You could fill out st12b without difficulty with our online PDF editor. Our editor is continually developing to provide the best user experience possible, and that is because of our resolve for continual enhancement and listening closely to comments from users. It just takes a few basic steps:

Step 1: Click on the "Get Form" button at the top of this webpage to get into our tool.

Step 2: As soon as you launch the PDF editor, you'll see the document ready to be filled in. Other than filling out various fields, you may also perform other things with the PDF, namely adding custom words, editing the original textual content, inserting images, putting your signature on the document, and much more.

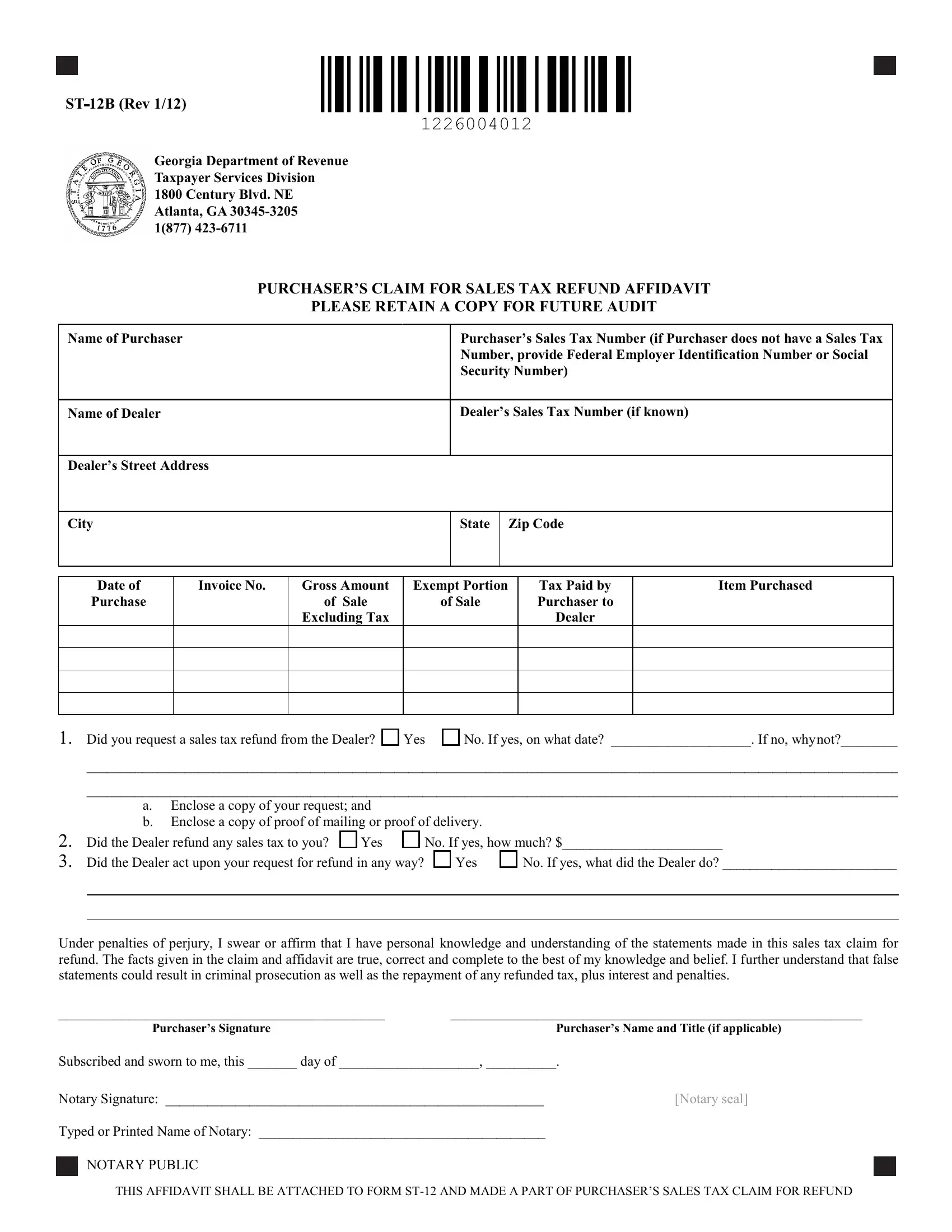

This PDF form will require specific info to be typed in, so be sure to take some time to enter precisely what is asked:

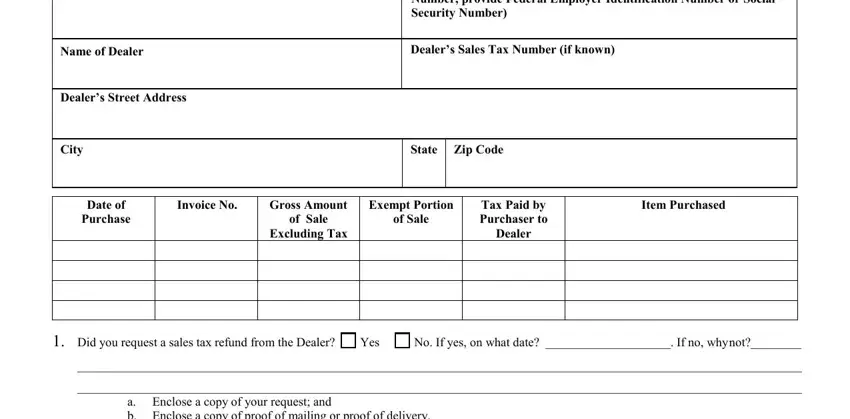

1. Fill out your st12b with a number of necessary blanks. Get all of the required information and make sure there is nothing neglected!

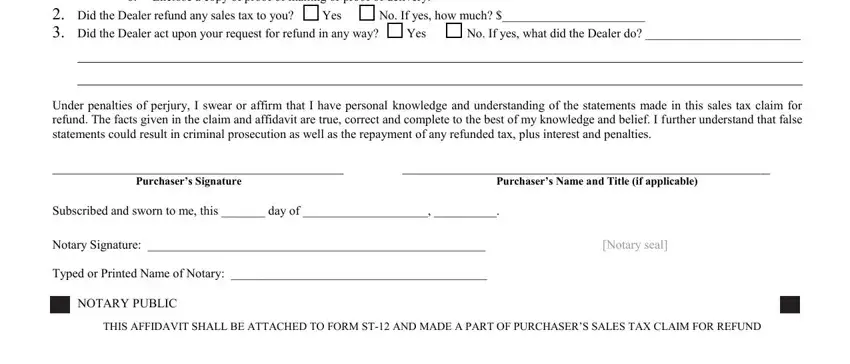

2. Once your current task is complete, take the next step – fill out all of these fields - a Enclose a copy of your request, Did the Dealer refund any sales, Under penalties of perjury I swear, Purchasers Name and Title if, Notary seal, and THIS AFFIDAVIT SHALL BE ATTACHED with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

You can easily make errors when completing your a Enclose a copy of your request, so be sure to look again prior to deciding to finalize the form.

Step 3: Make sure your information is right and then simply click "Done" to conclude the task. Join FormsPal now and easily use st12b, all set for downloading. Every change you make is conveniently kept , letting you modify the file at a later time as required. We don't share or sell the information you provide whenever completing documents at our website.