Navigating the obligations and requirements for employers concerning domestic employees in Florida involves understanding the Application for Annual Filing for Employers of Domestic Employees, known as the RT-7A form. This form, integral to the state’s administrative procedures, allows employers who exclusively hire domestic workers to shift from quarterly to annual reporting for reemployment tax purposes. Designed to streamline the tax reporting process, the RT-7A form mandates that employers confirm their eligibility for an earned tax rate, which requires having a history of timely reported taxes for a specified period and being assigned a tax rate beyond the initial one. It further binds employers to immediate notification obligations should they hire outside of the domestic services scope, ensuring that their filing status accurately reflects their employment practices. Application deadlines, the ramifications of failure to provide timely wage information, and conditions leading to the revocation of the annual filing privilege highlight the form’s emphasis on compliance and the potential consequences of oversight. With the annual report's deadline set at the start of each year, and specific provisions for transitions and cessation of employment, the RT-7A form encapsulates a critical aspect of tax reporting for employers of domestic employees in Florida.

| Question | Answer |

|---|---|

| Form Name | Form Rt 7A |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | florida rt 7, rt 7 florida, florida department of revenue rt 7, form rt 7 |

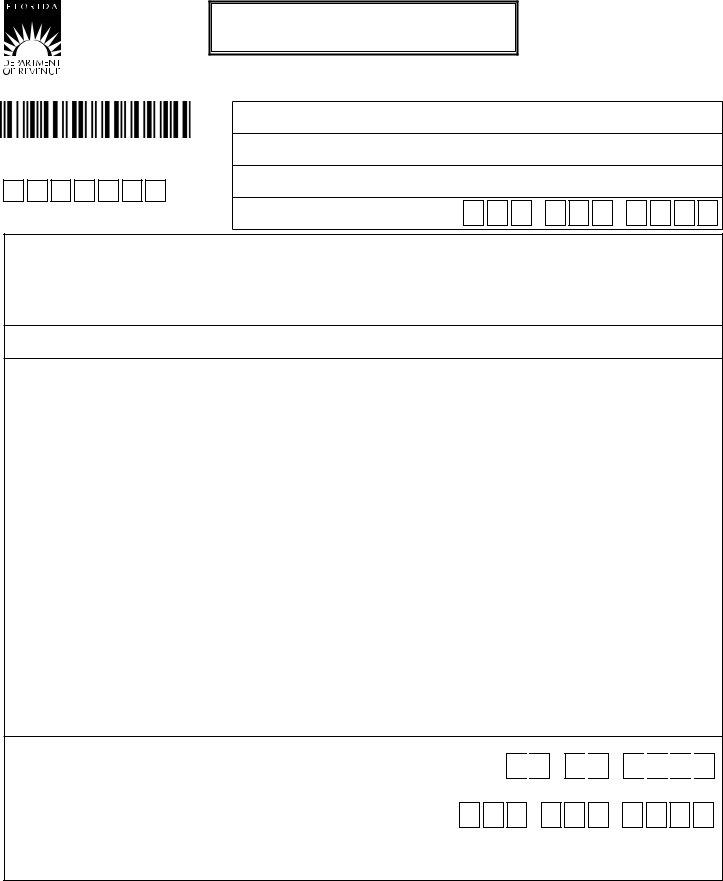

Application for Annual Filing for Employers of Domestic Employees

R. 01/13

Rule

Reemployment Tax Account Number

Name or legal entity name

Mailing address

City, State ZIP

Telephone number (include area code) |

– |

– |

|

I am an employer liable for reemployment tax* reporting and certify to the following:

•I only employ employee(s) who perform domestic services as deined in section 443.1216(6), Florida Statutes (F.S.).

•I am eligible for an earned tax rate (to be eligible for an earned tax rate means the employer has reported for the required number of calendar quarters and has been assigned a tax rate other than the initial rate).

I hereby make application to change from quarterly reporting to annual reporting, effective January 1,_____.

I understand that:

•If I employ individuals who perform services other than domestic services, I no longer qualify for annual reporting and agree to immediately notify the Department of Revenue and understand my iling period will revert to quarterly iling. (Example: A sole proprietor has a business employee and an employee in the owner’s home who performs domestic services. Since the sole proprietor employs individuals who perform services other than domestic services, all employment must be reported quarterly).

•Failure to timely provide wage information requested by the Department of Economic Opportunity, Reemployment Assistance Program or its designee shall result in the loss of privilege to ile annually, effective the calendar quarter immediately following the calendar quarter in which such failure occurred.

•If I am assigned a penalty rate due to indebtedness billed for more than one year, my iling period will revert to quarterly iling.

•If I do not have an annual payroll as deined in s.443.131(3)(b)1, F.S., and become ineligible for an earned rate, my iling period will revert to quarterly iling.

•Although I will be reporting on an annual basis, the wages for each employee must be itemized by quarter on the annual reporting form. The annual report is due January 1 and is delinquent if not postmarked by January 31.

•This application must be postmarked no later than December 1 to be eligible for annual iling for the next calendar year. (Note: for the transition year, an Employer’s Quarterly Report

•I will remain in annual reporting status until I request a change to quarterly iling or I no longer qualify for annual reporting.

•If I cease employment and my account is inactivated, I will immediately revert to quarterly illing for the completed quarters of the current calendar year.

_________________________________________________________________________

Signature

M M /

D D /

Date

Y Y Y Y

___________________________________________________________________

Title

–

Area Code

–

Telephone number

This form must be signed by the sole proprietor or owner, if a sole proprietorship; by a partner, if a partnership; or by an authorized agent who has a Power of Attorney

Submit the completed application to: |

For assistance call: |

Internet address: |

Account Management |

www.mylorida.com/dor |

|

Florida Department of Revenue |

|

|

PO Box 6510 |

|

|

Tallahassee FL |

|

|

* Formerly Unemployment Tax