This PDF editor makes it simple to complete forms. You don't need to perform much to manage short form financial statement massachusetts documents. Basically try out the following steps.

Step 1: Press the orange "Get Form Now" button on this webpage.

Step 2: Now you are on the document editing page. You can edit, add information, highlight particular words or phrases, put crosses or checks, and put images.

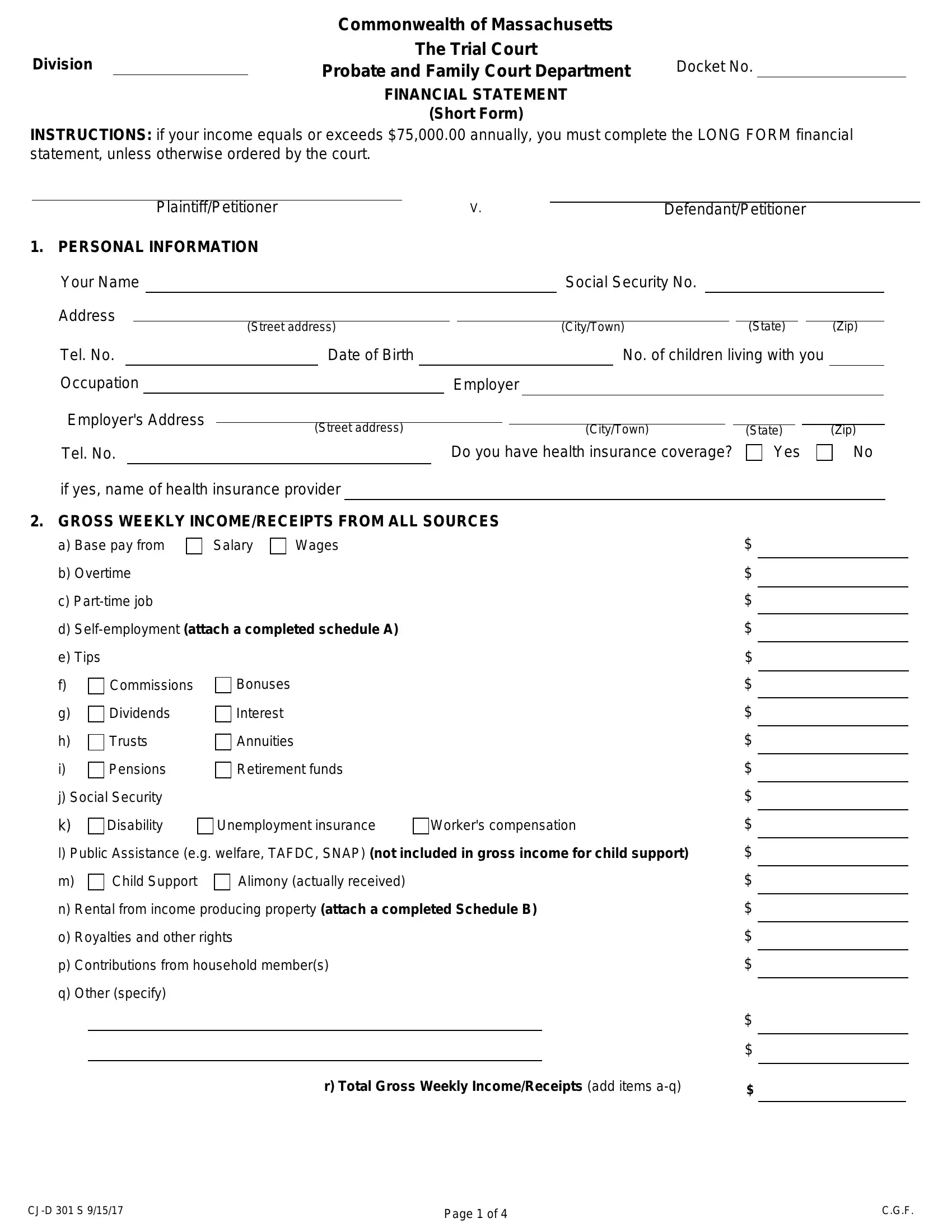

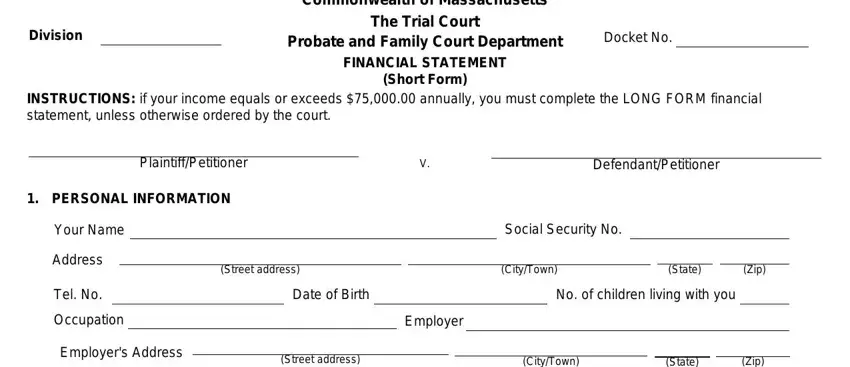

These areas will frame the PDF file that you'll be completing:

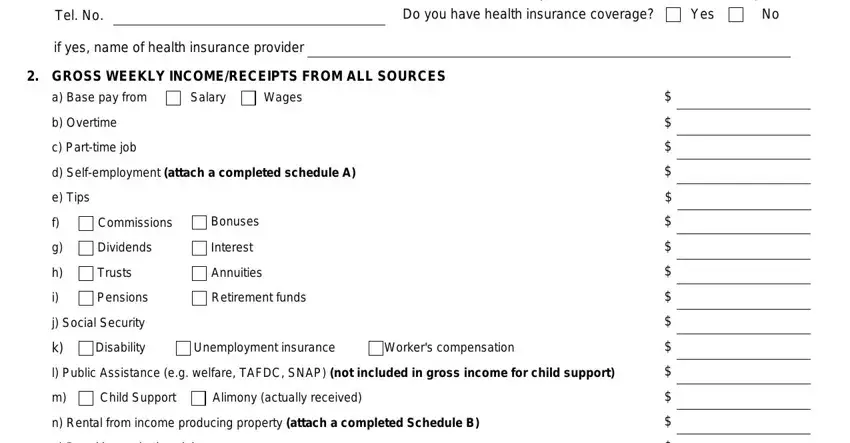

The system will require you to submit the Tel No, Street address, CityTown, Do you have health insurance, State, Yes, Zip, if yes name of health insurance, GROSS WEEKLY INCOMERECEIPTS FROM, a Base pay from, Salary, Wages, b Overtime, c Parttime job, and d Selfemployment attach a field.

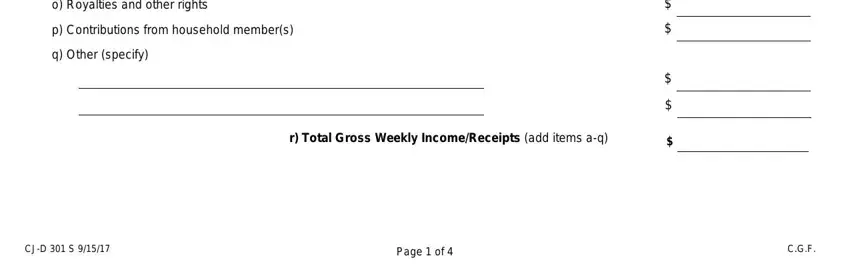

Write down any details you may need within the space o Royalties and other rights, p Contributions from household, q Other specify, r Total Gross Weekly, CJD S, Page of, and CGF.

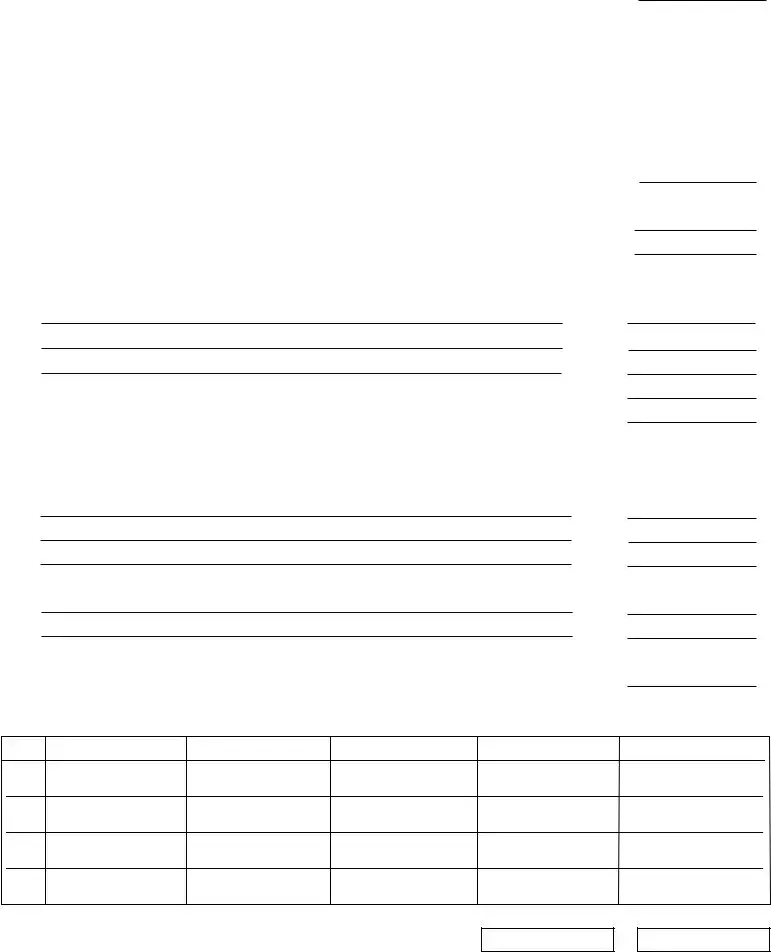

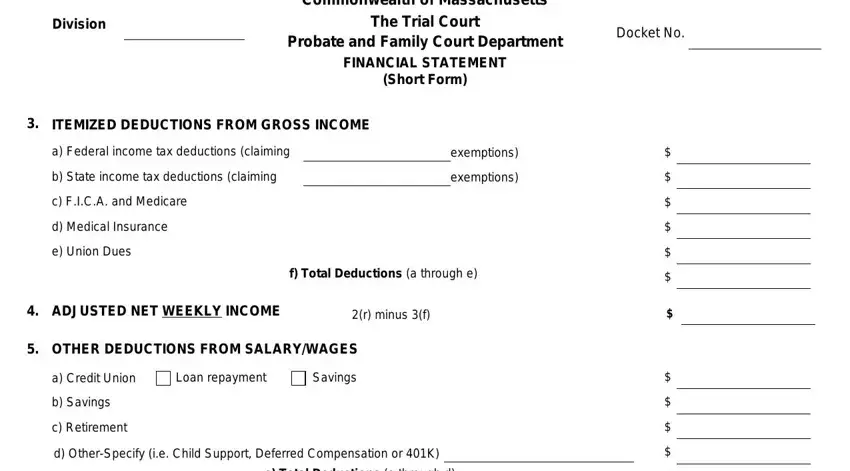

Identify the rights and obligations of the sides inside the section Division, Commonwealth of Massachusetts The, Docket No, ITEMIZED DEDUCTIONS FROM GROSS, a Federal income tax deductions, b State income tax deductions, exemptions, exemptions, c FICA and Medicare, d Medical Insurance, e Union Dues, f Total Deductions a through e, ADJUSTED NET WEEKLY INCOME, r minus f, and OTHER DEDUCTIONS FROM SALARYWAGES.

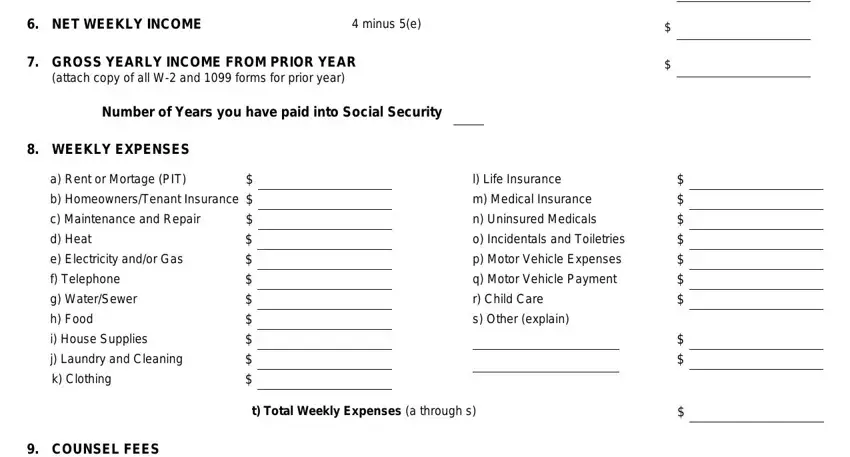

Finalize by taking a look at these sections and completing them accordingly: NET WEEKLY INCOME, minus e, GROSS YEARLY INCOME FROM PRIOR, Number of Years you have paid into, WEEKLY EXPENSES, d Heat, f Telephone, e Electricity andor Gas, a Rent or Mortage PIT, b HomeownersTenant Insurance c, j Laundry and Cleaning, i House Supplies, g WaterSewer, k Clothing, and h Food.

Step 3: Choose the button "Done". The PDF form can be exported. You can easily obtain it to your pc or send it by email.

Step 4: To protect yourself from any sort of concerns in the future, you should generate a minimum of two or three duplicates of the file.