Page 2 of 2 ST-121.3 (1/11)

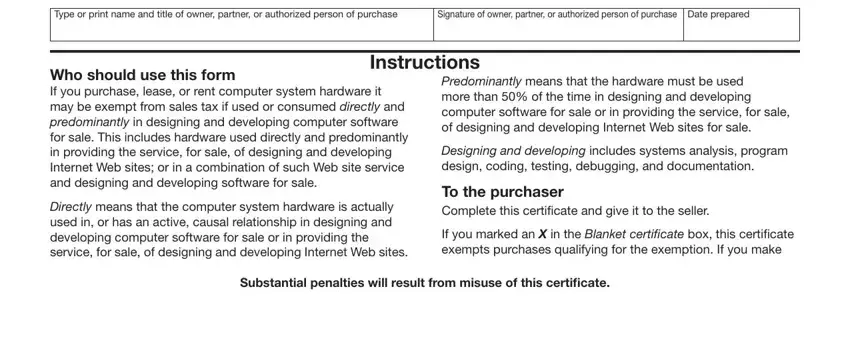

future purchases from this seller that do not qualify for the exemption, you must pay sales tax at the time of purchase.

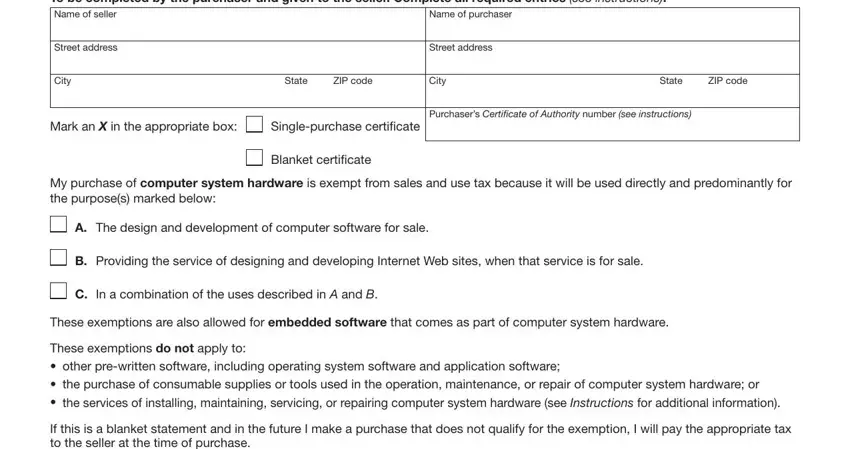

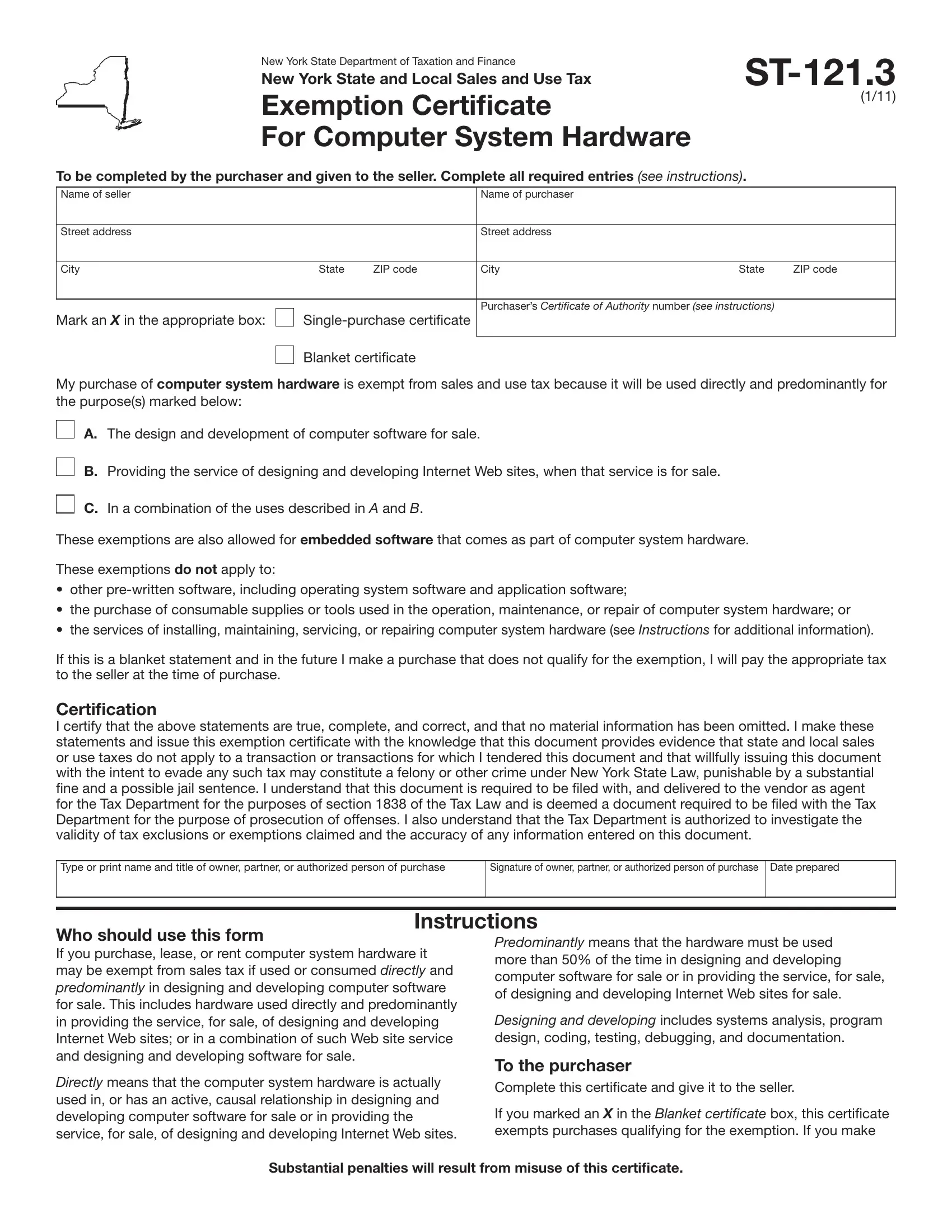

If you are registered, or required to be registered, with the New York State Tax Department as a person required to collect sales tax, enter your Certificate of Authority identiication number. If you are not required to be registered, enter N/A.

To the seller

This transaction is exempt from sales tax as long as the purchaser properly completes this Form ST-121.3 and gives it to you no later than 90 days after delivery of the property. If you receive it after this 90-day period, both you and the purchaser assume the burden of proving the sale was exempt.

If you accept an improperly completed exemption certiicate, you become personally liable for any sales and use tax, plus any penalty and interest that may be due, unless the certiicate is corrected within a reasonable period of time.

Keep this exemption certificate for at least three years after the due date or iling date (whichever is later) of the last return that it relates to. You must also maintain a method of associating an exempt sale made to a particular customer with the exemption certiicate you have on ile for that customer.

If the purchaser marked an X in the Blanket certificate box, you may consider this certiicate part of any order received from the purchaser during the period that the blanket certiicate remains in effect. However, each subsequent sales slip or purchase invoice based on this blanket certiicate must show the purchaser’s name and address. A blanket certiicate remains in effect until the purchaser gives you written notice of revocation, or you have knowledge that the certiicate is false or was fraudulently presented, or until the Tax Department notiies you that the purchaser may no longer make exempt purchases.

Purchases eligible for exemption

The term computer system hardware means the physical components from which a computer system is built, including associated parts and embedded software.

The hardware may include microcomputers, minicomputers, mainframe computers, personal computers, external hard drives, portable disk drives, CD-ROM drives, external modems, monitors, keyboards, mouses, printers, scanners, servers, network interfaces, network hubs, and network routers.

Associated parts are any components of, or attachments to, computer system hardware that are used in connection with, and are necessary to, the performance of the hardware’s operation. By deinition, a part cannot accomplish the work for which it is designed independent of the computer system hardware of which it is intended to be a component. Parts may include motherboards, daughterboards, central processing units, controller cards, internal hard drives, internal modems, network interface cards, sound cards, video cards, and network wiring and cables.

Embedded software comes as a part of the computer system hardware and is actually an integral part of the computer, typically in the form of a memory chip.

The sale of custom software is not subject to sales or use tax (see TSB-M-93(3)S, State and Local Sales and Compensating Use Taxes Imposed on Certain Sales of Computer Software).

For information on the taxability of computer software used

in an Internet data center, see Form ST-121.5, Exempt Use Certificate for Operators of Internet Data Centers (Web Hosting).

Purchases not eligible for exemption

Charges for the service of installing, maintaining, servicing, or repairing computer system hardware are not eligible for this exemption. Nor are charges for support packages and warranties.

Also not eligible are consumable supplies such as toner, ink, printer paper, loppy diskettes, removable disk cartridges, high-capacity disks, portable disk drive disks, and writable and erasable CD-ROM and DVD discs.

The purchase of pre-written computer software, whether pre-installed or not, is not eligible for this exemption unless it is embedded software. Pre-written computer software includes operating systems, irmware, algorithms, data sets, compilers and translators, assembly routines, utility programs, and application programs.

If a computer system hardware package includes pre-written computer software (other than embedded software), the seller must reasonably allocate the selling price between the hardware and the pre-written computer software and collect tax on

the amount allocated to the pre-written software. Failure to reasonably allocate the selling price between the hardware and the pre-written computer software will result in the entire sales price of the computer system hardware package being subject to tax.

Tools used in the operation, maintenance, or repair of computer system hardware are not eligible for this exemption.

For more information, see TSB-M-98(5)S, Exemption for Computer System Hardware.

Misuse of this certificate

Misuse of this exemption certiicate may subject you to serious civil and criminal sanctions in addition to the payment of any tax and interest due. These include:

•A penalty equal to 100% of the tax due;

•A $50 penalty for each fraudulent exemption certiicate issued;

•Criminal felony prosecution, punishable by a substantial ine and possible jail sentence; and

•Revocation of your Certificate of Authority, if you are required to be registered as a vendor.

See TSB-M-09(17)S, Amendments that Encourage Compliance with the Tax Law and Enhance the Tax Department’s Enforcement Ability, for more information.

Need help?

Internet access: www.tax.ny.gov

(for information, forms, and publications)

Sales Tax Information Center: |

(518) 485-2889 |

To order forms and publications: |

(518) 457-5431 |

Text Telephone (TTY) Hotline |

|

(for persons with hearing and |

|

speech disabilities using a TTY): |

(518) 485-5082 |