Form Rpd 41295 is an application for renewal of a Temporary Protected Status (TPS). This form must be filed by nationals of designated countries who have been granted TPS status. If you are a national of one of the designated countries, and your TPS has expired or will expire within the next 150 days, be sure to file this form to renew your status. The deadline to submit this form is July 24, 2017. If you do not renew your TPS status, you may lose your protection from deportation. For more information on Form Rpd 41295, and how to file it, please visit our website. Thank you for your time!

| Question | Answer |

|---|---|

| Form Name | Form Rpd 41295 |

| Form Length | 3 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 45 sec |

| Other names | rpd 41295 what is form rpd 41272 |

New Mexico Taxation and Revenue Department |

||

Rev. 03/2005 |

||

|

||

|

Application for New Mexico Retail Food Store Certification |

|

|

for the food deduction pursuant to Section |

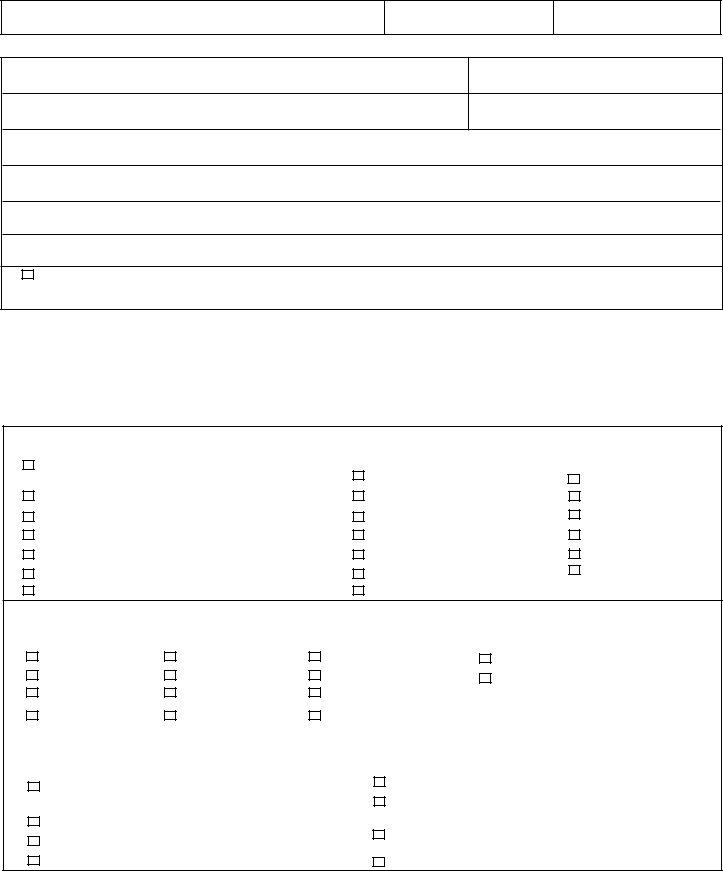

PART 1 - Business Information

Print the business name

CRS identification number

FEIN or SSN

Retail store information: Complete one application for each store location.

Print store name (if different from business name)

CRS identification number (if different)

chain store unit number (if applicable)

FEIN or SSN (if different)

Street address

City, state and zip code

Contact name, phone number and

Location of records; physical address

CHECK if applicable: The retail food store described in this application is requesting eligibility for New Mexico retail store certification retroactive to January 1, 2005. The description of this retail store operation contained within this application has been in effect since on or before January 1, 2005.

If you are authorized to accept food stamps under the federal Food Stamp Act, you do not need to file this application and obtain the New Mexico Retail Food Store Certificate to qualify to take the food deduction pursuant to Section

NOTE: All information submitted on this application is subject to verification by physical inspection.

PART 2 - Retail Store Operation Information

1. Type of business (Check one)

Supermarket |

|

|

|

|

|

(Annual gross sales $2 million or more) |

|

Nonprofit food buying |

|

|

Other route |

|

|||||

|

|

|

|||

Medium or small grocery |

|

Wholesaler |

|

|

Grocery/gas station |

|

|

|

|||

Convenience store |

|

Military commissary |

|

|

Grocery/bar |

|

|

|

|||

|

|

|

|||

|

|

||||

Produce stand (single store application) |

|

Other food store |

|

|

Grocery/restaurant |

|

|

|

|||

|

Milk route |

|

|

General store |

|

|

|

|

|||

Specialty foods - meat store, fish store, bakery, etc.... |

|

Bread route |

|

|

Other combination |

|

|

|

|||

|

|

|

|||

|

|

||||

Health/natural food store |

|

Produce route |

|

|

|

|

|

|

|

2. Inventory and services sold (Check all that apply)

Check the inventory and services at this store from choices listed below:

|

|

|

|

Gasoline |

|

|

Lottery Tickets |

|

|

Clothing |

|

|

Tobacco Products |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|||||||||

|

|

|

|

Motor Oil |

|

|

Beer/Wine |

|

|

Outdoor Equipment |

|

Other Services. What are they? (Games, |

||

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Household supplies |

|

|

Liquor |

|

|

Hardware |

|

|

videos, pharmacy, etc....) List below. Add |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|||||||||

|

|

|

|

Hot Food |

|

|

Auto Parts |

|

|

Food Stamp Issuance |

|

page if needed. ___________________ |

||

|

|

|

|

|

|

|

|

_________________________________ |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|||||||||

3. Staple foods in inventory stock (Check all that apply) |

|

|

|

|

|

|||||||||

Check the staple foods in inventory at this store from the choices listed below: |

|

|

||||||||||||

|

|

|

|

Bread, baked goods, rice, pasta, cereal, chips, |

|

|

Eggs |

|

|

|||||

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

Canned/frozen/packaged staple foods |

||||||||

|

|

|

|

cookies, crackers, etc.) |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

Dairy Products (milk, cheese, butter, yogurt, etc.) |

(including 100% juices) |

|||||||||

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

||||||||

|

|

|

|

Produce (fruits, vegetables) |

|

|

Fish/Seafood |

|

|

|||||

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

Meat (beef, pork, lamb, etc.) |

||||||||

|

|

|

|

|

|

|||||||||

|

|

|

|

Poultry/Fowl (chicken, turkey, etc) |

|

|

||||||||

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|||||||||

Page 1 of 3

New Mexico Taxation and Revenue Department |

||

Rev. 03/2005 |

||

Application for New Mexico Retail Food Store Certification |

||

|

||

|

for the food deduction pursuant to Section |

Print your company’s name

store name and chain unit number if applicable

CRS identificationFEIN or SSNnumber for store

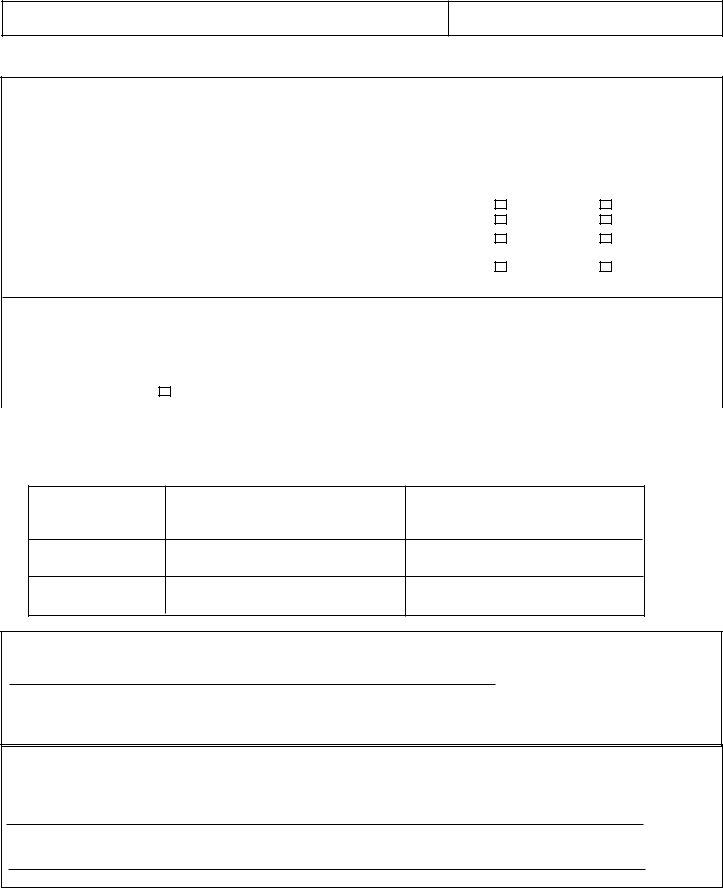

PART 3 - STAPLE FOOD STOCK

Complete either Section A or B using the terms defined in the instructions.

Section A: Firms that carry a full line of groceries - Complete this part if your store stocks on a continuous basis an ample variety of the types of foods listed below in each category.

Check “Variety” for each staple food category you sell in your store which meets the definition of variety (see instructions). Also, check “Perishable” for each category which meets the definition of perishable (see the instructions).

Staple Food Category Examples of staple food items |

Variety |

Perishable |

|||||

Bread/Cereals |

Bread, cereals, pasta, grains, rice, flour |

|

|

|

|

|

|

|

|

|

|

|

|

||

Dairy Products |

Cheese, butter, milk, yogurt |

|

|

|

|

|

|

|

|

|

|

|

|

||

Fruits/Vegetables |

All forms of fruits, vegetables, 100% juice |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

(Include fresh, frozen and canned) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Meat/Poultry/Fish |

Beef, chicken, bacon, ham, shellfish, sandwich meats |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

(Include fresh, frozen and canned) |

|

|

|

|

|

|

Section B: Firms with a specialty line of Staple Foods - Check the box below if your business sells a limited variety or line of staple foods; for example, a bakery, milk route, produce stand or meat market. Stores selling only accessory foods do not qualify. See Qualifying as a “retail food store” in the instructions. Provide the annual retail food sales and the annual gross sales at this location that you reported for the same time period for Gross Sales in Part 4 (see below) for the past two years. This may be an estimated figure.

Check if applicable: |

I am applying for New Mexico Retail Food Store Certification under Section B. |

||

|

|

|

|

PART 4 - SALES INFORMATION |

|

|

|

Gross sales reporting method: (Circle one) |

Actual |

Estimated* |

|

*Use estimated ONLY if previous year information is not yet available, or if this is a new store. You may be required to submit actual figures when available.

Federal income

tax year

Annual retail food sales at

this location as reported to the IRS

for the last two years.

Annual gross sales at

this location as reported to the IRS

for the last two years.

I declare that I have examined this application, including any accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct and complete.

Signature of Taxpayer or Agent |

|

Date |

|

|

|

Print name |

Title |

Phone |

FOR DEPARTMENT USE ONLY

This application for New Mexico Retail Food Store Certification was reviewed by the New Mexico Taxation and Revenue Department and was approved.

Name of Certified New Mexico retail food store

Authorized Department Signature |

Date of approval |

Page 2 of 3

New Mexico Taxation and Revenue Department |

|

Rev. 03/2005 |

Application for New Mexico Retail Food Store Certification |

|

|

|

for the food deduction pursuant to Section |

|

INSTRUCTIONS |

Who Must File This Form Effective January 1, 2005, receipts of certain retail food stores from the sale of food intended for home consumption are deductible from gross receipts pursuant to Section

Complete this application and submit it to the department. When approved, you will receive a New Mexico Retail Food Store Certification and may begin taking the deduction for qualified sales of certain foods pursuant to Section

Qualifying as a retail food store: To qualify, a retail store must meet at least one of two criteria the federal government sets. It either must stock and offer a variety of foods on a continuous basis in each of four staple food categories - two of which must be perishable foods - or function as a specialty store attributing 50% or more of its gross retail sales to staple foods. The terms food, retail food store, staple food and variety are defined in the federal Food Stamp Act of 1964. See these important definitions below. Stores selling only accessory foods including spices, candy, soft drinks, tea or coffee, ice cream, or dough- nuts or bakeries not selling bread are ineligible. These stores stores do not qualify to accept food stamps and therefore do not qualify as retail food stores for the gross receipts tax deducion in New Mexico.

IMPORTANT DEFINITIONS

Food Any food or food product intended for human consumption, except alcoholic beverages, tobacco, hot foods and hot food products prepared for immediate consumption. Food also includes seeds and plants to grow foods for personal con- sumption of households according to 7 USCA 2012(g)(1).

Retail Food Store An establishment that sells food for home preparation and consumption. For New Mexico purposes the establishment must meet the federal definition of retail food store in

Variety Enough items (no fewer than 3) in each of the staple food groups listed below to meet most people’s food needs. Staple Food (1) Bread, rice, pasta, (2) dairy foods, (3) fruits and vegetables and (4) meats (fresh, packaged, canned or frozen). Do not count hot foods, prepared foods such as sandwiches or salads, candy, condiments, spices, coffee, tea, cocoa, or carbonated or

Perishable foods Fresh, frozen or refrigerated food that could spoil in two or three weeks.

Completing this form: File one application for each location. Complete all parts of this application and all information as requested, or your application may be returned without review. Be sure to transfer the business name and the CRS identifica- tion number from the first page to the top of the second page. Sign the application. Mail the completed application to the local district tax office nearest you. The phone numbers of the local district tax offices are also included in the listing below. If approved, your application will be returned to you with department approval.

ALBUQUERQUE: Taxation & Revenue Department |

LAS CRUCES: |

|

|

P.O. Box 8485 |

Taxation & Revenue Department |

|

Albuquerque, NM |

P.O. Box 607 |

|

Telephone: |

Las Cruces, NM |

|

|

Telephone: |

SANTA FE: |

Taxation & Revenue Department |

|

|

P.O. Box 5374 |

ROSWELL: |

|

Santa Fe, NM |

Taxation & Revenue Department |

|

Telephone: |

P.O. Box 1557 |

|

|

Roswell, NM |

FARMINGTON: Taxation & Revenue Department |

Telephone: |

|

|

P.O. Box 479 |

|

|

Farmington, NM |

|

|

Telephone: |

|

Page 3 of 3