In an era where the complexities of business operations intertwine with legal frameworks, the South Carolina Department of Revenue's Business Tax Application, denoted as SCTC-111, emerges as a seminal document for entities navigating the taxation landscape. Revised last on June 17, 2003, this form serves as a gateway for businesses to register for various taxes at a state level, ensuring compliance with South Carolina's tax obligations. At its core, the SCTC-111 form facilitates registration for withholding taxes, purchaser's certificates for use tax, and retail sales licenses, necessitating a nuanced understanding of its sections which delineate specific tax registrations and exemptions. The form caters to a broad spectrum of businesses by accommodating diverse classifications of trade, from agriculture to information technology, and mandates detailed disclosures about business operations, ownership types, and anticipated tax liabilities. Moreover, it sets a foundation for responsible tax practice by requiring businesses to attest to the accuracy of the information provided, underpinning the legal principles of transparency and accountability. Given its pivotal role in the state's tax administration, exploring the SCTC-111 form's provisions, implications for businesses, and its function within the wider framework of South Carolina's tax policy unveils the intricate balance between regulatory requirements and business operations.

| Question | Answer |

|---|---|

| Form Name | Form Sctc 111 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | sctc111 sctax 111 e file form |

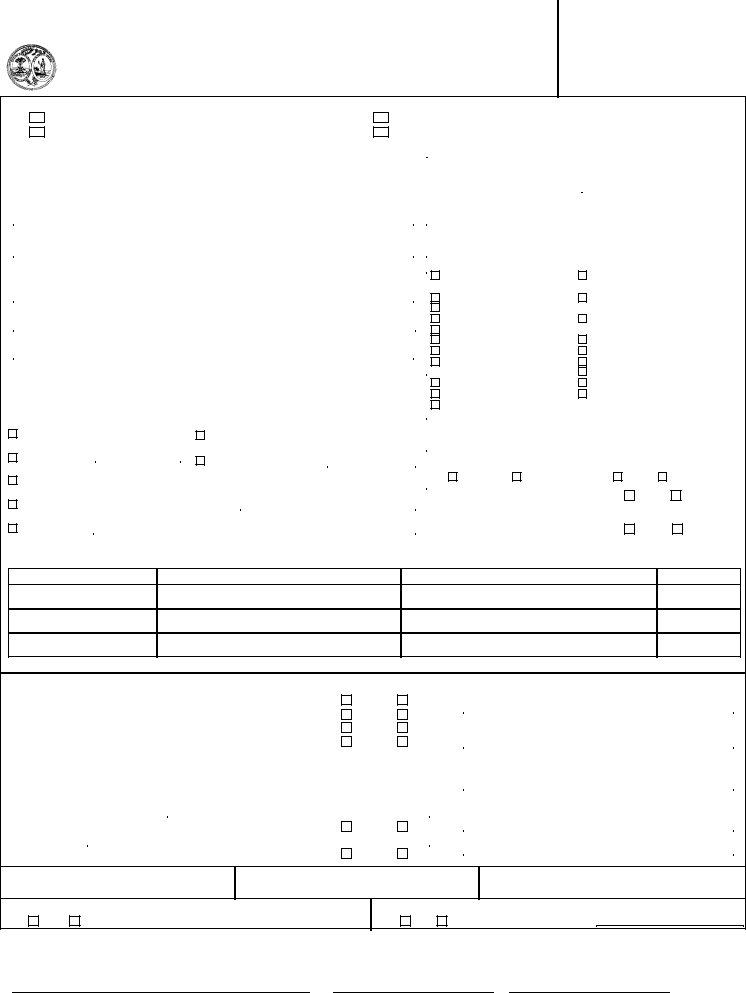

SOUTH CAROLINA DEPARTMENT OF REVENUE |

|

(Rev. 6/17/03) |

BUSINESS TAX APPLICATION |

8011 |

INTERNET REGISTRATION: www.sctax.org |

|

|

|

TELEPHONE (803) |

|

Mail TO: |

|

SC DEPARTMENT OF REVENUE, REGISTRATION UNIT, COLUMBIA, SC |

FOR OFFICE USE ONLY

SID# ___________________

W/H ____________________

SALES __________________

USE ____________________

LICENSE TAX ____________

|

|

|

|

|

|

|

TAXES TO BE REGISTERED FOR THIS BUSINESS LOCATION |

|

|

|

||||||||||

|

|

WITHHOLDING (complete section A) |

|

|

|

SALES (complete section C; $50.00 license tax is required) |

||||||||||||||

|

|

Nonresident Withholding Exemption (complete section B) |

|

PURCHASER'S CERTIFICATE ( complete section D) |

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

COMPLETE BOTH SIDES OF THIS APPLICATION |

|

|

|

|

|

PLEASE PRINT OR TYPE ALL INFORMATION |

||||||||||||

1. |

|

OWNER, PARTNERSHIP, OR CORPORATE CHARTER NAME |

|

|

|

|

2. TRADE NAME (DOING BUSINESS AS) |

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

3. PHYSICAL LOCATION OF BUSINESS REQUIRED (NO P.O. BOX) |

|

|

|

|

4. |

BUSINESS PHONE NUMBER |

|

DAYTIME PHONE NUMBER |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

STREET |

|

|

|

|

|

|

5. |

FEDERAL IDENTIFICATION NUMBER |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

CITY |

COUNTY (REQUIRED) |

STATE |

ZIP |

|

|

|

7. |

TYPE OF BUSINESS |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AGRICULTURE, FORESTRY, FISHING |

PROFESSIONAL, SCIENTIFIC, |

|||||

6. MAILING ADDRESS (FOR ALL CORRESPONDENCE) |

|

|

|

|

||||||||||||||||

|

|

|

|

& HUNTING (11) |

|

|

& TECHNICAL SERVICES (54) |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MINING (21) |

|

|

MANAGEMENT OF COMPANIES |

|||

|

|

|

|

|

IN CARE OF |

|

|

|

|

|

|

|

UTILITIES (22) |

|

|

& ENTERPRISES (55) |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

CONSTRUCTION (23) |

|

|

ADMINISTRATIVE AND SUPPORT, WASTE |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MANUFACTURING (31 |

MANAGEMENT & REMEDIATION SERVICES (56) |

|||||

|

|

|

|

|

STREET |

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

WHOLESALE TRADE |

EDUCATION SERVICES (61) |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RETAIL TRADE |

|

|

HEALTH CARE & SOCIAL ASSISTANCE (62) |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TRANSPORTATION & |

|

|

ARTS, ENTERTAINMENT, & RECREATION (71) |

|||

|

|

CITY |

COUNTY |

|

STATE |

ZIP |

|

|

|

|

|

|||||||||

|

|

|

|

|

|

WAREHOUSE |

|

|

ACCOMMODATION & FOOD SERVICES (72) |

|||||||||||

9. |

LOCATION OF RECORDS (NO P.O. BOX) |

|

|

|

|

|

|

|

INFORMATION (51) |

|

|

OTHER SERVICES (81) |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FINANCE & INSURANCE (52) |

PUBLIC ADMINISTRATION |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REAL ESTATE, RENTAL & LEASING (53) |

|

|

|

|||

10. TYPE OF OWNERSHIP |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

SOLE PROPRIETOR (one owner) |

|

|

|

|

|

|

|

8. MAIN BUSINESS (I.E., RETAIL FURNITURE SALES) |

||||||||||

|

|

PARTNERSHIP (two or more owners, other than LLP) |

|

|

|

|

|

|

|

|||||||||||

|

|

LLC/LLP FILING AS |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

SC CORPORATION DATE INC. |

|

|

|

|

|

8A. |

CHECK IF YOU SELL THESE PRODUCTS (for Solid Waste Purposes): |

||||||||

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

FOREIGN CORPORATION (ATTACH COPY OF ARTICLES OF CERTIFICATE OF AUTHORITY). |

|

|

|

|

MOTOR OIL |

LEAD ACID BATTERIES |

TIRES |

LARGE APPLIANCES |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

UNINCORPORATED ASSOCIATION; ENTER LEGAL NAME |

|

|

|

|

|

|

8B. |

DO YOU SELL AVIATION GASOLINE? |

YES |

NO |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8C. DO YOU PROVIDE SERVICE TO CELLULAR AND PERSONAL |

||||||

|

|

OTHER (EXPLAIN) |

|

|

|

|

|

|

|

|

|

|

|

|

COMMUNICATIONS USERS? |

|

YES |

NO |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11. NAME(S) OF BUSINESS OWNER, GENERAL PARTNERS, OFFICERS OR MEMBERS:

SOCIAL SECURITY NUMBER

NAME/TITLE/GENERAL PARTNERS

HOME ADDRESS

IF PARTNER

PERCENT OWNED

ARE YOU A SC RESIDENT? (Y/N) _______________________ HOW LONG HAVE YOU LIVED IN SC? _________________________ (YEARS, MONTHS)

12. HAVE YOU: |

|

|

|

D. FORMER OWNER'S S.C.E.S.C. ACCOUNT NUMBER: |

|||

A. ACQUIRED ANOTHER BUSINESS? |

YES |

NO |

|

||||

MERGED W ITH ANOTHER BUSINESS? |

YES |

NO |

|

||||

FORMER OWNER'S S.C. TAX ACCOUNT NUMBER: |

|||||||

FORMED A CORPORATION OR PARTNERSHIP |

YES |

NO |

|||||

|

|||||||

MADE ANY OTHER CHANGE IN THE OWNERSHIP? |

YES |

NO |

|

||||

B. DID YOU ACQUIRE: ALL OF THE SOUTH CAROLINA OPERATIONS? |

|

|

|

E. NAME OF BUSINESS ACQUIRED: |

|||

PART OF THE SOUTH CAROLINA OPERATIONS? |

|

|

|

|

|||

PERCENTAGE ACQUIRED: |

|

|

|

|

|||

|

|

|

(Full organization name including trade name) |

||||

|

|

|

|

|

|

ADDRESS OF FORMER OWNER: |

|

C. DATE ACQUIRED OR CHANGED: |

|

|

|

|

|

||

|

YES |

NO |

|

||||

WAS THE BUSINESS OPERATING AT THE TIME OF ACQUISITION OR CHANGE? |

|

||||||

DATE CLOSED: |

|

|

|

|

|

||

DOES THE FORMER OWNER OR LEGAL ENTITY CONTINUE TO HAVE EMPLOYEE? |

YES |

NO |

|

||||

|

|||||||

13.FIRST DATE OF EMPLOYMENT IN S.C. mo/day/year

14.ANTICIPATED DATE OF FIRST S.C.PAYROLL mo/day/year

15. ESTIMATE NUMBER OF EMPLOYEES IN S.C.

16. IS BUSINESS WITHIN SC MUNICIPAL LIMITS?

YES |

NO |

WHICH CITY? ________________________ |

17.IS YOUR BUSINESS SEASONAL?

YES |

NO IF YES, LIST MONTHS ACTIVE. |

COMPLETE REVERSE SIDE OF THIS FORM

I CERTIFY THAT ALL INFORMATION ON THIS APPLICATION, INCLUDING ANY ATTACHMENTS, IS TRUE AND CORRECT TO THE BEST OF MY KNOWLEDGE

SIGNATURE OF OWNER, ALL PARTNERS, OR CORPORATE OFFICER |

TITLE |

DATE |

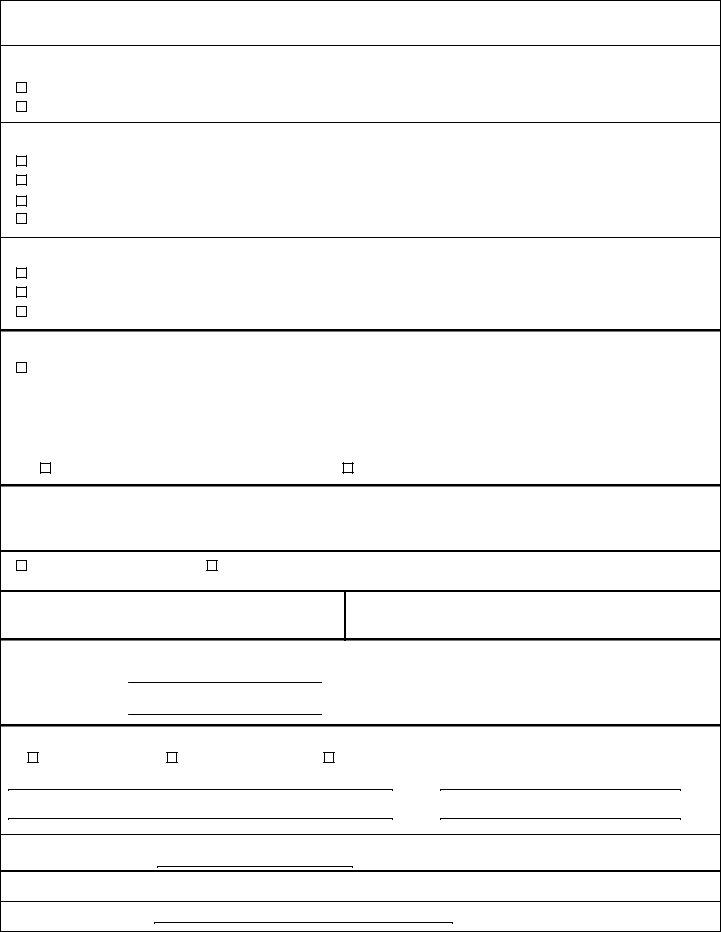

SECTION A: TO APPLY FOR WITHHOLDING NUMBER Every employer having employees earning wages in SC must register for withholding. Other types of payments also require state tax withholding.

STATUS OF EMPLOYER (CHECK ONE):

RESIDENT - Principal place of activity inside SC

NONRESIDENT - Principal place of activity outside SC

CLASSIFICATION OF RESIDENT EMPLOYER (CHECK ONE):

01 Tax withheld from sources that do not require withholding (Ex.: Domestic Help, Farmers, Fishermen)

02 FEDERAL withholding (941 total) does not exceed $2,500.00 per quarter

03 FEDERAL withholding (941 total) is less than $50,000 during

CLASSIFICATION OF NONRESIDENT EMPLOYER (CHECK ONE):

01 Tax withheld from sources that do not require withholding (Ex.: Domestic Help, Farmers, Fishermen)

05 SC State withholding is less than $500 per quarter 06 SC State withholding Totals $500 or more per quarter

SECTION B: EXEMPTION FROM WITHHOLDING ON NONRESIDENTS

Check the appropriate block to administratively register with the Department and claim exemption from nonresident withholding required by SC Code Sections

See instructions for further information.

I agree to file SC tax return

I am not subject to SC Tax Jurisdiction (no NEXUS)

SECTION C: TO APPLY FOR RETAIL SALES LICENSE ($50.00 LICENSE TAX IS REQUIRED.)

In and

If applying for Retail License, a $50.00 Sales License Tax is required with this application.

ANTICIPATED DATE OF FIRST SALES mo/da/yr

HOW MANY RETAIL SALES LOCATIONS DO YOU OPERATE IN S.C. UNDER YOUR OWNERSHIP?

SECTION D: TO APPLY FOR PURCHASER'S CERTIFICATE OF REGISTRATION FOR USE TAX S. C. Use Tax is imposed on the storage, use, or consumption of tangible personal property on which S.C. sales tax has not been previously paid.

SECTION E: If mailing address for returns is different from front of application indicate type of tax this applies to.

SALES |

WITHHOLDING |

PURCHASERS CERTIFICATE

STREET OR BOX

CITY |

STATE |

ZIP |

IN CARE OF

PHONE

IF CURRENTLY OR PREVIOUSLY REGISTERED WITH SC DEPARTMENT OF REVENUE UNDER THIS OWNERSHIP, INDICATE ACCOUNT NUMBER(S) IN THIS SPACE

NAME OF BANKING INSTITUTION USED

Enter

UPON COMPLETION OF BOTH SIDES, SIGN AND DATE ON FRONT OF APPLICATION.

MAIL TO: SC DEPARTMENT OF REVENUE, REGISTRATION UNIT, COLUMBIA, SOUTH CAROLINA