Understanding the nuances and requirements of the South Carolina Department of Revenue's ST-236 form is crucial for individuals who are in the process of purchasing or selling vehicles, boats, airplanes, or other specific property through casual or use transactions. This form, which plays a significant role in ensuring compliance with the state's casual excise tax and use tax obligations, is not just a document but a comprehensive report of a transaction's specifics including the identity of the purchaser and seller, the details of the property sold including make, model, and serial number or VIN, and the transaction's date. It outlines the conditions under which the property is considered for tax and provides specific codes to denote various non-taxable scenarios, making it a pivotal component for both buyers and sellers to understand their tax liabilities or exemptions. With provisions for different rates and exemptions based on the item sold and the status of the seller or buyer, the ST-236 form is an integral part of South Carolina's efforts to fairly tax property transactions while accounting for special circumstances such as sales to immediate family members or non-resident military personnel. Additionally, this form includes detailed sections for computing the tax owed, adjustments for trade-ins, and credits for taxes paid to other states. It requires not just a careful listing of sale details but also a comprehension of how casual excise and use taxes are applied within the state, providing a pathway for compliance while offering clear instructions for documenting and submitting the tax due.

| Question | Answer |

|---|---|

| Form Name | Form St 236 |

| Form Length | 6 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min 30 sec |

| Other names | legatee, Bamberg, Abbeville, Sumter |

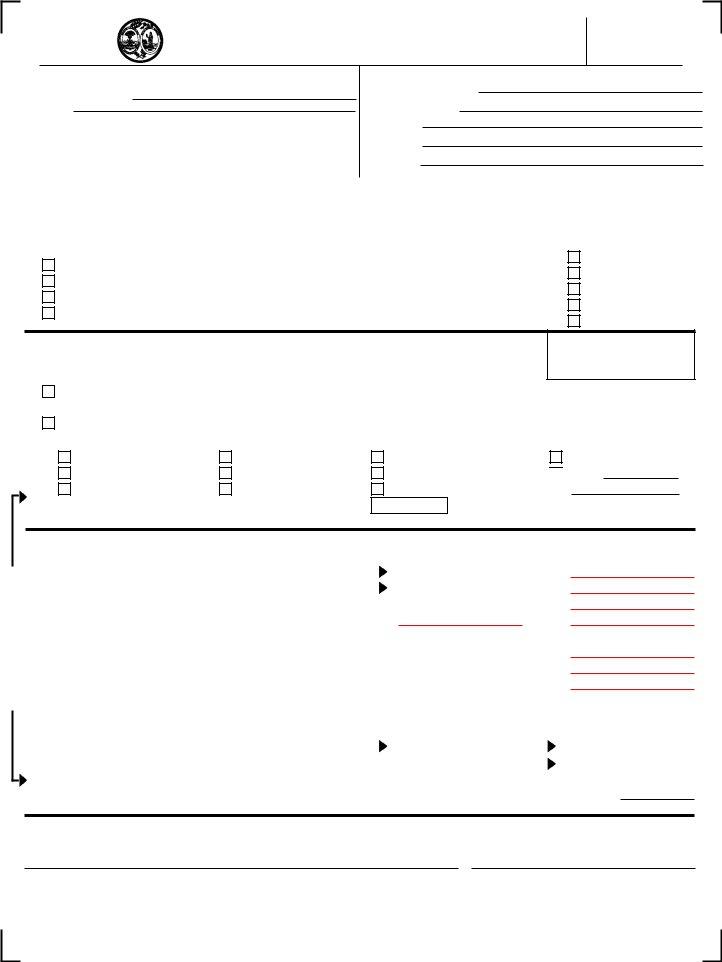

1350 |

STATE OF SOUTH CAROLINA |

|

DEPARTMENT OF REVENUE |

|

|

|

CASUAL OR USE EXCISE TAX RETURN |

|

Mail To: SC Department of Revenue, PO Box 125, Columbia, SC |

|

|

(Rev. 9/24/10)

5112

PROPERTY PURCHASE INFORMATION

Name of Purchaser:

Address:

City |

|

|

|

State |

|

|

Zip Code |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of Purchase |

|

|

|

|

|

|

|

|

|

|

|

|

Property Purchase |

|

|

|

|

|

|

|

|

|

|

||

Serial/VIN Number |

|

Year |

|

|

|

|

Make |

|||||

|

|

|

|

|

|

|

|

|

|

|||

Seller's Information:

Name of Seller:

Address:

Date:

NOTE: Payment of tax on this form requires the submission of a bill of sale and the signature of the |

5% GL CODE: |

|

|||||

owner. |

|

|

|

6% GL CODE: |

|

||

|

|

|

|

|

|||

CASUAL EXCISE TAX: (Purchase from an individual) |

|

|

FILE #: |

|

|||

|

Place "X" in the appropriate box |

||||||

Code |

Reason |

|

|||||

|

|

1. |

Motor Vehicle |

||||

01 |

Transfer to member of immediate family - indicate relationship |

|

|

||||

|

|

2. |

Motorcycles |

||||

02 |

Transfer to legal heir, legatee or distributee |

|

|

||||

|

|

3. |

Boats |

||||

03 |

Transfer to partnership or corporation upon formation |

|

|

||||

|

|

4. |

Motors (Outboard) |

||||

07 |

Nonresident military personnel (Statement as to Home of Record (HOR) MUST be attached.) |

||||||

5. |

Airplanes |

||||||

|

|

|

|

||||

USE TAX: (Purchase from an out of state retail dealer)

Code Reason

5% GL CODE:

6% GL CODE:

FILE #:

09 |

Nonresident military personnel (Statement as to Home of Record (HOR) MUST be attached.) |

|

Note: The sales of trucks, boats and motors are taxable. |

11 |

Tax paid to SC registered |

Place "X" in the appropriate box

1. |

Motor Vehicle |

**4. |

Motors (Outboard) |

7. |

2. |

Motorcycles |

5. |

Airplanes |

8. |

3. |

Boats |

6. |

Trailers |

9. |

If purchase is

Skip lines 1 through 10 (Computation of Tax) and Sign Return.

Manufactured Homes 11.

Campers

Recreational Vehicles

Other

ATTACH CHECK HERE

COMPUTATION OF TAX: |

Items Not Subject to Maximum Tax |

||||

|

|

|

|

Column A (6%) |

|

1. |

Sales Price |

1. |

$ |

|

|

|

|

||||

|

|

|

|

||

2. |

Less |

2. |

$ |

|

|

|

|

||||

|

|

|

|

||

3. |

Balance Subject to Tax |

3. |

$ |

|

|

|

|

||||

|

|

|

|

||

4.Tax Due: Line 3 by tax rate of Column A, B ($300 if subject to Max)..4. $

|

*** Local tax does not apply to sales that are subject to $300.00 tax cap |

|

|

|

||

5. |

Local Option Tax (1% of line 3 if applicable - list attached) |

5. |

$ |

|

|

|

|

|

|||||

|

|

|

|

|||

6. |

Other Local Tax (line 3 times the applicable Local Tax Rate) |

6. |

$ |

|

|

|

|

|

|||||

|

|

|

|

|||

7. |

Total Tax Due (add lines 4, 5 and 6) |

7. |

$ |

|

|

|

|

6% |

|||||

|

|

|

||||

|

** $ 300.00 maximum tax does NOT apply to the purchase of a boat |

|

|

|

||

|

|

|

|

|

||

|

motor sold separately, boat trailers, trailers pulled by other than truck |

|

|

|

|

|

|

tractor and contents of mobile homes. |

8. |

$ |

< |

> |

|

8. |

Credit for taxes paid to another state (See Instructions) |

|||||

|

|

|||||

9. |

Amount Due |

9. |

$ |

|

|

|

|

|

|||||

|

|

|

|

|||

10.Total Amount Due (add line 9, column A and B).........................................................................................

Items Subject to Maximum Tax or Purchased Prior to June 1, 2007

Column B (5%)

$

$

$

$

$

$

$

|

|

5% |

$ < |

> |

|

$ |

|

|

$ |

|

|

Name of County or Municipality |

|

County or Municipality Code |

(See Instructions)

Under penalty of law, I certify that the information provided herein is correct and to the best of my knowledge is true and complete.

Signature of Purchaser |

Date |

See reverse side

51121028

TAX COMPUTATION FOR MANUFACTURED HOMES AND CONTENTS

|

(Computation does not apply to modular homes) |

|

|

||

SECTION - A Compute tax on the sale of the home. |

|

|

|

|

|

1. |

Enter total sales price amount of home. |

|

|

$ |

|

|

|

|

|||

2. |

Enter |

|

|

$ |

|

|

|

|

|||

3. |

SUBTRACT line 2 from line 1 and enter results here. |

|

|

$ |

|

|

|

|

|||

4. |

MULTIPLY line 3 by 35% (.35) and enter results here. |

|

|

$ |

|

|

|

|

|||

5. |

SUBTRACT line 4 from line 3 and enter results here. |

|

|

$ |

|

|

|

|

|||

6. |

BASIS OF COMPUTATION OF TAX ON HOME |

|

|

$ |

|

|

|

|

|||

|

(A) If line 5 is less than or equal to $6000.00, enter results on line 6. |

|

|

|

|

|

Go to line 7. |

|

|

|

|

|

(B) If line 5 is greater than $6000.00 and home is energy efficient (EEF), enter $6000.00 on line 6. |

||||

|

Go to line 7. |

|

|

|

|

|

(C) If Line 5 is greater than $6000.00 and home is |

|

|

|

|

|

(1) Subtract $6000.00 from line 5 and enter results here |

$ |

|

|

|

|

(2) Multiply line C, (1) by 40% (.40) and enter results here |

$ |

|

|

|

|

(3) Add $6000.00 to line C, (2) and enter results on line 6. |

|

|

|

|

|

Go to line 7. |

|

|

|

|

7. |

Multiply amount on line 6 by 5% (.05), enter results here and go to section B. |

$ |

|

||

SECTION - B Compute tax on the sale of the contents of the home. (subject to local taxes)

(Items subject to $300.00 cap are not included in this tax computation.)

8. |

Enter the sales price for the contents of the home. |

$ |

|

||

9. |

Enter |

$ |

|

||

10. |

Subtract line 9 from line 8 and enter results here. |

$ |

|

||

11. |

If delivery is made in a local tax county, multiply amount on line 10 by the state and local |

$ |

|

||

|

tax rate and enter results here. |

|

Total tax due on home and contents |

|

|

12. |

Add line 7 and line 11 enter results here. |

$ |

51122026

General Information |

(Rev. 9/24/10) |

The purpose of these instructions is to provide information on the remittance of casual excise tax and use tax, if any, on motor vehicles, motorcycles, boats, motors, airplanes, trailers, etc. The tax is required of transactions where the purchaser has purchased from an individual,

The Department of Revenue publishes advisory documents on casual excise tax; sales and use tax collected by the Department and the exemptions allowed under each tax. For the most recently published information, visit the Department’s website, www.sctax.org

Use Tax

1. What is the use tax?

The use tax is a tax that applies to purchases of tangible personal property from

2. What is the rate for the use tax?

The tax rate for the use tax is the same as the sales tax. This rate is determined by where the tangible personal property will be used, stored or consumed, regardless of where the sale actually takes place. Therefore, the tax rate for the use tax will be the 6% state rate plus the applicable local use tax rate for the location where the tangible personal property will be used, stored or consumed.

Note: Information concerning local sales and use tax rates can be found on the Department’s website, www.sctax.org

3. Does South Carolina allow credit for taxes paid in another State?

Yes, a credit is allowed for the state and local sales or use tax due and paid in another state against the state and local use tax due in South Carolina. The credit is allowed upon proof that the sales or use tax was due and paid in the other state.

Note: For a further explanation on credit for taxes paid to another state, please visit the Department’s website, www.sctax.org and refer to Department Advisory Opinions Index for Sales and Use Tax.

4. Which transactions are not subject to the use tax?

The following transfers of motor vehicles, motorcycles, boats, motors, airplanes, trailers, semi trailers, or pole trailers are excluded from the use tax:

A. Purchases from outside South Carolina that have been substantially used in another state by the purchaser before being titled, registered or licensed in South Carolina. The purchaser must show proof that the property was titled, registered or licensed in another state.

B. Purchases in which the purchaser has a receipt from an out of state retailer authorized to collect South Carolina's use tax and shows the seller has collected the tax from the purchaser.

C. Sales to dealers for resale. The liability for tax will shift from the seller to the purchaser if the seller receives a properly completed

D. Sales to qualifying nonresident military personnel, sales to the federal government, transfers to an insurance company, and sales of airplanes used in planting, cultivating or harvesting farm crops (e.g. crop dusting).

5. Assessment Time Limitations for Use Tax

If a person fails to pay the use tax due on a purchase, the law allows the Department to assess any use taxes due (plus interest and penalties) within:

(1)36 months of when the return was filed or due to be filed (whichever is later) or

(2)12 months of receiving information from other states, regional and national tax administration or the

federal government, but no later than 72 months after the last day the use tax may have been paid without penalty. However, the Department may assess use taxes due (plus interest and penalties) beyond these time limits if (1) there is fraudulent intent to evade the taxes, (2) the taxpayer failed to file a return, (3) there is a 20% understatement of the total of all taxes required to be shown on the return, or (4) as otherwise allowed under the law.

51123024

Casual Excise Tax

1.What is casual excise tax and when is it imposed on sales of motor vehicles, motorcycles, boats, motors, or airplanes?

The casual excise tax is imposed upon the issuance of a certificate of title or other proof of ownership for every (1) motor vehicle, (2) motorcycle, (3) boat, (4) motor, or (5) airplane required to be registered, titled, or licensed. It applies only to the last sale before the application for title.

2.What is the Casual Excise Tax Rate and how the tax is computed?

The tax rate is 5% of the “fair market value” of the motor vehicle, motorcycle, airplane, and boat purchased. The casual excise tax is computed on the “fair market value” which is defined as (1) the total purchase price (i.e., price agreed upon by the buyer and seller) less any

However, the tax is 6% of the “fair market value” of a motor that is purchased alone (not permanently attached to the boat). Any transaction subject to the maximum tax of $300 is taxed at a state rate of 5% and is not subject to any local tax administered and collected by the Department of Revenue on behalf of local jurisdictions. Any transaction not subject to the maximum tax of $300 is taxed at a state rate of 6% and is subject to any local tax administered and collected by the Department of Revenue on behalf of local jurisdictions.

3. Who does not have to pay the Casual Excise Tax?

The following transfers of motor vehicles, motorcycles, boats, motors, or airplanes are not subject to the casual excise tax.

Code 1. Transfers to members of the immediate family ("immediate family" is spouse, parent, child, sister, brother, grandparent, and grandchild);

Code 2. Transfers to a legal heir, legatee, or distributee;

Code 3. Transfers from an individual to a partnership upon formation, or from a stockholder to a corporation upon formation;

Code 4. Transfers of motor vehicles, motorcycles, or airplanes specifically exempted by Section

Note: For a further explanation on how Casual Excise Tax is administered, please visit the Department’s website, www.sctax.org and refer to Department Advisory Opinions Index on Sales and Use Tax.

4. Who should complete the

The purchaser should complete

General Guidelines

Special Provisions for Persons 85 or Older

For purposes of the casual excise tax, and the sales and use tax, purchases by an individual 85 years old or older who titles or registers a motor vehicle, motorcycle, boat, airplane, recreational vehicle, a trailer,

The tax rate imposed on a purchase by an individual 85 years or older who titles or registers a motor that is purchased alone (not permanently attached to the boat), pole trailer, trailer, or semi trailer capable of being pulled by vehicles other than a truck tractor or any other vehicle not subject to the maximum tax for his own personal use is subject to tax at 5% instead of 6%.

51124022

Where Do I Pay the Use Tax or Casual Excise Tax?

Department of Revenue Form

To pay tax with the Form

South Carolina Department of Revenue

Sales Tax

P O Box 125

Columbia, SC

***Local Sales and Use Taxes

Local sales and use taxes apply to sales or purchases that are not subject to the $300 maximum tax. Motors sold alone, trailers (not required to be pulled by a truck tractor only), and contents of a manufactured home are subject to local taxes administered by the Department of Revenue.

51125029

LOCAL OPTION NUMERICAL CODES FOR COUNTY/MUNICIPALITY

Local Option Tax is applicable only to the counties listed below. Only names of incorporated towns are included in this listing. Other counties may be added at a later date, by referendum.

If your business is located in a municipality you must use the city code, not the general county code.

*If your sales or purchases are delivered within a city or town, you must use the CITY or TOWN code to properly identify the specific city.

Name |

Code |

Name |

|

Abbeville County |

1001 |

Cherokee County |

|

Abbeville (City)* |

2005 |

Blacksburg |

|

Calhoun Falls |

2100 |

Gaffney |

|

Donalds |

2212 |

Chester County |

|

Due West |

2216 |

Chester (City)* |

|

Honea Path |

2425 |

Fort Lawn |

|

Lowndesville |

2538 |

Great Falls |

|

Ware Shoals |

2944 |

Lowrys |

|

Allendale County |

1003 |

Richburg |

|

Allendale (Town)* |

2015 |

Chesterfield County |

|

Fairfax |

2280 |

Chesterfield (Town)* |

|

Sycamore |

2889 |

Cheraw |

|

Ulmers |

2910 |

Jefferson |

|

Bamberg County |

1005 |

McBee |

|

Bamberg (Town)* |

2052 |

Mount Croghan |

|

Denmark |

2204 |

Pageland |

|

Ehrhardt |

2245 |

Patrick |

|

Govan |

2346 |

Ruby |

|

Olar |

2674 |

Clarendon County |

|

|

1006 |

||

Barnwell County |

Manning |

||

Barnwell (City)* |

2054 |

Paxville |

|

Blackville |

2070 |

Summerton |

|

Elko |

2255 |

Turbeville |

|

Hilda |

2408 |

Colleton County |

|

Kline |

2466 |

||

Cottageville |

|||

Snelling |

2835 |

Edisto Beach |

|

Williston |

2970 |

Lodge |

|

Berkeley County |

1008 |

Smoaks |

|

Charleston (City)* |

2129 |

Walterboro |

|

Bonneau |

2076 |

Williams |

|

Goose Creek |

2342 |

Darlington County |

|

Hanahan |

2382 |

Darlington (City)* |

|

Jamestown |

2442 |

Hartsville |

|

Moncks Corner |

2600 |

Lamar |

|

St. Stephens |

2858 |

Society Hill |

|

Summerville |

2876 |

Dillon County |

|

Calhoun County |

1009 |

||

Dillon (City)* |

|||

Cameron |

2106 |

||

Lake View |

|||

St Matthews |

2855 |

||

Latta |

|||

Charleston County |

1010 |

||

Edgefield County |

|||

Charleston (City)* |

2130 |

||

Edgefield (Town)* |

|||

Awendaw |

2038 |

||

Johnston |

|||

Folly Beach |

2292 |

||

North Augusta |

|||

Hollywood |

2420 |

||

Trenton |

|||

Isle of Palms |

2436 |

||

Fairfield County |

|||

James Island |

2441 |

||

Jenkinsville |

|||

Kiawah Island |

2462 |

||

Ridgeway |

|||

Lincolnville |

2514 |

||

Winnsboro |

|||

McClellanville |

2573 |

||

Florence County |

|||

Meggett |

2597 |

||

Florence (City)* |

|||

Mt. Pleasant |

2609 |

||

Coward |

|||

North Charleston |

2656 |

||

Johnsonville |

|||

Ravenel |

2745 |

||

Lake City |

|||

Rockville |

2783 |

||

Olanta |

|||

Seabrook Island |

2812 |

||

Pamplico |

|||

Sullivans Island |

2867 |

||

Quinby |

|||

Summerville |

2875 |

||

Scranton |

|||

|

|

Timmonsville

Code |

Name |

1011 |

Hampton County |

2068 |

Hampton (Town)* |

2330 |

Brunson |

1012 |

Estill |

2139 |

Furman |

2304 |

Gifford |

2354 |

Luray |

2542 |

Scotia |

2755 |

Varnville |

1013 |

Yemassee |

2142 |

Jasper County |

2133 |

Hardeeville |

2444 |

Ridgeland |

2570 |

Kershaw County |

2606 |

Bethune |

2686 |

Camden |

2695 |

Elgin |

2790 |

Lancaster County |

1014 |

Lancaster (City)* |

|

2585 |

Heath Spring |

|

Kershaw |

||

2698 |

||

Laurens County |

||

2871 |

||

Laurens (City)* |

||

2905 |

||

Clinton |

||

1015 |

||

Cross Hill |

||

2172 |

||

Fountain Inn |

||

2243 |

||

Gray Court |

||

2530 |

||

Ware Shoals |

||

2831 |

||

Waterloo |

||

2940 |

||

Lee County |

||

2965 |

||

Bishopville |

||

1016 |

||

Lynchburg |

||

2200 |

||

Marion County |

||

2392 |

||

Marion (City)* |

||

2478 |

||

Mullins |

||

2837 |

||

Nichols |

||

1017 |

||

Sellers |

||

2208 |

||

Marlboro County |

||

2474 |

||

Bennettsville |

||

2494 |

||

Blenheim |

||

1019 |

||

Clio |

||

2240 |

||

McColl |

||

2448 |

||

Tatum |

||

2653 |

||

McCormick County |

||

2901 |

||

McCormick (City)* |

||

1020 |

||

Parksville |

||

2445 |

||

Plum Branch |

||

2775 |

||

Pickens County |

||

2972 |

||

Pickens (City)* |

||

1021 |

||

Central |

||

2286 |

||

Clemson |

||

2175 |

||

Easley |

||

2446 |

||

Liberty |

||

2470 |

||

Norris |

||

2670 |

||

Six Mile |

||

2689 |

||

|

||

2735 |

|

|

2810 |

|

|

2897 |

|

Code |

Name |

Code |

||

1025 |

Richland County |

|

1040 |

|

2380 |

Arcadia Lakes |

|

2030 |

|

2082 |

Blythewood |

|

2075 |

|

2265 |

Columbia |

|

2160 |

|

2320 |

Eastover |

|

2235 |

|

2336 |

Forest Acres |

|

2298 |

|

2546 |

Irmo |

|

2434 |

|

2807 |

Saluda County |

|

1041 |

|

2932 |

Saluda (Town)* |

|

2801 |

|

2985 |

Batesburg |

|

2057 |

|

1027 |

Monetta |

|

2602 |

|

2384 |

Ridge Spring |

|

2760 |

|

2765 |

Ward |

|

2942 |

|

1028 |

Sumter County |

|

1043 |

|

2064 |

Sumter (City)* |

|

2880 |

|

2103 |

Mayesville |

|

2594 |

|

2250 |

Pinewood |

|

2720 |

|

1029 |

Williamsburg County |

1045 |

||

2482 |

Andrews |

|

2026 |

|

2396 |

Greeleyville |

|

2358 |

|

2460 |

Hemingway |

|

2400 |

|

1030 |

Kingstree |

|

2463 |

|

2498 |

Lane |

|

2490 |

|

2151 |

Stuckey |

|

2864 |

|

2181 |

|

|

|

|

2316 |

|

|

|

|

Capital Project |

|

|

||

2350 |

|

|

||

Aiken County |

|

1002 |

||

2946 |

|

|||

Allendale County |

|

1003 |

||

2947 |

|

|||

Chester County |

|

1012 |

||

1031 |

|

|||

Florence County |

|

1021 |

||

2066 |

|

|||

Greenwood County |

|

1024 |

||

2554 |

Horry County |

|

1026 |

|

1034 |

Lancaster County |

|

1029 |

|

2588 |

Newberry County |

|

1036 |

|

Orangeburg County |

|

1038 |

||

2612 |

|

|||

Sumter County |

|

1043 |

||

2636 |

|

|||

York County |

|

1046 |

||

2813 |

|

|||

|

|

|

||

School District (SD) / Education |

||||

1035 |

||||

2062 |

Capital Improvement (ECI) |

|||

2072 |

Cherokee (SD) |

|

5111 |

|

2154 |

Chesterfield (SD) |

|

5131 |

|

Clarendon (SD) |

|

5140 |

||

2576 |

|

|||

Darlington (SD) |

|

5161 |

||

2895 |

|

|||

Dillon (SD) |

|

5170 |

||

1033 |

|

|||

Horry (ECI) |

|

5261 |

||

2582 |

Jasper (SD) |

|

5271 |

|

2692 |

Lee (SD) |

|

5311 |

|

2722 |

Lexington (SD) |

|

5320 |

|

|

|

|

||

1039 |

Transportation Tax |

|

|

|

2716 |

Beaufort |

|

1007 |

|

2118 |

Berkeley |

|

1008 |

|

2148 |

Charleston |

|

1010 |

|

2230 |

Dorchester |

|

1018 |

|

2510 |

Tourism Development Tax |

|||

2644 |

Myrtle Beach |

|

2615 |

|

2828 |

|

|||

|

|

|

||

|

|

|

||

51126027