Making use of the online tool for PDF editing by FormsPal, you may fill in or change the form t239 here. Our tool is continually developing to give the very best user experience attainable, and that is thanks to our commitment to constant enhancement and listening closely to user feedback. To get started on your journey, take these easy steps:

Step 1: Just press the "Get Form Button" above on this page to access our pdf file editor. This way, you will find everything that is required to fill out your document.

Step 2: With this handy PDF tool, you could accomplish more than merely fill out blanks. Edit away and make your documents seem perfect with customized text put in, or fine-tune the original input to excellence - all that comes with an ability to incorporate almost any pictures and sign the PDF off.

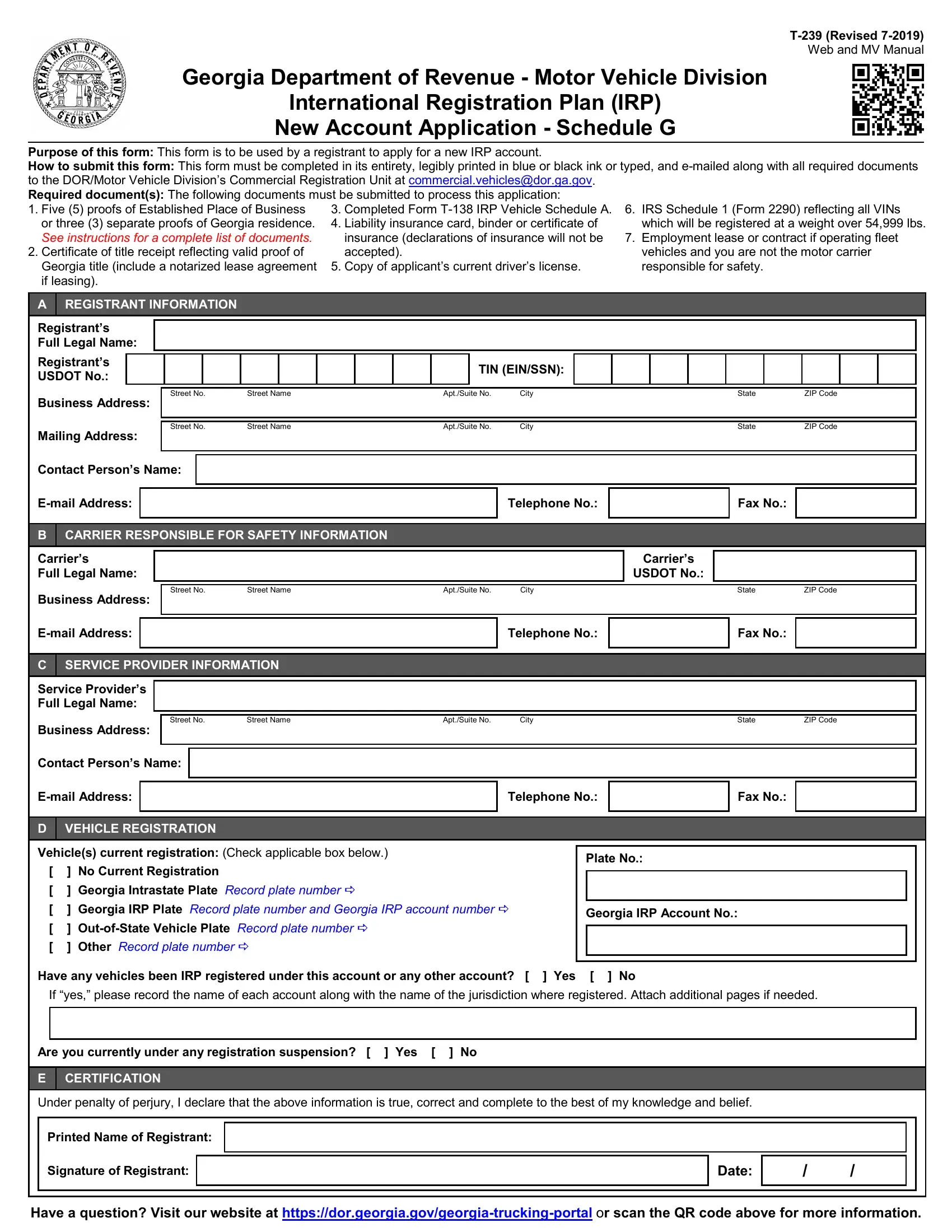

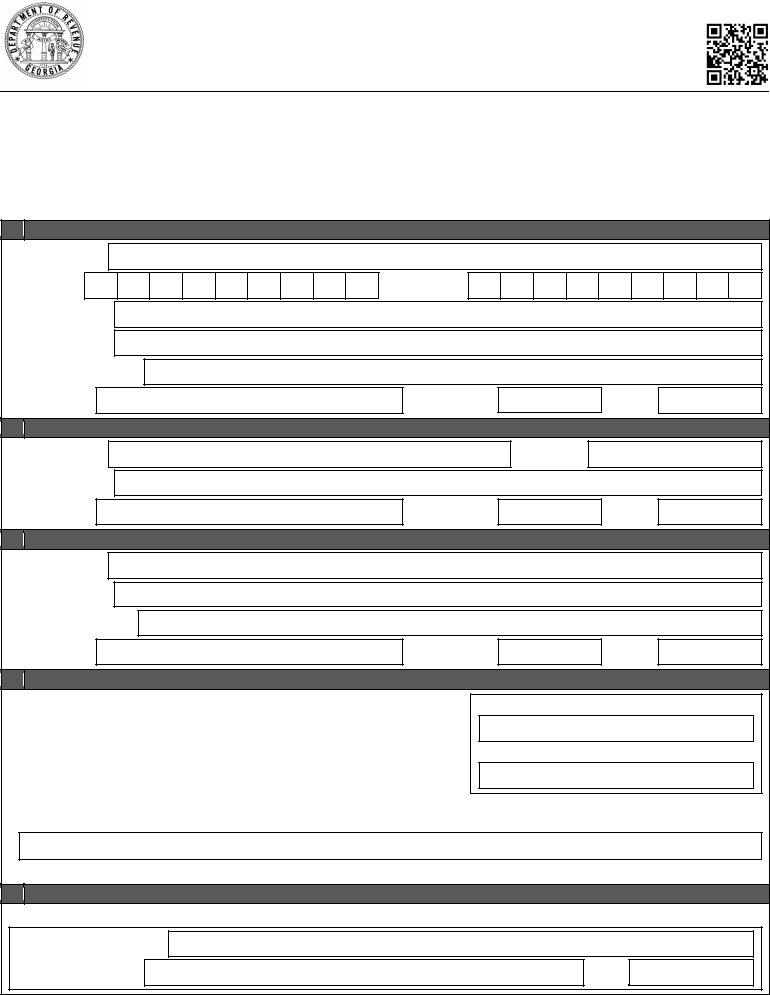

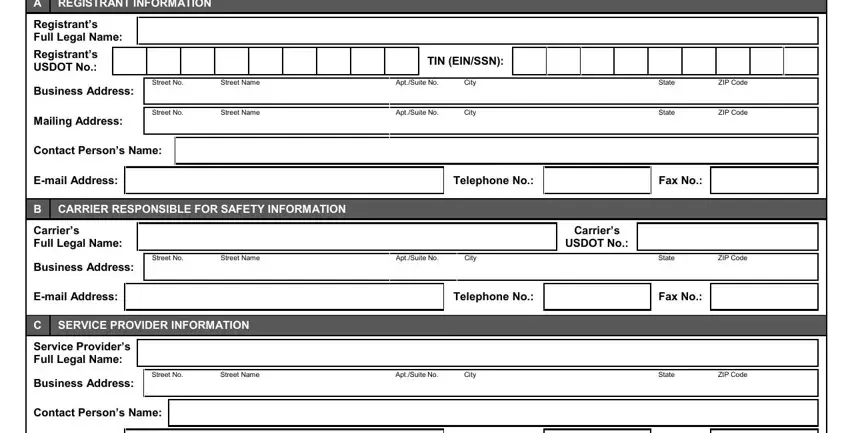

To be able to fill out this document, be certain to type in the required information in each and every blank field:

1. Before anything else, once completing the the form t239, start in the area that features the subsequent blanks:

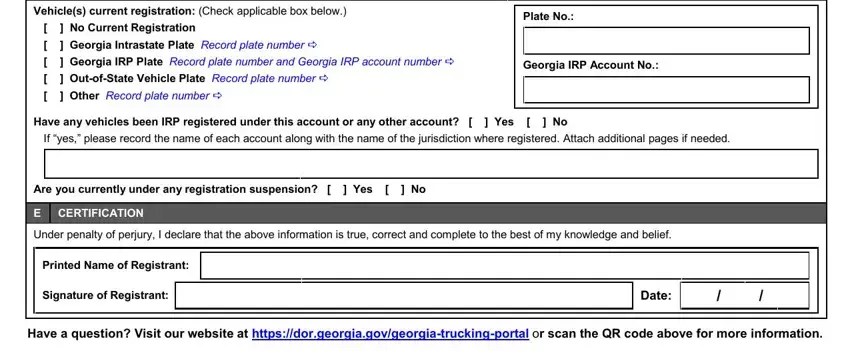

2. Now that this part is finished, you'll want to include the required details in Vehicles current registration, No Current Registration, Plate No, Georgia IRP Account No, Have any vehicles been IRP, If yes please record the name of, Are you currently under any, E CERTIFICATION, Under penalty of perjury I declare, Printed Name of Registrant, Signature of Registrant, Date, and Have a question Visit our website so you're able to move forward to the 3rd stage.

It is possible to make errors while filling out your E CERTIFICATION, so ensure that you go through it again prior to when you send it in.

Step 3: Once you've reviewed the information entered, just click "Done" to conclude your form. Grab your the form t239 the instant you register at FormsPal for a free trial. Immediately gain access to the pdf document in your FormsPal cabinet, along with any modifications and changes being all preserved! When using FormsPal, you're able to fill out forms without worrying about data incidents or records being shared. Our protected software ensures that your personal data is kept safe.