Form SSA-1560 (04-2021) |

|

Discontinue Prior Editions |

Page 1 of 5 |

Social Security Administration |

OMB No. 0960-0104 |

INSTRUCTIONS FOR USING THIS PETITION

Any appointed representative who wants to charge and collect a fee for services in connection with a claim before the Social Security Administration (SSA) is required by law to first obtain SSA's authorization of the fee. The only exceptions are:

(1)when a third party entity (i.e. a business, firm, or government agency) will pay the fee and any expenses from its own funds and the claimant and any auxiliary beneficiaries incur no liability, directly or indirectly;

(2)when a court has awarded a fee for services provided in connection with proceedings before SSA to a legal guardian, committee, or similar court-appointed office; or

(3)when representational services were provided before a court. A representative who has provided services in a claim before both SSA and a court of law may seek a fee from either or both, but neither has the authority to set a fee for the other [42 U.S.C. 406(a) and (b)].

It is important to fill in all of the applicable boxes on the SSA-1560-U4, including the claimant's social security number and the Representative Identification Number (Rep ID). SSA issues a Rep ID if the representative has registered with SSA. For more information on representative registration visit www.socialsecurity.gov/ar, call 1-800-772-1213 (TTY 1-800-325-0778) or contact a local Social Security office.

When to File a Fee Petition

The representative should request a fee using this form only after completing all services on a claim(s). The representative has the option to either petition before or after SSA makes the determination(s). In order to obtain direct payment of all or part of an authorized fee from withheld Title II and/or Title XVI past-due benefits, the representative who is eligible for direct payment should file the petition, or a written notice of the intent to petition, within 60 days of the date of the favorable determination or decision notice.

Where to File a Fee Petition

•If a court or the Appeals Council issued the case decision, send the petition to the Office of Analystics, Review, and Oversight: Attorney Fee Branch, 5107 Leesburg Pike, Suite 601, Falls Chuch VA 22041-3255.

•If an Administrative Law Judge issued the case decision, send the petition to him or her using the hearing office address listed in the decision.

•In all other cases, send the petition to the reviewing office address, which appears at the top right of the notice of award or notice of disapproved claim.

If the claimant has questions or disagrees with the fee requested or any information shown, he or she should contact SSA within 20 days from the date of this request. The claimant may call or visit the local Social Security office or write to the office that took the last action in the case.

The claimant may also file questions or disagreements about fee petition decision at the same locations.

Evaluation of a Petition for a Fee

SSA determines a reasonable fee for the services provided on a claim, considering the purpose of the Social Security program and/or Supplemental Security Income program and

(1)the extent and type of services the representative performed;

(2)the complexity of the case;

(3)the level of skill and competence required of the representative in giving the services;

(4)the amount of time the representative spent on the case;

(5)results the representative achieved;

(6)the levels of review to which the representative took the claim and at which level he or she became the representative; and

(7)the amount of fee requested for services provided, including any amount authorized or requested before but excluding any amount of expenses incurred

Form SSA-1560 (04-2021) |

Page 2 of 5 |

|

|

SSA also considers the amount of benefits payable, if any, but authorizes the fee amount based on consideration of all the factors listed above. The amount of benefits payable in a claim is determined by specific rules unrelated to the representative's efforts. In addition, the amount of past-due benefits may depend on the length of time that has elapsed since the claimant's effective date of entitlement.

What happens Next

Once SSA determines a reasonable fee for the representative's work on the claim or pending matter, SSA will send both the representative and the claimant a written notice showing the authorized fee amount the representative may charge.

Administrative Review

If the claimant or the representative disagrees with the amount SSA authorized, he or she must send a request in writing, explaining the reason(s) for disagreement. The request should be sent to the SSA office address shown on the "Authorization to Charge and Collect a Fee" or to any SSA office within 30 days on the date of the notice.

Collection of the Fee

The claimant is liable for any fee authorized. However, SSA will pay all or part of the authorized fee directly to a representative eligible to receive direct payment, if the determination or decision results in past-due Title II or Title XVI benefits. In these cases, SSA generally withholds up to 25 percent of the past-due benefits. This statement does not mean that SSA will authorize as a reasonable fee 25 percent of the past-due benefits. If the representative is eligible to receive direct payment of the authorized fee from the past-due benefits, SSA will pay the smallest of the following directly to the representative from the claimant's withheld funds:

•25 percent of the total past-due benefits payable to the claimant and any auxiliaries as a result of the claim; or

•The fee amount authorized

If the authorized fee is more than the amount of the withheld benefits, collection of the difference is a matter between the representative and the claimant. SSA will not pay a fee from withheld past-due benefits when the authorized fee is for a representative whom the claimant discharged or who withdrew from the case.

The amount payable to the representative from the withheld benefits is subject to the assessment required by Sections 206 (d) and 1631 (d) (2) (C) of the Social Security Act, and it is also subject to offset by any fee payment(s) the representative has received or expects to receive from an escrow or trust account.

For the Claimant's Protection

Until the claimant receives notice that SSA has authorized a fee, he or she should not pay the representative unless the payment is held in an escrow or trust account. If the claimant is charged or pays any money after he or she receives a copy of this petition but before he or she receives notice from SSA of the authorized fee amount the representative may charge, he or she must report this fact to SSA immediately.

Penalty for Charging or Collecting an Unauthorized Fee

Any individual who charges, demands, receives, or collects a fee in excess amount authorized for services provided before SSA may be subject to administrative sanctions or criminal prosecution, or both. If convicted, the individual will be punished for each offense by a fine not exceeding $500, imprisonment for not more than one year, or both.

Form SSA-1560 (04-2021) |

Page 3 of 5 |

|

|

Privacy Act Statement

Collection and Use of Personal Information

Sections 206 and 1631(d) of the Social Security Act, as amended, allow us to collect this information. Furnishing us this information is voluntary. However, failing to provide all or part of the information may prevent us from authorizing a reasonable fee for services before the Social Security Administration after the decision on a claim.

We will use the information you provide to process your fee petition request. We may also share the information for the following purposes, called routine uses:

•To contractors and other Federal agencies, as necessary, to assist us in efficiently administering our programs; and

•To the Internal Revenue Service and to State and local government tax agencies in response to inquiries regarding receipt of fees we paid directly above $600.

In addition, we may share this information in accordance with the Privacy Act and other Federal laws. For example, where authorized, we may use and disclose this information in computer matching programs, in which our records are compared with other records to establish or verify a person’s eligibility for Federal benefit programs and for repayment of incorrect or delinquent debts under these programs.

A list of additional routine uses is available in our Privacy Act System of Records Notice (SORN) 60-0325, entitled Appointed Representative File, as published in the Federal Register (FR) on October 8, 2009, at 74 FR 51940. Additional information, and a full listing of all of our SORNs, is available on our website at www.ssa.gov/privacy.

Paperwork Reduction Act Statement - This information collection meets the requirements of 44 U.S.C. § 3507, as amended by section 2 of the Paperwork Reduction Act of 1995. You do not need to answer these questions unless we display a valid Office of Management and Budget control number. We estimate that it will take about 60 minutes to read the instructions, gather the facts, and answer the questions. SEND OR BRING THE COMPLETED FORM TO YOUR LOCAL SOCIAL SECURITY OFFICE. You can find your local Social Security office through SSA’s website at www.socialsecurity.gov. Offices are also listed under U. S. Government agencies in your telephone directory or you may call Social Security at 1-800-772-1213 (TTY

1-800-325-0778). You may send comments regarding this burden estimate or any other aspect of this collection, including

suggestions for reducing this burden to: SSA, 6401 Security Blvd, Baltimore, MD 21235-6401. Send only comments relating to

our time estimate to this address, not the completed form.

References

Social Security Act Sec. 206 [42 U.S.C. 406 (a) and (b) and 1631]

20CFR §§ 404.1720 - 404.1730, and §§416.1520 - 416.1530

Form SSA-1560 (04-2021) |

Page 4 of 5 |

|

|

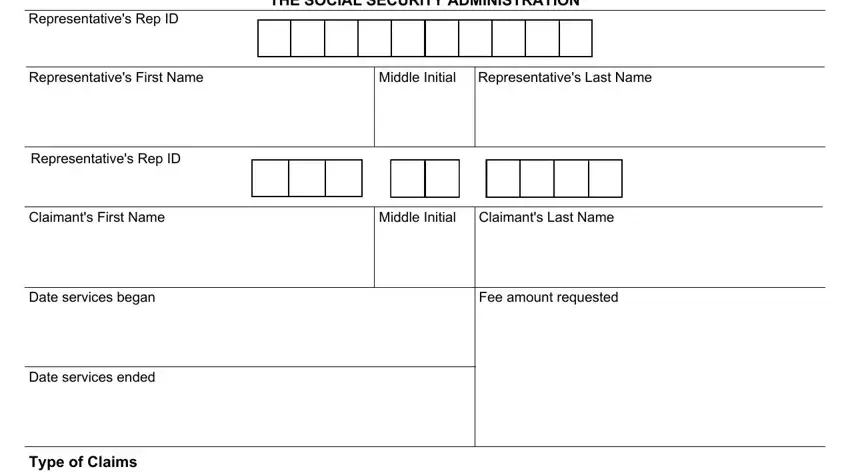

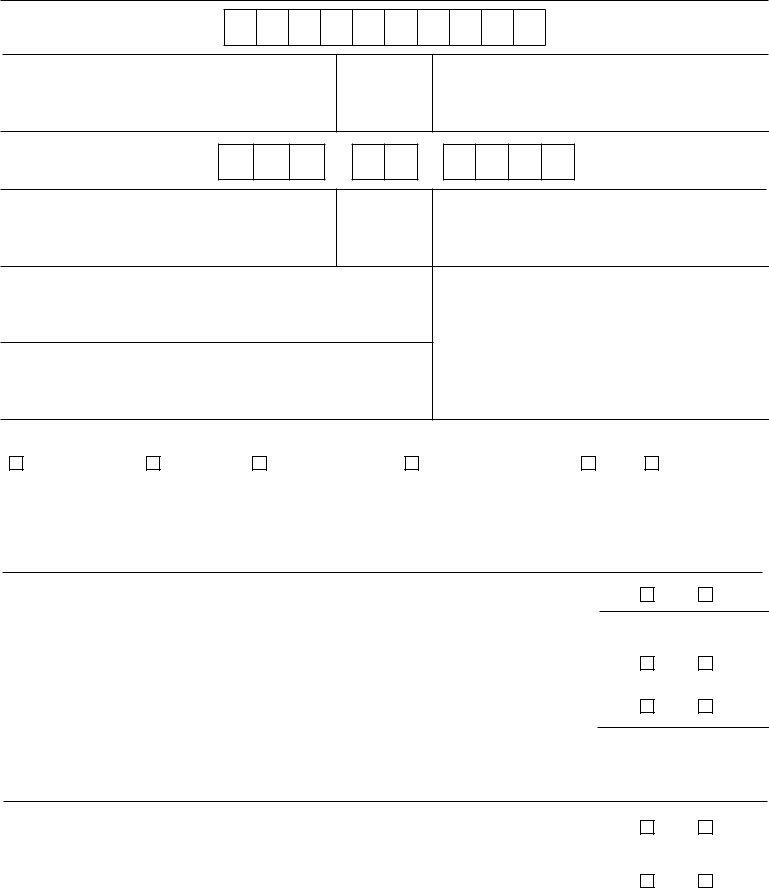

PETITION FOR AUTHORIZATION TO CHARGE AND COLLECT A FEE FOR SERVICES BEFORE

THE SOCIAL SECURITY ADMINISTRATION

Representative's Rep ID

Representative's First Name

Representative's Last Name

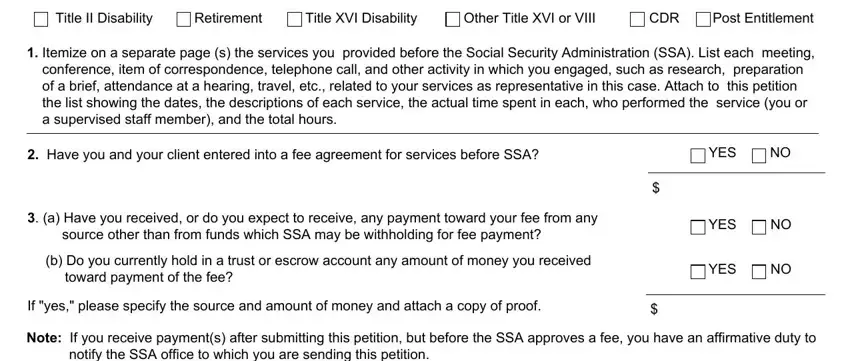

Type of Claims

Title II Disability

1.Itemize on a separate page (s) the services you provided before the Social Security Administration (SSA). List each meeting, conference, item of correspondence, telephone call, and other activity in which you engaged, such as research, preparation of a brief, attendance at a hearing, travel, etc., related to your services as representative in this case. Attach to this petition the list showing the dates, the descriptions of each service, the actual time spent in each, who performed the service (you or a supervised staff member), and the total hours.

2. Have you and your client entered into a fee agreement for services before SSA? |

YES |

NO |

$

3. (a) Have you received, or do you expect to receive, any payment toward your fee from any source other than from funds which SSA may be withholding for fee payment?

(b)Do you currently hold in a trust or escrow account any amount of money you received toward payment of the fee?

If "yes," please specify the source and amount of money and attach a copy of proof. |

$ |

|

Note: If you receive payment(s) after submitting this petition, but before the SSA approves a fee, you have an affirmative duty to notify the SSA office to which you are sending this petition.

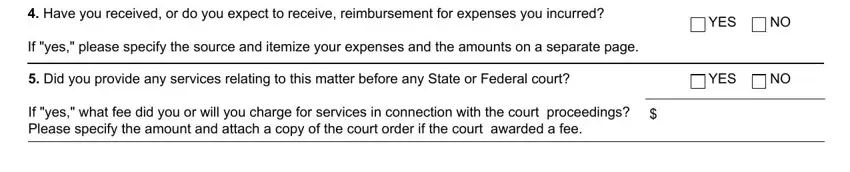

4. Have you received, or do you expect to receive, reimbursement for expenses you incurred? |

YES |

NO |

|

If "yes," please specify the source and itemize your expenses and the amounts on a separate page. |

|

|

|

|

|

|

|

5. Did you provide any services relating to this matter before any State or Federal court? |

YES |

NO |

If "yes," what fee did you or will you charge for services in connection with the court proceedings? |

|

|

|

$ |

|

|

Please specify the amount and attach a copy of the court order if the court awarded a fee. |

|

|

|

|

|

|

|

Form SSA-1560 (04-2021) |

Page 5 of 5 |

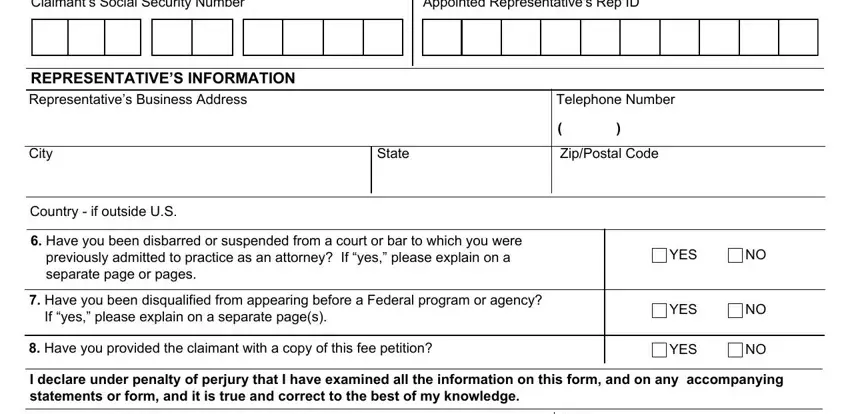

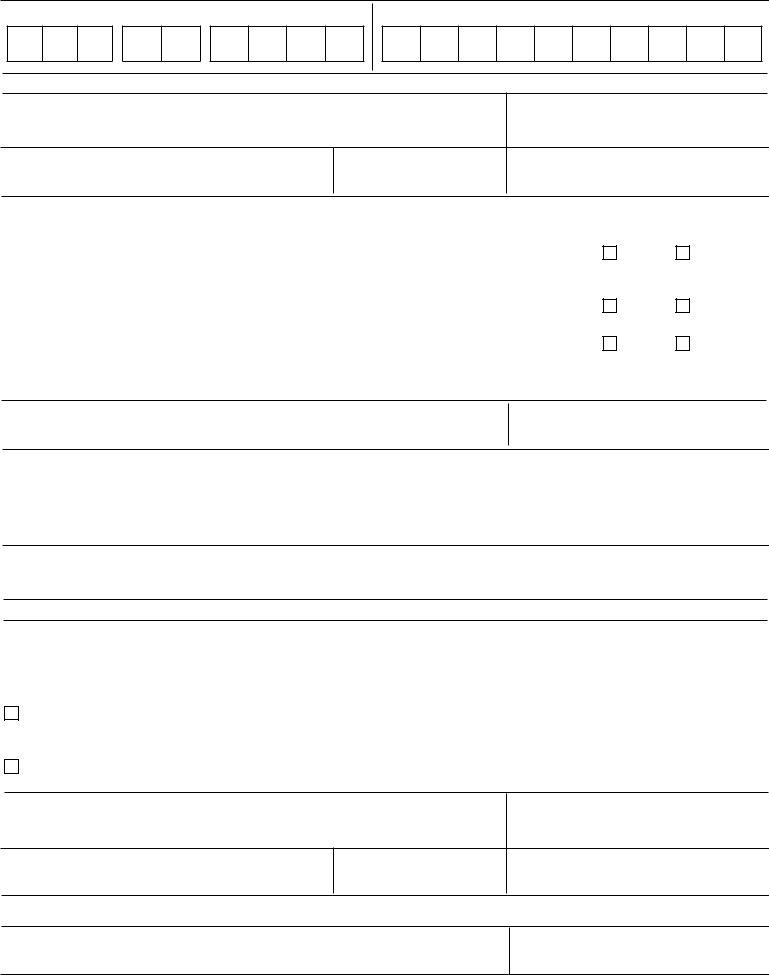

Claimant’s Social Security Number

Appointed Representative's Rep ID

REPRESENTATIVE’S INFORMATION

Representative’s Business Address

Country - if outside U.S.

|

6. Have you been disbarred or suspended from a court or bar to which you were |

|

|

|

|

previously admitted to practice as an attorney? If “yes,” please explain on a |

YES |

NO |

|

separate page or pages. |

|

|

|

|

|

|

|

|

|

7. Have you been disqualified from appearing before a Federal program or agency? |

YES |

NO |

|

If “yes,” please explain on a separate page(s). |

|

|

|

|

|

|

|

|

|

|

8. Have you provided the claimant with a copy of this fee petition? |

YES |

NO |

|

|

|

|

|

|

|

|

|

|

I declare under penalty of perjury that I have examined all the information on this form, and on any accompanying statements or form, and it is true and correct to the best of my knowledge.

Representative's Signature

Organization's Name (If you performed the services before SSA and you are affiliated with the business, entity, firm or organization on your 1699, enter the full name here.)

[Note: The following is optional. However, SSA can consider your fee petition more promptly if your client knows and already agrees with the amount you are requesting.]

CLAIMANT’S STATEMENT

I understand that I do not have to sign this petition or request. It is my right to disagree with the amount of the fee requested or any information given, and to ask more questions about the information given in this request (as explained in the instructions). I have marked my choice below

I agree with the fee, which my representative is asking to charge and collect. However, I understand that I retain the right to contest this fee at a later time if I decide I no longer agree with this fee agreement.

I do not agree with the requested fee or other information given here, or I need more time. I understand I must call, visit, or write to SSA within 20 days if I have questions or if I disagree with the fee requested or any information shown (as explained in the instructions).

Claimant’s Business Address

Country - if outside U.S.

Claimant's Signature