You'll be able to prepare illinois tax exemption form easily with our online tool for PDF editing. To make our editor better and less complicated to work with, we continuously work on new features, with our users' suggestions in mind. By taking several basic steps, it is possible to start your PDF journey:

Step 1: Hit the "Get Form" button at the top of this webpage to access our tool.

Step 2: After you start the tool, you will notice the form prepared to be filled out. Besides filling in different fields, you may as well perform other actions with the form, specifically putting on custom textual content, editing the original text, inserting images, affixing your signature to the document, and much more.

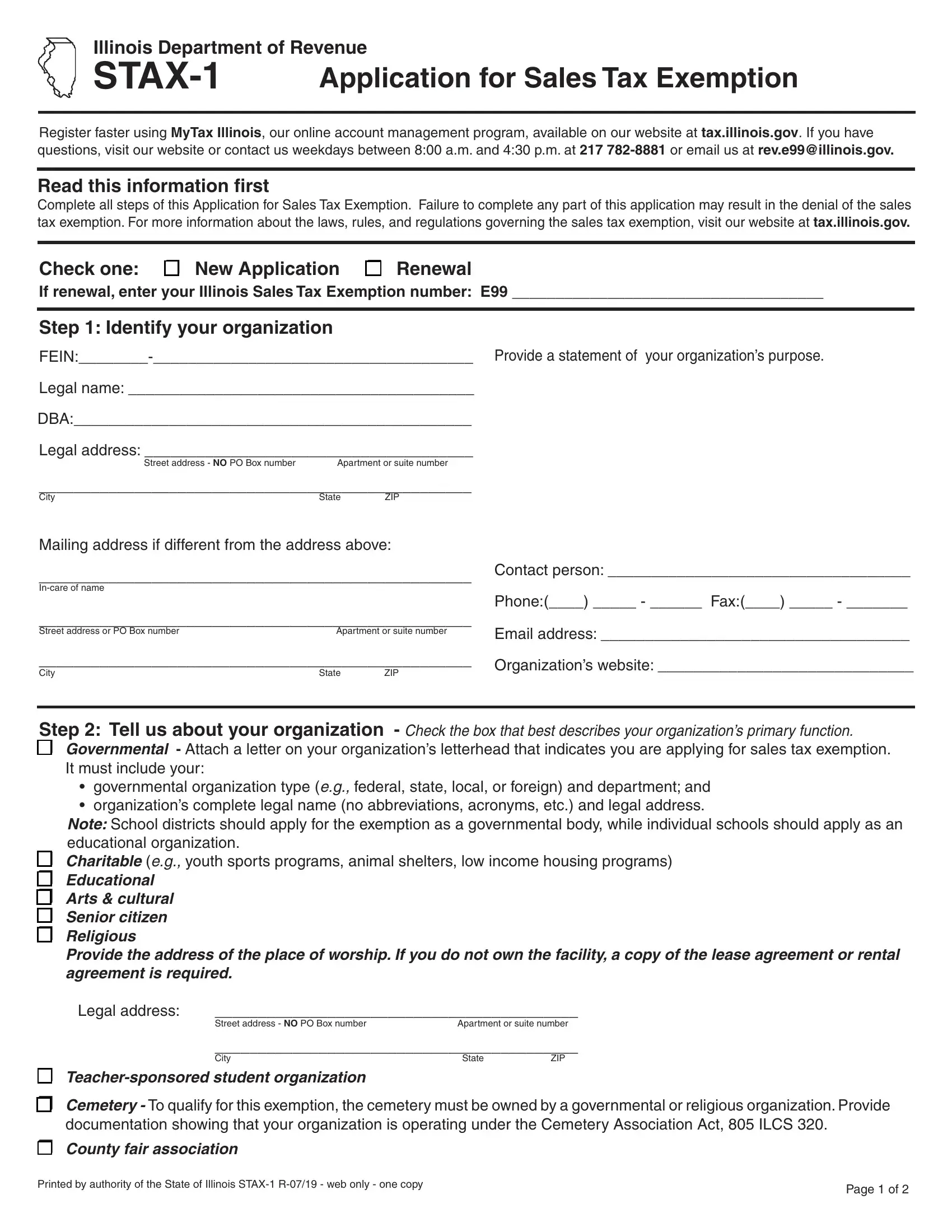

This form will need particular data to be filled out, thus you should definitely take whatever time to enter exactly what is expected:

1. While filling out the illinois tax exemption form, make certain to complete all of the necessary blank fields in its associated area. It will help to speed up the process, allowing for your information to be handled swiftly and appropriately.

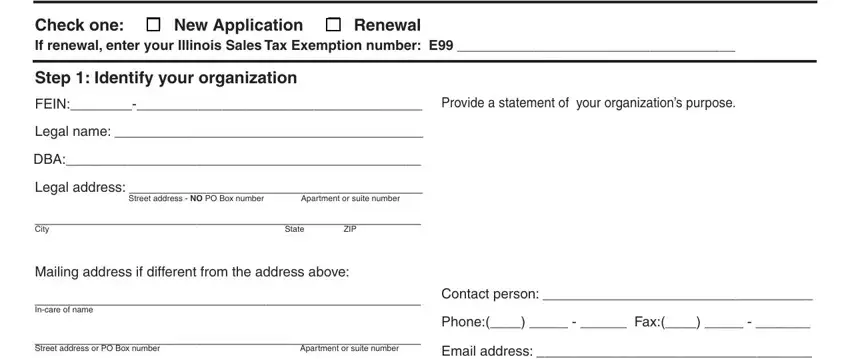

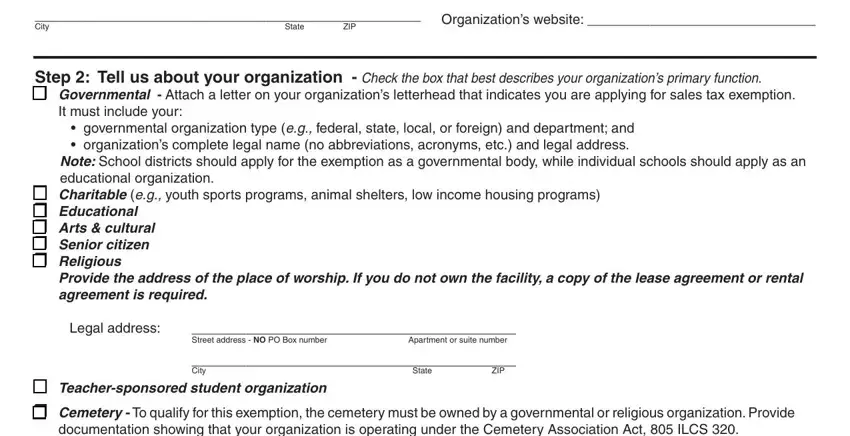

2. Once your current task is complete, take the next step – fill out all of these fields - City, State, ZIP, Email address, Organizations website, Step Tell us about your, Governmental Attach a letter on, governmental organization type eg, Note School districts should apply, Legal address, Street address NO PO Box number, Apartment or suite number, City, State, and ZIP with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

As to Organizations website and Governmental Attach a letter on, ensure that you get them right in this section. These are the most important fields in the file.

3. This part is going to be hassle-free - complete all of the form fields in Cemetery To qualify for this, County fair association, Printed by authority of the State, and Page of to complete this segment.

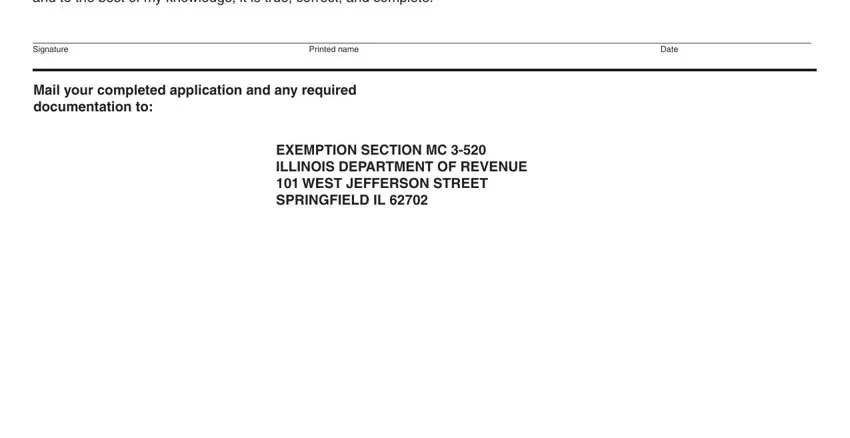

4. To move forward, your next section requires filling out a handful of blank fields. Examples of these are Under the penalties of perjury I, Signature, Printed name, Date, Mail your completed application, and EXEMPTION SECTION MC ILLINOIS, which you'll find vital to moving forward with this form.

Step 3: Right after taking another look at the form fields, hit "Done" and you are good to go! Right after setting up a7-day free trial account here, you'll be able to download illinois tax exemption form or send it via email right off. The form will also be at your disposal from your personal account page with all your modifications. FormsPal offers secure form editing with no personal data record-keeping or any type of sharing. Feel at ease knowing that your data is safe here!