When you want to fill out register of wills form 1124, you won't have to download and install any software - simply try using our PDF tool. Our expert team is continuously working to develop the tool and help it become much better for people with its extensive features. Uncover an endlessly revolutionary experience today - check out and uncover new opportunities along the way! For anyone who is seeking to start, here is what it's going to take:

Step 1: Simply hit the "Get Form Button" in the top section of this site to see our pdf editing tool. This way, you will find all that is necessary to fill out your document.

Step 2: After you open the PDF editor, you'll see the form made ready to be completed. In addition to filling in various blank fields, you could also perform other sorts of actions with the file, particularly writing your own words, changing the original textual content, inserting images, placing your signature to the form, and more.

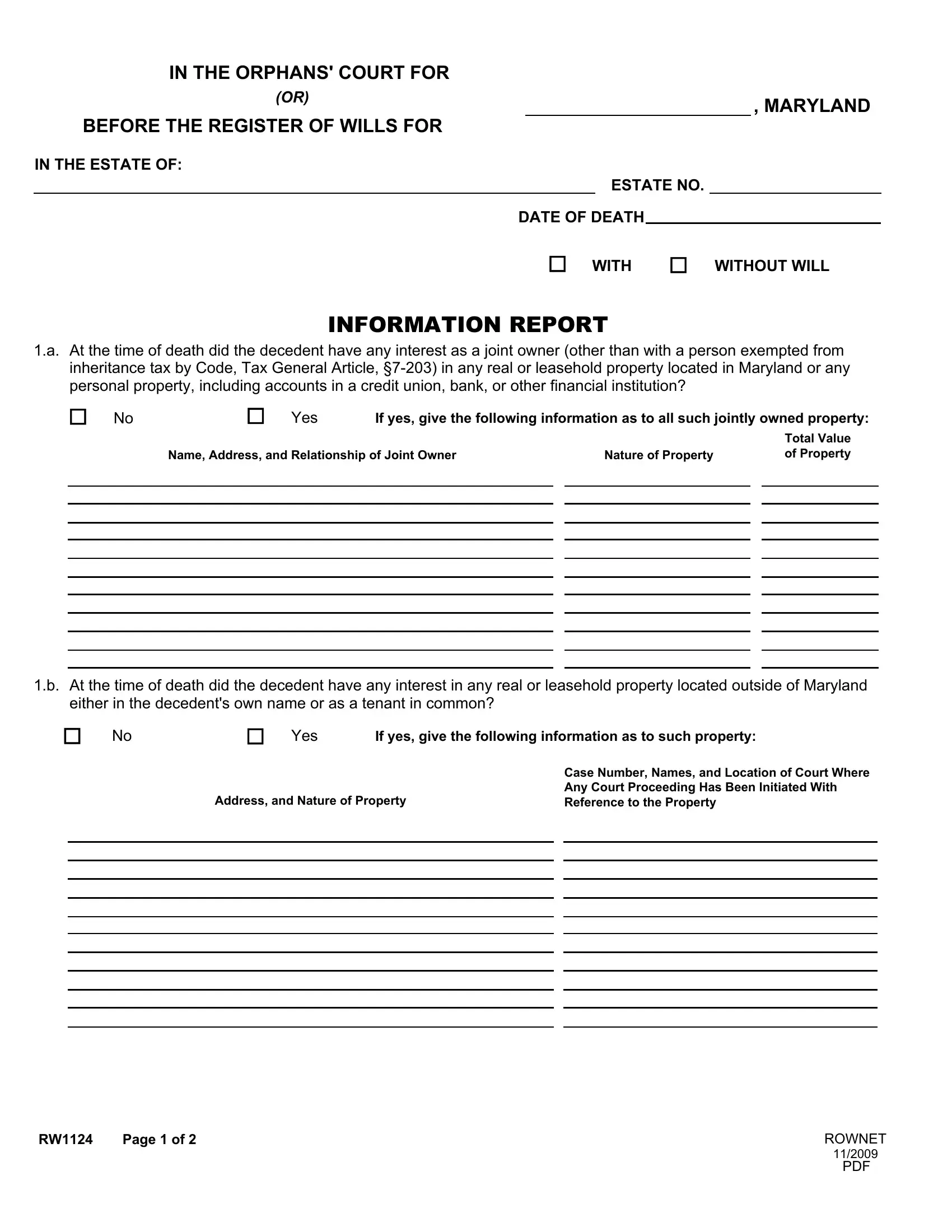

This PDF form requires specific details to be typed in, thus ensure that you take the time to provide what is required:

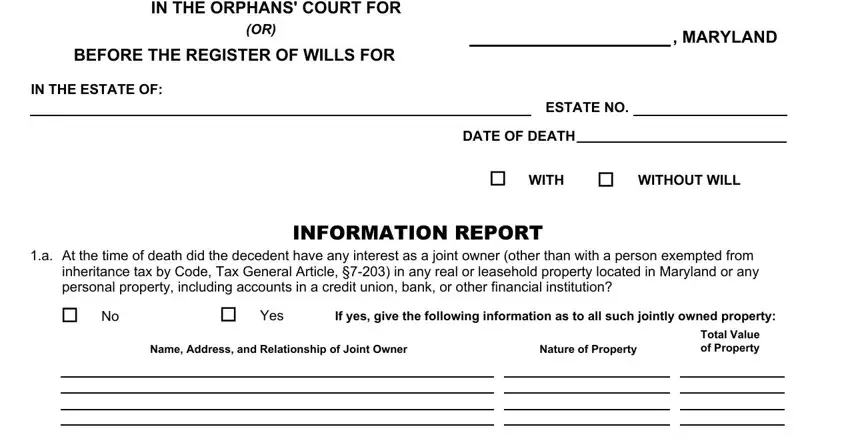

1. Start filling out the register of wills form 1124 with a number of major blanks. Note all the necessary information and make sure there's nothing overlooked!

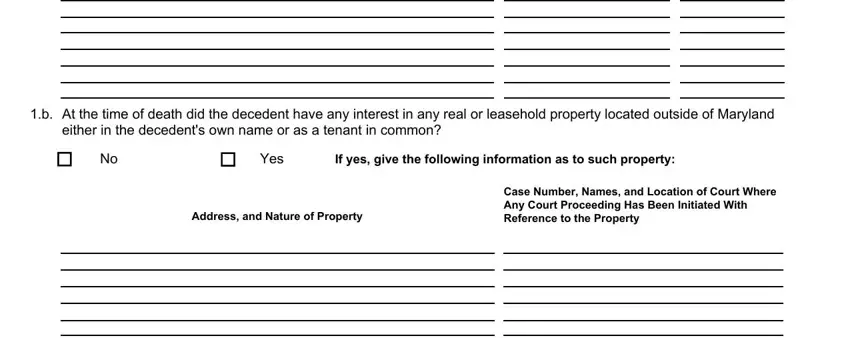

2. Given that this part is finished, it is time to put in the essential details in At the time of death did the, Yes, If yes give the following, Address and Nature of Property, and Case Number Names and Location of allowing you to move forward further.

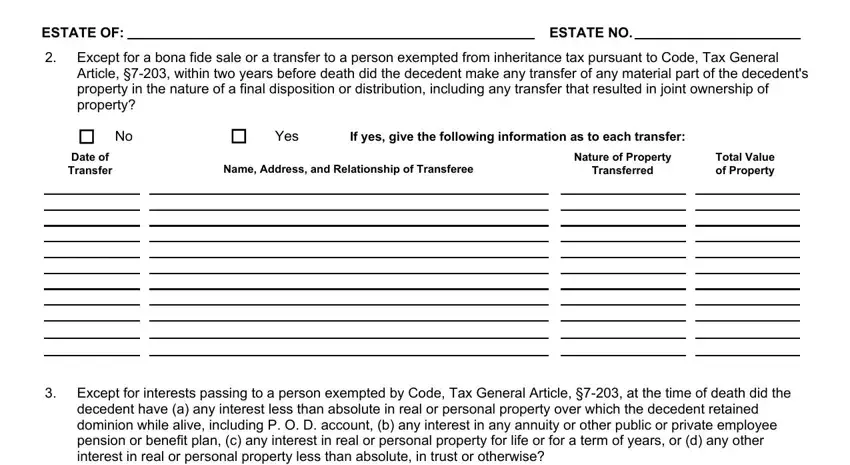

3. The following segment is all about ESTATE OF, ESTATE NO, Except for a bona fide sale or a, Date of Transfer, Yes, If yes give the following, Name Address and Relationship of, Nature of Property, Transferred, Total Value of Property, and Except for interests passing to a - complete these empty form fields.

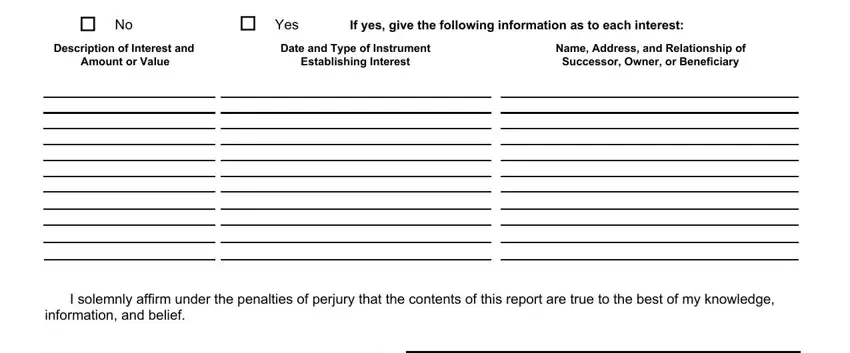

4. It's time to proceed to the next form section! In this case you'll get all of these Yes, If yes give the following, Description of Interest and, Amount or Value, Date and Type of Instrument, Establishing Interest, Name Address and Relationship of, Successor Owner or Beneficiary, I solemnly affirm under the, and information and belief form blanks to fill in.

A lot of people frequently make mistakes when completing information and belief in this section. You should definitely re-examine what you type in here.

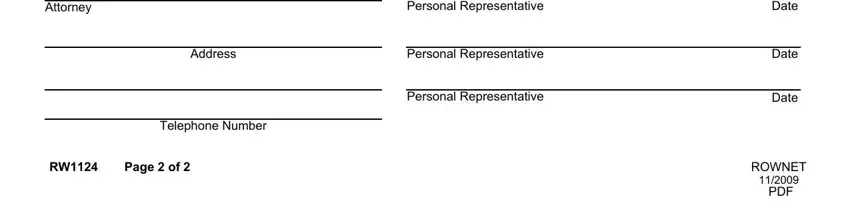

5. To wrap up your document, the particular segment incorporates some extra blanks. Typing in Attorney, Personal Representative, Address, Personal Representative, Personal Representative, Telephone Number, Page of, Date, Date, Date, ROWNET, and PDF will certainly finalize the process and you'll be done in no time at all!

Step 3: Right after you have looked once more at the information in the document, just click "Done" to complete your form at FormsPal. Sign up with FormsPal today and instantly get register of wills form 1124, prepared for downloading. Every last change you make is handily saved , making it possible to customize the form at a later point when required. FormsPal is committed to the personal privacy of all our users; we ensure that all information processed by our editor remains secure.