You can complete massachusetts form st 6e effectively by using our online tool for PDF editing. To make our tool better and less complicated to use, we consistently develop new features, taking into consideration feedback coming from our users. Starting is simple! All that you should do is adhere to these simple steps directly below:

Step 1: First of all, open the pdf editor by pressing the "Get Form Button" at the top of this page.

Step 2: With the help of this advanced PDF editor, you could accomplish more than merely complete forms. Express yourself and make your forms appear sublime with customized textual content added, or tweak the original input to perfection - all that backed up by the capability to add your personal images and sign the document off.

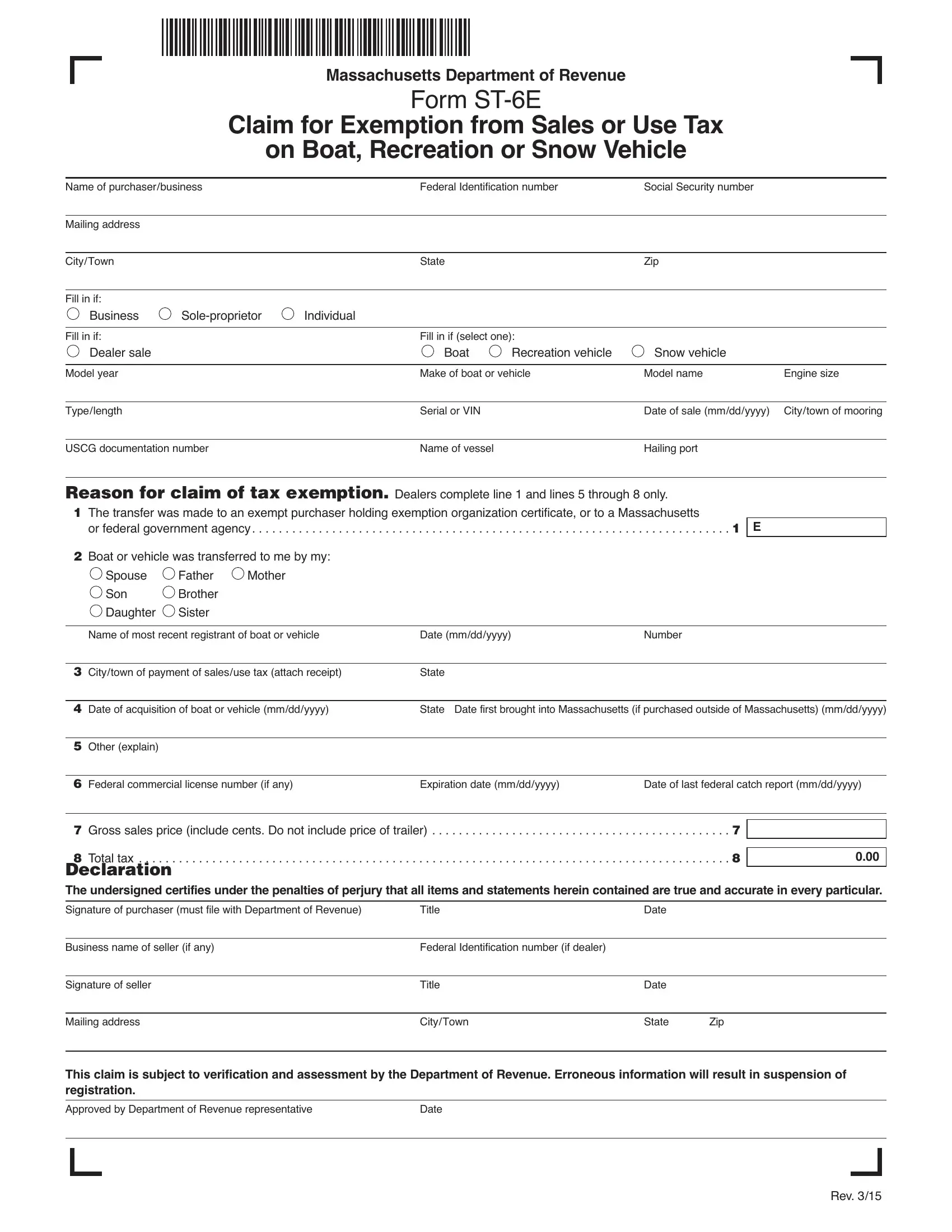

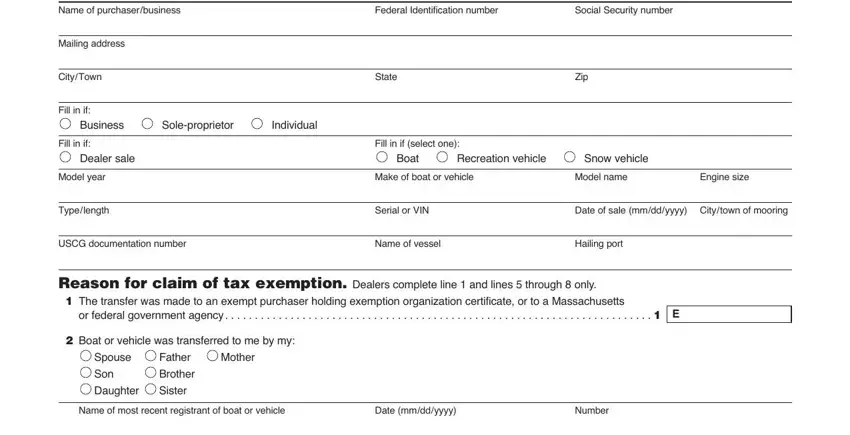

Filling out this form requires focus on details. Ensure that all necessary blank fields are filled out correctly.

1. You should complete the massachusetts form st 6e properly, so be attentive while working with the parts comprising all these fields:

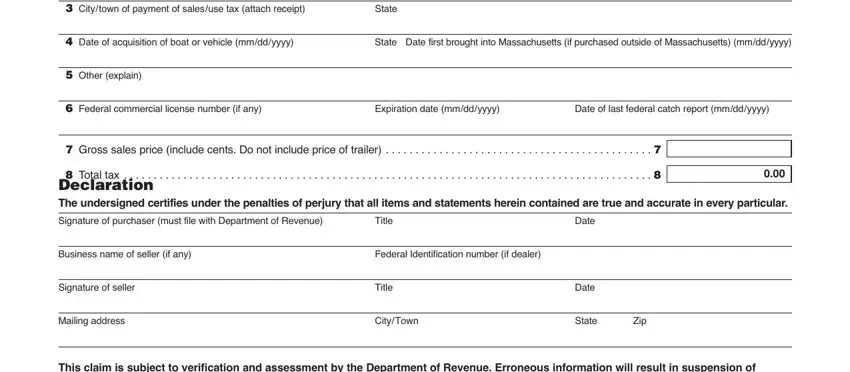

2. After finishing the previous section, head on to the next step and fill out the essential details in these blanks - Citytown of payment of salesuse, State, Date of acquisition of boat or, State Date first brought into, Other explain, Federal commercial license number, Expiration date mmddyyyy, Date of last federal catch report, Gross sales price include cents, Total tax, Signature of purchaser must file, Title, Business name of seller if any, Federal Identification number if, and Signature of seller.

Always be very attentive while filling in Gross sales price include cents and Signature of seller, as this is where most people make errors.

3. This next segment will be focused on This claim is subject to, Approved by Department of Revenue, Date, and Rev - fill out these fields.

Step 3: Prior to getting to the next step, double-check that all form fields have been filled in the proper way. Once you believe it's all good, click on “Done." After creating afree trial account here, it will be possible to download massachusetts form st 6e or send it via email right away. The PDF will also be accessible via your personal account page with your changes. FormsPal provides risk-free document tools with no personal information record-keeping or sharing. Feel at ease knowing that your details are in good hands with us!