Are you a homeowner in the Province of Ontario? If so, you may be eligible for the Homeowners’ Grant. The grant helps reduce the amount of property taxes homeowners pay each year. In this blog post, we will discuss how to apply for the Homeowners’ Grant and what kind of documentation you will need to provide. We hope this information is helpful and encourages you to apply for the grant if you are eligible. Have a great day!

| Question | Answer |

|---|---|

| Form Name | Form St 104 Hm |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | subdivisions, reimbursement, Idaho, MasterCards |

Idaho State Tax Commission |

||

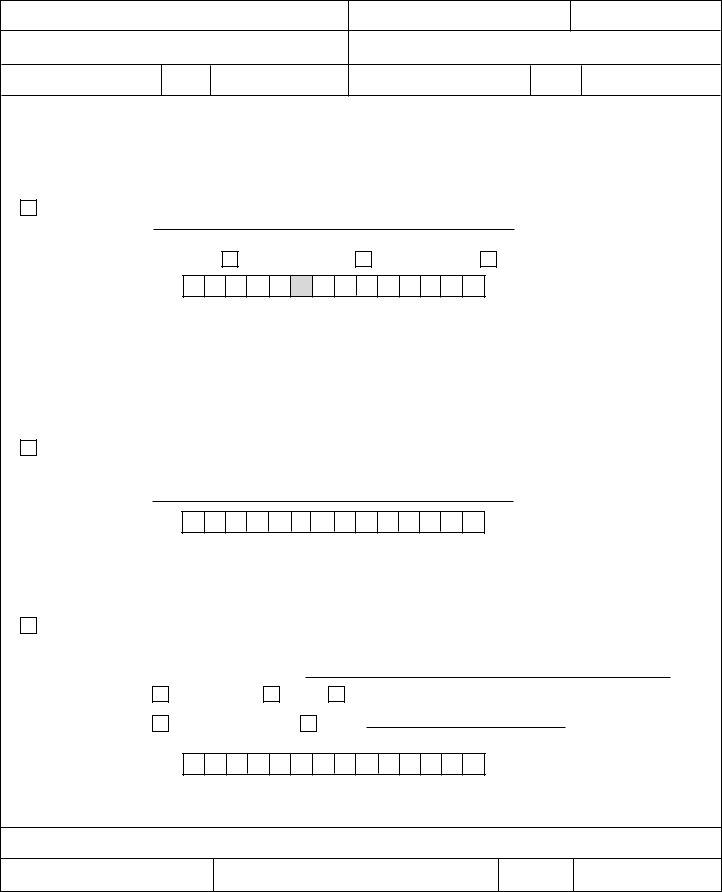

SALES TAX EXEMPTION ON LODGING ACCOMMODATIONS |

||

TC00140 |

||

Claimed by Employees Using A Qualifying Credit Card Payment |

||

|

Hotel/Motel/Campground Name (Seller)

Guest (Name)

Driver's license/Social Security Number

Address

Address

City

State

Zip Code

City

State

Zip Code

This exemption does not apply if you pay charges from your own personal funds or from expense reimbursements. To qualify, the credit card company must directly bill your employer.

I am an employee of an:

U.S. Government Agency

Name of Agency:

Qualifying type of card: |

Purchase Card |

Fleet Card |

Credit Card Number:

Travel Card

•

•

•

•

Purchase cards will be either VISA (beginning with 4486 or 4716) or MasterCard (beginning with 5568).

Fleet cards will be either Voyager (beginning with 8699) or MasterCard (beginning with 5568).

Travel cards will be either VISA (beginning with 4486) or MasterCard (beginning with 5568). Travel cards with the sixth digit of 6, 7, 8, 9, or 0 are billed directly to the government agency and qualify for exemption.

Charges to travel cards with the sixth digit of 1,2, 3, or 4 are billed directly to the employee, do not qualify for the tax exemption, and are subject

to tax.

Idaho State Government Agency

(State schools are included as nonprofit schools under Other Qualified Organizations.)

Name of Agency:

Credit Card Number:

•Qualifying cards are MasterCards issued by Wells Fargo Bank. They include the name of the agency and usually the name of a state employee.

The card is specifically marked "Tax Exempt." Other cards such as Diners Club, which include the state agency and an employee name, are billed directly to the employee and do not qualify for exemption.

Idaho Local Government Agency or Other Qualified Organization*

*(See the back of this form for qualified organizations.)

Name of Agency or Qualified Organization:

MasterCard Visa

Type of Card:

Diner's Club

Credit Card Number:

American Express

Other

(Name of Card)

I certify that all statements I have made on this form are true and correct to the best of my knowledge. I understand that falsification of this certificate for the purpose of evading payment of tax is a misdemeanor. Other penalties may also apply.

Signature of Guest

Work Address

Date

Work Phone Number

•This form may be reproduced.

•This form is valid only if all information is complete.

•The seller must retain this form.

Instructions For Idaho Form

Sales Tax Exemption On Lodging Accommodations

016. EXEMPTIONS (Rule 016).

02.Exempt Entities. Rooms or campground spaces furnished to governmental entities, educational institutions, or hospitals are exempt from the taxes if and only if the charge for the room or campground space occupancy is billed directly to and paid directly by the governmental entity, educational institution, or hospital.

d.“Billed directly to” means a contractual agreement between the facility operator and the governmental entity, educational institution, or hospital whereby the charge for the room or campground space is directed to and is the responsibility of the governmental agency or institution. “Billed directly to” also includes credit card charges billed to an account opened by an exempt agency, educational institution, or hospital.

e.“Paid directly by” means a remittance tendered directly by the governmental entity, educational institution, or hospital to the facility operator. It does not include a payment by the governmental entity or institution to an employee or agent for reimbursement of expenses incurred during business travel. However, “paid directly by” does include payments made by an exempt entity to a financial institution for credit card charges made on a charge account in the name of the exempt entity with a credit card issued to the entity itself and not to any individual or employee.

f.Credit cards issued to employees of governmental agencies are NOT considered to be billed directly to and paid directly by the governmental entity when the employee is responsible for making payment to the credit card company.

QUALIFIED ORGANIZATIONS

American Indian Tribes - Tribal entity only, sales made to tribal members off the reservation do not qualify.

American Red Cross

Amtrak

Centers for Independent Living - Only non residential centers run by disabled persons that provide inde- pendent living programs to people with various disabilities qualify.

Emergency Medical Service Agency

Forest Protective Association

Idaho Community Action Agency

Idaho Food Bank Warehouse, Inc.

Nonprofit Canal Company

Nonprofit Hospital

Nonprofit Schools - Only nonprofit colleges, universi- ties, primary and secondary schools qualify. Schools primarily teaching subjects like business, dancing, dramatics, music, cosmetology, writing and gymnastics do not qualify. Auxiliary organizations, such as

Senior Citizen Center

State/Federal Credit Union

Volunteer Fire Department

Qualified Health Organization - Only these qualify: American Cancer Society

American Diabetes Association American Heart Association Arthritis Foundation

The Arc, Inc.

Children's Home Society of Idaho Easter Seals

Family Services Alliance of SE Idaho Idaho Cystic Fibrosis Foundation Idaho Diabetes Youth Programs Idaho Epilepsy League

Idaho Lung Association

Idaho Primary Care Association and its Community Health Centers

Idaho Ronald McDonald House

Idaho Women's and Children's Alliance March of Dimes

Mental Health Association Muscular Dystrophy Foundation National Multiple Sclerosis Society Rocky Mountain Kidney Association Special Olympics Idaho

United Cerebral Palsy

Government - Only the federal government and Idaho State, county or city government qualify. Sales to other states and their political subdivisions are taxable.