In the landscape of tax incentives designed to bolster affordable housing development, the RPD-41301 form emerges as a pivotal document for entities navigating the financial nuances of these projects in New Mexico. Issued by the New Mexico Taxation and Revenue Department, the Affordable Housing Tax Credit Claim Form serves as the bridge between investment in affordable housing and the realization of a tax credit benefit against a modified combined tax liability, personal income tax, or corporate income tax liabilities. Notably, this form accommodates the claiming of credits derived from investments in land, buildings, construction, and other components integral to affordable housing projects that have received the green light from the New Mexico Mortgage Finance Authority. What sets this form apart is its capacity to embody transfers, allowing credits to be assigned, thus introducing flexibility and liquidity into the realm of affordable housing finance. The stipulation of a five-year carryforward period for unused credits post the original issuance date underscores a commitment to long-term investment in the housing sector. Furthermore, the form's meticulous design, evident in the required attachment of supporting schedules and adherence to specific deadlines, ensures that claimants are both informed and compliant in their quest to contribute to affordable housing while navigating their tax obligations responsibly.

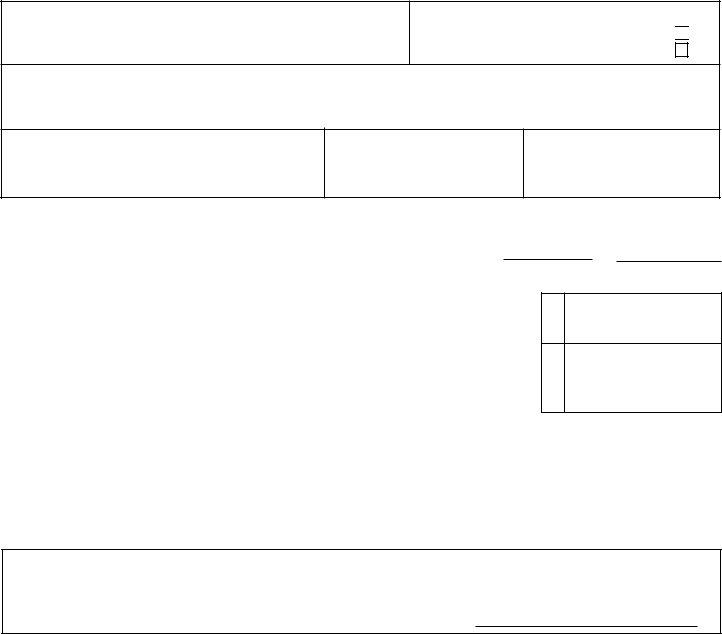

| Question | Answer |

|---|---|

| Form Name | Form Rpd 41301 |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | this form must accompany the applicable tax return, PURPOSE OF THIS FORM: When claiming the affordable housing tax credit, see |

New Mexico Taxation and Revenue Department

AFFORDABLE HOUSING TAX CREDIT CLAIM FORM

Page 1 of 4

PURPOSE OF THIS FORM: When claiming the affordable housing tax credit, this form must accompany the applicable tax return, see

instructions for applicable tax programs. The holder of an investment voucher may apply all or a portion of the value (approved tax credit amount) of the investment voucher as an affordable housing tax credit against the holder’s modified combined tax liability (see definition on page 3), personal income tax, or corporate income tax liability. Any balance may be carried forward for up to five years from the end of the calendar year in which the investment voucher for the affordable housing project was originally issued, or the original voucher date. To claim the credit, the holder must attach a completed Form

Taxpayer Access Point (TAP) at https://tap.state.nm.us, and follow the prompts to attach this form. To mail in, attach this form to the tax return and mail to the address on the return. For assistance completing this form, call (505)

The holder is the individual or business to whom an investment voucher has been issued or to whom the investment voucher has been sold, exchanged or otherwise transferred. When an investment voucher is transferred to a new holder, notification must be made to the

New Mexico Taxation and Revenue Department and New Mexico Mortgage Finance Authority (MFA) within ten days of the transfer by submitting to the MFA a completed Affordable Housing Tax Credit Transfer Form. The new holder will receive notification of approval of

the transfer and a new voucher number will be issued for the investment voucher or the portion of the balance that was transferred. A

taxpayer may not claim the tax credit until the transfer investment voucher and subsequent voucher number have been issued. (See more about Transfers on page 3.)

Name of holder

Social security number (SSN) or federal employer

identification number (FEIN) of holder

Mark one: FEIN

SSN

Mailing address |

City, state and ZIP code |

Name of contact

Phone number

1. Enter the beginning and ending date of the tax year of this claim. |

From |

to |

2.Enter the New Mexico tax due for this report period. If applying against an income tax return, enter the Net New Mexico income tax calculated before applying any credit.

3.Enter the portion of total credit available (from Schedule A) you are claiming on the at- tached tax return. Do not enter more than the amount of Net New Mexico tax due on the return (Imporant: Include Schedule CR when inticated in the instructions). ............

2.

3.

NOTE: Failure to attach this form and required attachments to your New Mexico return will result in denial of the credit.

Under penalty of perjury I declare that I have examined this claim, and to the best of my knowledge and belief, it is true, correct and complete.

Signature of claimant |

|

Date |

New Mexico Taxation and Revenue Department

AFFORDABLE HOUSING TAX CREDIT CLAIM FORM

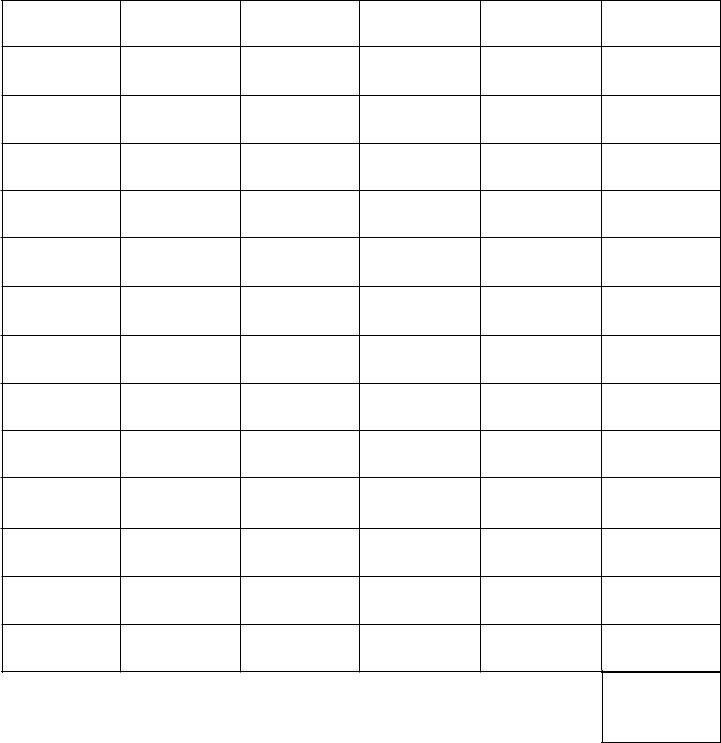

Schedule A

Page 2 of 4

You must attach Schedule A with Form

Column A

Investment Voucher

Number

Column B Issue Date

Column C

Amount Of Credit

Approved

Column D

Total Credit Claimed

In Previous Tax Years

Column E

Unused Credit

(C - D)

Column F

Applied To The

Attached Return

TOTAL credit available

Enter the sum of Column F here and on line 3 of Form

New Mexico Taxation and Revenue Department

AFFORDABLE HOUSING TAX CREDIT CLAIM FORM

Page 3 of 4

About This Credit:

The Mortgage FinanceAuthority (MFA) may issue investment vouch-

ers to persons who have invested in approved affordable housing projects. MFA may issue an investment voucher to a person who

has made an investment of land, buildings, materials, cash, or ser- vices for an affordable housing project approved by MFA or for a

trust fund administered by MFA. The vouchers, good for up to 50% of the investment, may be sold or transferred. Affordable housing

projects cover land acquisition, construction, materials, building acquisition, remodeling, improvement, rehabilitation, conversion, or weatherization for single family residential housing or multifamily residential housing approved by MFA. After receiving the investment

vouchers from MFA, the taxpayer may apply them for a credit against the taxpayer’s modified combined tax liabilities, personal income

tax, or corporate income tax liabilities, and the taxpayer may carry unused credit forward for five years.

NOTE: Effective July 1, 2010, this law is expanded to include all counties, and adds materials to the list of eligible investments.

Transfers:

The credit may also be sold, exchanged, or otherwise transferred to another holder. When an investment voucher is transferred in whole or in part to a new holder, New Mexico Taxation and Revenue

Department and MFA must be notified within 10 days of the transfer

by submitting a completed Affordable Housing Tax Credit Transfer Form to MFA. The Affordable Housing Tax Credit Transfer Form may be obtained from MFA. The new holder will be notified of approval

of the transfer and issued a new investment voucher number. The transfer form will identify the new holder, the new voucher number, and the transfer amount, but will also identify the original voucher

date. The original voucher date is the date the original investment voucher was issued for the affordable housing project. Upon receipt of the approved transfer form, the new holder may apply the afford-

able housing tax credit against future returns, but may not carry forward any credit for more than 5 years from the calendar year in which the original investment voucher was issued.

For example, if an affordable housing project was approved and later certified by MFA, and the resulting original investment voucher was issued to holder Z on January 15, 2006, Z may not claim the affordable housing tax credit for any unused balance of the invest-

ment voucher after December 31, 2011. If all or a portion of the investment voucher balance is subsequently transferred to holder X, X may not claim the tax credit for the transferred balance after December 31, 2011. The original voucher date for the original in-

vestment voucher issued to Z and the transfer investment voucher issued to X is January 15, 2006.

“Modified combined tax liability” means the total liability for the report period for gross receipts tax less any local option gross receipts tax due (5.125% of taxable gross receipts), compensat- ing and withholding taxes, interstate telecommunications gross

receipts tax, E911 surcharges, and telecommunications relay sur- charges, minus any credit (other than the affordable housing tax credit) applied against these taxes. Modified combined tax liability

does not include amounts collected for local option gross receipts taxes and governmental gross receipts taxes.

How To Apply For The Credit:

Taxpayers seeking the affordable housing tax credit must con- tact the New Mexico Mortgage Finance Authority

or

How To Claim The Credit:

When completing Form

Schedule A if you have any investment vouchers that were previ- ously claimed. Schedule A is used to compute any carryforward credits allowable. Attach Schedule B if there is more than one investment voucher to claim.

Attach Form

credit. Enter the credit claimed on the applicable line of the New Mexico income/business tax form for the following tax programs:

Income Tax Programs |

Required Forms |

Corporate Income Tax |

|

|

|

Fiduciary Income Tax |

|

|

|

Personal Income Tax |

|

|

|

Sub Chapter S Corporate |

|

Income and Franchise Tax |

|

|

|

Business Tax Programs |

Required Forms |

Compensating Tax |

|

|

|

E911 Services Surcharge* |

|

|

|

Gross Receipts Tax |

|

|

|

Interstate Telecommunications |

|

Gross Receipts Tax |

|

|

|

Telecommuications Relay |

|

Services Surcharge* |

|

|

|

|

|

Wage Withholding Tax |

|

|

|

*Underpay the amount recorded as due by the amount of the credit claimed.

The credit to be applied may not exceed the tax liability due on the return. First, apply unused credit available from the investment voucher with the oldest original voucher date to the tax liability.

Important: The credit may not be claimed against local option gross receipts tax imposed by any county or municipality, or the governmental gross receipts tax.

Any balance of the affordable housing tax credit may be carried

forward for up to 5 years from the calendar year during which the

original investment voucher used to claim the affordable housing tax credit was issued.

Websites:

New Mexico Mortgage Finance Authority

www.housingnm.org

New Mexico Taxation & Revenue Department

www.tax.newmexico.gov

New Mexico Taxation and Revenue Department

AFFORDABLE HOUSING TAX CREDIT CLAIM FORM

INSTRUCTIONS

Page 4 of 4

Page 1 Instructions

Enter in Name of Holder, SSN or FEIN, Mailing Address, Name of Contact, Phone Number, and

Line 1. Begining and Ending Date

Enter in both the beginning and ending date of the tax year or filing period for which this credit is to be applied.

Line 2. Tax Due

Enter the New Mexico tax due for this report period. If applying against an income tax return, enter the Net New Mexico income tax calculated before applying any credit.

Line 3. Credit Claimed on the Tax Return

Enter the portion of total credit available (from Schedule A) you are claiming on the attached

Schedule A Instructions

For each affordable housing tax credit approved by the New Mexico Mortgage Finance Authority (MFA) complete a row in Schedule A.

Do not include credits approved in a tax year that is more than six years prior to the tax year for which this claim is filed. Unused af-

fordable housing tax credits may not be carried forward for more than five consecutive tax years following the tax year for which

the credit was approved. Do not include credits which have been claimed in full in prior tax years..

Column Instructions

Column A. Investment Voucher Number

Enter the investment voucher number (credit number) assigned by MFA on the investment voucher. If the credit was transferred to you, enter the new voucher number assigned by MFA. The person

to whom an investment voucher is issued, the holder, may claim an affordable housing tax credit against certain taxes and surcharges

imposed on the holder for the value (approved tax credit amount)

of the investment voucher that has been issued to them. The holder may not claim a credit for any unused balance after five years from

the end of the calendar year in which the investment voucher for

the affordable housing project was originally issued, or the original

voucher date. (See more about Transfers on page 3.)

Enter the credit number assigned by MFA on the investment voucher. If the voucher was transferred to you, enter the new voucher number assigned by MFA.

Column B. Issue Date

For each investment voucher reported, enter the original issue

date of the investment voucher. The original issue date is the date the original investment voucher was issued for an affordable hous- ing project approved and certified by the New Mexico Mortgage

Finance Authority. If the investment voucher is transferred and a

subsequent voucher number is issued, the original voucher date is the date that the first investment voucher is issued for that afford-

able housing project.

Column C. Amount Of Credit Approved

For each investment voucher, enter the value of the investment voucher or the transfer value if an investment voucher has been transferred to you.

Column D. Total Credit Claimed In Previous Tax Years

For each credit amount listed in Column C, enter the total amount of credit claimed in all tax years prior to the current tax year.

Column E. Unused Credit

For each credit, subtract the amount in Column D from the amount in Column C.

Column F. Applied To The Attached Return

For each credit, enter in Column F, the amount that is applied to the attached New Mexico tax return.

When calculating the amount in Column F, apply the following rules:

•Applying credits: Apply the affordable housing tax credit in the order that they were approved. If you have both a

current tax year, apply the oldest credit against the liability first. List each investment voucher separately.

•The maximum amount of credit claimed in a tax year.

The sum of tax credits applied to the tax due on the return may not exceed the tax due on the New Mexico tax return.