Whenever you need to fill out Form Rs 6163 A, there's no need to download any software - simply use our online tool. Our editor is continually developing to give the very best user experience attainable, and that is due to our resolve for constant improvement and listening closely to user opinions. Starting is easy! All you have to do is adhere to these simple steps directly below:

Step 1: Access the PDF form inside our tool by pressing the "Get Form Button" at the top of this page.

Step 2: As you open the editor, you will find the form made ready to be filled out. Apart from filling out different fields, it's also possible to do many other actions with the file, including writing any textual content, modifying the initial textual content, adding graphics, putting your signature on the form, and more.

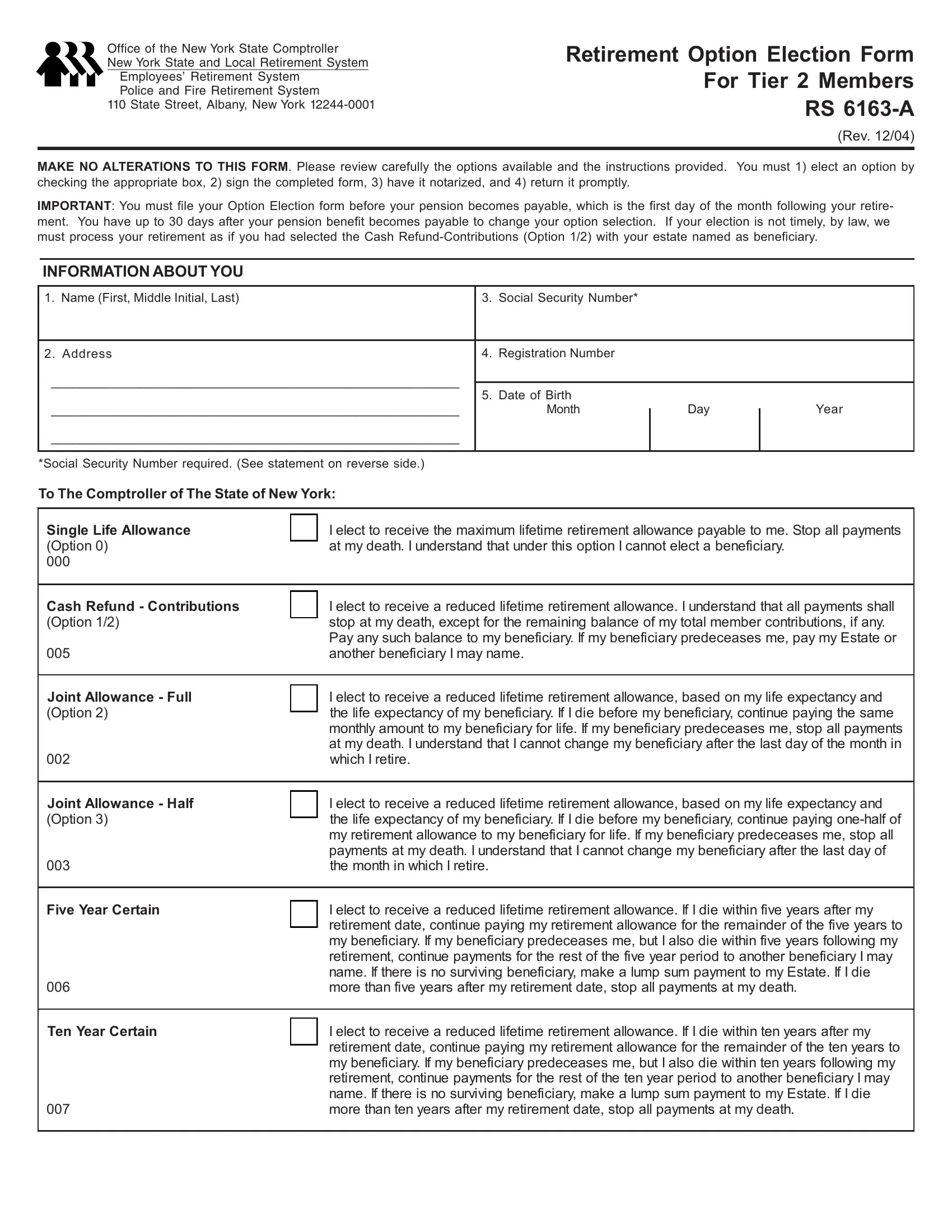

With regards to the blanks of this particular form, this is what you should consider:

1. To start with, when filling out the Form Rs 6163 A, start in the form section that features the next fields:

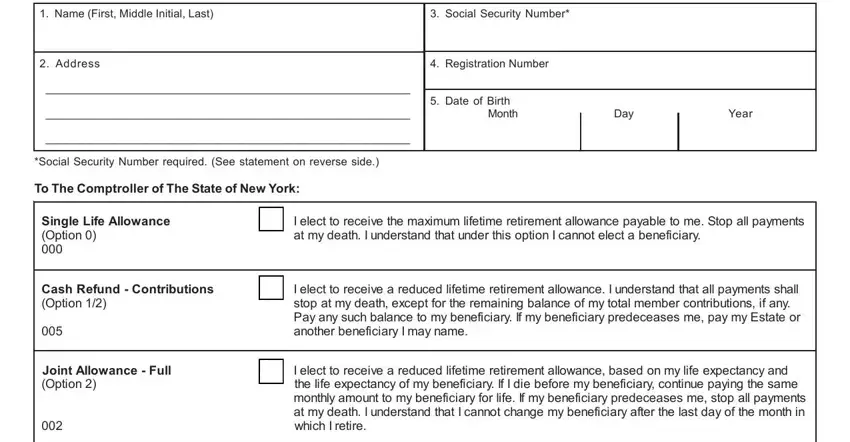

2. Your next step would be to fill in these particular blank fields: Joint Allowance Half Option, Five Year Certain, Ten Year Certain, I elect to receive a reduced, the life expectancy of my, I elect to receive a reduced, retirement date continue paying my, I elect to receive a reduced, and retirement date continue paying my.

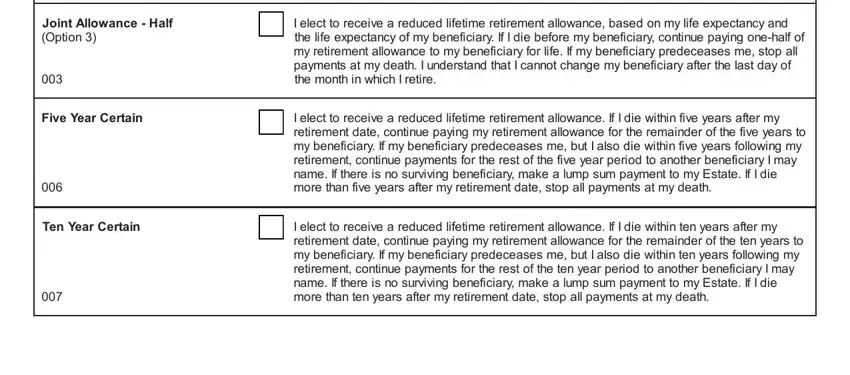

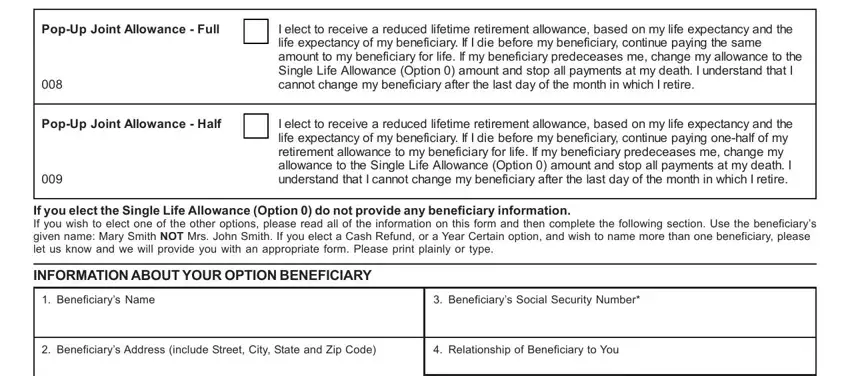

3. This next step is normally easy - complete every one of the fields in PopUp Joint Allowance Full, PopUp Joint Allowance Half, I elect to receive a reduced, life expectancy of my beneficiary, I elect to receive a reduced, If you elect the Single Life, INFORMATION ABOUT YOUR OPTION, Beneficiarys Name, Beneficiarys Social Security, Beneficiarys Address include, and Relationship of Beneficiary to You to conclude this process.

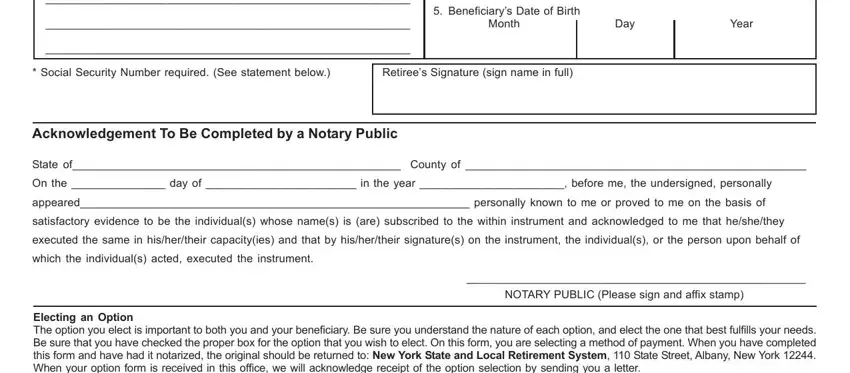

4. This next section requires some additional information. Ensure you complete all the necessary fields - Beneficiarys Date of Birth, Month, Day, Year, Social Security Number required, Retirees Signature sign name in, Acknowledgement To Be Completed by, State of County of, On the day of in the year, appeared personally known to me or, satisfactory evidence to be the, executed the same in hishertheir, which the individuals acted, NOTARY PUBLIC Please sign and, and Electing an Option The option you - to proceed further in your process!

Concerning Month and Day, be certain that you don't make any mistakes in this current part. Both of these could be the most important fields in the PDF.

5. Lastly, this final portion is precisely what you will need to complete prior to closing the form. The blank fields in this case are the next: Information Services Information, Social Security Disclosure, Personal Privacy Protection Law, and RS A Rev.

Step 3: Revise all the information you've entered into the form fields and click on the "Done" button. Right after creating afree trial account with us, you will be able to download Form Rs 6163 A or email it at once. The PDF will also be accessible through your personal account with your modifications. We don't sell or share the details you enter whenever completing documents at our website.