Working with PDF forms online is certainly super easy with our PDF editor. Anyone can fill in rtso1 form online here effortlessly. The editor is constantly upgraded by us, getting awesome features and turning out to be a lot more convenient. With a few simple steps, you'll be able to start your PDF journey:

Step 1: Firstly, open the tool by clicking the "Get Form Button" above on this page.

Step 2: With our advanced PDF editing tool, you are able to accomplish more than just fill in forms. Edit away and make your documents appear great with custom textual content added in, or adjust the original content to excellence - all that backed up by the capability to incorporate any kind of graphics and sign the document off.

It will be simple to fill out the form using out practical guide! Here is what you must do:

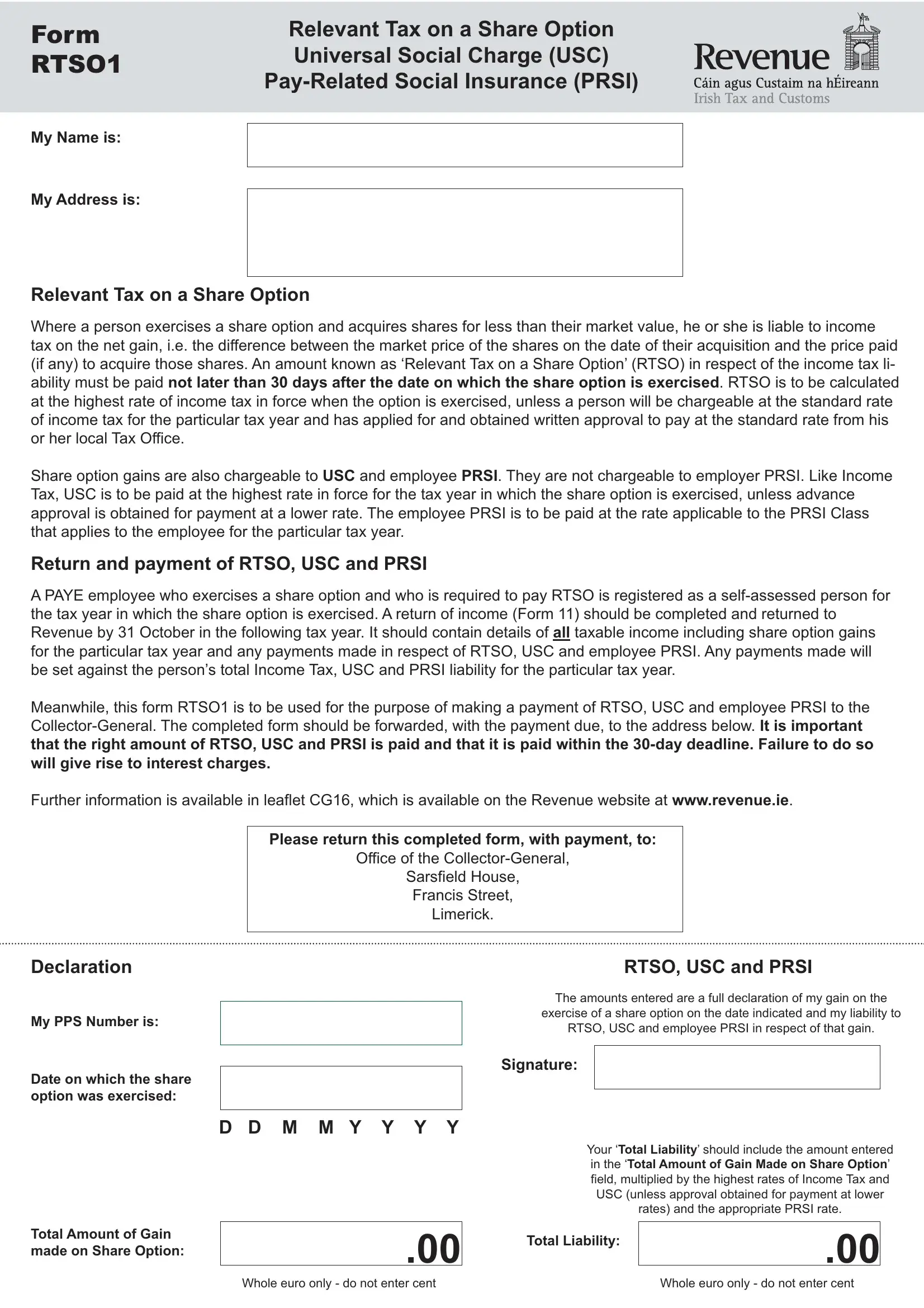

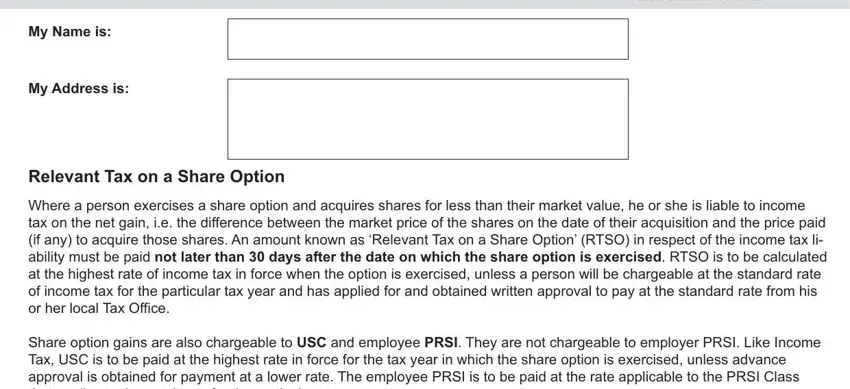

1. When submitting the rtso1 form online, make sure to complete all of the needed blank fields in the corresponding section. It will help to speed up the work, allowing your details to be processed swiftly and properly.

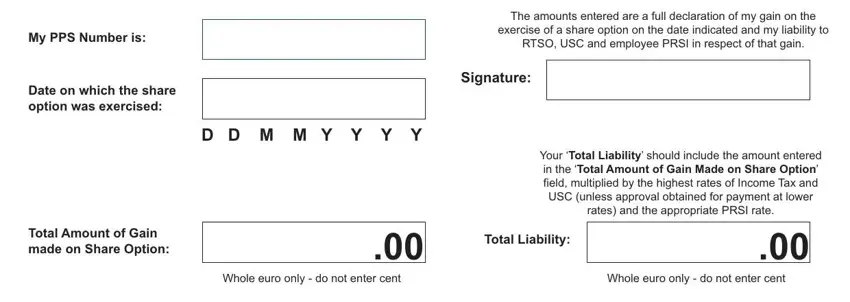

2. Soon after filling out the last part, go on to the next part and fill out the essential particulars in all these fields - My PPS Number is, Date on which the share option was, D D M M Y Y Y Y, The amounts entered are a full, exercise of a share option on the, RTSO USC and employee PRSI in, Signature, Your Total Liability should, rates and the appropriate PRSI rate, Total Amount of Gain made on Share, Total Liability, Whole euro only do not enter cent, and Whole euro only do not enter cent.

People frequently make errors while completing The amounts entered are a full in this area. Be sure you go over whatever you type in here.

Step 3: Right after rereading your fields, press "Done" and you're good to go! Create a free trial subscription at FormsPal and obtain immediate access to rtso1 form online - download, email, or change in your personal account. With FormsPal, you can complete forms without stressing about personal information incidents or records being distributed. Our secure software helps to ensure that your private details are kept safe.