In the intricate landscape of taxation and regulatory compliance, the T 11A form plays a pivotal role for businesses dealing with cigarette rolling papers in the State of Rhode Island and Providence Plantations. Crafted by the Department of Revenue’s Excise Section, this form is essentially a requisition sheet for cigarette tax stamps, which are indispensable for the legal sale of cigarette rolling papers. Required to be filled with meticulous attention to detail, it covers a range of critical information including the name and address of the requestor, their license number, order specifics, and whether the payment is made via cash or charge. Additionally, the form delves into the nuances of quantity and denominations of the tax stamps sought, alongside offering a special 1.25% discount for licensed distributors. It's a document that underscores the balance between regulatory demands and business operations, empowering the state to effectively monitor and tax cigarette rolling paper distribution while enabling distributors to comply with state tax obligations. Its importance cannot be overstated, as it not only facilitates the legal distribution of taxed goods but also represents a crucial touchstone in the broader framework of excise taxation and regulatory compliance.

| Question | Answer |

|---|---|

| Form Name | Form T 11A |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | T-11A, CRP, t11a form, ENCLOSE |

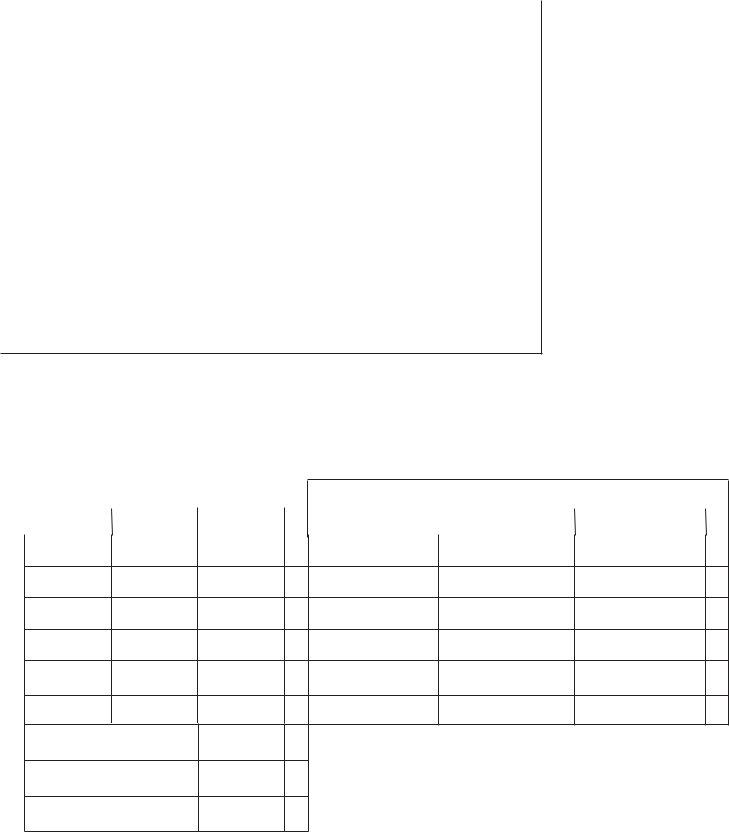

STATE OF RHODE ISLAND AND PROVIDENCE PLANTATIONS

DEPARTMENT OF REVENUE

DIVISION OF TAXATION

ONE CAPITOL HILL

PROVIDENCE, RI 02908

EXCISESECTION

REQUISITION FOR CIGARETTE TAX STAMPS

(STAMPS FOR CIGARETTE ROLLING PAPER ONLY)

DATE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CITY |

|

STATE |

|

|

|

ZIP CODE |

|

|

|

|

|

|

|

|

|

|

|

LICENSE NUMBER: |

|

|

|

|

|

|

|

|

|

|

|

|

THIS SPACE FOR TAX |

||||

IS THIS ACASH OR CHARGE ORDER (circleone) |

|

TELEPHONENUMBER |

|

|||||

|

|

|

|

|

|

|

|

DIVISION USE ONLY |

TAX OFFICE USE ONLY |

AUDIT [ |

] |

USE TAX [ |

] |

CARRIER [ |

] |

|

|

PREPARE THIS ORDER IN DUPLICATE, KEEPING ACOPYFOR YOUR FILES.

(PLEASE ORDER STAMPS IN UNBROKEN SHEETS OF 100)

UNLESS YOU HAVE ARRANGED CREDIT, ENCLOSE AREMITTANCE FOR

THE NET AMOUNT OF THIS ORDER PAYABLE TO TAX ADMINISTRATOR

Please furnish the Cigarette Tax Stamps listed below: |

TAX DIVISION USE ONLY - CRPSTAMPSHEETNUMBERS |

||

|

|

||

|

|

|

|

NUMBER |

CRP |

BEGINNING NUMBER |

ENDING NUMBER NUMBER OF STAMPS |

OF STAMPS |

DENOMINATIONS VALUE |

||

(24’s) Purple $4.20

(32’s) Purple $5.60

(48’s) Purple $8.40

(50’s) Purple $8.75

(100’s) Purple $17.50

Other

TOTALFACE VALUE STAMPS

1.25% DISCOUNTALLOWED LICENSED DISTRIBUTORS ONLY

NETVALUE OF ORDER

THIS ORDER WILLNOTBE |

THE UNDERSIGNED HAS RECEIVED THE CIGARETTE |

FILLED UNLESS SIGNED |

ROLLING PAPER STAMPS LISTED ABOVE. |

|

Distributor or Dealer |

|

Authorized Agent |

Date |

|

|

#12 (CASH) |

||||

|

|

|

|

#58 (CREDIT) |

|