRING the vehicle.

D. What to do next

When the OWNER DISPOSING OF the vehicle and the NEW OWNER have completed the form:

•The OWNER DISPOSING OF the vehicle should detach Part C of the form and hand it to the NEW OWNER.

•The NEW OWNER (if not a motor dealer) should enter his/her name and address in the “Next Owner” section of the vehicle’s Registration Book.

•The OWNER DISPOSING OF the vehicle should IMMEDIATELY forward Parts A and B of this form WITH the Registration Book to the local Motor Tax Office unless the NEW OWNER is Motor Dealer.

•In cases where the NEW OWNER is a Motor Dealer, the OWNER DISPOSING OF the vehicle should IMMEDIATELY forward Parts A and B of this form to the local Motor Tax Office, HOWEVER, the Registration Book should NOT be sent to the Motor Tax Office, but should be handed to the Motor Dealer, to be held by the Motor Dealer until the vehicle is sold on.

E.Registration Book Unavailable

Where the OWNER DISPOSING OF the vehicle is unable to provide the Registration Book, an Application Form (RF134) for Replacement Documents should be completed and forwarded to the local Motor Tax Office with the appropriate fee.

WARNING - PENALTIES

ANY PERSON INVOLVED IN THE TRANSFER OF OWNERSHIP OF A VEHICLE AND WHO FAILS TO CARRY OUT THE ABOVE INSTRUCTIONS IS LIABLE TO PROSECUTION AND POSSIBLE HEAVY PENALTIES.