Navigating the complexities of sales and use tax reporting in New York can be daunting for part-quarterly (monthly) filers, but understanding the ST-810 form is a crucial step in ensuring compliance and avoiding potential pitfalls. This form is specifically designed for businesses to report their quarterly sales and use tax for part of the quarter. Key sections address new or changed business addresses, indicate whether no tax is due for the period, and provide detailed instructions on completing the return summary, which includes reporting gross sales and services, along with taxable purchases. Additionally, the form requires information on any changes to the business, such as sales or discontinuations, and calculates taxes due based on the collected data. Businesses claiming any credits must also pay special attention to accurately reporting these on the ST-810 form, accompanied by the corresponding ST-810-ATT form for a detailed claim. Keeping abreast of the due date for the third quarter, as well as the mandated move toward electronic filing for most filers, further underscores the importance of timely and accurate submissions to the New York State Department of Taxation and Finance. This comprehensive tool aids part-quarterly filers in navigating the nuances of sales and use tax reporting, ensuring businesses meet their obligations efficiently.

| Question | Answer |

|---|---|

| Form Name | Form St 810 |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | Fillable Online st 810 sales tax form - Form ST-810: 2/19 ... |

Department of Taxation and Finance

New York State and Local Quarterly

Sales and Use Tax Return for

Sales tax identification number

Legal name (Print ID number and legal name as it appears on the Certificate of Authority)

DBA (doing business as) name

Number and street

City, state, ZIP code

Quarterly

Tax period: 3rd Quarter

September 1, 2021 – November 30, 2021

Due: Monday, December 20, 2021

Mandate to use Sales Tax Web File

Most filers fall under this requirement.

See Form

Has your address or business 0922 information changed?

Is this your final return? – If you sell or discontinue your business, or change the form of your business, you are required to file a final return with the applicable information completed in Step 2 below. You must file your final return within 20 days of the last day of business or change in status. The return should include the tax due from business operations to the last day of

business, as well as any tax collected on assets that you sell. Mark an X in the box if this is your final return. ..........................................

Are you claiming any credits in Step 3 on this return or any schedules? (Mark an X in the box.) .................................................................

If Yes, enter the total amounts of credits claimed and complete Form |

.00 |

credits? in instructions) |

Step 1 Return summary

(see instructions)

1 Gross sales and services...............................................................

1a Nontaxable sales ...........................................................................

1

.00

1a

.00

Step 2 Final return information (see instructions)

A Business sold or discontinued

Mark an X in the appropriate box if your business has been sold or discontinued.

Sold

Insolvent

Owner deceased

Dissolved

Other

Note: If you intend to sell your business or any of your business assets, including tangible, intangible, or real property, other than in the ordinary course of business, you must give each prospective purchaser a copy of Form

Last day of business |

|

Date of sale |

|

Sale price |

In whole |

|

In part |

|

|

/ |

/ |

/ |

/ |

|

|

|

|

||

|

|

|

|||||||

Name and address of purchaser |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name and address of business |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Location of property |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Was sales tax collected on any taxable items (furniture, fixtures, etc.) included in the sale? |

Yes |

B Business form changed (sole proprietor to partnership, partnership to corporation, etc.)

In addition to filing a final return, you must also apply for a new Certificate of Authority for the new entity (see Business form changed in instructions).

No

80000111210094

Proceed to Step 3, page 2

For office use only

Page 2 of 4

Sales tax identification number

0922

Quarterly

Step 3 Calculate sales and use taxes |

|

|

|

Column C |

|

|

|

Column D |

|

Column E |

|

|

Column F |

||

|

|

+ |

|

|

|||||||||||

|

|

|

Taxable sales |

|

Purchases subject |

× Tax rate = |

Sales and |

||||||||

|

(see instructions) |

|

|

|

and services |

|

|

|

to tax |

|

|

|

|

use tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(C + D) × E |

|

Enter the total from Schedule FR, page 4, step 6, box 18, (if |

|

|

|

|

|

|

|

|

|

2 |

|

|

|||

any) in box 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|||

Enter the total paper bag fee from Schedule E, box 1 (if any) in box 2a |

|

|

|

|

|

|

|

|

|

2a |

|

|

|||

Enter the sum of any totals from Schedules A, B, H, N, T and W (if any) |

3 |

|

.00 |

|

4 |

|

.00 |

|

|

5 |

|

|

|||

|

Column A |

Column B |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jurisdiction |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Taxing jurisdiction |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

code |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

New York State only |

NE |

0021 |

|

|

.00 |

|

|

|

.00 |

4% |

|

|

|

|

|

Albany County |

AL |

0181 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

Allegany County |

AL |

0221 |

|

|

.00 |

|

|

|

.00 |

8½% |

|

|

|

|

|

Broome County |

BR |

0321 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

Cattaraugus County (outside the following) |

CA |

0481 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

|

Olean (city) |

OL |

0441 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

Salamanca (city) |

SA |

0431 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

Cayuga County (outside the following) |

CA |

0511 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

|

Auburn (city) |

AU |

0561 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

Chautauqua County |

CH |

0651 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

Chemung County |

CH |

0711 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

Chenango County (outside the following) |

CH |

0861 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

|

Norwich (city) |

NO |

0831 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

Clinton County |

CL |

0921 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

Columbia County |

CO |

1021 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

Cortland County |

CO |

1131 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

Delaware County |

DE |

1221 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

Dutchess County |

DU |

1311 |

|

|

.00 |

|

|

|

.00 |

8⅛%* |

|

|

|

|

|

Erie County |

ER |

1451 |

|

|

.00 |

|

|

|

.00 |

8¾% |

|

|

|

|

|

Essex County |

ES |

1521 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

Franklin County |

FR |

1621 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

Fulton County (outside the following) |

FU |

1791 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

|

Gloversville (city) |

GL |

1741 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

Johnstown (city) |

JO |

1751 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

Genesee County |

GE |

1811 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

Greene County |

GR |

1911 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

Hamilton County |

HA |

2011 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

Herkimer County |

HE |

2121 |

|

|

.00 |

|

|

|

.00 |

8¼% |

|

|

|

|

|

Jefferson County |

JE |

2221 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

Lewis County |

LE |

2321 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

Livingston County |

LI |

2411 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

Madison County (outside the following) |

MA |

2511 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

|

Oneida (city) |

ON |

2541 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

Monroe County |

MO |

2611 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

Montgomery County |

MO |

2781 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

Nassau County |

NA 2811 |

|

|

.00 |

|

|

|

.00 |

8⅝%* |

|

|

|

|

||

Niagara County |

NI |

2911 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

Oneida County (outside the following) |

ON |

3010 |

|

|

.00 |

|

|

|

.00 |

8¾% |

|

|

|

|

|

|

Rome (city) |

RO |

3015 |

|

|

.00 |

|

|

|

.00 |

8¾% |

|

|

|

|

|

Utica (city) |

UT |

3018 |

|

|

.00 |

|

|

|

.00 |

8¾% |

|

|

|

|

Onondaga County |

ON |

3121 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

Ontario County |

ON |

3211 |

|

|

.00 |

|

|

|

.00 |

7½% |

|

|

|

|

|

Orange County |

OR |

3321 |

|

|

.00 |

|

|

|

.00 |

8⅛%* |

|

|

|

|

|

Orleans County |

OR |

3481 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

Oswego County (outside the following) |

OS |

3501 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

|

Oswego (city) |

OS |

3561 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

Otsego County |

OT |

3621 |

|

|

.00 |

|

|

|

.00 |

8% |

|

|

|

|

|

|

|

|

|

6 |

|

|

|

7 |

|

|

|

|

8 |

|

|

Column subtotals; also enter on page 3, boxes 9, 10, and 11: |

|

|

.00 |

|

|

|

.00 |

|

|

|

|

|

|||

80000211210094

Quarterly |

|

0922 |

|

|

Sales tax identification number |

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Step 3 Calculate sales and use taxes (continued) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

Column A |

|

Column B |

|

Column C |

|

|

|

Column D |

|

Column E |

|

|

Column F |

||||||||

|

|

|

Taxing jurisdiction |

|

Jurisdiction |

|

Taxable sales |

+ Purchases subject |

× Tax rate = |

Sales and use tax |

|||||||||||||||

|

|

|

|

|

|

|

code |

|

and services |

|

|

|

to tax |

|

|

|

|

|

|

(C + D) × E |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Putnam County |

|

PU |

3731 |

|

|

|

.00 |

|

|

|

|

|

.00 |

8⅜%* |

|

|

|

|

|

||||||

Rensselaer County |

|

RE |

3881 |

|

|

|

.00 |

|

|

|

|

|

.00 |

8% |

|

|

|

|

|

|

|||||

Rockland County |

|

RO |

3921 |

|

|

|

.00 |

|

|

|

|

|

.00 |

8⅜%* |

|

|

|

|

|

||||||

St. Lawrence County |

|

ST |

4091 |

|

|

|

.00 |

|

|

|

|

|

.00 |

8% |

|

|

|

|

|

|

|||||

Saratoga County (outside the following) |

|

SA |

4111 |

|

|

|

.00 |

|

|

|

|

|

.00 |

7% |

|

|

|

|

|

|

|||||

|

Saratoga Springs (city) |

|

SA |

4131 |

|

|

|

.00 |

|

|

|

|

|

.00 |

7% |

|

|

|

|

|

|

||||

Schenectady County |

|

SC |

4241 |

|

|

|

.00 |

|

|

|

|

|

.00 |

8% |

|

|

|

|

|

|

|||||

Schoharie County |

|

SC |

4321 |

|

|

|

.00 |

|

|

|

|

|

.00 |

8% |

|

|

|

|

|

|

|||||

Schuyler County |

|

SC |

4411 |

|

|

|

.00 |

|

|

|

|

|

.00 |

8% |

|

|

|

|

|

|

|||||

Seneca County |

|

SE |

4511 |

|

|

|

.00 |

|

|

|

|

|

.00 |

8% |

|

|

|

|

|

|

|||||

Steuben County |

|

ST |

4691 |

|

|

|

.00 |

|

|

|

|

|

.00 |

8% |

|

|

|

|

|

|

|||||

Suffolk County |

|

SU |

4711 |

|

|

|

.00 |

|

|

|

|

|

.00 |

8⅝%* |

|

|

|

|

|

||||||

Sullivan County |

|

SU |

4821 |

|

|

|

.00 |

|

|

|

|

|

.00 |

8% |

|

|

|

|

|

|

|||||

Tioga County |

|

TI |

4921 |

|

|

|

.00 |

|

|

|

|

|

.00 |

8% |

|

|

|

|

|

|

|||||

Tompkins County (outside the following) |

|

TO |

5081 |

|

|

|

.00 |

|

|

|

|

|

.00 |

8% |

|

|

|

|

|

|

|||||

|

Ithaca (city) |

|

IT |

5021 |

|

|

|

.00 |

|

|

|

|

|

.00 |

8% |

|

|

|

|

|

|

||||

Ulster County |

|

UL |

5111 |

|

|

|

.00 |

|

|

|

|

|

.00 |

8% |

|

|

|

|

|

|

|||||

Warren County (outside the following) |

|

WA |

5281 |

|

|

|

.00 |

|

|

|

|

|

.00 |

7% |

|

|

|

|

|

|

|||||

|

Glens Falls (city) |

|

GL |

5211 |

|

|

|

.00 |

|

|

|

|

|

.00 |

7% |

|

|

|

|

|

|

||||

Washington County |

|

WA 5311 |

|

|

|

.00 |

|

|

|

|

|

.00 |

7% |

|

|

|

|

|

|

||||||

Wayne County |

|

WA 5421 |

|

|

|

.00 |

|

|

|

|

|

.00 |

8% |

|

|

|

|

|

|

||||||

Westchester County (outside the following) |

WE |

5581 |

|

|

|

.00 |

|

|

|

|

|

.00 |

8⅜%* |

|

|

|

|

|

|||||||

|

Mount Vernon (city) |

|

MO |

5521 |

|

|

|

.00 |

|

|

|

|

|

.00 |

8⅜%* |

|

|

|

|

|

|||||

|

New Rochelle (city) |

|

NE |

6861 |

|

|

|

.00 |

|

|

|

|

|

.00 |

8⅜%* |

|

|

|

|

|

|||||

|

White Plains (city) |

|

WH |

6513 |

|

|

|

.00 |

|

|

|

|

|

.00 |

8⅜%* |

|

|

|

|

|

|||||

|

Yonkers (city) |

|

YO |

6511 |

|

|

|

.00 |

|

|

|

|

|

.00 |

8⅞%* |

|

|

|

|

|

|||||

Wyoming County |

|

WY |

5621 |

|

|

|

.00 |

|

|

|

|

|

.00 |

8% |

|

|

|

|

|

|

|||||

Yates County |

|

YA |

5721 |

|

|

|

.00 |

|

|

|

|

|

.00 |

8% |

|

|

|

|

|

|

|||||

New York City/State combined tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

[New York City includes counties of Bronx, Kings (Brooklyn), |

NE |

8081 |

|

|

|

.00 |

|

|

|

|

|

.00 |

8⅞%* |

|

|

|

|

||||||||

New York (Manhattan), Queens, and Richmond (Staten Island)] |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

New York State/MCTD |

|

NE |

8061 |

|

|

|

.00 |

|

|

|

|

|

.00 |

4⅜%* |

|

|

|

|

|||||||

New York City - local tax only |

|

NE |

8091 |

|

|

|

.00 |

|

|

|

|

|

.00 |

4½% |

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

Column subtotals from page 2, boxes 6, 7, and 8: |

9 |

|

|

.00 |

10 |

|

|

|

|

.00 |

|

|

|

|

11 |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

12 |

|

|

|

13 |

|

|

|

|

|

|

|

|

|

14 |

|

|

|

|

|

|

|

|

Column totals: |

|

|

|

.00 |

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

||

|

|

Calculate special taxes (see instructions) |

|

|

Internal code |

|

|

|

Column G |

|

Column H |

|

|

Column J |

|

||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

Step 4 |

|

|

|

|

|

|

Taxable receipts |

× Tax rate |

= |

Special taxes due |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(G × H) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Passenger car rentals (outside the MCTD) |

|

|

|

|

PA |

0012 |

|

|

|

|

|

|

.00 |

12% |

|

|

|

|

|

||||||

Passenger car rentals (within the MCTD) |

|

|

|

|

PA |

0030 |

|

|

|

|

|

|

.00 |

12% |

|

|

|

|

|

||||||

Information & entertainment services furnished via telephony and telegraphy |

|

IN |

7009 |

|

|

|

|

|

|

.00 |

5% |

|

|

|

|

|

|

||||||||

Vapor products |

|

|

|

|

VA |

7060 |

|

|

|

|

|

|

.00 |

20% |

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total special taxes: |

|

15 |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Step 5 |

Other tax credits and advance payments (see instructions) |

|

|

|

|

|

|

|

Internal code |

|

|

|

Column K |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Credit amount |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Credit for prepaid sales tax on cigarettes |

|

|

|

|

|

|

|

|

|

|

|

CR C8888 |

|

|

|

|

|

||||||||

Overpayment being carried forward from a prior period |

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

||||||||

Advance payments (including |

|

|

|

|

|

|

|

|

|

A |

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

Total tax credits, advance payments, and overpayments: |

|

16 |

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*43/8% = 0.04375; |

83/8% = 0.08375; |

|

Proceed to Step 6, |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

73/8% = 0.07375; |

85/8% = 0.08625; |

|

|

|

|

page 4 |

||||||||

|

|

|

|

|

|

|

|

|

|

|

81/8% = 0.08125; |

87/8% = 0.08875 |

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

80000311210094

Page 4 of 4 |

|

|

|

Sales tax identification number |

|

|

|

|

|

0922 |

Quarterly |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Step 6 |

|

|

|

|

|

|

Add Sales and use tax column total (box 14) to Total special |

|

|

|

|

|

|||||||||

Calculate taxes due |

|

|

taxes (box 15) and subtract Total tax credits, advance |

|

|

|

|

Taxes due |

|||||||||||||

|

|

|

|

|

|

|

|

|

payments, and overpayments (box 16). Enter result in box 17. |

|

|

|

|

|

|||||||

Box 14 |

|

+ |

Box 15 |

|

|

|

Box 16 |

= |

17 |

|

|

|

|

||||||||

amount $ |

|

amount $ |

|

|

|

amount $ |

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Step 7 Pay penalty and interest if you are |

Penalty and interest are calculated on the amount in box 17, |

|

Penalty and interest |

||||||||||||||||||

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|||||||||||||||||

|

|

|

filing late (see instructions) |

|

|

Taxes due. |

|

|

18 |

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Step 8 |

Calculate total amount due |

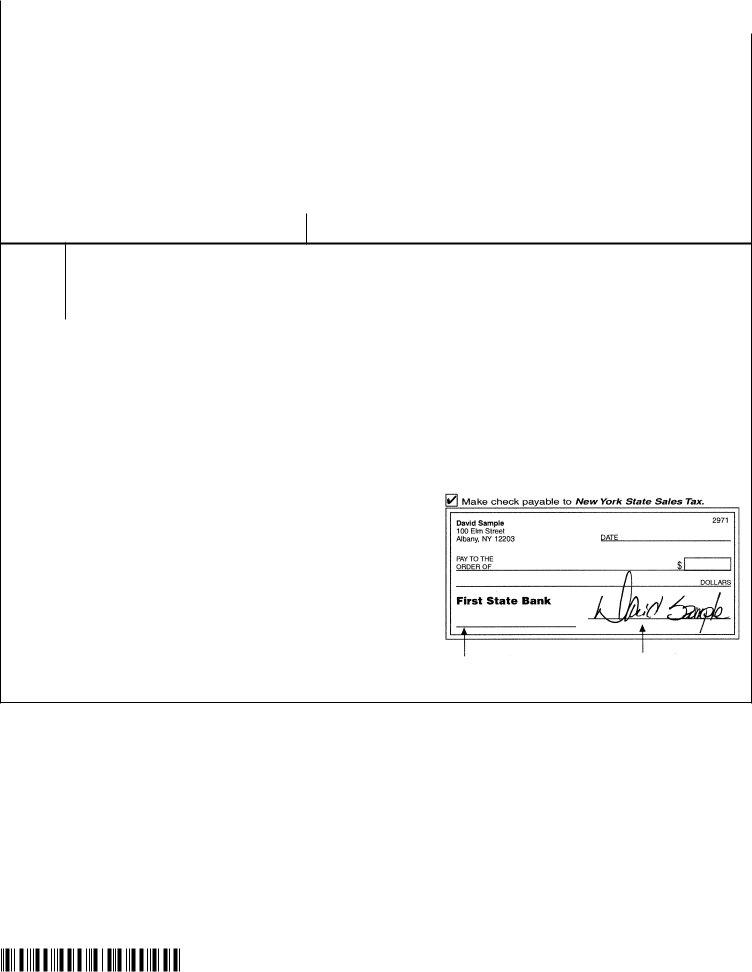

Make check or money order payable to New York State Sales Tax. Write |

|

Total amount due |

|||||||||||||||||

|

|

|

(see instructions) |

|

|

|

|

|

on your check your sales tax identification number, |

11/30/21. |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

8A |

Amount due: |

Paying penalty and interest? Add box 18 to box 17. |

|

|

19 |

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

8B |

Amount paid: |

Enter your payment amount. This amount should match your amount |

|

|

20 |

|

|

|

|

||||||||||||

due in box 19. |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Step 9 Sign and mail this return (see instructions)

Please be sure to keep a completed copy for your records.

Must be postmarked by Monday, December 20, 2021, to be considered filed on time. See below for complete mailing information.

Third –

party

designee

Do you want to allow another person to discuss this return with the Tax Dept? (see instructions) |

Yes |

|

(complete the following) No |

|

|

||||

|

|

|

|

|

|

|

|||

Designee’s name |

Designee’s phone number |

|

Personal identification |

|

|

|

|||

|

|

|

|||||||

|

( |

) |

|

number (PIN) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Designee’s email address

Authorized |

Signature of authorized person |

|

|

Official title |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|||

person |

|

Email address of authorized person |

|

|

|

|

|

Telephone number |

|

|

Date |

|||

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

Paid |

|

Firm’s name (or yours if |

|

|

|

|

Firm’s |

EIN |

|

|

|

Preparer’s |

PTIN or SSN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

preparer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature of individual preparing this return |

Address |

|

|

|

|

City |

|

|

|

State |

ZIP code |

||

use |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

only |

|

|

|

|

|

|

|

|

|

|

|

|||

|

Email address of individual preparing this return |

Telephone number |

|

Preparer’s NYTPRIN |

|

|

NYTPRIN |

Date |

||||||

(see instr.) |

|

|

|

( |

) |

|

|

|

|

|

|

excl. code |

|

|

Where to file your return and attachments

Web File your return at www.tax.ny.gov (see Highlights in instructions).

(If you are not required to Web File, mail your return and attachments to: NYS Sales Tax Processing, PO Box 15172, Albany NY

If using a private delivery service rather than the U.S. Postal Service, see Publication 55, Designated Private Delivery Services.

December 10, 2021

New York State Sales Tax |

X,XXX.XX |

(your payment amount) |

|

|

|

Don’t forget to write your sales tax |

Don’t forget to |

ID#, |

sign your check |

Need help?

See Form

80000411210094