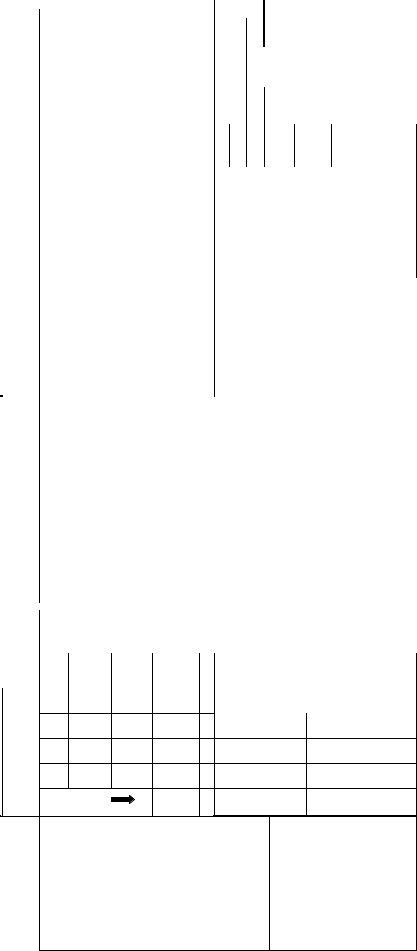

Navigating through the complexities of international trade requires a keen understanding of customs documentation, and at the forefront of this ordeal is the SAD 500 - Customs Declaration Form. This comprehensive document serves as a pivotal conduit for traders, facilitating the legal import and export of goods across borders. It meticulously captures details from the exporter/consignor's information, including office codes and various identification numbers, to particulars about the goods being transported such as commodity codes, descriptions, package types, and weights. Additionally, it delves into financial aspects, outlining currency values, exchange rates, costs, and duty/tax calculations. What sets this form apart is not only its breadth of required data — covering everything from the declaration, importer/consignee information, to intricate logistics of transportation and freight — but also the declaration segment undersigned by the agent, asserting the authenticity and compliance of the provided information with the Customs and Excise Act. As such, the SAD 500 form becomes an indispensable tool for ensuring that all parties involved in the trading process are fully informed and compliant with legal and regulatory obligations, making it a cornerstone of smooth international commerce operations.

| Question | Answer |

|---|---|

| Form Name | Form Sad 500 |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | sad 500 bill of entry, sad500 500 pdf, sad forms, sad form customs |

O |

|

SAD 500 - CUSTOMS DECLARATION FORM |

|

|

|

|

|

|

|

||

1 |

|

1. DECLARATION |

|

A. OFFICE OF DESTINATION OR DEPARTURE |

|||||||

|

|

|

|

|

|||||||

2 |

|

2. EXPORTER/CONSIGNOR |

|

|

|

|

|

OFFICE CODE |

MANIFEST NUMBER |

||

3 |

|

|

TIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

|

|

BSIC |

|

|

|

|

|

|

|

|

6 |

|

|

|

|

3. FORMS |

4. |

REGISTRATION NO. |

ASSESSMENT NO AND DATE |

|||

7 |

|

|

|

|

|

|

|

|

|

|

|

8 |

|

|

|

|

|

|

|

|

|

|

|

9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8. IMPORTER/CONSIGNEE |

|

|

5. ITEMS |

6. |

7. DECLARANT REFERENCE N |

RECEIPT NO. & DATE |

|||

|

|

|

TIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BSIC |

|

|

|

|

|

|

|

|

|

|

|

|

9. 10. |

11. |

12. |

13. |

13A. Invoice No. and Date |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

G |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

E |

14. DECLARANT/AGENT |

|

|

|

|

15. |

16. |

17. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

TIN |

|

|

|

COE |

COO |

COD |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

N |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20. DELIVERY TERMS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

R |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

L |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18. IDENTIFICATION, DATE AND NATIONALITY OF |

19. CONT 22. CURRENCY AND TOTAL VALUE |

23. RATE OF EXCHANGE |

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

TRANSPORT AT ARRIVAL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

S |

|

|

|

|

|

|

|

|

( 0/1 ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

G |

21. IDENTIFICATION, DATE AND NATIONALITY OF |

28. |

|

|

|

|

|

24. OTHER COSTS DETAILS |

|

|

|

|

|

||||||||||||||||

|

M |

|

|

|

|

TRANSPORT AT FRONTIER |

|

|

|

|

|

|

|

|

|

Currency |

|

Amount |

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

N |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FREIGHT |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

T |

25. |

26. |

|

|

|

|

|

27. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TMF |

TMI |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INSURANCE |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

29. |

|

|

|

30. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OOE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER COST |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

31. |

|

|

|

|

|

|

|

|

|

|

|

|

32. ITEM |

33. COMMODITY CODE |

|

|

|

|

|

|||||||||||

PACKAGES |

MARKS AND |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

AND |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

NUMBERS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

DESCRIPTION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

OF GOODS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

34. COC |

|

35. GROSS MASS |

36. PREF- |

|

||||||||||

|

|

NUMBER & |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(KGS) |

|

ERENCE |

|

|||||

|

|

TYPE OF |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

PACKAGES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

37. CPC |

|

38. NET MASS |

39. QUOTA |

T |

||||||||||

|

|

CONTAINER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(KGS) |

|

|

|

|

|

|||

|

|

NUMBERS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

E |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

M |

|

|

DESCRIPTION |

|

|

|

|

|

|

|

|

|

|

40. SUMMARY DECLARATION / PREVIOUS DO |

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

41. SUPP. UNITS |

42. CUSTOMS VALU |

43.V.M |

G |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( FCY ) |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

M |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

44. |

LICENCE NUMBER |

DEDUCTED VALUE |

DEDUCTED QUANTITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

N |

||||||||||||

ADDITIONAL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EX WAREHOUSE CODE |

45. |

|

|

|

|||||||||||

INFORMATION/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

T |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PRODUCED |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DOCUMENTS REMOVAL IN BOND (R.I.B.) & DATE |

|

|

REBATE CODE |

|

|

|

|

|

|

|

|

|

46. STATISTICAL VALUE |

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

47. |

TYPE DUTY/TAX BASE |

RATE |

AMOUNT |

MP 48. ACCOUNT CODE |

|

|

49. IDENTIFICATION OF WAREHOUSE/T |

|

||||||||||||||||||||||

CALCULATIO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIMIT |

|

||

OF DUTIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AND TAXES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SUMMARY OF TOTAL DUTIES AND TAXES |

|

TOTAL DUTIES & TAXES |

|

GUARANTEE AMOUNT |

|

OTHER |

TOTAL |

TOTAL PAYABLE |

DECLARATION |

FOR OFFICIAL USE |

I, |

he undersigned of _______________________ |

|

being the |

(agent) hereby declare that the particulars her |

|

true and correct and comply with the provisions of the Customs and Excise Act. |

||

Signature |

I.D number |

Date |