Designed to navigate the complexities of reporting sales tax for Oklahoma oil and gas operators, the STS 20015 form serves as a crucial document for ensuring compliance with state tax obligations. This form, rigorously revised in June 2013, is tailored specifically for operators in the oil and gas sector, guiding them through the casual sales tax return process. It demands detailed inputs ranging from taxpayer identification to the minutiae of sales and exemptions, underscoring the necessity for accurate record-keeping. The form captures essential data, including taxpayer FEIN/SSN, reporting period, due dates, and account numbers, while also providing space for declaring amendments to returns. Notably, it encompasses a variety of schedules for sales tax exemptions and city/county tax computations, pointing out the exemptions applicable to sales to permit holders, gasoline and motor vehicle sales, and transactions subject to federal food stamp exemptions, among others. Critical for compliance, the form not only delineates the specifics of taxable and nontaxable sales but also outlines the calculation of net taxable sales, state, and local taxes due. Moreover, it offers a structured format for reporting changes such as business closure or mailing address updates, ensuring a comprehensive approach to sales tax reporting. Through the careful completion of this form, Oklahoma oil and gas operators can accurately report transactions and adhere to state sales tax laws, reflecting the intricate balance between regulatory requirements and the operational realities of the oil and gas industry.

| Question | Answer |

|---|---|

| Form Name | Form Sts 20015 |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | YY, SSN, FEIN, oklahoma casual sales tax return |

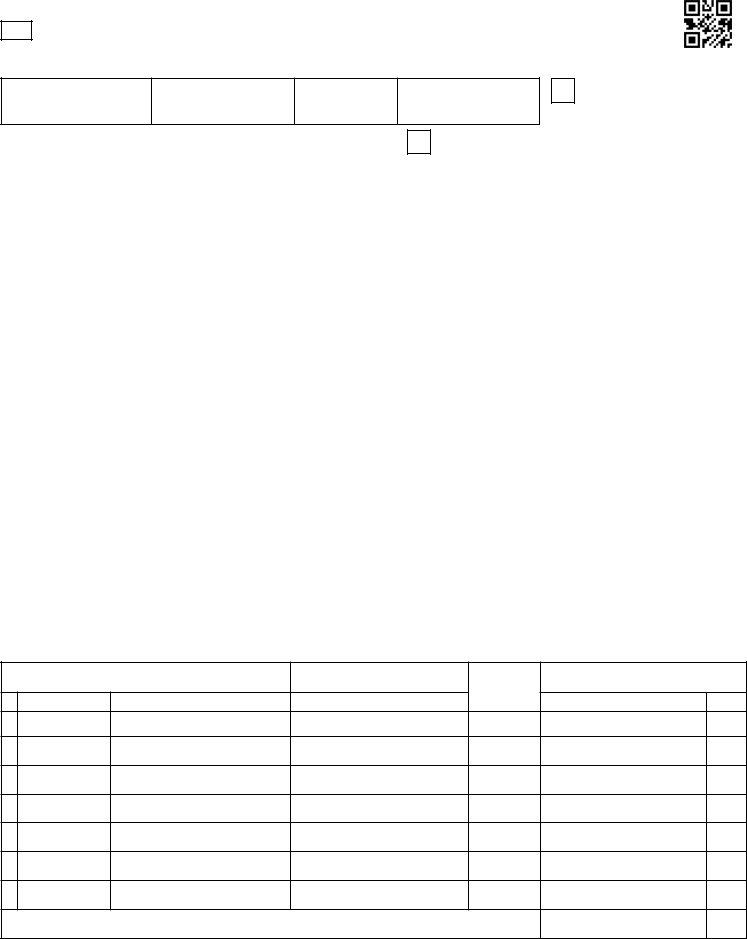

STS 20015

Revised

OKLAHOMA OIL AND GAS OPERATORS CASUAL SALES TAX RETURN

A. Taxpayer FEIN/SSN

B. Reporting Period

C. Due Date

D. Account Number

E. Amended Return

01

H. Page ______ of _________ Page(s)

|

|

|

|

|

|

Date Out |

|

|

|

|

|

|

|

of Business:__________________ |

|

MM/DD/YY |

|||||||

|

|||||||

_________________________________________________________

Name

_________________________________________________________

Address

_________________________________________________________

City |

State |

ZIP |

G.Mailing

Address Change

G. New Mailing Address

_________________________________________________________

Address

_________________________________________________________

City |

State |

ZIP |

|

|

- - - - - - - DOLLARS - - - - - - - |

- CENTS - |

|

|

I. SALES TAX EXEMPTION SCHEDULE |

|

|

|

|

|

|

- - - - WHOLE DOLLARS ONLY - - - - |

3a. |

Sales to Those Holding Sales |

|

|

Tax Permits or Direct Pay Permits ..... ________________________ |

|

|

Indicate Sales Tax Permit Number of purchaser below: |

|

|

_______________________________________________________ |

|

3b. |

Gasoline Sales with State |

NA |

|

Gasoline Tax Paid |

|

|

________________________ |

|

3c. |

Motor Vehicle Sales on which |

NA |

|

Excise Tax Has Been Paid |

|

|

________________________ |

|

3d. |

Agricultural Sales |

NA |

________________________ |

||

3e. |

Sales Subject to Federal Food |

NA |

|

Stamp Exemption |

|

|

________________________ |

|

3f. |

Returned Merchandise |

NA |

________________________ |

||

3g. |

Other Legal Sales Tax Exemptions |

NA |

________________________ |

||

|

|

|

1. |

Total Sales |

______________________ |

00 |

. ______ |

|||

2. |

Removed from inventory and |

|

|

|

consumed or used or purchases.... |

NA |

NA |

|

for which direct payment is due |

______________________ |

. ______ |

3. |

Total Exemptions |

|

00 |

|

(Total from Schedule I, Line 3a)... |

- ______________________ |

|

|

. ______ |

||

4. |

Net taxable sales |

= ______________________ |

00 |

. ______ |

|||

5. |

State Tax |

= ______________________ |

00 |

. ______ |

|||

6. |

City/County Tax (sum of line(s) O. |

|

|

|

of Column N from schedule below |

|

|

|

and supplemental pages) |

+ ______________________ |

. ______ |

7.Tax Due (Add lines 5 and 6) ....... = ______________________ . ______

8.Discount - Limit $2,500.

|

(Discount not allowed for direct pay) |

.. - ______________________ . |

______ |

9. |

Interest |

+ ______________________ . |

______ |

10. Penalty |

+ ______________________ . |

______ |

|

11. |

Total Due (If no total due put ‘0’) = ______________________ . |

______ |

|

CITY AND COUNTY TAX SCHEDULE

L. Net Sales Subject to Tax

J. City/County Code |

K. City/County Name |

- - - WHOLE DOLLARS ONLY - - - |

M. Tax Rate

(%)

N. Amount of Tax Due

(Multiply Item L by Item M)

- - - DOLLARS - - -CENTS

12

13

14

15

16

17

18

O.TOTAL (if more space is needed, use supplement page[s])

Signature: _____________________________________________________ |

Date: ___________________________ |

The information contained in this return and any attachments is true and correct to the best of my knowledge.

Form STS20015 |

|

|

|

|

|

|

|

|

Page 2 |

OKLAHOMA OIL AND GAS OPERATORS CASUAL SALES TAX RETURN |

|

||||||

|

|

|

||||||

1. Name: ________________________________________________ |

Ofice Use Only _____________________________ |

|||||||

Address: ______________________________________________ |

2. FEIN: ___________________________________ |

|||||||

City, State, Zip: _________________________________________ |

3. Reporting Period: _________________________ |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

A |

B |

|

C |

|

D |

|

|

|

|

|

|

|

|

|

4. |

PUN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. |

API |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6. |

Lease Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7. |

Well Name |

|

|

|

|

|

|

|

|

and Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8. |

Legal Description |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. |

Buyer’s Operator |

|

|

|

|

|

|

|

|

Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10. |

Buyer’s Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11. |

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12. |

City/State/Zip |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13. |

Lease Purchase |

|

|

|

|

|

|

|

|

Price |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14. |

Taxable Amount |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

E |

F |

|

G |

|

H |

|

|

|

|

|

|

|

|

|

4. |

PUN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. |

API |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6. |

Lease Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7. |

Well Name |

|

|

|

|

|

|

|

|

and Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8. |

Legal Description |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. |

Buyer’s Operator |

|

|

|

|

|

|

|

|

Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10. |

Buyer’s Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11. |

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12. |

City/State/Zip |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13. |

Lease Purchase |

|

|

|

|

|

|

|

|

Price |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14. |

Taxable Amount |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15.If the taxpayer is not the seller, or if the tax due is zero (0), indicate the reason why:

____________________________________________________________________________________________________

____________________________________________________________________________________________________

Form STS20015

Page 3 |

OKLAHOMA OIL AND GAS OPERATORS CASUAL SALES TAX RETURN INSTRUCTIONS |

This form is to be used to report:

1.Sales of tangible personal property included in the sale of oil and gas leases.

2.Occasional sales of equipment and ixtures you used in your business.

3.Sales Tax due on material transfers between leases.

GENERAL INSTRUCTIONS

WHO MUST FILE FORM STS20015

Every person who is responsible for collecting/remitting payment of

Oklahoma sales tax must ile a Sales Tax Return. Returns must be iled for every period even though there is no amount subject to tax nor any tax due.

WHEN TO FILE FORM STS20015

Returns must be postmarked on or before the 20th day of the month fol- lowing each reporting period.

PAYMENT INFORMATION

Please send a separate check with each return submitted and put your Taxpayer FEIN/SSN (Item A) on your check.

SPECIFIC INSTRUCTIONS

If you received this form by mail, make sure the

Commission’s Taxpayer Assistance Division at (405)

ITEM B - If not preprinted, enter the month(s) and year for the sales be- ing reported. (Begin with the month when you made your irst sale)

ITEM C - If not preprinted, enter the date the return is due.

ITEM D - If not preprinted, enter your Account Number.

ITEM E - Check Box E if this is an amended return.

ITEM F - If out of business and this will be your last sales tax return,

check Box F and give the Date Out of Business.

ITEM G - Check Box G if your mailing address has changed. Enter the

new address in Item G. NOTE: Changes to location address must be submitted on the Notiication of Business Address Change Form

ITEM H - Enter the total number of pages enclosed to the right of the word “of.”

Line 1: Total Sales

Enter the total amount of gross receipts from (1) sales of tangible personal property, (2) material transfers, (3) tangible personal property involved in the sale of an oil and gas lease.

Line 2: Does NOT apply.

Line 3: Total Sales Tax Exemption

Enter the total from Schedule I, Line 3a.

Line 4: Net Taxable Sales

Subtract Line 3 from Line 1 to arrive at net taxable sales. If you have no amount subject to tax, leave blank.

Line 5: State Tax

Multiply Line 4 by the applicable tax rate. If there is no tax due, leave blank.

City/County Tax Schedule Computation (continued)

Column J - Enter the code for each city or county for which you are remit- ting tax.

Column K - Print the name of the city or county for which you are remitting tax.

Column L - Enter the “taxable sales” for each city/county associated with the code entered in Column J. If no “taxable sales” were made, leave blank.

Column M - Enter the current sales tax rate for each city/county for which you are remitting tax.

Column N- Multiply the amounts in Column L times the rates in Column M and enter the sales tax due for each city/county.

ITEM O. TOTAL: Add the total from Column N.

If additional supplemental pages are needed, download additional pages

from our website at www.tax.ok.gov or call the Oklahoma Tax Commission ofice at (405)

Casual Sales Tax Return Supplement pages required.

Line 7: Tax Due

Add the amount on lines 5 and 6. This will be the total state, city, county tax due before any discount, interest or penalty is applied.

Line 8: Discount

If this return and remittance is iled by the due date in Item C, you are eligible for a 1% discount for timely payment. Multiply Line 7 (tax) by 0.01. The maximum discount allowed is $2,500.00. Make no entry if this return is late. No discount allowed for Direct Pay.

Line 9: Interest

If this return and remittance is postmarked after the due date in Item C, the tax is subject to interest from the due date (Item C) until it is paid. Multiply the amount on Line 7 by 0.0125 the applicable rate for each month or part thereof that the return is late.

Line 10: Penalty

If this tax return and remittance is not postmarked within 15 calendar days of the due date, a 10% penalty is due. Multiply the tax amount on Line 7 by 0.10 to determine the penalty.

Line 11: Total Due

Total the return. Subtract Line 8 from Line 7, then add Line 9 and Line 10.

WHEN YOU ARE FINISHED...

Sign and date the return and mail It with your payment to:

Oklahoma Tax Commission

Compliance Division - ABA

Post Ofice Box 269058

Oklahoma City, OK

NEED ASSISTANCE?

For assistance, contact the Oklahoma Tax Commission at (405)

Mandatory inclusion of Social Security and/or Federal Identiication numbers is required on forms iled with the Oklahoma Tax Commission pursuant to Title 68 of the Oklahoma Statutes and regulations thereunder, for identiication purposes, and are deemed part of the conidential iles and

records of the Oklahoma Tax Commission.

Line 6: Total from City/County Tax Computation

Add the City/County tax due from Column N, Item O from City/County Tax Schedule and supplemental page(s).

City/County Tax Schedule Computation (Lines

•If you received this form by mail, we are aware the computer printed information is subject to change, therefore, we have provided blank lines for you to add counties as needed. If any computer printed information is incorrect, mark through the incorrect information and write in the correct data. If no taxable sales were made for a computer printed county, leave the line blank.

•If you downloaded this form from our website, complete Sections J through O.

The Oklahoma Tax Commission is not required to give actual notice of changes in any state tax law.

Form STS20015 |

INSTRUCTIONS FOR FILLING OUT FORM STS20015 - PAGE 2 |

Page 4 |

|

1. Name |

) Enter your information on these lines. |

Address |

) |

City/State/Zip |

) |

2.FEIN – Enter your Federal Employer Identiication Number.

3.Reporting Period – Enter date(s) covered by this return.

4.PUN – If the lease has been or is now producing, enter the production Unit Number that was assigned by the

Oklahoma Tax Commission.

5.API - Enter the number assigned to the well bore by the American Petroleum Institute. This number is available at the Oklahoma Corporation Commission.

6.Lease Name – Enter name given by the producer to the pay out area.

7.Well name and number – Enter the name and number of the well bore.

8.Legal Description – Give spot location of the well bore or the lease description in quarter sections. Block/Lot information is not acceptable.

9.Buyer’s Operator Number - Enter the buyer’s operator number.

10.Buyer’s Name – List the new title/owner information.

11.Address – List the buyer’s address.

12.City/State/Zip – List the buyer’s city, state and zip.

13.Lease Purchase Price – Enter full selling price of the lease/well.

14.Taxable Amount – Enter the dollar amount of tangible personal property transferred in the sale. This amount must be included in line 1 on page 1.

15.If the taxpayer is not the seller, or if the tax due is zero (0), indicate the reason why (such as no change in working interest).