Handling PDF forms online is actually a piece of cake with our PDF tool. Anyone can fill out t1032 here and try out several other options we provide. Our team is aimed at providing you the ideal experience with our editor by consistently presenting new functions and upgrades. Our tool has become even more user-friendly thanks to the latest updates! Currently, filling out PDF documents is easier and faster than before. It just takes just a few simple steps:

Step 1: Access the PDF form inside our editor by clicking on the "Get Form Button" above on this webpage.

Step 2: With the help of our advanced PDF file editor, you'll be able to do more than just fill out blank form fields. Express yourself and make your documents look faultless with custom textual content added in, or tweak the file's original content to perfection - all backed up by the capability to add any photos and sign it off.

This form requires some specific details; to ensure correctness, don't hesitate to bear in mind the following tips:

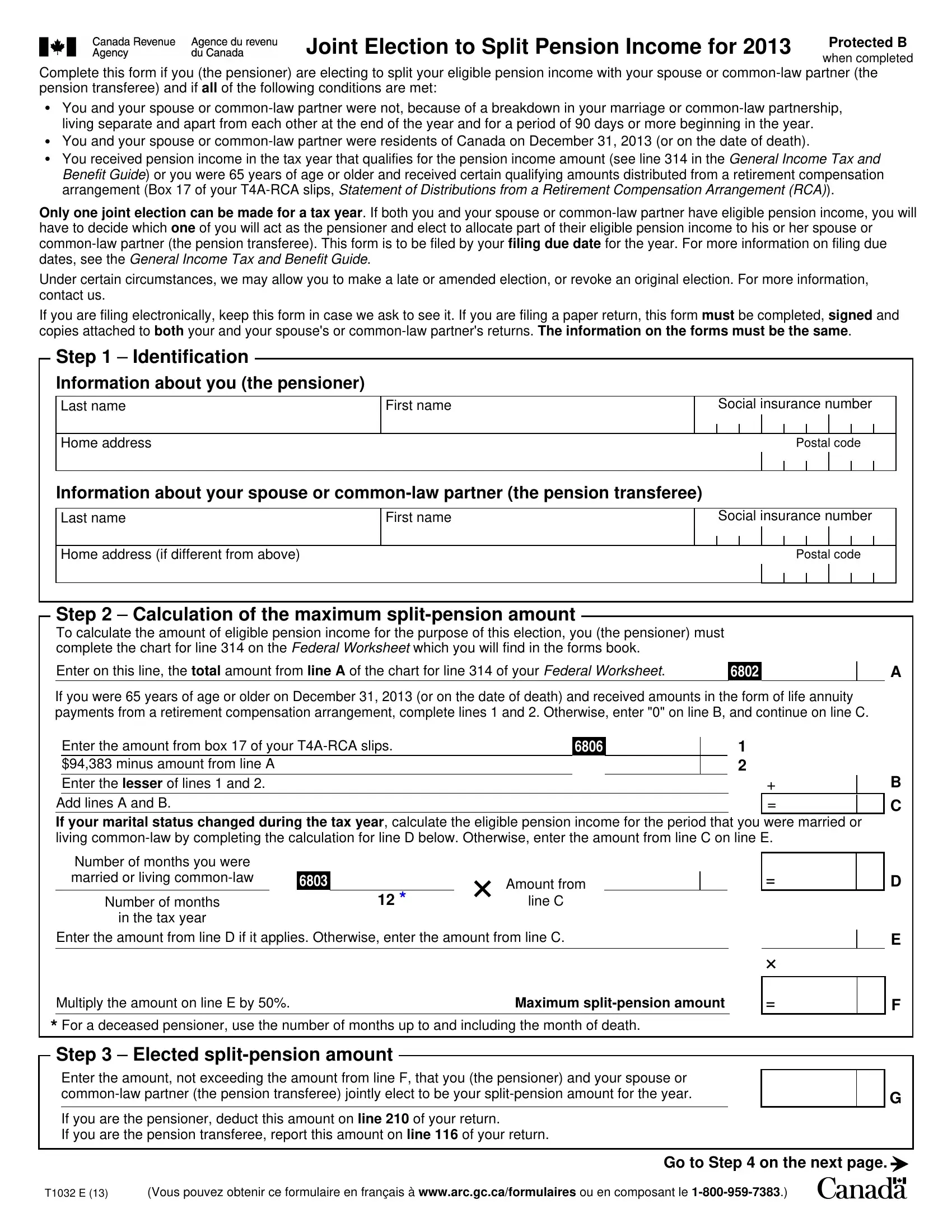

1. Start filling out your t1032 with a selection of major blanks. Get all of the required information and make sure there is nothing neglected!

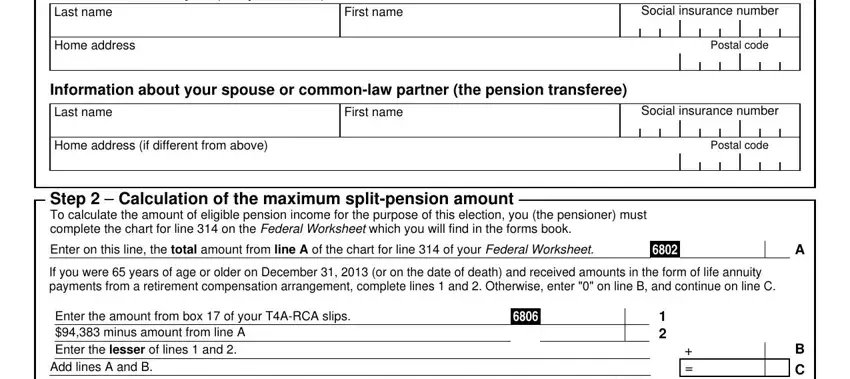

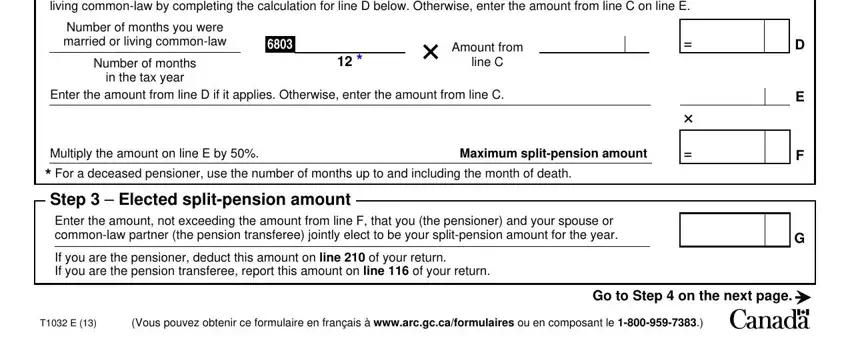

2. Once your current task is complete, take the next step – fill out all of these fields - Enter the amount from box of your, Number of months you were married, Number of months, in the tax year, Amount from, line C, Enter the amount from line D if it, Multiply the amount on line E by, Maximum splitpension amount, If you are the pensioner deduct, T E, Vous pouvez obtenir ce formulaire, and Go to Step on the next page with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

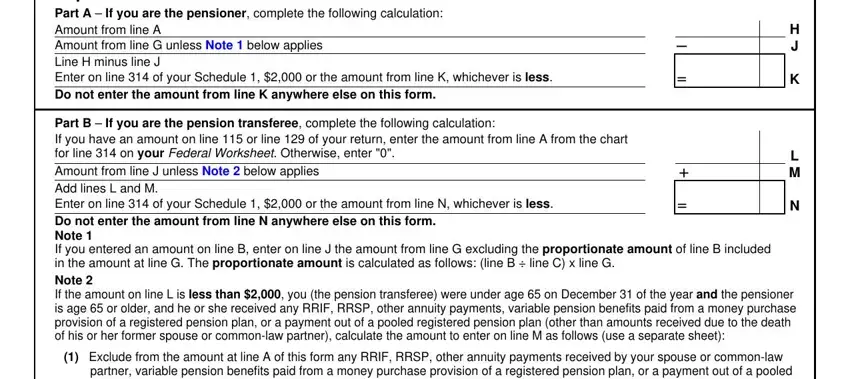

3. Completing Step Pension income amount Part, H J, Part B If you are the pension, L M, Exclude from the amount at line A, and partner variable pension benefits is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

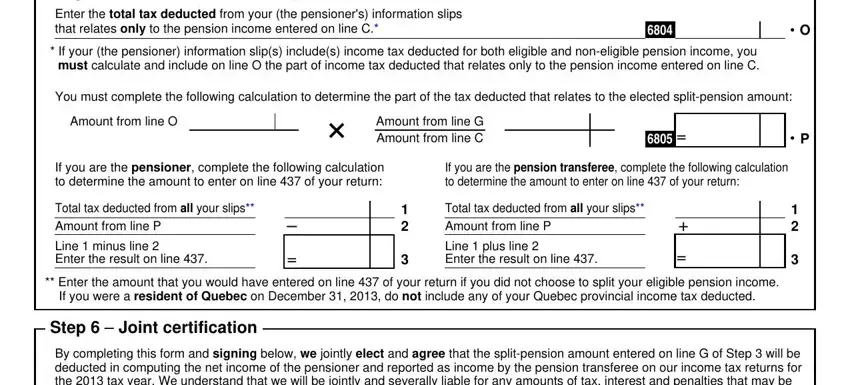

4. The next paragraph needs your information in the subsequent places: Step Income tax deducted line, If your the pensioner information, You must complete the following, Amount from line O, Amount from line G, Amount from line C, If you are the pensioner complete, If you are the pension transferee, Total tax deducted from all your, Line minus line Enter the result, Total tax deducted from all your, Line plus line Enter the result, Enter the amount that you would, Step Joint certification, and By completing this form and. It is important to give all of the needed info to move onward.

Those who use this form often get some points wrong when filling out If you are the pension transferee in this area. You need to go over everything you type in right here.

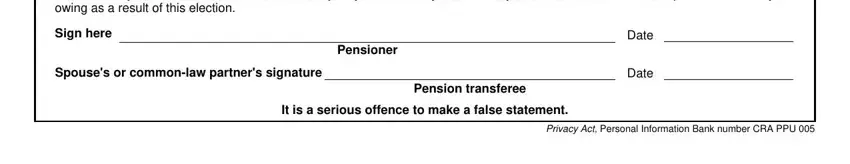

5. Now, this last section is precisely what you'll want to finish prior to closing the PDF. The blanks at this point include the next: By completing this form and, Sign here, Spouses or commonlaw partners, Pensioner, Date, Date, It is a serious offence to make a, Pension transferee, and Privacy Act Personal Information.

Step 3: Go through everything you've typed into the blank fields and then hit the "Done" button. Sign up with FormsPal right now and immediately gain access to t1032, prepared for download. Every modification you make is handily preserved , helping you to customize the document further anytime. At FormsPal.com, we aim to make sure that all your information is kept secure.