Using the online editor for PDFs by FormsPal, you can easily fill out or change state bank of india form rmt 2c here and now. Our editor is continually developing to provide the very best user experience possible, and that is due to our commitment to continuous enhancement and listening closely to comments from users. Starting is simple! Everything you should do is stick to these simple steps below:

Step 1: Just hit the "Get Form Button" above on this page to open our pdf form editing tool. This way, you'll find all that is necessary to fill out your file.

Step 2: This tool allows you to customize your PDF document in many different ways. Enhance it by including personalized text, correct original content, and include a signature - all manageable in no time!

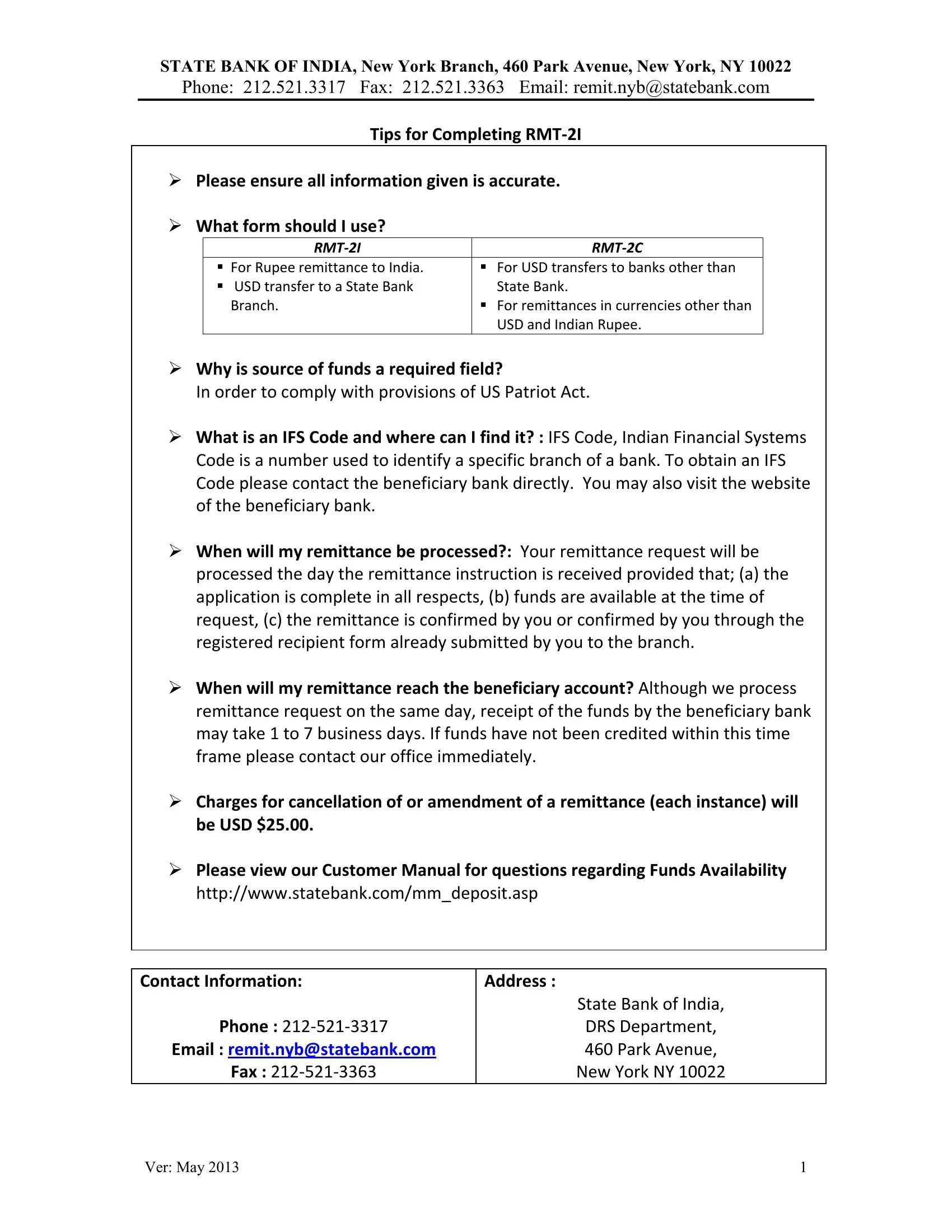

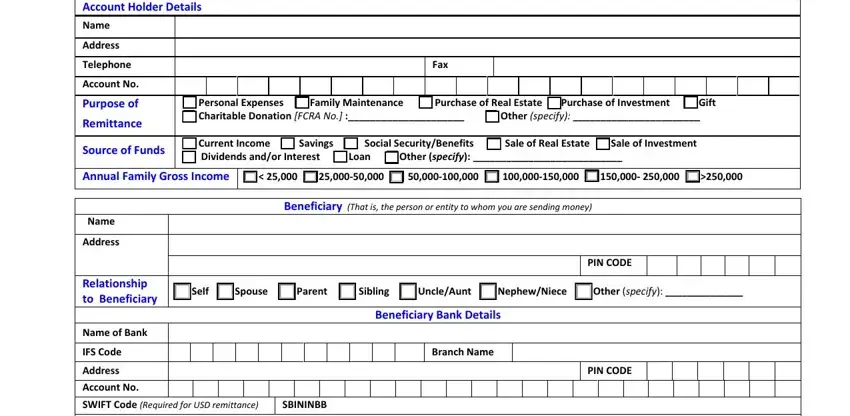

If you want to complete this document, ensure that you provide the required information in each and every blank:

1. Whenever completing the state bank of india form rmt 2c, make sure to complete all essential blank fields in the relevant form section. This will help facilitate the process, allowing your information to be handled efficiently and correctly.

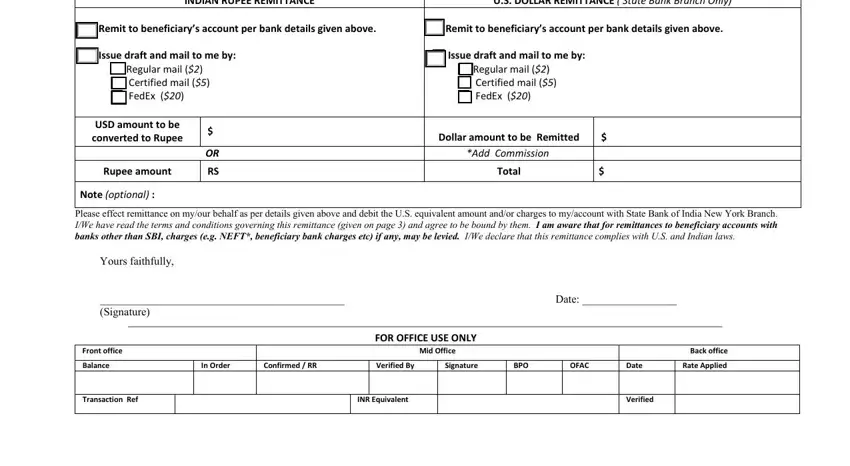

2. The subsequent step would be to fill out the next few blanks: INDIAN RUPEE REMITTANCE, US DOLLAR REMITTANCE State Bank, Remit to beneficiarys account per, Issue draft and mail to me by, Regular mail Certified mail, USD amount to be converted to Rupee, Rupee amount, Note optional, Remit to beneficiarys account per, Issue draft and mail to me by, Regular mail Certified mail, Dollar amount to be Remitted, Add Commission, Total, and Please effect remittance on myour.

Always be extremely mindful when filling in Dollar amount to be Remitted and INDIAN RUPEE REMITTANCE, since this is where most users make a few mistakes.

Step 3: Revise the information you have inserted in the form fields and then click on the "Done" button. Find the state bank of india form rmt 2c the instant you subscribe to a free trial. Immediately view the document from your personal account page, with any edits and adjustments conveniently saved! FormsPal ensures your data confidentiality via a protected method that in no way saves or distributes any kind of personal data used in the form. Be assured knowing your docs are kept confidential each time you use our editor!