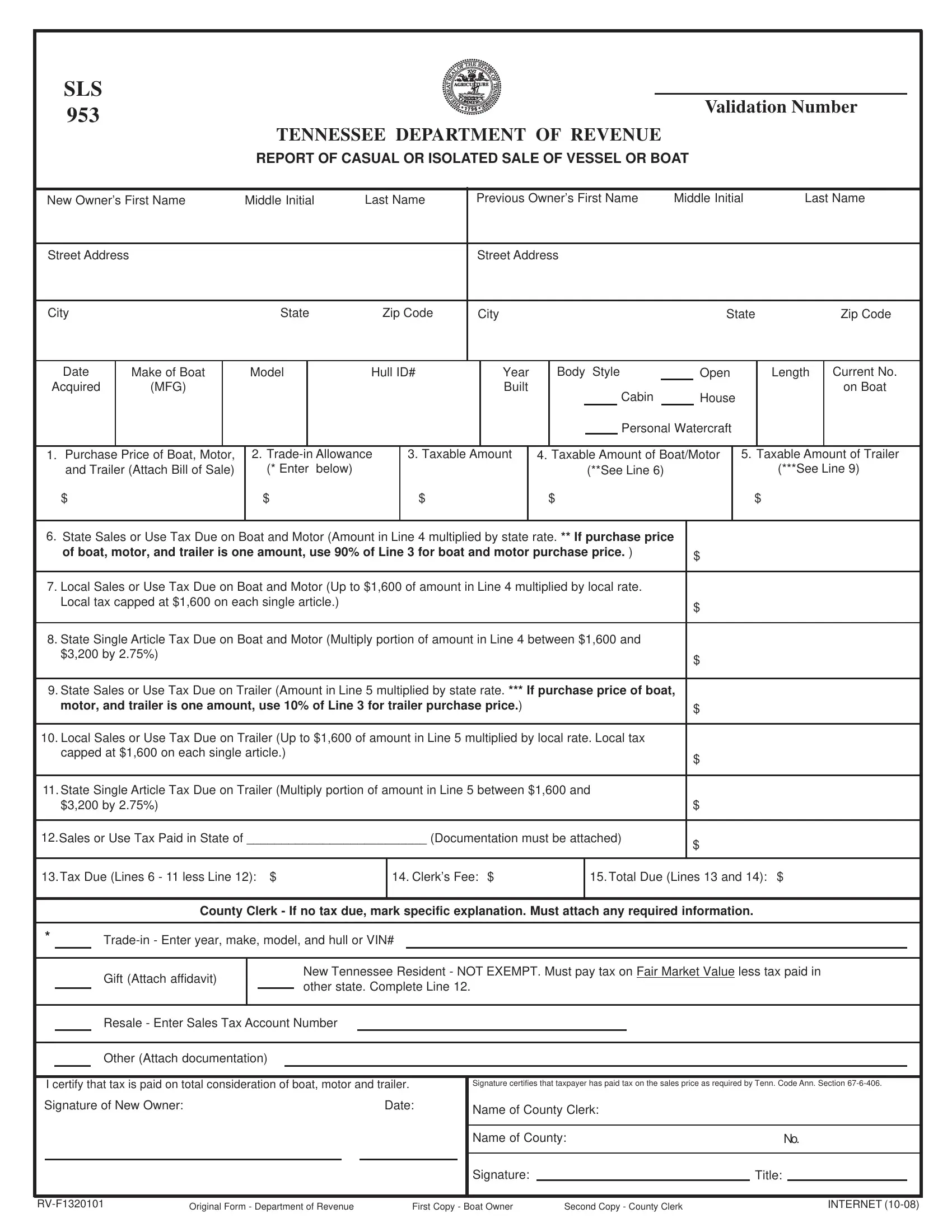

INSTRUCTIONS FOR FORM SLS953 - REPORT OF CASUAL OR ISOLATED SALE OF VESSEL OR BOAT

Note: Information required on this form must be complete. Please print all entries.

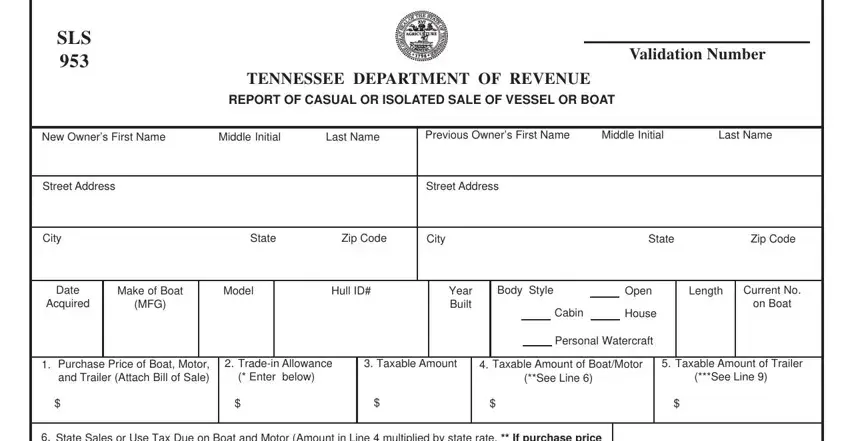

PURCHASER AND SELLER INFORMATION:

(1)Enter the full names of both the purchaser and the seller. In the event of joint registration, enter both registrants’ names.

(2)Enter the street addresses of both the purchaser and the seller. Do not enter post office boxes.

(3)Enter the city, state, and zip codes of both the purchaser and the seller.

BOAT IDENTIFICATION INFORMATION:

Enter the date the purchaser acquired the boat/trailer, the make of boat, the model, the hull identification number, the year built, the body style, the length, and any current number of the boat in the fields provided. This information must be complete and accurate.

TAX CALCULATION:

Item 1: Enter the full purchase price of the three items (boat, motor, and trailer) and attach the bill of sale. If no bill of sale is available, use the N.A.D.A. fair market value of the boat, motor, and trailer. The purchaser may also obtain an appraisal from a reputable boat dealer. Item 2: Enter the documented trade-in-allowance. If the trade-in is not documented, none will be allowed. Please note the trade-in must be identified in the lower portion of this document.

Item 3: Subtract the amount in Item 2 from the amount in Item 1. Enter the amount here.

Item 4: Enter the taxable amount of the boat and motor. If the boat, motor, and trailer had a single purchase price, use 90% of the Item 3 amount.

Item 5: Enter the taxable amount of the trailer. If the boat, motor, and trailer had a single purchase price, use 10% of the Item 3 amount.

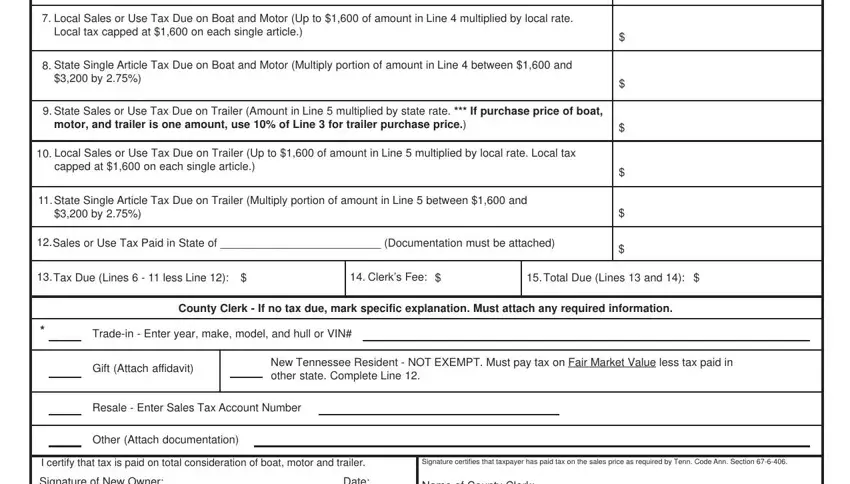

Item 6: Calculate the state sales or use tax on the combined value of the boat and motor, as shown in Item 4.

Item 7: Calculate the local sales or use tax rate on the first $1,600 of the combined value of the boat and motor. Use the local tax rate in effect in the purchaser’s home county.

Item 8: Calculate the state single article tax of 2.75% on any portion of the combined value of the boat and motor beginning with $1,600.01 up to $3,200.

Item 9: Calculate the state sales tax on the value of the trailer, as shown on Line 5.

Item 10: Calculate the local sales or use tax rate on the first $1,600 of the value of the trailer. Use the local tax rate in effect in the purchaser’s home county.

Item 11: Calculate the state single article tax of 2.75% on any portion of the value of the trailer beginning with $1600.01 up to $3200.

Item 12: Enter the amount of sales or use tax paid on the boat, motor, and trailer in the prior state of residence and the name of the state where the tax was paid. Tax paid in another state must be documented.

Item 13: Enter the total tax due. Add Lines 6 – 11 and subtract Line 12.

Item 14: Enter the appropriate clerk’s fee.

Item 15: Enter the total tax and clerk’s fee. This is the amount to be collected from the customer.

COUNTY CLERK INFORMATION:

Trade-in: Completely identify and describe the boat, motor, and trailer for which a trade-in allowance was entered in Item 2.

Gift: Gifts between lineal relatives are exempt from sales and use tax. Gifts between other entities must be completely free of consideration (monetary or tangible), services provided, etc., to be exempt from sales and use tax. Clerks must require an affidavit from the donor (prior owner) affirming that no consideration was given and explaining why the boat, motor, and trailer are being given away. Questionable gifts

may be reviewed by the Department of Revenue, and the owner may be contacted for confirmation.

Important Information on New Tennessee Residents Importing a Boat, Motor, and Trailer: The boat, motor, and trailer are tangible personal property subject to use tax on the fair market value at the time of importation under Tenn. Code Ann. Section 67-6-203. Trailers are included under Tenn. Code Ann Section 67-6-102(6)(C). The fair market value may be established by N.A.D.A. or appraisal by a reputable dealer. One hundred percent of documented sales tax paid to the state of origin may be given in Line 12. Title and registration in the prior state does not establish the basis for giving the credit unless the amount of tax paid is shown. Also, there is no time element of ownership in the other state that will create an exemption from Tennessee use tax.

Resale: A dealer in Tennessee may register a boat on temporary basis for demonstration under a TWRA permit. Enter the sales tax number of the dealer. This cannot be used for registration in other than the business name.

Other: If the transaction or importation does not fall into any of the other categories given, explain here and attach documentation.

Signature of New Owner and County Clerk Information: Please obtain the signature of the new owner and fill in the fields as indicated. Three copies of this form are needed - one for the county clerk, one for the owner, and one copy for the Tennessee Department of Revenue.