It shouldn’t be a challenge to get nys tax exempt form st 120 with the help of our PDF editor. This is the way you may rapidly prepare your template.

Step 1: Hit the orange button "Get Form Here" on this web page.

Step 2: As you get into our nys tax exempt form st 120 editing page, you will notice lots of the options it is possible to take about your template within the top menu.

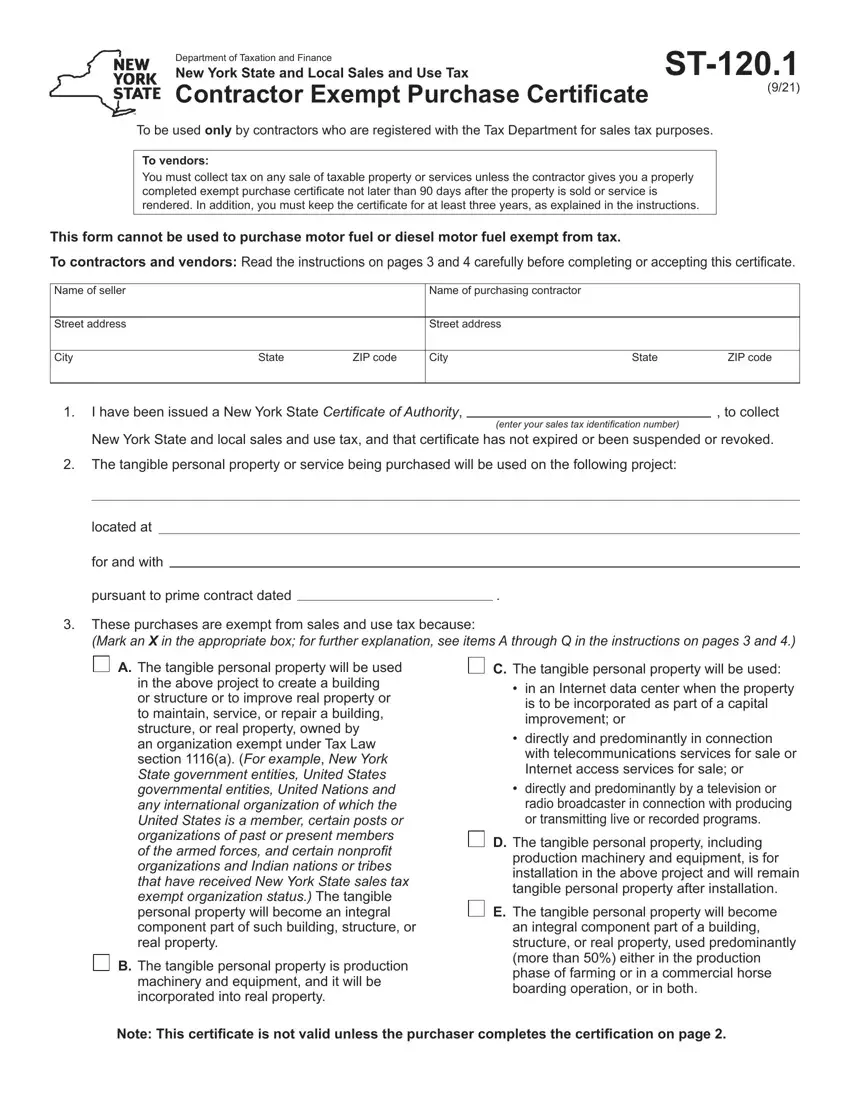

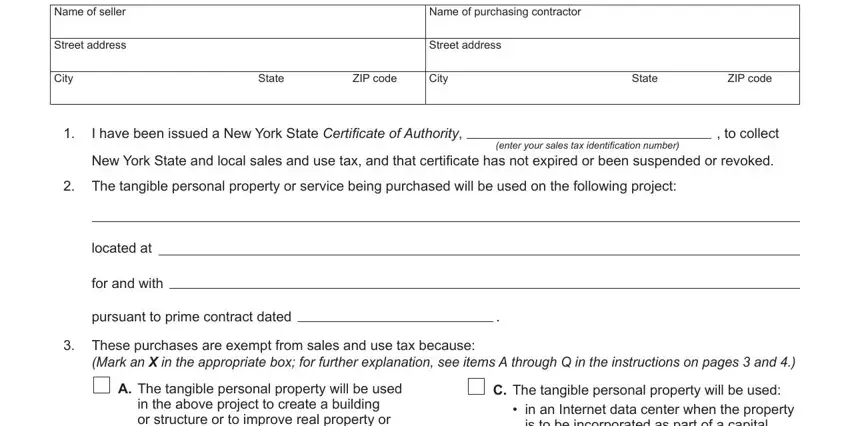

You will have to enter the next details if you would like fill in the template:

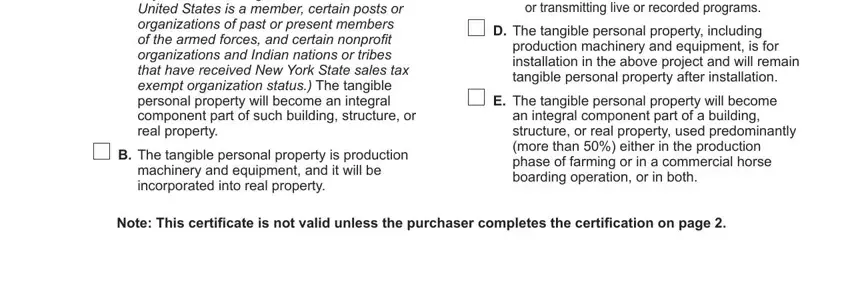

Write down the essential details in the space A The tangible personal property, B The tangible personal property, radio broadcaster in connection, D The tangible personal property, production machinery and equipment, E The tangible personal property, and Note This certificate is not valid.

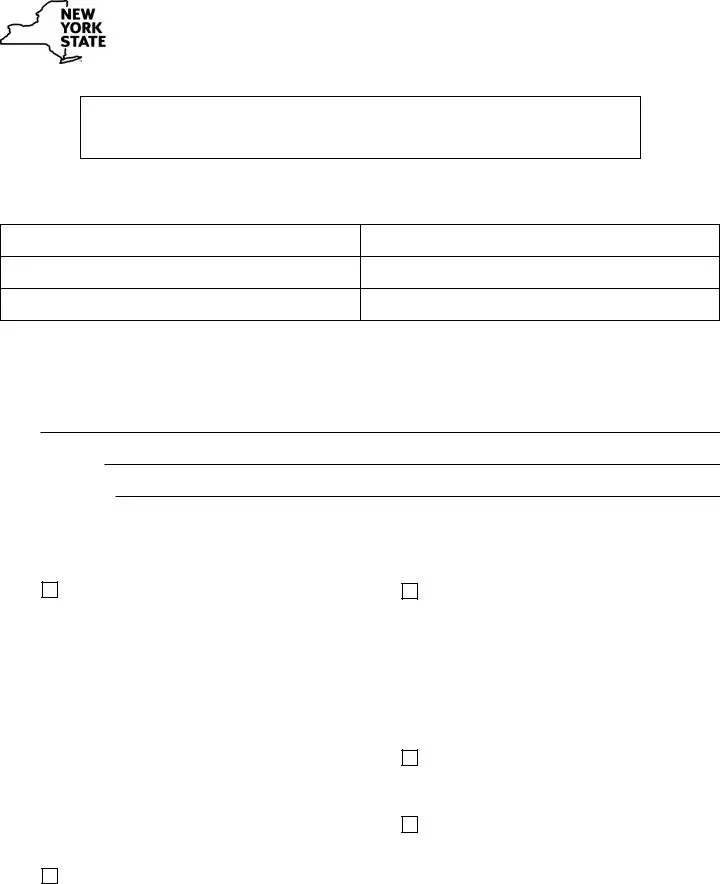

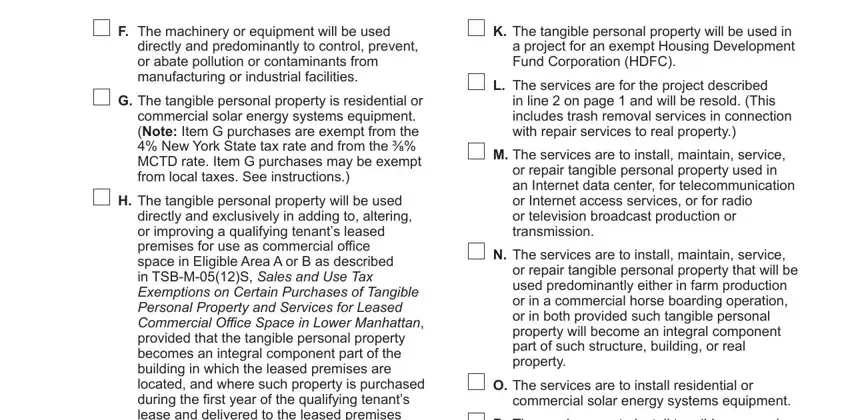

In the Page of ST, F The machinery or equipment will, directly and predominantly to, G The tangible personal property, H The tangible personal property, directly and exclusively in adding, K The tangible personal property, L The services are for the project, in line on page and will be, M The services are to install, or repair tangible personal, N The services are to install, or repair tangible personal, O The services are to install, and commercial solar energy systems box, identify the vital data.

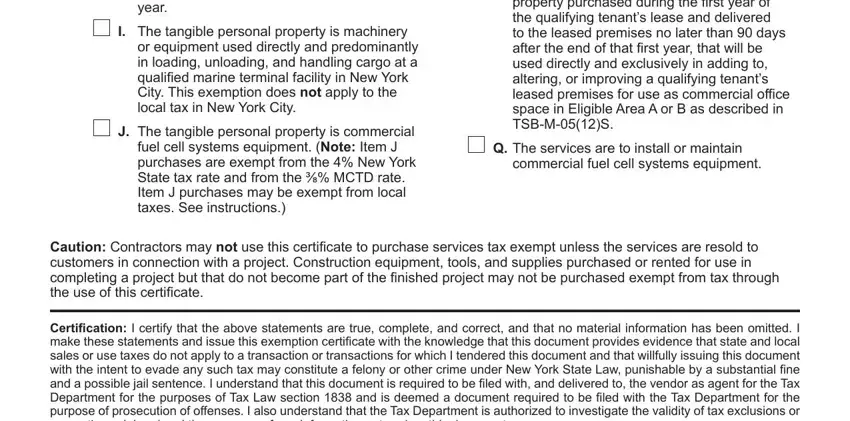

The directly and exclusively in adding, I The tangible personal property, or equipment used directly and, J The tangible personal property, property purchased during the, Q The services are to install or, commercial fuel cell systems, Caution Contractors may not use, and Certification I certify that the section will be applied to write down the rights or obligations of both sides.

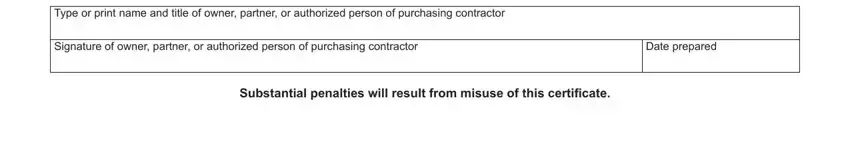

Review the areas Type or print name and title of, Signature of owner partner or, Date prepared, and Substantial penalties will result and thereafter fill them in.

Step 3: After you press the Done button, your finalized document can be easily transferred to each of your gadgets or to email indicated by you.

Step 4: You should generate as many duplicates of the document as possible to avoid potential misunderstandings.